The Trade War Begins with Canada, China, and Mexico

On February 1, 2025, President Trump declared a national emergency based upon the threat posed by undocumented foreign workers and drugs entering the United States. The White House has published a fact sheet outlining steps to address the threat by implementing (i) a 25% additional tariff on imports from Canada and Mexico, (ii) a 10% additional tariff on imports from China, and (iii) a carveout for a lower 10% tariff for energy resources from Canada (see Fact Sheet: President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico and China – The White House).

President Trump declared the national emergency pursuant to the International Emergency Economic Powers Act (IEEPA) and the National Emergencies Act. This action marks the first time a President has used the IEEPA to impose tariffs. President Nixon had used a precursor law to impose 10% tariffs on all imports in 1971 in order to avoid a balance of payments crisis resulting from ending the U.S. dollar’s gold standard (see prior alert Can the President Impose Tariffs Without Congressional Approval?).

President Trump issued Executive Orders imposing these additional tariffs on Canada, China, and Mexico (see link to Canada EO, China EO (unpublished), and Mexico EO (unpublished)).[1] The Executive Orders generally provide that the IEEPA national security tariffs may be removed if Canada and Mexico demonstrate adequate steps have been undertaken to alleviate the illegal migration and illicit drug crisis through cooperative actions, and China demonstrates adequate steps have been taken to alleviate the opioid crisis through cooperative actions.

A quick overview of five key initial questions:

1. When do the IEEPA national security tariffs take effect?

These IEEPA national security tariffs will be collected at the ad valorem rate of duty beginning 12:01 am ET, Tuesday, February 4, 2025.

2. How do I know if my import is subject to the IEEPA national security tariffs?

The Executive Orders reference “all articles” suggesting that the IEEPA national security tariff will apply to all merchandise imported from Canada, China, and Mexico; excepting that, there will be a carveout for energy from Canada, with the definitions based upon section 8 of Executive Order 14156 of January 20, 2025 (Declaring a National Energy Emergency). The necessary modifications to the Harmonized Tariff Schedule of the United States will be updated by the Department of Homeland Security and published in the Federal Register.

3. How is the IEEPA national security tariff rate calculated and applied?

The IEEPA national security tariff will be collected at an ad valorem rate based upon the entered value of the merchandise, meaning that the IEEPA national security tariff will be calculated on the entered value of the merchandise and simply added to any other duty applicable on the subject merchandise.

4. Who is responsible for paying the IEEPA national security tariff?

The importer of record is responsible for paying all duties to U.S. Customs and Border Protection. There is no change to this requirement.

5. Is there a process to apply for exclusions from IEEPA national security tariffs?

There have been no stated exemptions or processes for exclusions from the IEEPA national security tariffs, but importers may continue to review mitigation strategies for application (see prior alert Preparing for Tariff Increases – Mitigation Strategies: Miller Canfield).

In addition, the Executive Orders further provide that:

There is no duty drawback available for the covered merchandise, i.e. the refund of duties, taxes, and fees paid on imported merchandise subsequently exported or destroyed;

Merchandise must be admitted as “privileged foreign status,” meaning the merchandise remains subject to the tariff based upon its imported state, regardless of whether the classification changes in a Free Trade Zone, i.e. no avoiding the tariff by importing the merchandise into a Free Trade Zone;

There is no de minimis treatment available under Section 321, i.e. duty free treatment for shipments below $800; and

The President may increase or expand in scope the tariffs imposed under the Executive Orders upon retaliation against the United States by Canada, China, or Mexico through the application of tariffs or similar.

Because the imposition of additional IEEPA national security tariffs remains in flux, importers should carefully monitor this situation. For up-to-date advice and assistance on mitigation options to tariff exposure applicable to your business, please contact your Miller Canfield attorney or one of the authors of this alert.

[1] Press reports indicate that the China EO and Mexico EO have been signed and are similar in form, but as of the time of this publication the China EO and Mexico EO have not yet been posted to www.whitehouse.gov.

FDA & OHRP Draft Guidance: Including Tissue Biopsies in Clinical Trials

The U.S. Food and Drug Administration (FDA), and the Office of Human Research protections (OHRP) released draft guidance titled, “Considerations for Including Tissue Biopsies in Clinical Trials.” Although non-binding, the guidance document reflects FDA’s and OHRP’s current view on the inclusion of biopsies in clinical trials and is informative for sponsors.

Background

The draft guidance acknowledges that biopsies involve some inherent risk, and sponsors must consider whether the risk of including biopsies in a trial are reasonable in relation to the anticipated benefits and resulting knowledge. Within clinical trials, there are two types of biopsies — mandatory biopsies (which are required as a condition of trial participation) and optional biopsies (which are not required as a condition of trial participation).

Consideration for Conducting Tissue Biopsies in Clinical Trials

Generally, the following three factors should be considered when deciding whether to include biopsies (mandatory or optional) as part of a clinical trial: the purpose of the biopsy, the reason for its inclusion, and the associated risks. Because biopsies of different tissue types can have dramatically different levels of risk, the associated risks can vary greatly depending on the trial. Whenever biopsies are included in a clinical trial, the trial protocol should state the relevant rationale and scientific justification for the decision.

The draft guidance notes that use of biopsy tissue in a trial may be reasonable, and thus mandatory, if the information from the biopsy is necessary to:

Evaluate the primary endpoint(s) or key secondary endpoint(s) of the clinical trial;

Identify participants who may derive clinical benefit from the investigational medical product or other study interventions;

Identify participants who should not be enrolled in the study due to the risk of certain side effects or toxicities associated with investigational medical products;

Identify participants whose current disease state would render it unlikely for them to derive benefit from the investigational medical product or other study interventions; and

Evaluate treatment response.

Conversely, the draft guidance states that use of biopsy tissue in a trial should be optional in clinical trials when:

Information from the biopsy will be used to evaluate non-key secondary and exploratory endpoints; and

The purpose of the biopsy is solely to obtain specimens that will be stored and used for future unspecified research.

Regardless of whether the biopsy is mandatory or optional in the trial, trial participants always retain the right to withdraw consent to undergo a biopsy. In the case of mandatory biopsies, a participant’s decision to withdraw consent for a biopsy may impact the participant’s ability to continue participating in the trial.

Considerations for Conducting Tissue Biopsies in Children in Clinical Trials

Although the above considerations are relevant for trials that involve children, the draft guidance provided that, with respect to children, any biopsy conducted for research purposes needs to be evaluated to determine if there is a direct benefit to the enrolled child. In circumstances where biopsies do not offer a direct benefit, the risk of the biopsy must be limited to “minimal risk” or a “minor increase over minimal risk.” Finally, a child’s parent or guardian must give consent to trial participation and the performance of the biopsy. There must also be adequate provisions for soliciting the assent of the children, based on the child’s age, maturity, and psychological state, when the child can provide assent.

Conclusion

Clinical trial industry sponsors and stakeholders should take note of guidance and considerations discussed in the draft guidance and implement recommendations as needed. When sponsors are considering inclusion of biopsies, whether optional or mandatory, in a clinical trial, the draft guidance is helpful in outlining risk factors that should be evaluated, considered, and addressed, in the clinical trial design. Adherence to the draft guidance could assist sponsors in expediting the reviews required to initiate clinical trials.

Federal Court Applies Antitrust Standard of Per Se Illegality to “Algorithmic Pricing” Case

A federal district court in Seattle recently issued an important antitrust decision on “algorithmic pricing.” Algorithmic pricing refers to the practice in which companies use software to help set prices for their products or services. Sometimes this software will incorporate pricing information shared by companies that may compete in some way. In recent years, both private plaintiffs and the government have filed lawsuits against multifamily property owners, hotel operators, and others, claiming their use of such software to set prices for rentals and rooms is an illegal conspiracy under the antitrust laws. The plaintiffs argue that, even without directly communicating with each other, these companies are essentially engaging in price-fixing by sharing pricing information with the algorithm and knowing that others are doing the same, which allegedly has led to higher prices for consumers. So far, these cases have had mixed outcomes, with at least two being dismissed by courts.

Duffy v. Yardi Systems, Inc.

Previously, courts handling these cases have applied, at the pleadings stage, the “rule-of-reason” standard for reviewing the competitive effects of algorithmic pricing. Under the rule-of-reason standard, a court will examine the algorithm’s actual effects before determining whether the use of the algorithm unreasonably restrains competition. In December, however, the U.S. District Court for the Western District of Washington in Duffy v. Yardi Systems, Inc., No. 2:23-cv-01391-RSL (W.D. Wash.) held that antitrust claims premised on algorithmic pricing should be reviewed under the standard of per seillegality, meaning the practice is assumed to harm competition as a matter of law. Under the per sestandard, an antitrust plaintiff need only prove an unlawful agreement and the court will presume that the arrangement harmed competition. This ruling is significant because it departs from prior cases and could ease the burden on plaintiffs in future disputes.

In Yardi, the plaintiffs sued several large, multifamily property owners and their management company, Yardi Systems, Inc., claiming these defendants conspired to share sensitive pricing information and adopt the higher rental prices suggested by Yardi’s software. The court refused to dismiss the case, finding the plaintiffs had plausibly shown an agreement based on the defendants’ alleged “acceptance” of Yardi’s “invitation” to trade sensitive information for the ability to charge increased rents. See Yardi, No. 2:23-cv-01391-RSL, 2024 WL 4980771, at *4 (W.D. Wash. Dec. 4, 2024). The court also found the defendants’ parallel conduct in contracting with Yardi, together with certain “plus factors,” were enough to allege a conspiracy. The key “plus factor” was defendants’ alleged exchange of nonpublic information. The court noted the defendants’ behavior — sharing sensitive data with Yardi — was unusual and suggested they were acting together for mutual benefit.

The court decided the stricter per serule should apply to algorithmic pricing cases, rather than the rule-of-reason. The court emphasized that “[w]hen a conspiracy consists of a horizontal price-fixing agreement, no further testing or study is needed.” Id. at *8. This decision diverged from an earlier case against a different rental-software company, where the court thought more analysis was needed because the use of algorithms is a “novel” business practice and thus not one that could be condemned as per seillegal without more judicial experience about the practice’s competitive effect. The Yardi case also stands apart from others that have been dismissed, like a prior case involving hotel operators, where there was no claim that the companies pooled their confidential information in the dataset the algorithm used to suggest prices. The court in that case decided that simply using pricing software, without sharing confidential data, did not necessarily mean there was illegal collusion. Future cases may thus depend in part on whether the software uses competitors’ confidential data to set or suggest prices.

It is unclear if other courts will adopt the same strict approach as the Yardi case when dealing with claims involving algorithmic pricing. It is clear, however, that more cases are on the horizon, likely spanning a variety of industries using pricing software.

Regulatory Efforts

Beyond private lawsuits, government agencies and lawmakers also are paying close attention to algorithmic pricing. Last year, for example, the U.S. Department of Justice (DOJ) and a number of state attorneys general sued a different rental-software company. The DOJ also has weighed in on several ongoing cases. Meanwhile Congress, along with various states and cities, has introduced laws to regulate algorithmic pricing, with San Francisco and Philadelphia banning the use of algorithms in setting rents. And just last month, the DOJ and Federal Trade Commission raised concerns about algorithmic pricing in a different context — exchanges of information about employee compensation — in the agencies’ new Antitrust Guidelines for Business Activities Affecting Workers. The new guidelines note that “[i]nformation exchanges facilitated by or through a third party (including through an algorithm or other software) that are used to generate wage or other benefit recommendations can be unlawful even if the exchange does not require businesses to strictly adhere to those recommendations.” Expect more legal and legislative action on this front in 2025 and beyond.

New Massachusetts Employer EEO Reporting Begins Monday, February 3, 2025

As we previously reported, certain Massachusetts employers will now be required to annually submit Equal Employment Opportunity (EEO) reporting to the state. Massachusetts Governor Maura Healey signed the legislation into law in July 2024 and the first deadline arrives Monday, February 3, 2025. The Executive Office of Labor and Workforce Development recently issued FAQs clarifying what’s required.

Who Is Impacted: Employers with 100 or more employees in Massachusetts at any time during the prior calendar year and who are already required to submit EEO reports to the U.S. Equal Employment Opportunity Commission (EEOC).

What: Covered employers must submit copies of their EEO-1, EEO-3, and EEO-5 reports to the state secretary. Next year, they will need to submit copies of their EEO-1 and EEO-4 reports. Employers should file the same copy of the EEO report that they most recently filed with the EEOC. Large, multi-state employers should submit the report covering their Massachusetts establishments.

When: The EEO-1 reports must be submitted annually by February 1, 2025, and the other reports are due biannually by the same date with EEO-3 and EEO-5 reports due this year and EEO-4 reports due next year. Since February 1st falls on a Saturday this year, the reports are due Monday, February 3, 2025.

Where: Reports can be submitted to the Secretary of State’s office through a web portal. They can be submitted in PDF, JPG, or PNG format.

The new law additionally requires employers with 25 or more employees in Massachusetts to include salary ranges in job postings. This requirement was originally set to take effect on July 31, 2025 but the posted FAQs indicate that it has been pushed back to October 29, 2025. The state has also indicated it will publish additional guidance on these new job posting requirements at a later date.

(UK) Revolution Bars: When is a Meeting Really a Meeting?

In his judgment to sanction the restructuring plan (“RP”) of Revolution Bars[1], Justice Richards proceeded on the basis that the Class B1 Landlords and the General Property and Business Rate Creditors were dissenting classes, notwithstanding that they approved the Plan by the statutory majority. This is because they did not approve the Plan at “meetings”, since only one person was physically present at each “meeting” even though the chair held proxies from other creditors.

Pursuant to Part 26A of the Companies Act 2006, to agree a RP, at least 75% in value of a class of creditors, present and voting either in person or by proxy at the meeting, must vote in favour (section 901F). This is repeated when considering the cross-class cram down (“CCCD”), which can be applied “if the compromise or arrangement is not agreed by a number representing at least 75% in value of a class of creditors… present and voting either in person or by proxy at the meeting” (section 901G).

Applying various case law on the subject, we now have the following guidance in relation to a “meeting” for the purposes of RPs:

The ordinary legal meaning of a meeting requires there to be two or more persons assembling or coming together[2];

If there is only one shareholder, creditor or member of a relevant class, that would constitute a “meeting” by necessity, but a meeting in this instance would be considered an exception to the ordinary legal meaning[3];

An inquorate and invalid “meeting” does not preclude the court from exercising its discretion to apply a CCCD to those “dissenting” classes[4].

To ensure a proper “meeting”, there must be two or more creditors physically present (where two or more creditors exist in a class). The physical presence of only one person voting in two capacities – as creditor and as proxy for another – will not suffice, nor will it suffice if the chair holds proxies and there is only one creditor in attendance. Only in cases where there is one creditor in a class, will a meeting of one be valid. If there is no valid meeting, the creditors of that class will be treated as dissenting, and potentially subject to CCCD (assuming the RP has also met the relevant voting threshold and CCCD is engaged).

It does beg the question – if the circumstance were to arise where there were no valid meetings, then what? It seems likely that the RP would fall at the first hurdle.

In this case, the judge sanctioned the CCCD of all “dissenting” classes, and the RP.

Notably, in Re Dobbies Garden Centre Limited[5] the Scottish court took a different approach. Here, only one creditor attended the meeting of the only “in the money” class which approved the plan. If the court had adopted the approach in Revolution Bars, that meeting would be considered invalid, the class categorised as dissenting and the plan would not have been sanctioned.

Focusing on the words “either in proxy or by person” as a qualifier to being “present and voting”, the Scottish court found that a meeting may be quorate where two or more creditors were in attendance or represented in person, or by proxy, or by a combination, and one person can act in two capacities; therefore the meeting was valid.

[1] [2024] EWHC 2949 (Ch)

[2] Sharp v Dawes (1876) 2 Q.B.D. 26

[3] East v Bennett Bros Ltd [1911] 1 Ch. 163; Re Altitude Scaffolding [2006] BCC 904

[4] Revolution Bars

[5] [2024] CSOH 11

Employers Who Administer PFML Programs Get Much-Needed Guidance from IRS

Takeaways

The Guidance clarifies the federal income and employment tax treatment of contributions and benefits under state-funded PFML Programs.

It does not apply to privately insured or self-insured arrangements.

Affected employers should work with their in-house finance and payroll teams to ensure that payments into the funds are treated consistent with the Guidance and that employee payments and employer pick-up payments are properly reported as taxable wages (taking into account the 2025 transition guidance).

Related links

FAMLI Taxability Letter FINAL (2).pdf

Revenue Ruling 2025-4

Article

In response to taxpayer and state government requests, including a 2024 letter from governors of nine states imploring the Internal Revenue Service (IRS) to clarify the federal tax treatment of premiums and benefits under state paid family and medical leave programs (PFML Programs), the IRS issued Revenue Ruling 2025-4 (Guidance) which clarifies the federal income and employment tax treatment of contributions and benefits under state-funded PFML Programs.

Any employer who administers one or more PFML Programs should continue reading this article.

What Is the Relevance of the Guidance?

Thirteen states and the District of Columbia have already adopted mandatory PFML Programs and more states are considering them. Each state PFML Program is unique, but generally PFML Programs provide income replacement for a certain number of weeks for employees who are absent from work for specified family reasons, such as the birth of a child, and/or medical reasons, such as the employee’s own serious health condition.

Employers and states have been unsure of the federal income and employment tax treatment of the payments into the funds and the benefits being paid from the state funds. The Guidance helps fill in some of these gaps.

As an alternative to contributions into a state fund, many states permit employers to establish and maintain private plans providing comparable benefits at comparable cost to employees. Such private plans may be insured or self-insured.

Notably the guidance does not address the federal tax treatment of employer or employee contributions to privately insured or self-insured arrangements designed to comply with PFML Program obligations or to benefits paid under such programs.

Thus, while some of the analysis in the Guidance may be applicable in analyzing the tax consequences under such arrangements, the Guidance is not dispositive ragrding such arrangements.

What Does the Guidance Say?

How Are Employer Contributions Treated for Federal Tax Purposes?

State-mandated employer contributions to a state fund under a PFML Program are deductible by the employer as an excise tax.

Employees are not required to include the value of these employer payments in their compensation.

Observation: As noted above, the Guidance does not apply to privately insured or self-insured arrangements. Since the Guidance bases the exclusion of the employer payments on the fact that the payments are an excise tax, employer premium payments and coverage under privately insured and self-insured arrangements likely would not be governed by the same analysis. Until further IRS guidance is issued (which may be a while given the change in administration), employers should carefully consider whether such employer-paid premiums or coverage should be treated as taxable wages to their employees.

How Are Employee Contributions Treated for Federal Tax Purposes?

Employee contributions to a state fund are wages reportable on an employee’s Form W-2. The Guidance notes that an employee is eligible for a potential income tax deduction for such contribution.

Observation: The Guidance treatment of employee contributions as taxable wages would reasonably apply to privately insured or self-insured arrangements as well. However, such employee payments likely would not be eligible for a potential tax deduction as such payments would not appear to qualify as payments of state income taxes.

How Are Employer Pick-Up Contributions Treated for Federal Tax Purposes?

An employer pick-up contribution occurs where an employer pays from its own funds all or a portion of its employees’ otherwise mandatory contributions (as opposed to withholding such amounts from the employee’s wages).

Employers may deduct such expenses as ordinary and necessary business expenses and must include such payments in wages on employees’ Forms W-2. The Guidance provides that employees are eligible for potential tax deductions for such contributions.

How Are PFML Program Benefits Taxed for Federal Tax Purposes?

The Guidance distinguishes benefits paid for paid family leave (PFL) and paid medical leave (PML).

PFL Benefits

PFL benefit payments are fully taxable and must be included in an employee’s income, but benefit payments are not wages. For benefit payments from state funds, the state must file with the IRS and furnish employees with a Form 1099 reporting the PFL payments.

Observation: For employers who pay into a state fund, generally the state has this reporting obligation rather than the employer. Notably, under the Guidance, employees do not have a “basis” equal to the employee and employer pick-up contribution payments previously treated as taxable compensation.

PML Benefits

The Guidance analogizes PML payments to disability payments and provides tax guidance that is consistent with the federal tax rules that apply to disability payments.

Accordingly, under the Guidance, generally PML benefits attributable to employer contributions are includible in employee gross income and are treated as wages.

However, PML benefits attributable to employee contributions and employer pick-up contribution payments are not includable in an employee’s gross income.

Observation: The Guidance indicates that the state must follow the sick-pay reporting rules that apply to third-party payors (with insurance risk). Whether the states are able to modify their systems to comply with these requirements remains to be seen. However, employers who privately insure or self-insure these arrangements may be able to glean insights from the Guidance, particularly in the way that the Guidance applies the Internal Revenue Code’s rules regarding disability pay to PML.

When Is Compliance Required?

The Guidance notes that:

“Calendar year 2025 will be regarded as a transition period for purposes of IRS enforcement and administration of the information reporting requirements and other rules described below. This transition period is intended to provide States and employers time to configure their reporting and other systems and to facilitate an orderly transition to compliance with those rules, and should be interpreted consistent with that intent.”

Of note to employers who pay into state funds, for calendar year 2025, the employers are not required to treat amounts they voluntarily pay into a state fund (that would otherwise be required to be paid by employees) as wages for federal employment tax purposes.

What Are the Employer Takeaways?

Employers who administer PFML Programs (other than through privately insured and self-insured plans) now have definitive guidance concerning the treatment of payments and benefits. Such employers should work with their in-house finance and payroll teams to ensure that payments into the funds are treated consistent with the Guidance and that employee payments and employer pick-up payments are properly reported as taxable wages (taking into account the 2025 transition guidance). Generally, the states will be responsible for ensuring benefit payments are properly reported and taxed.

While the Guidance does not apply to privately insured and self-insured plans, it does provide employers participating in such arrangements with insight into the IRS’s analysis of these arrangements.

NLRB Shake-Up Continues: Trump Fired Acting General Counsel

On February 1, 2025, five (5) days after President Trump fired NLRB Member Gwynne A. Wilcox, and NLRB General Counsel Jennifer A. Abruzzo, President Trump fired the NLRB’s second-ranked attorney, NLRB Deputy General Counsel Jessica Rutter. Rutter briefly served as the NLRB Acting General Counsel after Abruzzo’s termination on January 27, 2025. As of this posting, it is not clear who will be appointed to serve as the new Acting General Counsel. The Senate must confirm any eventual appointee by President Trump to serve as the NLRB General Counsel.

The Board is now officially without a quorum and, while Regional Offices will continue to operate, without an administrative head of the organization equipped to make major decisions regarding the investigation and prosecution of unfair labor practice cases.

Firings at the US Privacy and Civil Liberties Oversight Board and Potential Impact on Transatlantic Data Transfers

President Trump recently fired the three democrats on the Privacy and Civil Liberties Oversight Board (PCLOB). Since these firings bring the Board to a sub-quorum level, they have the potential to significantly disrupt transatlantic transfers of employee and other personal data from the EU to the US under the EU-US Data Privacy Framework (DPF).

The PCLOB is an independent board tasked with oversight of the US intelligence community. It is a bipartisan board consisting of five members, three of whom represent the president’s political party and two represent the opposing party. The PCLOB’s oversight role was a significant element in the Trans-Atlantic Data Privacy Framework (TADPF) negotiations, helping the US demonstrate its ability to provide an essentially equivalent level of data protection to data transferred from the EU. Without this key element, it is highly likely there will be challenges in the EU to the legality of the TADPF. If the European Court of Justice invalidates the TADPF or the EU Commission annuls it, organizations that certify to the EU-US Data Privacy Framework will be without a mechanism to facilitate transatlantic transfers of personal data to the US. This could potentially impact transfers from the UK and Switzerland as well.

Organizations that rely on their DPF certification for transatlantic data transfers should consider developing a contingency plan to prevent potential disruption to the transfer of essential personal data. Steps to prepare for this possibility include reviewing existing agreements to identify what essential personal data is subject to ongoing transfers and the purpose(s), determining whether EU Standard Contractual Clauses would be an appropriate alternative and, if so, conducting a transfer impact assessment to ensure the transferred data will be subject to reasonable and appropriate safeguards.

Legal Precedents Offer Novel Ways for Federal Employee Whistleblowers to Fight Retaliation

The system of anti-retaliation protections for federal employees who blow the whistle or speak out about their agency’s conduct is infamously weak. Under the Whistleblower Protection Act (WPA) and other laws, federal employees seeking relief for an adverse action taken against them for whistleblowing must rely on the Merit Systems Protection Board (MSPB). This quasi-judicial entity is plagued by delays and threatened by politicization.

However, there are several potentially effective but under-utilized legal precedents that can permit federal employees facing retaliation to obtain relief in federal court and not solely rely on the WPA for relief. These precedents have been established by the U.S. Courts of Appeal for the District of Columbia and Fourth Circuits, and offer novel ways to have cases heard in federal court or otherwise bolster retaliation complaints. By utilizing these methods, federal employees can feel more confident and in control, knowing they have better chances of gaining meaningful relief if they face retaliation for whistleblowing, oppose discrimination, prevent the violation of their privacy, and enforce their rights to engage in outside First Amendment protected speech.

First Amendment Rights for Federal Employees

The landmark 1995 case Sanjour v. EPA upheld the First Amendment rights of federal employees to criticize the government in activities outside their employment. This created a legal precedent that provides a strong shield for federal employees to make First Amendment challenges to agency regulations stifling whistleblowing when made outside of work. The case permits federal employees at the GS-15 level or below (higher level federal workers were not discussed in the decision, as the applicant for relief was at the GS-15 level) to seek pre-enforcement injunctive relief if a rule or regulation (which would include an Executive Order) has an improper chilling effect on First Amendment protected speech of an employee’s outside speaking or writing.

William Sanjour was the branch chief of the Hazardous Waste Management Division within the EPA who challenged rules written by the Federal Office of Government Ethics that restricted EPA workers’ rights to speak to environmental community groups.

Because the EPA had warned Sanjour that his acceptance of a cost reimbursement for travelling to North Carolina to give a speech critical of EPA policies concerning waste incineration was in violation of a regulation and could result in adverse action, Sanjour could challenge the “chilling effect” on speech of the government’s rule. The D.C. Circuit upheld the constitutional challenge to a regulation that had a chilling effect on First Amendment protected speech.

If he had waited until he was subjected to retaliation he would have been required to use the WPA to remedy the adverse action. But because Sanjour was challenging an unconstitutional chilling effect of a government regulation, he could obtain injunctive relief directly in federal court and avoid the long delays and other problems when pursuing a case before the presidentially appointed MSPB.

The key precedent established in Sanjour v. EPA, by the U.S. Court of Appeals for the District of Columbia Circuit, was that the Court could issue a nationwide injunction preventing the implementation of the regulation because of its chilling effect on the First Amendment right of employees to criticize the federal government. The court recognized that federal employee speech to the public on matters of “public concern” was protected under the First Amendment, and served a critical role in alerting the public to vital issues:

“The regulations challenged here throttle a great deal of speech in the name of curbing government employees’ improper enrichment from their public office. Upon careful review, however, we do not think that the government has carried its burden to demonstrate that the regulations advance that interest in a manner justifying the significant burden imposed on First Amendment rights.”

The precedent in Sanjour v. EPA means that federal employees who plan on making public statements (outside speaking or writing on matters of public concern) can seek a federal court injunction preventing future retaliation based on their First Amendment rights, if they have a reasonable basis to believe that their government employer would take adverse action against them if they made the public disclosures or violated the regulation. Significantly, First Amendment protected speech should cover criticisms of government policy. Policy disagreements alone may not even be covered under the WPA.

The Sanjour case covers outside speaking and writing, not workplace activities. It affirms a federal employee’s right to engage in conduct such as TV interviews, writing op-eds, and speaking before public interest groups, even if the speech engaged in is highly critical of the government or their government-employer. However, employees would have to give a disclaimer making sure that the public understood they were speaking in their private capacity, and the employee could not release confidential information.

Mixed Cases Combining Title VII Discrimination with Whistleblower Retaliation

Precedent established by two landmark federal employee whistleblower retaliation cases holds that federal employees may have their WPA retaliation case heard in federal court in instances where it is a “mixed case” that also involves discrimination or retaliation under Title VII of the Civil Rights Act. The scope of retaliation covered under Title VII is broader than the coverage under the WPA, and by combining both claims a federal employee can significantly increase both their procedural and substantive rights.

Specifically, when an employee is a member of a protected class (Title VII covers race, religion, sex, national origin, among other classes) it is often hard to distinguish whether retaliation originates from their membership in a protected class, their filing complaints of retaliation under Title VII, or their filing complaints of retaliation covered by the WPA. There is often significant overlap in these types of cases.

While federal employees’ retaliation cases under the WPA are forced to remain with the MSPB, under the Civil Service Reform Act, discrimination cases (and cases of retaliation based on protected activities or whistleblowing covered under Title VII) may be removed to federal court if the MSPB does not issue a final ruling within 120 days.

Dr. Duane Bonds was a top researcher at the National Institutes of Health on sickle cell disease who blew the whistle on the unauthorized cloning of participants’ cells. Dr. Bonds faced retaliation for blowing the whistle, including sex discrimination, harassment in the workplace, and eventual termination.

In 2011, the United States Court of Appeals for the Fourth Circuit ruled in Bonds v. Leavitt that Dr. Bonds’ retaliation and discrimination complaint must be considered a “mixed case” and heard together. Under the Civil Service Reform Act, the court allowed Dr. Bonds to pursue her mixed discrimination and retaliation case before a federal court, and she was not required to continue to pursue her WPA case before the MSPB.

In its ruling in Bonds v. Leavitt, the Fourth Circuit cited an earlier D.C. Circuit ruling in Ikossi v. Department of Navy, which similarly allowed a female whistleblower to pursue a “mixed case” alleging both retaliation and discrimination in federal court. Kiki Ikossi was retaliated against after filing complaints to the Navy Research Lab HR Office for workplace gender discrimination in the early 2000s.

The Bonds and Ikossi decisions are controlling precedent in both the District of Columbia and Fourth Circuit judicial circuits. Thus, these precedents would be binding of federal courts in the District of Columbia, Maryland, and Virginia.

The precedents in Bonds v. Leavitt and Ikossi v. Department of Navy mean that federal employees who face discrimination in addition to retaliation may combine their complaints and pursue their case in federal court if the MSPB delays a ruling (which is the norm given its backlog of cases). However, the rules permitting a mixed case are complex, and require employees to identify their invocation of that right when filing an initial complaint. By carefully following the complex timing and filing requirements mandated under both the WPA and Title VII an employee can have his or her whistleblower case can be heard in federal court, and avoid many of the problems associated with cases pending before the MSPB.

Privacy Act Rights for Federal Employees

Linda Tripp is most famous for her role in the impeachment of President Clinton. However, her retaliation case established a strong precedent protecting federal employees under the Privacy Act. Tripp successfully challenged the Department of Defense when it illegally released confidential information from her security clearance file.

The illegally released file was an act of retaliation for her role in presidential impeachment proceedings. However, Tripp did not seek relief under the WPA. Instead, she was able to bring a Privacy Act complaint before a federal court. The Privacy Act covers requests for information concerning yourself, and federal employees are covered under the law with the same rights as other non-government employees. The Privacy Act prevents federal agencies from collecting or maintaining information based on an individual’s First Amendment activities, it prevents the improper disclosure of information to various persons, including any personal information a government employee or manager may provide to individuals outside of the federal government.

The Privacy Act requires the federal government to provide applicants access to all government records related to the applicant that are not restricted from access under very specific exemptions. Once obtaining the documents a the requestor can request correction of any inaccurate information, or inclusion into a file of the requestor’s statement as to why the documents are not accurate. It requires agencies to maintain a record of who they share information with. The law prohibits improper leaks of information. Moreover, of particular interest to whistleblowers, the law prohibits the government from maintaining records related to any person’s First Amendment protected activities.

The law provides all persons, including federal employees, the right to file a lawsuit in federal court to obtain access to their files and seek damages for the actual harm caused by any leaks or violations of the law. A court can also order an agency to correct information in government files that are inaccurate and prevent agencies from maintaining information in violation of law. Persons who filed successful Privacy Act complaints are entitled to attorney fees and costs related to their lawsuit.

Thus, the Privacy Act offers numerous potential avenues for a whistleblower to use those provisions to obtain protection, information, and relief. For example, as in the Tripp case, when the federal government leaked information covered under the Privacy Act to discredit her, Tripp successfully pursued a Privacy Act for damages and fees. She could attack the illegal retaliation caused by the leak of information through the Privacy Act, and avoid the many limitations of the WPA.

Conclusion

For decades, attempts to reform the WPA and give federal employees the right to have whistleblower retaliation cases heard in federal courts have stalled. Over the years, however, legal challenges to retaliation that avoid the limits of the WPA have produced strong precedents allowing specific federal employees to pursue cases in federal courts as long as they strictly follow the correct technical procedures required under each of the specific law or Constitutional provision.

Federal employee whistleblowers are essential to rooting out fraud, abuse, and misconduct throughout the government. Leveraging these strong legal precedents, which can supplement remedies offered under the WPA, can offer critical avenues to protect federal employees from retaliation and ensure they receive the proper relief when it occurs.

Useful Resources

Government Webpages:

Overview Of Federal Sector EEO Complaint Process

U.S. Office of Special Counsel

U.S. Merit Systems Protection Board

Privacy Act of 1974

Financial Abuse and the Need for Better Financial Services Regulation

In December 2024 the Parliamentary Joint Committee on Corporations and Financial Services (the Committee) published a Report following an inquiry into how well the existing financial services regulatory framework is protecting against financial abuse. The Report highlighted a range of regulatory gaps and considered how financial institutions could better mitigate the risk of financial abuse.

Privacy

Inquiry submissions revealed that existing privacy laws prevent financial institutions from appropriately identifying, responding to and reporting financial abuse. Institutions are currently required to obtain explicit consent from customers before recording any sensitive information in their accounts. This prevents financial institutions from proactively documenting or flagging actual or suspected financial abuse thereby creating a barrier to the provision of appropriate support. It was therefore recommended that privacy legislation be revised to better allow financial institutions to respond to financial abuse cases.

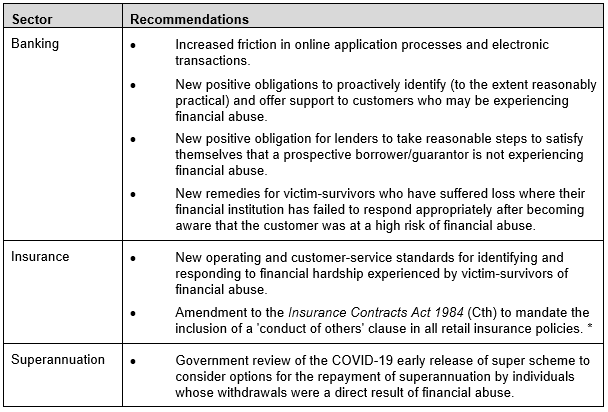

Sector-Specific Reform

While it was recognised that financial institutions were making progress in the implementation of measures to identify and respond to financial abuse, the Committee highlighted the need for reform across all three sectors. The table below outlines some of the key recommendations for each sector.

Key Takeaways

The Committee’s Report has shed greater light on the urgent need to improve the existing regulatory framework to allow financial institutions to explicitly address the widespread risk of financial abuse arising in relation to financial services. To prepare for potential reform, financial institutions should consider the Committee’s recommendations and seek to proactively improve internal mechanisms designed to identify and respond to financial abuse.

*For information on ‘conduct of others’ clauses see our previous alert on general insurance policies.

Tamsyn Sharpe also contributed to this article.

U.S. Department of Education Confirms That It Will Enforce 2020 Title IX Rule

On January 31, 2025, the U.S. Department of Education’s Office for Civil Rights (OCR) issued a “Dear Colleague Letter” (DCL) announcing that it would enforce Title IX of the Education Amendments of 1972 under the provisions of the 2020 Title IX Rule, rather than the recently invalidated 2024 Title IX Final Rule.

The DCL and Executive Order 14168 (“Defending Women From Gender Ideology Extremism and Restoring Biological Truth to the Federal Government”) have significant implications for schools, colleges, universities, and other recipients of federal financial assistance that are subject to Title IX. These institutions will likely need to review and revise their policies, procedures, and practices to ensure compliance with the 2020 Title IX Rule and the executive order and to prepare for potential enforcement action by OCR or the U.S. Department of Justice.

Quick Hits

OCR will enforce Title IX protections under the 2020 Title IX Rule, not the 2024 Title IX Final Rule.

The 2020 Title IX Rule provides procedural protections for complainants and respondents and requires supportive measures.

The 2024 Title IX Final Rule, which was criticized for impermissibly expanding the definition of “sex” to include gender identity and other categories, has been invalidated by federal courts.

OCR’s new course for enforcement aligns with Executive Order 14168. The 2020 Title IX Rule, issued by the first Trump administration in May 2020, defines “sexual harassment,” provides procedural protections for complainants and respondents, requires the provision of supportive measures to complainants, and clarifies school-level reporting processes. The 2024 Title IX Final Rule, issued by the Biden administration in April 2024, expanded the definition of “on the basis of sex” to include gender identity, sex stereotypes, sex characteristics, and sexual orientation, and mandated that schools allow students and employees to access facilities, programs, and activities consistent with their self-identified gender.

The DCL follows a series of federal court decisions that vacated or enjoined the 2024 Title IX Final Rule, finding that it violated the plain text and original meaning of Title IX, which prohibits discrimination on the basis of sex in federally funded education programs and activities. The most recent decision, issued by the U.S. District Court for the Eastern District of Kentucky on January 9, 2025, stated that the 2024 Title IX Final Rule “turn[ed] Title IX on its head” by allowing males to identify as and thus become women and vice versa, and by requiring schools to treat such claims as valid. The court also noted that “every court presented with a challenge to the [2024 Title IX] Final Rule has indicated that it is unlawful.” On this note, the DCL states that OCR’s enforcement measures will interpret the word “sex” to mean “the objective, immutable characteristic of being born male or female.”

The DCL also aligns with President Trump’s Executive Order 14168, issued on January 20, 2025, after the president was sworn in for his second term of office. The executive order declares that “[i]t is the policy of the United States to recognize two sexes, male and female” that are “not changeable and are grounded in fundamental and incontrovertible reality.” It directs all executive agencies and departments to “enforce all sex-protective laws to promote this reality,” to use “clear and accurate language and policies that recognize women are biologically female, and men are biologically male,” and to refrain from using federal funds to “promote gender ideology,” a concept that the executive order defines as including a “spectrum of genders that are disconnected from one’s sex.”

The executive order also rescinds several previous executive orders, presidential memoranda, and agency guidance documents issued by the Biden administration that addressed sexual orientation and gender identity issues. The order instructs the attorney general to issue guidance to agencies to “correct” what it describes as the “misapplication of the Supreme Court’s decision in Bostock v. Clayton County, Georgia (2020) to sex-based distinctions in agency activities.” (In Bostock, the Supreme Court of the United States held that Title VII of the Civil Rights Act of 1964’s prohibition against unlawful sex discrimination encompassed discrimination based on sexual orientation or gender identity.)

The executive order authorizes agency action to “ensure that intimate spaces [such as prisons, shelters, and bathrooms] designated for women, girls, or females (or for men, boys, or males) are designated by sex and not identity.” It also prohibits the use of federal funds “for any medical procedure, treatment, or drug for the purpose of conforming an inmate’s appearance to that of the opposite sex.”

Next Steps

In light of OCR’s “Dear Colleague Letter” and President Trump’s Executive Order 14168, schools, colleges, universities, and other recipients of federal financial assistance may want to consider:

reviewing and revising their policies, procedures, and practices to ensure compliance with the 2020 Title IX Rule and executive order; and

providing training and education to staff, faculty, and students on the new requirements and changes related to Title IX enforcement.

President Trump Orders Additional Tariffs on Imports from Canada, China, and Mexico

On 1 February 2025, President Trump announced that the United States plans to impose additional tariffs on imports from Canada, China, and Mexico to address “the sustained influx of illicit opioids and other drugs” into the United States which is having “profound consequences on our Nation, endangering lives and putting a severe strain on our healthcare system, public services, and communities.”

In sum, the US tariffs will:

Increase tariffs on goods from Canada and Mexico to 25% (oil imports from those countries will be subject to a 10% additional tariff);

Increase existing tariffs on imports from China (such as normal customs duties and Section 301 duties) by a 10% additional tariff; and

Should Canada, China, or Mexico impose retaliatory tariffs, the US tariffs will be increased further.

The US tariffs will go into effect at 12:01 am ET on 4 February 2025. Goods in transit as of 12:01 am ET 1 February will not be subject to the additional tariffs.

Duty drawback will not be allowed on subject imports, and subject imports will not be eligible for the Section 321 “de minimis” exception for small shipments to individual consumers valued at less than $800.

Retaliation by the impacted countries is likely to also take effect shortly, pending a resolution of the disputes.

The text of the first of the Executive Orders (EO) to be released, addressing tariffs on imports from Canada, is available here: https://www.whitehouse.gov/presidential-actions/2025/02/imposing-duties-to-address-the-flow-of-illicit-drugs-across-our-national-border/. A fact sheet issued by the White House explaining the rationale for the tariffs is available here: https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-imposes-tariffs-on-imports-from-canada-mexico-and-china/.

Of particular note for companies and investors with interests in US energy, metals, transportation, and manufacturing markets, the Canada tariff EO defines the scope of “energy” and “energy resources” covered by the 10% duty rate by reference to section 8 of EO 14156 of 20 January 2025. EO 14156, in turn, defines “energy” and “energy resources” as:

crude oil, natural gas, lease condensates, natural gas liquids, refined petroleum products, uranium, coal, biofuels, geothermal heat, the kinetic movement of flowing water, and critical minerals, as defined by 30 U.S.C. 1606 (a)(3).

“Critical minerals” within the meaning of 30 U.S.C. 1606(a)(3), in turn, are currently defined by regulations issued by the US Geological Survey (via determination issued in 2022) as any of:

aluminum, antimony, arsenic, barite, beryllium, bismuth, cerium, cesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium, palladium, platinum, praseodymium, rhodium, rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, vanadium, ytterbium, yttrium, zinc, and zirconium.

Thus, the latest EO has the effect of re-imposing 10% duties on aluminum imports from Canada. It also means that the 25% duties on steel products from Canada have returned (because steel is not currently defined as a “critical mineral.”) In 2018, President Trump imposed tariffs of 25% and 10%, respectively, on steel and aluminum imports from Canada and Mexico under the authority of Section 232 of the Trade Expansion Act of 1962. Those Section 232 tariffs were withdrawn in 2018 following agreements with Canada and Mexico.

Lastly, in a late-night press conference on 1 February outgoing Canadian Prime Minister Trudeau gave some details on the retaliatory measures Canada will take. These will reportedly include 25% tariffs on $155 billion (Canadian) in US imports into Canada. $30 billion of these tariffs will be imposed on 4 February 2025. A further $125 billion will be imposed on 21 February to allow Canadian companies to find alternatives to US sources. The tariffs will be “far reaching” and will specifically target imports that Canada believes to be politically sensitive in the United States, including Canadian imports of US beer, wine, and bourbon, fruits, orange juice, consumer products, appliances, lumber, and plastics. In addition, Canada is considering with the governments of the Canadian provinces and territories several non-tariff measures including several related to critical minerals. Canada is coordinating with Mexico in response to US tariffs. Lastly, Prime Minister Trudeau called for Canadians to avoid purchasing US products and going to the United States for travel.