2025 New York Legislative Session: 3 Alcohol Law Bills Await Governor’s Action

During the 2025 New York legislative session, three notable bills affecting the Alcohol Beverage and Control (ABC) Law passed both houses of the Legislature and will be delivered to Gov. Kathy Hochul during the second half of 2025 for her approval or veto.

S. 409-A would permit some retail licensees to purchase a small amount of wine and liquor from certain other retail licensees. Under the three-tiered system of alcohol production, retailers purchase alcohol from wholesalers, who in turn receive the product from manufacturers. New York retailers have been prevented from purchasing alcohol from other retailers under New York’s tied-house law. As a result, when an on-premises liquor establishment such as a restaurant runs out of a particular product, it has not been permitted to purchase any wine or liquor from an off-premises retailer such as a liquor store to address this shortage on an emergency basis. S. 409-A would allow on-premises retailers to purchase up to six bottles of wine or liquor in the aggregate per week from off-premises retailers for sale and consumption. The law would take effect 90 days after the governor signs the bill.

A. 6277-A would add a new section to the ABC Law to establish a brand owner’s license, allowing its holder to contract with New York manufacturers for the production of alcohol, appoint a New York wholesaler as an exclusive brand agent to negotiate payment for alcohol beverages, and sell alcohol to New York wholesalers. According to the Sponsor’s Memorandum, the purpose of the legislation is to encourage business opportunities in the manufacturing sector by allowing alcohol beverage producers to engage in contract manufacturing with major or emerging brands. The bill would permit co-packing arrangements common in the food and beverage industries but not previously allowed by the ABC Law with regard to New York alcohol sales.

A. 7040-B would authorize private membership establishments to apply for on-premises liquor licenses. A new license category for For-Profit Clubs engaged in recreational, patriotic, political, benevolent, or other purposes would be created, with an annual fee of $20,000. To date, New York has only licensed not-for-profit membership clubs. The legislation sponsors assert that the measure would support the nightlife and hospitality industry, an important economic driver for the state.

Other efforts to reform the ABC Law to ease burdens on liquor license applicants, especially those in New York City, were unsuccessful this year. These include proposals to reform or repeal the “200-Foot Rule,” which prohibits new liquor establishments within 200 feet of a church or school, and the “500-Foot Rule,” which requires applicants seeking an on-premises license within 500 feet of three or more existing liquor licenses to demonstrate to the New York State Liquor Authority that granting an additional license in the vicinity is in the public interest.

Texas Targets Proxy Advice Based on Nonfinancial Factors With SB 2337

On June 20, 2025, Texas Governor Greg Abbott signed into law Senate Bill 2337 (SB 2337), which imposes new regulations on proxy advisory firms — such as ISS and Glass Lewis — when providing voting recommendations and other proxy advisory services concerning Texas public companies. The new law, which takes effect on September 1, 2025, applies to proxy advisory services involving any public company that is incorporated in Texas, has its principal place of business in Texas, or has proposed redomiciling in Texas. SB 2337 requires proxy advisors to provide detailed disclosures when their recommendations are based, in whole or in part, on nonfinancial factors — including environmental, social or governance (ESG) principles or diversity, equity and inclusion (DEI) considerations — or when they diverge from management’s recommendation or provide conflicting advice across clients. Any violation of the new law constitutes a deceptive trade practice under the Texas Business & Commerce Code and is actionable by the company that is the subject of the recommendation, any of its shareholders, advisory clients, and the Texas Attorney General.

Scope and Applicability of SB 2337

SB 2337 will apply to “proxy advisory services” provided in connection with or in relation to any public company that:

is organized or created under the laws of Texas;

has its principal place of business in Texas; or

has made a proposal in its proxy statement to redomicile in Texas.

SB 2337 defines “proxy advisory services” as:

advice or a recommendation on how to vote on a shareholder proposal or company proposal;

proxy statement research and analysis regarding a shareholder proposal or company proposal;

a rating or research regarding corporate governance; or

development of proxy voting recommendations or policies, including establishing default recommendations or policies.

Disclosure Triggers for Nonfinancial Voting Recommendations

Under SB 2337, a proxy advisory service is subject to enhanced disclosure requirements if it:

is wholly or partly based on or, or otherwise takes into account, one or more nonfinancial factors, including those based on environmental, social or governance (ESG) principles, diversity, equity or inclusion (DEI), social credit or sustainability factors or scores or membership in or commitments to groups that wholly or partly bases its evaluation on non-financial factors;

involves providing a voting recommendation with respect to a shareholder proposal that (A) is inconsistent with the voting recommendation of the board of directors or a board committee composed of a majority of independent directors and (B) does not include a written economic analysis of the financial impact on shareholders of the proposal;

is not based solely on financial factors and subordinates the financial interests of shareholders to other objectives, including sacrificing investment returns or undertaking additional investment risk to promote nonfinancial factors; or

advises against a company proposal to elect a director unless the proxy advisor affirmatively states that the proxy advisory service solely considered the financial interest of the shareholders in making such advice.

Mandatory Disclosure Obligations for Proxy Advisors

If a proxy advisor provides a proxy advisory service that meets any of the foregoing qualifications, the proxy advisor must:

disclose to each shareholder (or entity acting on behalf of a shareholder receiving the service) a conspicuous statement that the service is not being provided solely in the financial interest of the company’s shareholders and explain, with particularity, the basis of the proxy advisor’s advice concerning each recommendation and that the advice subordinates the financial interests of shareholders to other objectives, including sacrificing investment returns or undertaking additional investment risk to promote one or more nonfinancial factors;

immediately provide a copy of the disclosure to the company that is the subject of the recommendation; and

include a conspicuous disclosure on the home or front page of the proxy advisor’s website that its proxy advisory services include advice and recommendations that are not based solely on the financial interest of shareholders.

Notice Requirements for Conflicting Voting Recommendations

SB 2337 also includes enhanced notice requirements for a proxy advisor that recommends that one or more clients vote on a proposal in opposition to the recommendation of the company’s management or that one or more clients who have not expressly requested services for a nonfinancial purpose vote differently from one or more other clients on a proposal or director nominee. If so, the proxy advisor is required to:

if applicable, comply with the disclosure requirements for proxy advisory services not solely based on financial interests (as described above);

provide written notice to each shareholder receiving the recommendation, the company that is the subject of the recommendation and the Texas Attorney General; and

disclose which of the conflicting advice or recommendations is provided solely in the financial interest of the shareholders and supported by any specific financial analysis performed or relied on by the advisor.

Enforcement and Remedies

SB 2337 provides that any violation of its provisions is a deceptive trade practice under the Texas Business & Commerce Code, and names the recipient of the proxy advisory services, the company that is the subject of the proxy advisory services and any of the company’s shareholders as affected parties that are entitled to bring a claim for injunctive relief. The bill also authorizes the Texas Attorney General to intervene in such a claim. Additionally, the consumer protection division of the Attorney General’s office may pursue civil penalties for violations of SB 2337.

Legislative Context

SB 2337 is the latest in a series of pro-business corporate governance reforms, which we discussed in our two previous alerts concerning Senate Bills 29 and 1057 and Senate Bill 2411, aimed at positioning Texas as a jurisdiction of choice for public companies. By requiring proxy advisory firms to disclose when their voting recommendations are based on ESG, DEI or other nonfinancial factors, the Texas Legislature has reaffirmed its commitment to a business-first approach that prioritizes transparency and shareholder financial interests.

Texas Governor Signs HB 40, Expanding Jurisdiction of the Texas Business Court

On the final day of the 89th Legislative Session, the Texas Legislature passed House Bill 40 (HB 40) to expand the jurisdictional and operational framework of the Texas Business Court.1 The Bill has since been signed by Governor Abbott and becomes effective on September 1, 2025. The new law builds on Texas’s 2023 initiative to establish a specialized venue for complex business litigation and makes the forum more accessible to corporate litigants. The most significant changes include amendments to reduce the monetary threshold for invoking the Business Court’s jurisdiction and to expand the category of case types that may be heard.

The Bill’s amendments, coupled with broader national conversations around litigation costs and court specialization, support the Business Court playing an increasingly important role in the national corporate governance and commercial litigation landscape. The new statutory changes also make now the time for Texas businesses and in-house counsel to evaluate whether their governing documents and contracts are up-to-date to take full advantage of Texas’s new laws.

Reduced Monetary Threshold

HB 40 lowers the Business Court’s amount-in-controversy requirement from $10 million to $5 million — and allows that threshold to be met by aggregating “the total amount of all joined parties” claims — for certain case types. These include:

cases arising out of a “qualified transaction” (defined as any single transaction or a “series of related transactions” with consideration valued at or above $5 million);

actions arising out of a “business, commercial, or investment contract or transaction,” other than an insurance contract, in which the parties agree to Business Court jurisdiction;

claims involving alleged violations of the Texas Finance Code or Business & Commerce Code by an organization, its officers or other governing persons; and

certain matters relating to intellectual property rights or trade secrets disputes.

Under the initial version of the Texas Business Court Act that passed in 2023, the lower $5 million threshold applied only to fundamental internal governance and securities matters — such as derivative actions, internal affairs disputes, securities claims against an organization or related persons, fiduciary duty claims against controlling persons and managerial officials and the like. The Bill’s promulgation of a lower threshold for other claim types within the Court’s jurisdiction should ultimately make the Business Court more accessible to a broader array of commercial parties and increase the volume of cases.

Additional Claim Categories Within Business Court Jurisdiction

In a significant addition, HB 40 adds intellectual property and trade secrets claims to the statute’s jurisdictional coverage. While the 2023 Act did not authorize the Business Court to hear intellectual property matters, HB 40 now expressly permits the Court to hear trade secrets cases and other “action[s] arising out of or relating to the ownership, use, licensing, lease, installation, or performance of intellectual property.”

HB 40 separately clarifies the Business Court’s authority to render decisions on arbitration matters. Parties that otherwise have standing to file claims in Business Court will be permitted to use the forum to enforce arbitration agreements, appoint arbitrators, review arbitral awards or seek other judicial relief authorized by an arbitration agreement.

While the above amendments to the Business Court’s jurisdictional scope are significant, HB 40 was almost more expansive. The initial version of the Bill would have extended the Business Court’s jurisdiction to also capture insurance and indemnity contract matters, “fundamental business transactions” involving mergers and similar large corporate asset transactions, certain large banking litigations, malpractice claims filed by corporate clients and multidistrict litigation (MDL) transfer cases. However, HB 40 was repeatedly revised in committee and through the legislative process to land on a much-narrowed change in the law, at least for now.

Other Substantive Changes to Texas State Laws

HB 40 includes other amendments to Texas state laws affecting the rights and obligations of parties seeking to litigate in the Business Court. Some of the more notable such amendments are addressed below.

Venue: The Bill expressly permits parties to amend their governing documents to designate venue for Business Court matters involving derivative proceedings, governance or internal affairs disputes, fiduciary duty claims against certain corporate persons and other actions arising out of the Business Organizations Code.

Exclusion of Consumer Actions: The Bill prohibits parties from filing state and federal consumer claims in Business Court, even if supplemental jurisdiction may otherwise exist. This amendment essentially prevents large consumer class actions from flooding the Court’s gates.

Expansion of Injunctive Relief Procedure: A new provision is added to the Texas Civil Practice & Remedies Code allowing parties to seek writs of injunction from another Business Court judge if the appointed judge is unavailable to timely consider and implement the writ’s purpose.

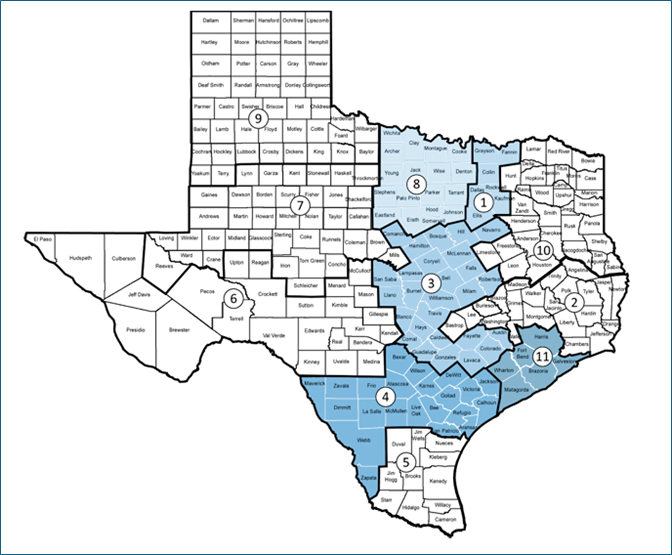

Montgomery County Moves Division: Montgomery County (covering Conroe, The Woodlands and other areas north of Houston) is being transferred out of the non-operational Second Business Court Division and added to the Eleventh Business Court Division (Houston). Houston — as well as Dallas — has notably received a large share of the new case filings in the opening months of the Court’s existence.

Preserving Rural Business Court Divisions: The legislature modified statutory sunsetting language from the Business Court Act to preserve the six non-operational divisions of the Business Court — namely the Second, Fifth, Sixth, Seventh, Ninth and Tenth Divisions (color-coded in the white regions of the map below).2

Context: New Industry Pressure in Delaware Increases Appeal for Texas Court System

The Texas Legislature’s passaContext: New Industry Pressure in Delaware Increases Appeal for Texas Court Systemge of HB 40 — less than a month after passing another business-friendly amendment to the Texas Business Organizations Code (SB 29) — comes at a time of significant scrutiny as to whether Delaware remains the premier state for incorporation and corporate governance.

While Delaware has long been the preferred forum for resolving internal governance and fiduciary matters, recent backlash from institutional investors and industry group advocates has highlighted perceived shortcomings in the Delaware Chancery Court. The Delaware Legislature has tried to step in to curb the noise, including by amending the Delaware General Corporation Law to add new safe harbor protections for controlling stockholder transactions, exculpating controlling shareholders from liability for alleged breaches of the duty of care, and implementing limits on shareholder books and records requests.

The national discourse continues nonetheless. In fact, the same week that HB 40 made its final rounds through the Texas Legislature, a Stanford Law School study3 also made rounds through corporate boardrooms, again questioning outcomes out of the Delaware Chancery Court. The study specifically found that the Chancery Court system has increasingly allowed large fee multipliers for plaintiffs’ attorneys, often exceeding 10 times the lodestar, at higher rates than observed in cases out of the federal court system. These findings have prompted renewed criticism from corporate governance groups and further calls for reform.

The growing tension in Delaware should ultimately increase the appeal of Texas and its alternative corporate governance system.

Conclusion

The Texas Legislature was busy this session expanding corporate protections and enhancing its Business Court system. The enactment of HB 40 specifically helps Texas build out its Business Court framework by refining jurisdictional standards and procedural mechanisms to expand access to the Court. Importantly, the statutory changes this session may require corporate parties to revise their governance documents and contracts to take full advantage of these laws. Katten attorneys across multiple practice groups continue to closely monitor developments and to counsel clients on invoking new protections provided by the legislature.

[1] The Texas Legislature enacts HB 40 just weeks after passing Senate Bill 29 (SB 29) — which previously expanded the Business Court’s jurisdiction over corporate governance matters and also extended related litigation protections to domestic entities. See Texas Governor Signs New Business-Friendly Governance Law to Promote In-State Corporate Growth: Senate Bill 29 Analysis, Katten (May 14, 2025), available at https://natlawreview.com/article/texas-governor-signs-new-business-friendly-governance-law-promote-state-corporate.

[2] See Texas Business Court Divisions Map, Tex. Judicial Branch, available at https://www.txcourts.gov/media/1458995/texas-business-court-divisions-map.pdf.

[3] Grundfest, Joseph A. and Dor, Gal, Lodestar Multipliers in Delaware and Federal Attorney Fee Awards (April 30, 2025), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5237545.

DOJ’s New FCPA Investigations and Enforcement Guidelines: How Organizations Need to Respond

The Deputy Attorney General of the U.S. Department of Justice Office recently issued new guidelines for investigations and enforcement actions of the Foreign Corrupt Practices Act. (FCPA). These new guidelines come as a first follow up to President Trump’s Executive Order from February 10, 2025, effectively pausing most FCPA investigations and enforcement. As discussed below, DOJ’s updated guidelines effectively “unpauses” FCPA enforcement with a highlighted emphasis on the current administration’s continuing “America First Priorities.”

More specifically, the June 9 DOJ Memorandum sets forth a “non-exhaustive” list of factors for DOJ to evaluate when considering whether to pursue FCPA investigations and enforcement. DOJ emphasizes two goals, “(1) limiting undue burdens on American companies that operate abroad and (2) targeting enforcement actions against conduct that directly undermines U.S. national interests.” New FCPA investigations and enforcements must be authorized by a senior DOJ official and should only be pursued after consideration of the following factors:

Total elimination of cartels and transnational criminal organizations – focusing on alleged conduct that is associated with or involves laundering money for a cartel or transnational criminal organization (TCO) or is linked to state-owned entities or foreign officials who have received bribes from cartels or TCOs.

Safeguarding fair opportunities for U.S. companies – prioritizing the investigation and prosecution of foreign bribery that impacts “specific and identifiable” U.S. entities or individuals (e.g., organizations that engage in bribery that “skew[s] markets and disadvantage[s] law-abiding U.S. companies”).

Advancing U.S. national security – focusing on “threats to U.S. national security resulting from the bribery of corrupt foreign officials involving key infrastructure or assets.” Key sectors include defense, software, artificial intelligence, critical minerals and deepwater infrastructure.

Prioritizing investigations of serious misconduct – emphasizing investigations of alleged conduct “that bears strong indicia of corrupt intent tied to particular individuals.”

Principles of Federal Prosecution – requiring consideration of multiple factors, including the nature and seriousness of the offense and any deterrent effect of prosecution.

Prosecutorial discretion – noting that DOJ will implement prosecutorial discretion in investigating, prosecuting, and continuing actions based on a totality of the circumstances.

Matthew R. Galeotti, Head of DOJ’s Criminal Division, recently spoke about the new FCPA enforcement guidelines, stating that while “[n]o one factor is necessary or dispositive,” the focus of these guidelines is “vindication of U.S. interests,” and that DOJ will be prioritizing misconduct that “genuinely impacts the United States or American people.”

After a lull in enforcement actions following President Trump’s February Executive Order, the new guidelines demonstrate that FCPA enforcement is alive and well under the current administration. While these new guidelines, along with DOJ and the Trump administration’s concurrent initiatives, emphasize a focus on individuals, non-U.S. entities, and specific business lines (e.g., those that have a risk of interaction with cartels and TCOs), the impact on all organizations will be broad.

The new FCPA enforcement guidelines underscore the importance for organizations to maintain a resilient, risk-based compliance program that implements a consistent and vigilant stance against corruption and bribery that will withstand broad prosecutor discretion and the possibility of policy changes under the current and future administrations. DOJ clarified in its new guidance that it will focus on serious misconduct, rather than “de minimis” violations like small gifts or modest perks (although those may be used in books-and-records charges by the SEC). While gifts, travel expenses and entertainment remain important in an effective compliance program, the new DOJ guidance emphasizes the need for companies to focus their compliance efforts on (1) areas where business decision are made, including third-party representatives and agents, joint ventures, government tenders and public-private partnerships and on (2) business activities in emerging and high-risk corruption regions such as Brazil, Mexico, India and China.

The following are additional key takeaways that organizations should consider in reviewing and enhancing their compliance programs to address the new FCPA enforcement priorities:

DOJ’s Prioritization of Investigating and Prosecuting Individuals

Impact: The impact to organizations that may come as the result of DOJ’s focus on individual conduct can be broad and significant. From personnel implications to reexamination and even restatement of financial information prepared or certified by specific individuals, organizations can be significantly impacted by individual misconduct and investigation and prosecution of individuals within their businesses.

Compliance Review: In an effort to prevent such misconduct, businesses should require regular and thorough training on FCPA compliance across their organizations — with a focus on the subjects at the forefront of DOJ’s prohibition of conduct that “directly undermines U.S. national interests.” Any impression that DOJ will not enforce the FCPA or that the FCPA is no longer applicable to specific industries due to DOJ’s updated focus areas should be eliminated throughout the organization, especially among personnel outside the United States.

DOJ’s Focus on “America First” Initiatives

Impact: International organizations with a U.S. nexus may now be held to higher levels of scrutiny under the FCPA than their U.S. counterparts. DOJ has vowed to “vindicate” U.S. interests through its enforcement of the FCPA, and with this focus, non-U.S. entities may see increased FCPA enforcement for their conduct that is viewed as harm to U.S.-based businesses.

Compliance Review: Non-U.S. entities should conduct a focused risk assessment and review of policies to determine whether its business could be perceived as negatively implicating U.S. business interests. For instance, DOJ is likely to focus on alleged corruption by international organizations competing with U.S-based companies. Moreover, DOJ is encouraging whistleblower reports, which may be utilized by companies to initiate potential investigations of their competitors. Organizations competing against U.S. companies for business outside the U.S should review and update as needed their compliance procedures and conduct additional training for employees and agents to guard against potential violations. Further, because DOJ has made clear it will use the FCPA to further U.S. interests, it is important that organizations and their leadership understand how national security interest connect with anti-corruption compliance. Organizations should have increased insights into its political contributions, lobbying efforts and dealings with foreign government-owned companies.

DOJ’s Emphasis on Cooperation and Self-Reporting

Impact: Under the new policy updates, failure by an organization to timely report and cooperate with DOJ’s investigation of individuals can have negative and potentially severe implications on DOJ’s charging decisions. Organizations should also be mindful that they could be tasked with cooperating with DOJ’s review of competitors and foreign contacts accused of FCPA violations. As Bracewell recently reported, DOJ continues to stress the importance of self-reporting by entities that have discovered violations within or outside of their organizations and DOJ has set out powerful incentives for companies to do so.

Compliance Review: DOJ has emphasized that “significant benefits” will be available to businesses that participate in the fight against corruption. And in contrast, “those who do not come forward despite all the benefits available,” will be “aggressively – yet fairly” prosecuted. Therefore, a robust compliance program that is designed to prevent and detect potential violations of law will not only include policies that forbid specific conduct in addition to broad statements against “violations of law,” but also, in the event that there are perpetrators, will allow for swift identification, investigation and elimination of violations and aid in self-reporting and cooperation efforts. Organizations should encourage a “speak up” culture with easily accessible and anonymous reporting options for employees as well as individuals outside of the organization. Stakeholders should be encouraged to raise concerns and complaints for the organization to review and investigate, and organizations should have effective internal investigation procedures in place to ensure efficient and thorough review of complaints. Moreover, companies should not rely only on manual reviews and internal whistleblowers to detect potential violations. Organizations should consider investing in right-sized automated monitoring that can offer proactive, data-driven detection to allow the organization to identify misconduct early and to act quicker.

DOJ’s Focus on Cartels and TCOs

Impact: With DOJ putting the world on notice of its focus on cartels and TCOs and tying cartel activity directly to FCPA enforcement, businesses will need to be more cognizant of their third-party intermediaries, agents, vendors, joint venturers and other third parties involved in transactions and avoid activity with these types of organizations, even indirectly.

Compliance Review: Stringent due diligence, policies and training on identification, verification and risk assessment of third parties will be paramount to ensure effective scrutiny of business partners. Organizations should ensure that “Know Your Customer” (as well as clients and counterparties) standards are updated and properly implemented to ensure proper continued monitoring and verification of third parties. Organizations should also update their risk assessment to identify regions in which cartels and TCOs are known to operate, such as Mexico and Colombia, and consider strengthening compliance procedures and conducting targeting training to reduce the risk in doing business in high-risk areas.

Reaction of Auditors, Banks and Financial Advisors

Impact: Auditors, banks and financial advisors may have a heightened interest in review of the books, records and internal accounting controls of businesses because of a concern of potential decreased anti-corruption compliance efforts by companies after mixed messaging on DOJ FCPA enforcement. It is likely that auditors and other financial advisors will increase scrutiny of anti-corruption compliance and the internal review or investigation of any potential violations of company policies or applicable laws.

Compliance Review: It is imperative that all levels of employees are trained and equipped to identify the impact that bribery and corruption can have on an organization’s internal records. Executives must additionally be adequately informed on their organization’s books and records and controls over financial reporting to make accurate representations in connection with the organization’s financial statements. With DOJ’s renewed focus on individual behavior, executives, as well as Audit Committee members, and other board members and senior officials must also be familiar with their obligations to certify accurate financial records. Further, board members and management should take steps to have an adequate understanding of the company’s key compliance programs and how the company has identified and addressed any anti-corruption compliance gaps and/or potential violations of law. Companies should consider refreshing policies and training to ensure each of these key groups understands their roles and responsibilities.

Anti-Corruption Actions Outside of the United States

Impact: With a drop in FCPA investigations and enforcement actions in the United States following President Trump’s pause on FCPA enforcement, other countries have increased their review of bribery and corruption. As Bracewell discussed in a previous alert, three countries established the International Anti-Corruption Prosecutorial Taskforce focused on anti-corruption initiatives earlier this year, and other countries and law enforcement agencies may follow suit. Similarly, while DOJ has historically been the primary enforcer of the FCPA, the SEC has stated that “FCPA enforcement continues to be a high priority area for the SEC’s enforcement program.” Thus, businesses are still at risk of facing consequences from regulators at home or abroad.

Compliance Review: In addition to the FCPA, organizations should review their compliance policies and procedures to ensure that they do not conflict with anti-corruption rules and regulations from other areas of the world and continue to be mindful of additional taskforces that may arise as a result as DOJ endeavors to address President Trump’s directives.

In response to these policy updates, and as part of an effective compliance program, organizations should consider steps to strengthen their compliance programs to prevent and detect misconduct, including corruption and bribery. Strong compliance programs that effectively prohibit and identify potential violations are designed around a focus on risk assessments, tone and culture, due diligence, regular training, effective policies and procedures, and continuous monitoring and improvement. Not only will this allow organizations to root-out misconduct, but it will also allow them to capitalize on the self-disclosure benefits emphasized by DOJ if violations are prevented.

Texas on My Mind: New Bills from the 2025 Legislative Session Affecting Contractors in the Lone Star State

With the recent conclusion of the biannual sprint that is the Texas Legislative session, Gov. Greg Abbott has started signing bills, including two that affect the construction industry: one in the area of construction defect claims on public buildings/public works projects and the second regarding the ability for parties to assign construction trust fund claims.

Accrual Date for Construction Defect Claims on Public Buildings/Public Works

HB 1922 was signed by Abbott on June 20, 2025, amending Texas Government Code Chapter 2272, which covers claims by governmental entities against contractors, subcontractors, suppliers, or design professionals for construction defects on public buildings or public works projects.

Under Chapter 2272, before a governmental entity can bring a construction defect claim, they must provide each party the governmental entity has a contract with for the design or construction of the affected building/public work with a written report by certified mail, return receipt requested, that (1) identifies the specific construction defect on which the claim is based; (2) describes the present physical conditions of the affected structure; and (3) describes any modification, maintenance, or repairs to the affected structure made by the governmental entity or others since the affected structure was initially occupied or used. A contractor who receives such a report then has five days to provide a copy of the report to each subcontractor retained on the construction of the affected structure whose work is subject to the claim.

HB 1922, which takes effect on September 1, 2025, amends Chapter 2272 to establish that a governmental entity’s construction defect claim under Chapter 2272 accrues on the date the governmental entity’s required report is postmarked by the U.S. Postal Service. HB 1922 goes on to state that for all other purposes, including the date of an occurrence under an applicable insurance policy and the date a cause of action accrues for purposes of determining whether the action is barred by a statute of limitations or repose, the date of the accrual of those causes of action is unaffected by HB 1922.

Practically, HB 1922’s intent is clarification of the accrual date for claims between governmental entities and contractors to avoid confusion, inconsistency, and disputes regarding when the government’s construction defect claim accrued. However, HB 1922’s adoption should not affect parties’ practice regarding notice to insurers, whether a claim by a governmental entity is barred by the statute of repose, or the applicable accrual date for claims arising out of the governmental entity’s defect claim between contractors, subcontractors, and suppliers (defense/indemnity/contribution, etc.).

Assignment of Trust Fund Claims

Texas Property Code Chapter 162, otherwise known as the Texas Construction Trust Fund Act, gives downstream parties, such as subcontractors and suppliers, the ability to assert claims against an upstream party, such as a general contractor, who receives payment from an owner on a construction project, and then wrongfully retains, uses, or disburses those funds without fully paying its obligations to the downstream subcontractor or supplier.

SB 841, which also takes effect on September 1, 2025, was drafted to address scenarios where general contractors received payment from an owner, passed that payment along to a first-tier subcontractor, and then that first-tier subcontractor failed to pay second-tier subcontractors or suppliers. Prior to SB 841, a general contractor in that situation could not pursue the wrongfully withheld trust funds under the Texas Construction Trust Fund Act, as that act only granted a cause of action to parties that did not receive payment.

With the adoption of SB 841, the Texas Construction Trust Fund Act has been amended to allow a second-tier subcontractor with a trust fund claim against a first-tier subcontractor to assign that claim to a general contractor or other party on the construction project.

SB 841 specifies that for the assignment to be enforceable it must:

Be made in writing not earlier than the date the assignee (general contractor in our scenario) has paid the beneficiary (second-tier subcontractor in our scenario) in good and sufficient funds for the assignment;

Not be made as part of the beneficiary’s (second-tier subcontractor) construction contract;

Make sure the assignee (general contractor in our scenario) is a beneficiary, trustee, or property owner under the construction contract with which the trust funds are paid (i.e., the assignee cannot be a stranger/outsider to the construction project); and

Provide written notice of the assignment to the property owner and the contractor on the project no later than the seventh day after the assignment is made.

Listen to this post

New Rhode Island Tax on Non-Owner-Occupied Properties Assessed at $1 Million or More

Rhode Island’s 2026 budget bill contains a “Non-Owner-Occupied Property Tax Act,” which is popularly referred to as the “Taylor Swift Tax.” This law imposes a new statewide tax on non-owner-occupied residential properties with assessed values of $1 million or more.

The tax applies to owners of residential properties that meet the following criteria:

The property must have an assessed value of $1 million or more as of December 31 of the tax year

The property must not serve as the owner’s primary residence

The owner must not occupy the property for a majority of days during the tax year.

The tax rate is set at $2.50 for each $500 of assessed value above $1 million. For example, a property assessed at $1.2 million would incur an annual tax of $1,000, while a property assessed at $2 million would face a $5,000 annual tax, and a $3 million property would be subject to $10,000 annually.

Beginning July 1, 2027, the $1 million threshold will be adjusted annually based on the Consumer Price Index for All Urban Consumers (CPI-U), with adjustments compounded annually and rounded up to the nearest $5 increment, though the threshold can never decrease from the prior year.

There are important exemptions that property owners should carefully consider. For instance, the tax does not apply to properties that are rented for more than 183 days during the prior tax year and are subject to Rhode Island’s landlord-tenant law. Property owners will have certain appeal rights and procedures available to challenge the tax.

The legislation also imposes significant record-keeping requirements on property owners. Property owners must maintain records necessary to determine tax liability for three years following the filing of any required return or until any litigation or prosecution is resolved.

Required records include rental agreements, rent payments, bank statements for residential expenses, utility bills, and any other records establishing residency or non-residency. These records must be made available for inspection by the tax administrator or authorized agents upon demand during reasonable business hours.

This law represents a significant development in Rhode Island property taxation and will substantially impact investment property owners, vacation homeowners, and others holding non-owner-occupied residential real estate. Property owners should consult with legal and tax professionals to assess the specific impact on their holdings and develop appropriate compliance and planning strategies.

New Indiana Law Requires Transparency in Political Subdivision Appointments

Effective July 1, 2025, Indiana Code 5-14-9 will require the inclusion and publication of certain appointment-related information for all appointed officers of any board, body, committee, commission or other instrumentality of a political subdivision in Indiana. This information must be included in meeting notices and agendas, as well as on political subdivision or state websites.

Barnes & Thornburg is alerting Indiana political subdivision clients to the adoption of Indiana Code 5-14-9 (the “Act”), pursuant to House Enrolled Act (HEA) 1509, which was signed by Governor Mike Braun on April 10, 2025.

Under the Act, any meeting notice or agenda of a “board, body, committee, commission or other instrumentality of … a political subdivision” (each, a “Board”) must include the following information for each officer appointed by an elected official or body:

The officer’s name;

The appointing authority who appointed the officer; and

The beginning and expiration date of the officer’s term of appointment.

This information must also be published on the website of the relevant Board or its appointing authority. If neither maintains a website, then the foregoing information must be published on Gateway.

To comply with the Act, leaders and administrators of Indiana political subdivisions should:

Identify all boards, bodies, committees, commissions or other instrumentalities associated with the political subdivision;

Gather the required appointment information for each officer by July 1, 2025;

Update meeting notice and agenda templates for each Board to include the new disclosure requirements; and

Publish the required information on the appropriate website – or, if no website exists, ensure it is posted on Gateway.

NEW ATDS BATTLEGROUND: Texas Passes HUGE NEW AMENDMENT to Its State Telemarketing Law Reviving The Risk of Autodialer Cases

Friday was an absolutely world-changer in TCPAWorld.

Yes, we had the McKesson Supreme Court ruling that will literally cast everything we know about the federal TCPA into doubt—but there was a critical development at the state level that NO ONE is talking about. But your state law compliance Queen is.

And its all about Texas and autodialers.

Brace yourselves.

First, it has been a nice couple of years since Facebook was decided.

After an initial brush with uncertainty the majority rule for interpreting the TCPA’s ATDS definition has settled around the requirement that a system randomly produce phone numbers to be dialed. While this interpretation is somewhat at odds with the express language of the statute—and the Supreme Court’s ruling in Facebook –that seems to allow claims where a system merely uses an ROSNG to store numbers, the clear majority of courts will not read the TCPA so expansively.

This is great news, of course, for TCPA defendants and callers nationwide as the volume of TCPA ATDS cases has shrunk to nothingness even as the overall volume of TCPA class litigation spikes.

But in Texas a massive change just took place. The Texas state legislature has modified the state’s marketing law to massively expand the private right of action available to individuals who received unconsented calls.

Specifically, the state will now allow direct private litigation for calls made using an autodialer. And the definition adopted in Texas varies from the federal definition in a critical respect.

The TCPA defines ATDS as:

The term “automatic telephone dialing system” means equipment which has the capacity—

to store or produce telephone numbers to be called, using a random or sequential number generator; and

to dial such numbers.

The Texas law defines an ADAD as:

Equipment used for telephone solicitation or collection that can:(A) store telephone numbers to be called or produce numbers to be called through use of a random or sequential number generator; and(B) convey, alone or in conjunction with other equipment, a prerecorded or synthesized voice message to the number called without the use of a live operator.

Notice the difference in the phrasing in sub (A) for each statute. With the TCPA’s definition there is a comma that follows the phrase “store or produce telephone numbers to be called.” This critical comma was the lynchpin for the Supreme Court’s textualist approach to interpreting the statute in Facebook. The comma demonstrated the phrase “using a random or sequential number generator” modified both store and produce—meaning the Ninth Circuit had wrongly interpreted the statute in holding any system that stores numbers and can dial them automatically qualified as an ATDS. (See Marks v. Crunch.)

But look at the Texas statute!

There is no comma! Plus, the phrase is different. The fragment “Store telephone numbers to be called” is a complete phrase, unlike in the TCPA where only the word “store” appears prior to the phrase “produce telephone numbers.” The TCPA’s structure strongly implies the following restriction—use of ROSNG—modifies both verbs prior to the comma. But the Texas statute lacks that structure. Instead, the provision merely continues to reference the seemingly alternative act of “produc[ing] numbers to be called through use of a random or sequential number generator.”

Yikes.

To be clear the statute can be read either way. I can certainly imagine a court concluding the phrase ROSNG does modify both “store” and “produce” just as it does with the TCPA. But there is simply no denying the structure of the two phrases is different.

Adding to the mix, section B of the Texas statute does not reference dialing but rather the ability to use either a prerecorded or synthesized voice message to the number without the use of a live operator. The tight restriction in section B implies that mere number storage may be the predicate trigger for the application of Section A.

On the other hand, if mere storage is the predicate for section A, doesn’t that render the ROSNG provision redundant and unnecessary? Seems like that will be a defendant’s best argument moving forward.

Regardless, this change is simply massive and really increases the pressure on all marketers or collectors in Texas to make sure they are collecting consent for all outbound calls.

Texas Noncompete Shakeup: New Frontier for Health Care Practitioners

Sweeping changes to noncompete covenants are set to take effect on September 1, 2025, for health care employers in Texas. These changes stem from recent amendments to Texas’ noncompete statute. These changes will:

Expand Texas’ heightened enforceability requirements to nearly all health care practitioners.

Impose strict limits on the duration and geographic area of applicable noncompete covenants.

Cap the buyout option that must be provided to covered health care practitioners.

Who Is Impacted?

The recent amendments to Texas’ noncompete statute were enacted through Texas Senate Bill 1318 (SB 1318) that was signed into law by Governor Abbott on June 20, 2025. It will impact Texas-licensed physicians, dentists, nurses (including advanced practice nurses), physician assistants, and health care entities that execute noncompete covenants with the aforementioned health care practitioners. Downstream, these amendments have the potential to alter various health care business models, and the value assigned to health care entities in mergers and acquisitions.

What Are the Key Changes?

Since 1999, the Texas noncompete statute has imposed heightened requirements for securing enforceable covenants with physicians licensed by the Texas Medical Board. SB 1318 takes these protections a step further by incorporating the following heightened requirements:

Mandatory/Salary-Capped Buyout Options – Similar to physicians, mandatory buyout clauses must now be integrated into noncompete covenants with dentists, nurses and physician assistants. The amendments eliminate the statute’s open-ended “reasonable price” requirement and will now require buyout clauses to not exceed a covered individual’s “total annual salary and wages at the time of termination.” For many agreements, this will result in a significant reduction from previous buyout clauses.

One-Year Duration – Noncompete covenants that are executed with physicians and other health care practitioners will be limited to one (1) year following the termination of the covered individual’s contract or employment.

Five-Mile Radius – The geographic area of noncompete covenants that are executed with physicians and other health care practitioners will now be limited to “a five-mile radius from the location at which the health care practitioner primarily practiced before the contract or employment terminated.”

Termination Without “Good Cause” for Physicians – The circumstances of a physician’s termination will impact the enforceability of their noncompete covenant. Noncompete covenants will be void and unenforceable against a physician if they are involuntarily terminated without “good cause,” which is defined as “a reasonable basis for discharge . . . that is directly related to the physician’s conduct, including the physician’s conduct on the job, job performance and contract or employment record.” Importantly, this distinction is limited to physicians. The enforceability of noncompete covenants that are executed with other health care providers will not be impacted by the circumstances of their termination.

Clear and Conspicuous Language – Noncompete covenants that are executed with physicians and other health care practitioners must now “have terms and conditions clearly and conspicuously stated in writing.” SB 1318 does not expand further on this requirement, but it will result in noncompete covenants being susceptible to attack on this basis.

Managerial/Administrative Carve-Out – Before the enactment of SB 1318, Texas’ heightened enforceability requirements extended to most physician-entered noncompete covenants “related to the practice of medicine” (excluding certain business ownership interests). This created some ambiguity regarding when these heightened requirements were triggered. SB 1318 partially resolves this by emphasizing “the practice of medicine does not include managing or directing medical services in an administrative capacity for a medical practice or other health care provider.” Stated differently, noncompete covenants that are executed with physicians employed solely in a managerial or administrative capacity will not be subject to these heighted requirements.

When Do These Changes Go into Effect?

The changes go into effect on September 1, 2025. Importantly, these changes are prospective in nature and only apply to noncompete covenants that are entered into or renewed on or after this date—meaning that preexisting noncompete covenants will continue to be governed by Texas’ noncompete laws existing before the effective date of SB 1318.

What’s Next?

These amendments are consistent with the nationwide trend towards more restrictions on the permissive use of noncompete covenants. While these amendments are not retroactive, it is conceivable that judges may still take these amendments into consideration when analyzing the enforceability of preexisting covenants in future litigation under Texas’ current “no greater than necessary” standard. In turn, employers will need to weigh whether they make these changes on a rolling basis or preemptively amend existing agreements and consider other avenues for protection.

Maine and Oregon Join List of States Prohibiting the Reporting of Medical Debt on Consumer Reports

In June, Maine and Oregon joined a growing list of states that now prohibit the reporting of medical debt to a consumer reporting agency.

On June 9, 2025, the governor of Maine signed into law LD558, which amends the Maine Fair Credit Reporting Act to prohibit medical creditors, debt collectors and debt buyers from reporting a consumer’s medical debt to a consumer reporting agency. Under the Maine law, a “medical creditor” is defined as “an entity that provides health care services and to whom a consumer incurs medical debt or an entity that provided health care services to a consumer and to whom the consumer previously owed medical debt if the medical debt has been purchased by one or more debt buyers.” Additionally, the Maine law forbids consumer reporting agencies from reporting medical debt on consumer reports. Consumers whose medical debt is reported in violation of the new amendments can seek civil remedies against the medical creditor, debt collector, debt buyer, or consumer reporting agency that reported the medical debt pursuant to the Maine Fair Credit Reporting Act for actual damages, attorneys’ fees and costs, and either treble damages or statutory damages depending on whether the violation was willful or negligent.

On June 17, 2025, the governor of Oregon signed into law SB0605, amending current Oregon statute 646A.677 to ban the reporting of medical debt owed by Oregon residents to any consumer reporting agency. The Oregon law is more expansive than the new Maine law in that it prohibits any “person” from “report[ing] to a consumer reporting agency the amount or existence of any medical debt” that a resident of Oregon “owes or is alleged to owe.” The law applies to medical debt that is owed to health care providers, as well as owed to credit cards issued for the purpose of covering medical expenses. The new law also states that consumer reporting agencies “may not include in a consumer report an item that the consumer reporting agency knows or reasonably should know is medical debt.”

The new Oregon law allows individuals to bring a private civil action pursuant to Oregon’s Unlawful Trade Practices Act against any violator of the statute. In a civil action, “in addition to any other relief a court may grant, the court may declare the medical debt void and uncollectible.”

Maine and Oregon join New York, California, Illinois, New Jersey, Minnesota, Virginia, Colorado, Rhode Island, and Vermont in enacting laws that prohibit or restrict what information regarding medical debt, if any, can be reported to consumer reporting agencies. The increase in states enacting consumer protection laws targeting medical debt is unsurprising in light of the Consumer Financial Protection Bureau’s (“CFPB”) failure to implement a federal rule on this topic.

As previously reported, in January 2025, the CFPB passed a federal rule banning the reporting of individuals’ medical debt on consumer credit reports that was set to become effective in March 2025. The CFPB, however, pursuant to a January 20, 2025 Executive Order, adjourned the implementation of the rule. Recently, the CFPB sided with creditor industry groups that filed lawsuits to halt the federal rule and asked a federal court to allow it to withdraw the federal rule banning reporting of consumer medical debt.

Health care providers delivering services to residents of Maine or Oregon, as well as debt collectors and debt buyers that perform services in these states, should ensure that their current policies regarding the reporting of consumer medical debt align with the new laws. Given the increasing number of jurisdictions enacting laws that ban the reporting of consumer medical debt and the potential for some of those laws to prevent the collection of consumer medical debts that are reported to a consumer reporting agency and/or expose the reporter of the medical debt to civil litigation and a potential monetary judgment against it, entities providing health care services and/or engaging in the collection of consumer medical debt need to remain abreast of the consumer protection laws in the states in which they provide services and adjust their practices accordingly.

New York Advances Frontier AI Bill

New York has taken a significant step toward becoming America’s first state to establish legally mandated transparency standards for frontier artificial intelligence systems. The Responsible AI Safety and Education Act (RAISE Act), which aims to prevent AI-fueled disasters while balancing innovation concerns that doomed similar efforts in other states, passed both chambers of the New York State Legislature in June 2025, and is now headed for New York Governor Kathy Hochul’s desk, where she could either sign the bill into law, send it back for amendments, or veto it altogether.

Background & Key Provisions

The RAISE Act emerged from lessons learned from California’s failed SB 1047, which was ultimately vetoed by Governor Gavin Newsom in September 2024. The RAISE Act targets only the most powerful AI systems, applying specifically to companies whose AI models meet both criteria:

Training Cost Threshold: AI models were trained using more than $100 million in computing resources.

Geographic Reach: Models are being made available to New York residents.

This narrow scope deliberately excludes smaller companies, startups, and academic researchers — addressing key criticisms of California’s SB 1047.

Core Requirements. The legislation establishes four primary obligations for covered companies:

1. Safety and Security Protocols. It requires the largest AI companies to publish safety and security protocols and risk evaluations. These protocols cover severe risks, such as the assisting in the creation of biological weapons or carrying out automated criminal activity.

2. Incident Reporting. The bill also requires AI labs to report safety incidents, such as concerning AI model behavior or bad actors stealing an AI model, should they happen. This includes scenarios where dangerous AI models are compromised by malicious actors or exhibit concerning autonomous behavior.

3. Risk Assessment and Mitigation. Companies must conduct thorough risk evaluations covering catastrophic scenarios, including:

Death or injury of more than 100 people

Economic damages exceeding $1 billion

Assistance in creating biological or chemical weapons

Facilitation of large-scale criminal activity

4. Third-Party Auditing. Conduct third-party audits to ensure compliance with the act.

Enforcement Mechanisms. If tech companies fail to live up to these standards, the RAISE Act empowers New York’s attorney general to bring civil penalties of up to $30 million. This enforcement structure provides meaningful deterrent power while avoiding criminal liability.

Safe Harbor Provisions. The Act includes important protections for responsible development, allowing companies to make “appropriate redactions” to safety protocols when necessary to:

Protect public safety

Safeguard trade secrets

Maintain confidential information as required by law

Protect employee or customer privacy

Distinguishing Features from California’s SB 1047

For frontier AI models, the New York RAISE Act appears crafted to address specific criticisms of California’s failed SB 1047:

No “Kill Switch” Requirement: The RAISE Act does not require AI model developers to include a “kill switch” on their models.

No Post-Training Liability: It does it hold companies that post-train frontier AI models accountable for critical harms.

Academic Exemptions: Universities and research institutions are excluded from coverage.

Startup Protection: The high computational cost threshold ensures smaller companies remain unaffected.

Broader Regulatory Landscape

State vs. Federal Regulation. The RAISE Act represents a broader debate over AI regulation in the United States. Key considerations include:

Regulatory Fragmentation: The potential for a patchwork of state regulations creating compliance challenges

Federal Preemption: Ongoing Congressional efforts to establish uniform national standards

International Competitiveness: Balancing safety concerns with maintaining U.S. leadership in AI development

Legal Implications

Immediate Compliance Considerations. Companies operating frontier AI models in New York should consider preparing for potential compliance requirements:

Safety Protocol Documentation: Begin developing comprehensive safety and security protocols that can withstand public scrutiny while protecting proprietary information.

Incident Response Systems: Establish robust systems for detecting, documenting, and reporting safety incidents.

Third-Party Audit Preparation: Identify qualified auditors and establish audit-ready documentation systems.

Legal Review: Conduct thorough legal analysis of current operations under the proposed regulatory framework.

This analysis is based on publicly available information as of June 2025. Legal practitioners should monitor ongoing developments and consult current legislation and regulations for the most up-to-date requirements.

For frontier AI models, the New York RAISE Act appears crafted to address specific criticisms of California’s failed SB 1047

Iowa Requires Equal Treatment for Adoptive Parents by Employers

On May 19, 2025, Iowa Governor Kim Reynolds signed House File 248, which requires employers to treat adoptive parents the same as biological parents under certain circumstances. Specifically, if an employee adopts a child up to six years of age, an employer must treat the employee “in the same manner as an employee who is the biological parent of a newborn child for purposes of employment policies, benefits, and protections for the first year of the adoption.”

The law defines adoption as the “permanent placement in this state of a child by the Department of Health and Human Services, by a licensed agency under chapter 238 [child-placing agencies], by an agency that meets the provisions of the interstate compact in section 232.158, or by a person making an independent placement according to the provisions of chapter 600.”

The law does not require employers to provide disability leave to an employee without a qualifying disability under an employer’s disability policies. However, Iowa employers should review any policies or benefits geared toward new parents to ensure compliance with the law.

The law will take effect on July 1, 2025, as Iowa Code § 91A.5B and it will be enforced by the Iowa Department of Inspections Appeals and Licensing.