Considerations for Connecticut’s New Environmental Cleanup Rules

Connecticut is transitioning to a new approach to environmental cleanup and property transactions. The Release-Based Cleanup Regulations (RBCRs) will replace the Transfer Act[1], which impacted property sales and redevelopment. Effective March 1, 2026, this shift seeks to align Connecticut with other states’ practices and may create opportunities and challenges for property owners, developers, and environmental professionals.

For nearly 40 years, the Transfer Act linked environmental inspections and cleanups to property transfers. While well-intentioned, the system created barriers and could delay transactions or deter sales. As properties languished under the weight of complex regulations, contamination issues frequently went unaddressed. A 2019 study examined the economic effects, noting potential impacts on employment and state and local revenue between 2014-2018.[2]

The RBCRs aim to flip this script by focusing on contamination as it is discovered, rather than tying remediation to property sales. By doing so, the new rules seek to encourage proactive cleanup while freeing up properties for timely transactions.

Changes Under the RBCRs

Under the new rules, owners must report contamination upon discovery and adhere to specific cleanup timelines. This shift could change the landscape of Connecticut property transactions, particularly in areas with historical contamination, like urban and coastal sites.

For buyers, the rules may offer greater flexibility. Inspections are no longer mandatory before a sale, which may expedite some transactions. However, this freedom comes with heightened risk. Buyers should consider the potential liabilities of purchasing contaminated properties, especially without pre-transaction inspections, and consider clearly defining environmental responsibilities in sale agreements.

The RBCRs also introduce new allowances, such as thresholds for minor contamination and exemptions for incidental releases. For example, contamination from routine roadwork or utility projects may no longer trigger immediate regulatory action. Similarly, single-family homeowners are exempt, but landlords of multifamily properties face stricter obligations regarding tenant safety.

For urban properties, which often face environmental challenges, there may be renewed interest under the RBCRs. The Transfer Act’s soil removal requirements, which mandated replacing four feet of soil in contaminated areas, could make redevelopment cost prohibitive. The new regulations provide more flexible remediation options, which may enable developers to manage contamination without excessive costs.

Possible Regional Implications of Connecticut’s Regulatory Shift

Connecticut’s transition from the Transfer Act to Release-Based Cleanup Regulations (RBCRs) exemplifies a shift toward decoupling environmental remediation from property transactions, a model that may influence regulatory frameworks in neighboring states. New Jersey’s Site Remediation Reform Act (SRRA) already reflects a release-based approach by emphasizing site-specific cleanup responsibilities, but the RBCRs may further encourage New Jersey to refine its existing policies. The broader principles underlying the RBCRs—streamlining remediation and balancing environmental and economic priorities—may serve as a model for other states in the region as they consider reforms to improve efficiency in addressing historical contamination.

[1] Connecticut General Statutes §§ 22a-134 through 22a-134e

[2] Connecticut Economic Resource Center, Study on the Impact of the Transfer Act (2019) (finding the Act caused the loss of approximately 7,000 jobs and $178 million in tax revenue from 2014 to 2018), available at Hartford Business Journal.

Trump Administration Day One Executive Orders: Regulatory Freeze

Among the flurry of executive orders that President Trump issued in the hours following his inauguration on January 20th was a memorandum titled Regulatory Freeze Pending Review (2025 Trump Regulatory Freeze Memorandum), which directs agencies to:

Refrain from proposing or issuing any rule[1] in any manner until a President Trump-appointed agency head reviews and approves the rule;

Immediately withdraw any rules that have been sent to the Office of Federal Register (OFR) but not published in the Federal Register so that they can be reviewed and approved by a President Trump-appointed agency head; and

Consider[2] postponing for 60 days the effective date for any rules that have been published or issued but have not taken effect, for the purpose of reviewing any questions of fact, law, and policy that the rules may raise.

This memorandum closely mirrors regulatory freeze memoranda issued by the first Trump administration in 2017 (2017 Trump Regulatory Freeze Memorandum) and the Biden administration in 2021, but the immediate impact of the memorandum will likely be different from what we have seen in the past. Six days after the Trump administration issued the 2017 Trump Regulatory Freeze Memorandum, EPA published in the Federal Register a final rule delaying the effective date of 30 final EPA regulations that the agency had published between October 28, 2016 and January 17, 2017. 82 Fed. Reg. 8499 (Jan. 26, 2017). These rules had original effective dates after January 20, 2017, the date that President Trump issued the 2017 Trump Regulatory Freeze Memorandum. Several agencies in the Biden administration, however, including EPA, appear to have been prepared for a regulatory freeze memorandum and avoided issuing final regulations at the end of 2024 that would go into effect after President Trump’s inauguration. For example, EPA’s rule implementing the requirements of the Waste Emissions Charge in the Clean Air Act’s Methane Emissions Reduction Program, enacted as part of the Inflation Reduction Act, went into effect on January 17, 2025. 89 Fed. Reg. 91094 (Nov. 18, 2024).

Nonetheless, some environmental and energy-related regulations may be affected by the freeze. For example, on January 21st, EPA’s final rule regarding Revisions to the Air Emission Reporting Requirements and proposed rule regarding Clean Water Act Effluent Limitations Guidelines and Standards for PFAS Manufacturers Under the Organic Chemicals, Plastics and Synthetic Fibers Point Source Category were both identified on the White House’s Office of Management and Budget’s (OMB) website as under review, but as of January 22nd are no longer identified as under OMB review and do not appear on OFR’s website. EPA may have withdrawn these rules from OMB’s consideration in accordance with the 2025 Trump Regulatory Freeze Memorandum, but their status remains unclear.

In addition, the Pipeline and Hazardous Materials Safety Administration (PHMSA) made available on its website pre-publication versions of proposed and final rules that have been submitted to the OFR but are not yet available for public inspection or published in the Federal Register. See Proposed Rule: Safety of Carbon Dioxide and Hazardous Liquid Pipelines; Final Rule: Gas Pipeline Leak Detection and Repair. These proposed and final rules are subject to the regulatory freeze in accordance with the memorandum’s directive that agencies “[i]mmediately withdraw any rules that have been sent to the [OFR] but not published in the Federal Register” so that they can be reviewed and approved by a President Trump-appointed agency head. Both of these rules appear to have been withdrawn from publication in the Federal Register. However, we also note that EPA published a proposed rule on January 22nd that was seemingly subject to the freeze. See National Emission Standards for Hazardous Air Pollutants: Chemical Manufacturing Area Sources Technology Review, 90 Fed. Reg. 7942 (Jan. 22, 2025). In sum, there appears to be some open questions on the status of certain rules not yet published in the Federal Register.

Lastly, final environmental regulations that have been published in the Federal Register as final but that have not yet gone into effect include the following EPA final rules:

Review of the Secondary National Ambient Air Quality Standards for Oxides of Nitrogen, Oxides of Sulfur, and Particulate Matter, 89 Fed. Reg. 105692 (Dec. 27, 2024) (eff. Jan. 27, 2025);

Integrating e-Manifest With Hazardous Waste Exports and Other Manifest-Related Reports, PCB Manifest Amendments, and Technical Corrections, 89 Fed. Reg. 60692 (Sept. 26, 2024) (eff. Jan. 22, 2025); and

Hazardous Waste Generator Improvements Rule, the Hazardous Waste Pharmaceuticals Rule, and the Definition of Solid Waste Rule; Technical Corrections, 89 Fed. Reg. 99727 (Dec. 11, 2024) (eff. Feb. 10, 2025).

Per the 2025 Trump Regulatory Freeze Memorandum, EPA is to consider postponing for 60 days the effective date of these rules for the purpose of reviewing any questions of fact, law, and policy that the rules may raise.

How quickly agencies will be able to initiate review and approval of these regulations depends on the Trump administration’s immediate priorities and how quickly agency roles are filled with President Trump appointees.

[1] The 2025 Trump Regulatory Freeze Memorandum defines “rule” to include both final rules and “any substantive action by an agency (normally published in the Federal Register) that promulgates or is expected to lead to the promulgation of a final rule or regulation, including notices of inquiry, advance notices of proposed rulemaking, and notices of proposed rulemaking.”

[2] The use of the word “consider” is one notable difference between the 2017 and 2025 memoranda issued by the Trump administration. The postponement directive in the 2017 Trump Regulatory Freeze Memorandum was not optional.

Will 2025 Continue Circuit Court Harmony in Nationwide Litigation Involving State Law Hemp Legislation, or Will a Circuit Split Emerge?

You’ve probably seen the reports of the United States Fourth Circuit Court of Appeals’ January 7, 2025 opinion upholding a Virginia law that regulates consumable hemp products. I planned to put up a blog post soon after the opinion was handed down, and I will still summarize the holding here. But the delay in writing allowed me to take a step back (and another step back), and view this in proper perspective: 2025 is going to be a huge year in the state law hemp legislation vs. hemp industry Farm Bill disputes that have been simmering over the last couple of years. Let me explain how this will soon boil over.

If you are still reading this, I suspect I don’t need to provide an overview of the 2018 Farm Bill and its impact on the hemp industry, notably on the consumable hemp product industry. If you want a refresher on that, you can read some of our older articles on the subject here and here. With that backdrop, more and more states have in recent years passed laws restricting the production and sale of consumable hemp products with each passing legislative session. And with each new piece of legislation comes a new legal challenge. Most of these cases start in a federal trial court, and over the last few years, we have seen those courts reach varying decisions although the majority uphold the restrictive state legislation. Appeals have followed, and this year, kicked off by the Fourth Circuit’s January 7 decision, should go a long way towards molding this little pocket of jurisprudence and potentially influencing how the Farm Bill is ultimately modified.

Fourth Circuit Upholds Consumable Hemp Restrictions

As the Fourth Circuit put it in its Northern Virginia Hemp & Agriculture, LLC v. Virginia opinion, Virginia “took action” to address its “marijuana problem” by passing a 2023 law that regulates the retail sale of hemp products based on their total THC level and limits the concentration of that level in products in a more restrictive manner than what was legal under federal law. — F.4th —-, 2025 WL 37238 (4th Cir. 2025). A lawsuit soon followed that sought injunctive relief under the usual constitutional arguments – the Supremacy Clause and Dormant Commerce Clause. The district court rejected the plaintiffs’ arguments, and the Fourth Circuit appeal followed.

Conceptually following the Seventh Circuit’s 2020 C.Y. Wholesale, Inc. v. Holcomb, 965 F.3d 541 (7th Cir. 2020) opinion, the Fourth Circuit affirmed the district court’s dismissal of the suit, detailing why each constitutional challenge failed. As for the Supremacy Clause, the court addressed each applicable preemption doctrine in turn (express, field, and conflict). Rejecting plaintiffs’ express preemption argument, the court concluded that “the plaintiffs’ argument overread” the Farm Bill’s notes stating that a state can’t prohibit the transportation or shipment of hemp or hemp products. Focusing on the Farm Bill’s plain language authorizing states to regulate the production of hemp more stringently than federal law, the court held that the plaintiff’s express preemption argument “crumbles.” And, based on that Farm Bill provision and further due to that law expressly designating states as the “primary regulatory authority over the production of hemp,” the court rejected plaintiffs’ field preemption argument. As for conflict preemption, the court disregarded plaintiffs’ argument that the total THC standard set forth in the Virginia bill conflicted with the Farm Bill’s definition of what constitutes legal hemp, concluding that “[w]hen the actual language of the statutes is considered, S.B. 903 is [neither] in direct conflict with the purpose of the Farm Bill [nor] does it pose an obstacle to its purpose.”

Plaintiffs’ dormant commerce clause faced the same fate. Holding that the Virginia law did not favor in-state entities to the detriment of out-of-state ones, the court noted that the total THC standard applied equally to resident and nonresident entities. The court also found that allegations of cost increases were both speculative and equally applicable to all entities, no matter where domiciled. This decision follows the Seventh Circuit (the only other circuit court addressing these precise challenges) in upholding state laws that regulate hemp products more restrictively than the Farm Bill.

Eighth Circuit Ruling Looms

We have discussed the Bio Gen LLC et al. v. Sanders case before here and here, which now awaits a ruling from the Eighth Circuit. The court heard arguments on September 24, 2024, and the Arkansas attorney general sent the court a letter on January 8 informing it of the Fourth Circuit’s decision. That letter follows a December 3, 2024 letter the AG sent informing the Eighth Circuit of an October 10, 2024 New Jersey federal court decision (Loki Brands, LLCv. Platkin, No. 24-9389, 2024 WL 4457485 (D.N.J. Oct. 10, 2024)) upholding a New Jersey law regulating hemp products in the state, in which the AG noted:

With that decision, one court of appeals [now two after the 2025 Fourth Circuit opinion] and a total of eight district courts spanning five other circuits – in Alaska, California, Hawaii, Iowa, South Dakota, Virginia, Wyoming, and now New Jersey – have rejection [sic] implied preemption challenges to laws like the one at issue here, with the district court below the sole outlier.

Will the Eighth Circuit affirm the lower court’s outlier ruling that sided with the hemp industry plaintiffs and enjoined the Arkansas law, or will the court follow the Fourth and Seventh circuits and reverse? We should have an answer very soon.

10th Circuit Ruling Expected in 2025

After a Wyoming court rejected constitutional challenges to a Wyoming law that prohibited hemp from containing “synthetic substances,” added certain psychoactive isomers to the definition of THC, and added delta-8 to the list of controlled substances, the plaintiff hemp businesses filed suit. Similar to the Fourth Circuit’s ruling discussed above, the U.S. district court in Wyoming concluded that the Farm Bill did not preempt the Wyoming law and that the law did not violate the Dormant Commerce Clause. The court also rejected a regulatory takings argument. The hemp companies appealed that ruling to the 10th Circuit where briefing concluded on January 2, 2025. Like the Arkansas attorney general, Wyoming’s AG informed the 10th Circuit of the Fourth Circuit’s recent opinion. The 10th Circuit case is Green Room, LLC v. Wyoming, Nos. 24-8053 & 24-8054.

Will the Fifth Circuit See a Similar Appeal in 2025?

During the 2024 legislative session, the Louisiana Legislature amended its hemp laws to restrict where certain hemp-derived products can be sold and their potency. The hemp industry quickly responded with litigation. That matter, Hemp Assoc. of La. v. Landry, No. 3:24-cv-00871, in the U.S. District Court for the Middle District of Louisiana, was filed on October 18, 2024. The plaintiffs alleged that the 2018 Farm Bill preempts the legislation and is unconstitutional on other grounds. The state disagreed and moved to dismiss, but on November 19, 2024, the state informed the court that it would stay the effective date of the new legislation so that the parties could fully brief the pending motions and the court could reach a decision. Under a January 8, 2025, order, briefing on defendants’ motion to dismiss the plaintiffs’ challenge to the Louisiana law will conclude on February 10, 2025, and a hearing on the motion is set for March 27, 2025.

What Does this All Mean?

With Congress again extending the reauthorization process for the Farm Bill, the judiciary branch is helping shape the future of the consumable hemp product industry. And, while we may not see any U.S. Circuit Courts of Appeals beyond those discussed above decide these issues in 2025, federal courts in other jurisdictions, including New Jersey, Iowa, and South Dakota, issued notable rulings on these same issues last year. Also, with new legislative sessions just ramping up in states across the country, we expect new state laws that, if history repeats itself at all, will lead to new court challenges that raise the same constitutional challenges that have been and are currently being adjudicated.

Geothermal: Another Source of Renewable Energy

Background

With ongoing concerns about fossil fuel emissions, focus continues to intensify on forms of renewable energy, most notably solar and wind, with proposed new solar and wind energy farms on the rise. Another form of renewable energy that is receiving more attention is geothermal energy.

Geothermal heating, which uses water from hot springs, has been used for bathing since Paleolithic times and for space heating since Roman times. Simply stated, geothermal energy is heat from within the earth. Below the earth’s crust is magma, a layer of hot and molten rock. Heat is continually produced in this layer, mostly from the decay of naturally radioactive materials such as uranium and potassium, making geothermal energy renewable. Unlike wind and solar energy, geothermal can produce power at a constant rate, without regard to weather conditions.

Geothermal Plants and Geothermal Heat Pumps

Geothermal energy can be viewed from at least two perspectives:

Geothermal energy plants that produce geothermal energy on a large-scale basis, and

(2) Geothermal systems that use ground source or geothermal heat pumps (“GHP”) to heat and cool commercial and residential buildings individually or in a geothermal heating and cooling “district,” i.e., multiple buildings within a specific area such as college campus, a military base, or a cluster of residential buildings (a “H&C District”).

Geothermal power plants have existed for more than 100 years. Today’s geothermal plants have multiple design options, but the main technique is to extract steam and hot water from the ground, use it to drive turbines, and then return it to the ground as warm water. The high costs of geothermal energy, plus the limited locations where plants can be installed, deterred the construction of geothermal energy plants, particularly in the eastern U.S.

For example, no known conventional geothermal resources suitable for power production exist in Pennsylvania. But even though the western U.S. is more conducive to the construction of geothermal power plants, issues such as earthquake risk, impacts on water quality and consumption, air contamination, and land subsidence present challenges. Nevertheless, geothermal energy use is increasing worldwide as an alternative to fossil fuel use.

How GHPs Work

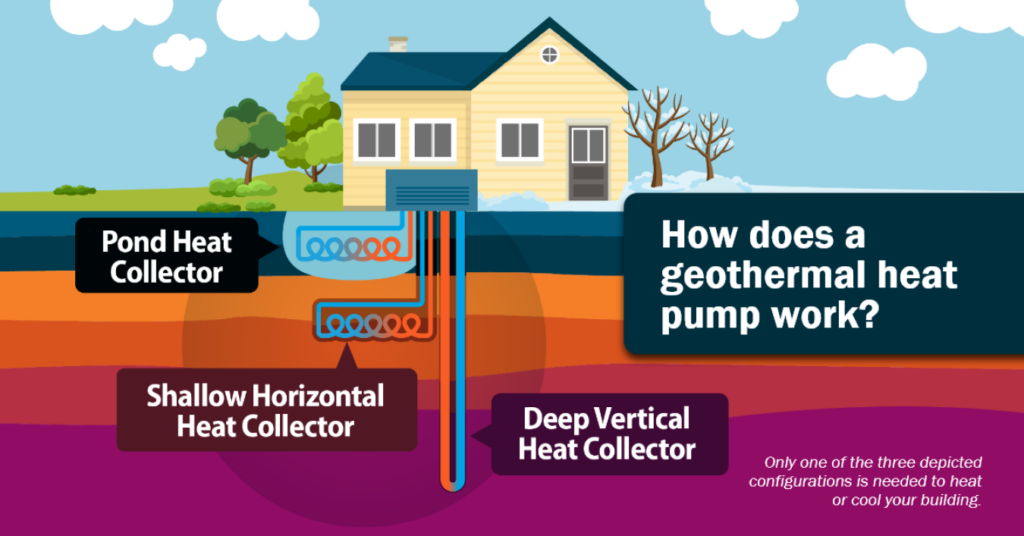

While some eastern U.S. states lack the resource capacity for large scale geothermal systems, GHPs present a viable alternative to fossil fuels in eastern U.S. states such as Pennsylvania, New Jersey, and New York. The Earth’s temperature in these states remains constant, which is conducive to the use of GHPs. GHP systems were first developed in the late 1940s. Using a heat exchanger, a geothermal heat pump can move heat from one space to another. In summer, the geothermal heat pump extracts heat from a building and transfers it to the ground for cooling. In a ground loop system, U-shaped pipes called ground loops are buried either vertically or horizontally in the ground and circulate a mix of water and antifreeze from the heat pump through the soil, and then back to the heat pump. This thermally conductive mix releases heat into or absorbs heat from the ground as it moves through the underground loop, facilitating the heat transfer that the ground-source heat pump needs to lower indoor temperatures in the summer or raise them in the winter. Once the geothermal heat pump conditions the air, the distribution system delivers it throughout the building.

Visuals from Department of Energy (energy.gov) “Geothermal Heat Pumps”

An open loop geothermal system uses groundwater as a heat exchange fluid. The system pumps groundwater from a well or a body of water. The groundwater passes through a heat exchanger, transferring heat to or from the building. The water is then discharged back into the ground or a surface water source like a pond.

A closed loop geothermal system circulates a mixture of water and antifreeze through a closed network of pipes buried in the ground. The three main types of closed loop systems are horizontal loop, where pipes are laid out horizontally in trenches, where pipes are installed in vertical boreholes, and pond/lake loop where pipes are submerged in a nearby body of water. This is possible only if there is a suitable water source.

Notably, GHP systems offer renewable, efficient temperature control solutions for H&C Districts, can reduce energy consumption by more than 70% compared to standard air-conditioning equipment, and can significantly reduce carbon emissions. Further, geothermal systems can be used in new construction and in retrofitted existing buildings.

Current Initiatives

Given the potential benefits of geothermal energy systems, the federal government, Pennsylvania, New Jersey, and New York have undertaken efforts to promote geothermal energy to varying degrees:

Federal

The Inflation Reduction Act of 2022 provides investment tax credits on capital expenditures (30%) and for certain “energy communities,” e.g., brownfield sites or closed coal mines (10%).

Pennsylvania

The Renewable Energy Program provides financial assistance in the form of grant and loan funds that will be used by eligible applicants to promote the use of alternative energy including geothermal energy.

Hundreds of thousands of oil and gas wells have been drilled in the state, many before modern regulations, and lost over time in fields, forests, and neighborhoods. Evaluation is underway to determine whether the infrastructure can be repurposed for the recovery of low-grade geothermal energy.

There are between 10,000 and 15,000 abandoned underground coal mines and numerous abandoned underground metal and non-metal mines in Pennsylvania. Many of these sites are flooded. The use of geothermal energy systems capable of exchanging heat with underground mine pools existing beneath sites such as a college campus offers significant potential. One such example is Marywood University in Dunmore, PA.

Pennsylvania’s 2004 Alternative Energy Portfolio Standards Act defines geothermal energy as a Tier I energy source.

New Jersey

According to the guide for New Jersey’s Clean Energy Program™ initiative, NJ’s “SmartStart Buildings® is a statewide energy efficiency program available to qualified commercial, industrial, institutional, government, or agricultural customers planning to construct, expand, renovate, or remodel a facility, or to replace electric or gas equipment. Incentives are available for prescriptive measures or for custom measures that are selected and incorporated into the project to help offset the added cost to purchase qualifying energy-efficient equipment.” These prescriptive measures include geothermal energy.

New York

In July 2022, Senate Bill S9422 was signed into law, establishing “the Utility Thermal Energy Network and Jobs Act to promote the development of ‘thermal energy networks’ throughout the state and to provide jobs to transitioning utility workers who have lost or are at risk of losing their employment.” Thermal Energy Networks, similar in concept to H&C Districts, are utility-scale infrastructure projects that connect multiple buildings into a shared network with sources of thermal energy like geothermal boreholes, surface water, and wastewater. Rather than each building needing its own borehole, multiple buildings in a network can share the same thermal sources. Buildings are linked via underground pipes, and each building is equipped with a heat pump that provides heating or cooling by exchanging thermal energy with pipes containing circulating water. The water in the pipes maintains a temperature within the needed range by exchanging heat with geothermal boreholes or other thermal resources.

New York in particular offers some excellent examples of geothermal energy projects:

A new 463-unit residential complex near Coney Island, completed in 2024, is heated and cooled by New York City’s largest geothermal heating and cooling system. However, in 2025, Greenpoint’s 1 Java Street development, comprising 830 rental units in five buildings, will be the largest all-electric multi-family geothermal project in the state.

Autumn Gardens, a 72-unit apartment complex in Lakeport (western New York state) is heated and cooled using nine separate closed-loop geothermal heat pump systems.

A new development comprising 108 rental apartments plus ground-floor commercial and community space is underway in Ossining. The development will be heated and cooled by a closed loop geothermal system using boreholes deeper than 500 feet because of the legislation discussed below.

In late December 2024, the New York State Energy Research and Development Authority (NYSERDA) announced that more than $29 million has been awarded to 15 innovative projects that will reduce statewide carbon emissions. Included in the awards is a project involving the design and development of the largest geothermal heating and cooling system in the Northeast for Fordham University’s Rose Hill Campus in the Bronx.

Legal Concerns

As with wind and solar, geothermal energy production involves numerous legal issues that must be addressed, particularly at the state and local level. Notably, Pennsylvania does not have state laws relating specifically to heat pumps, and the process of enacting legislation and related regulations could be a multi-year process. Further, ownership of surface rights and subsurface rights in Pennsylvania are often severed, and ownership of geothermal resources would likely have to be clarified by statute.

Well Drilling

Title 7 of the New Jersey Administrative Code sets forth the permitting requirements and the construction requirements and contains specific requirements to all Category 5 vertical closed loop geothermal wells. Boreholes must be drilled by a licensed driller.

Article 23 of New York’s Environmental Conservation Law provides that owners of open loop or standing column geothermal wells deeper than 500 feet are subject to the same well permitting and reporting requirements as owners of other wells. Due to September 2023 and February 2024 legislation changes, closed loop geothermal wells deeper than 500 feet are not currently subject to the same requirements..

As noted below, municipalities in Pennsylvania have enacted ordinances governing GHP geothermal energy systems.

Discharges

The EPA National Pollutant Discharge Elimination System (NPDES) regulations apply to the surface water discharge of GHP wastewater that may occur from an open loop geothermal system. The requirement to obtain a permit may also apply GHP wastewater discharges to a stormwater system that discharges to a jurisdictional surface water body regardless of whether or not a NPDES Permit has been issued for the stormwater discharge.

Land Use

As with other projects, local land development and zoning ordinances may impact the installation of geothermal energy systems. Pennsylvania’s Municipalities Planning Code, on which local zoning ordinances are based, includes “geothermal energy” in the definition of “renewable energy source.” Various municipalities in Pennsylvania have amended their zoning ordinances to address the location, installation, and other aspects of geothermal energy systems, with a particular focus on preventing groundwater contamination.

The amount of land on which a project involving the use of a geothermal energy system will affect the design and cost of the system, e.g., vertical loop vs. horizontal loop, as well as setback and other zoning-related requirements.

Conclusion

In the eastern U.S., GHP energy systems offer the potential to heat and cool buildings, particularly in a district, at potentially significant cost savings and carbon emissions reduction. The savings realized over the life cycle of the HP system would exceed any higher initial construction costs compared to conventional systems.

Trump Administration Day One Executive Orders: Key Environmental Regulatory, Permitting, and Enforcement Implications

President Trump’s first-day executive actions prioritize the development of a wide-range of domestic energy resources and take direct aim at the climate initiatives and environmental justice priorities of the Biden administration. With the declaration of a national energy emergency, President Trump has required the U.S. Environmental Protection Agency (EPA) and other federal agencies to review numerous agency actions and authorities with the goal of “unleashing American energy.” These first-day executive actions do not themselves implement the desired changes, but the environmental ripple effects and legal challenges stemming from these initial actions will unfold in the weeks, months, and years ahead and are likely to involve nearly every major federal environmental law. In this Alert, we summarize key federal environmental regulatory, permitting, and enforcement implications from President Trump’s initial executive actions.

Review of Existing Regulations and Regulatory Freeze. EPA and other federal regulatory agencies are ordered to review and identify existing regulations and policies that unduly burden domestic energy resources and develop and begin implementing plans to expeditiously suspend, revise, or rescind the identified regulations and policies. The universe of agency actions that must be reviewed include those related to the production of oil, natural gas, coal, hydropower, biofuels, critical mineral, and nuclear energy resources.[1] Regulations and policies that unduly burden domestic mining and processing of non-fuel minerals are also covered by this mandate.[2] As is customary for a new administration, President Trump has issued a regulatory freeze designed to pause certain types of pending regulatory actions until new leadership at EPA and other agencies have an opportunity to review such actions.[3] More information regarding potential EPA rules that may be subject to the regulatory freeze can be found in this separate Alert.

Environmental Regulatory Litigation and Enforcement Implications. President Trump directed EPA and other agencies to identify unduly burdensome agency actions that are the subject of pending litigation and notify the Attorney General of these actions so that the Attorney General can seek to stay or otherwise delay these lawsuits until challenged regulations can be suspended, revised, or rescinded as ordered.[4] President Trump also ordered EPA to review and identify existing settlements and consent orders that impose an undue burden on identification, development, and use of domestic energy resources. EPA will have 30 days to report any settlements and consent orders to the Office of Management and Budget (OMB).[5] Lastly, federal agencies are directed to assess whether enforcement discretion can be utilized to advance the Trump administration’s domestic energy policy.[6]

Emergency Authorities and Streamlining Permitting for Domestic Energy Projects. President Trump has issued broad mandates to the EPA and other federal resource agencies to identify and use “lawful emergency authorities” to facilitate generation of non-wind domestic energy resources and related infrastructure, including emergency authorities under the Clean Water Act Section 404 permitting program and the Endangered Species Act.[7] President Trump revoked a 1970’s Executive Order giving the White House Council on Environmental Quality (CEQ) the authority to issue National Environmental Policy Act (NEPA) regulations and directed the CEQ to propose to rescind existing NEPA regulations to expedite and simplify permitting for energy projects.[8] EPA is directed to consider issuing emergency fuel waivers allowing for the year-round sale of E15 gasoline, and the review of applications for liquefied natural gas projects are to be restarted.[9]

Climate-Related Regulatory Underpinnings and Considerations. President Trump revoked President Biden’s Executive Orders related to climate initiatives.[10] In addition to withdrawing from the Paris Climate Agreement,[11] President Trump directed EPA to abandon the consideration of the “social cost of carbon” in regulatory determinations and submit a recommendation on the fate of the 2009 finding under the Clean Air Act that greenhouse gases threaten public health and welfare, which serves as a necessary statutory prerequisite for EPA to implement greenhouse gas emission standards for motor vehicles and other sectors.[12] All federal agencies are directed to pause clean energy and climate-related funding under the Inflation Reduction Act and Infrastructure Investment and Jobs Act, and the Trump administration has pledged to “eliminate the ‘electric vehicle (EV) mandate.’”[13]

President Trump’s first-day executive actions set the stage for reshaping the federal environmental regulatory, permitting, and enforcement landscape. The actions EPA and other agencies take to implement these new directives will be closely watched and scrutinized.

[1] Executive Order: Unleashing American Energy, Section 3 (Jan. 20, 2025).

[2] Executive Order: Unleashing American Energy, Section 9(a) (Jan. 20, 2025).

[3] Memorandum: Regulatory Freeze Pending Review (Jan. 20, 2025).

[4] Executive Order: Unleashing American Energy, Section 3(b)-(d) (Jan. 20, 2025); see also Executive Order: Ending the Weaponization of the Federal Government (Jan. 20, 2025), Sec. 3(a) (requiring the Attorney General and heads of all departments and agencies to review civil and criminal enforcement activities over the last 4 years to identify instances where such authority was used to target perceived political opponents).

[5] Executive Order: Unleashing American Energy, Section 3(b) (Jan. 20, 2025).

[6] Executive Order: Unleashing American Energy, Section 7(c) (Jan. 20, 2025).

[7] Executive Order: Declaring a National Emergency, Section 2 (Jan. 20, 2025).

[8] Executive Order: Unleashing American Energy, Section 5 (Jan. 20, 2025).

[9] Executive Order: Declaring a National Emergency, Section 2(b) (Jan. 20, 2025); Executive Order: Unleashing American Energy, Section 8 (Jan. 20, 2025).

[10] Executive Order: Unleashing American Energy, Section 5 (Jan. 20, 2025).

[11] Executive Order: Putting America First in International Environmental Agreements, Section 4.

[12] Executive Order: Unleashing American Energy, Section 6 (Jan. 20, 2025).

[13] Executive Order: Unleashing American Energy, Sections 2(e) and 7 (Jan. 20, 2025).

EPA Administrator Nominee Advances to Senate for Confirmation Vote: Nomination Hearing Highlights

The Senate Committee on Environment and Public Works (EPW) on January 23, 2025, advanced the nomination of Lee Zeldin to the full Senate for a vote to confirm him as the next Administrator of the U.S. Environmental Protection Agency (EPA). The 11-8 vote to advance the nomination was largely along party lines, with Senator Mark Kelly (D-AZ) as the only Democrat to vote in favor of advancing Zeldin’s nomination. Zeldin is expected to be confirmed by the Senate.

EPW held a hearing on the nomination of Lee Zeldin to be Administrator of EPA on January 16, 2025. The hearing provided insights into the issues of highest interest and concern to EPW members. Chairman Shelly Moore Capito (R-WV) noted several issues on which she hoped EPA would focus, including cleaning up brownfields and Superfund sites, addressing “legacy [per- and polyfluoroalkyl substances] PFAS contamination,” and reliability and affordability of electricity. Senator Sheldon Whitehouse (D-RI), ranking Democrat on EPW, stated that climate change is the number one issue for him.

Republicans raised a range of issues both for awareness and for Zeldin to focus on at EPA. Of particular interest, newly elected Senator John Curtis (R-UT) mentioned the low approval rate for new chemicals under the Toxic Substances Control Act (TSCA). Senator John Boozman (R-AR), who also Chairs the Senate Committee on Agriculture, Nutrition, & Forestry, spoke about pesticides and the need for a “predictable, science-based system.” PFAS was identified as an important issue from several perspectives, including cleanup, ongoing critical uses (e.g., defense), and the need to protect “passive receivers.” Several Republicans highlighted “cooperative federalism” as an issue.

Most Democrats emphasized climate change as a top priority issue with Zeldin. Other issues raised by Democrats included problems with cross-border pollution (both air and water), potential cuts to EPA budget and personnel, and lead in drinking water, and they flagged concerns about Clean Air Act attainment due to ongoing wildfires.

Both Republican and Democratic Senators mentioned plastics, but from differing perspectives. Senator Jeff Merkley (D-OR) stated his strong opposition to “thermal melting of plastics.” Senator Dan Sullivan (R-AK) talked about the need to clean up ocean plastics and stated that he is working on “Save Our Seas 3.0.”

Maine DEP Accepting Restoration Applications for Coastal Sand Dunes

On January 22, 2025, the Maine Department of Environmental Protection (DEP) announced that it would begin accepting applications to fund coastal sand dune restoration and protection projects.

Last year, the Legislature allocated $1 million for the 2024/2025 fiscal year for restoration, protection, and enhancement of sand dune systems. The DEP will use this money to provide funding for qualifying projects.

To qualify for funding, a project must be located in a coastal sand dune system where public access is provided to a beach or waterfront area adjacent to the coastal sand dune. Qualifying projects may include the following:

Physical projects to restore, nourish, or revegetate coastal sand dunes

Projects to protect or conserve coastal sand dunes via legal mechanisms such as conservation easements

Public education and/or technical assistance programs to restore and protect coastal sand dunes

Among the criteria the DEP will evaluate are the project’s feasibility, community benefit, cost efficiency (e.g., other funding sources), and habitat enhancement. If selected, the DEP may pay up to 50% of the project costs (except for projects that include technical assistance and public education the DEP may pay up to 100% of the cost).

The application deadline is February 24, 2025.

Trump Administration Day One Executive Orders: Energy Policy

The Trump administration issued several Executive Orders aimed at significantly altering American energy policy, which are summarized below.

Executive Order: Declaring a National Energy Emergency

Fundamental to President Trump’s efforts to stimulate American energy production is his Executive Order declaring a national energy emergency. This is the first time that a president has declared a national energy emergency, although regional energy emergencies were declared by President Jimmy Carter in the 1970s due to shortages of fossil fuels. By declaring a national energy emergency, President Trump is allowing federal agencies to use various emergency authorities to facilitate the “identification, leasing, siting, production, transportation, refining, and generation of domestic energy resources.” The Order defines “energy” and “energy resources” to include “crude oil, natural gas, lease condensates, natural gas liquids, refined petroleum products, uranium, coal, biofuels, geothermal heat, the kinetic movement of flowing water, and critical minerals.”

The Order represents the administration’s first step in promoting domestic energy production which, according to the Order, will lower energy prices, create jobs, and strengthen national security. In furtherance of these objectives, the Order directs federal agencies to identify and use all relevant lawful emergency and other authorities to expedite the completion of all authorized and appropriated infrastructure, energy, environmental, and natural resources projects.

Among the more significant provisions in the Order to the regulated community are directives to agencies to evaluate the use of emergency measures in environmental regulations to facilitate and streamline permitting and environmental reviews. Federal agencies must identify and report on planned or potential actions to facilitate energy supply that may be subject to emergency treatment under the regulations and nationwide permits promulgated by the Army Corps of Engineers, such as projects subject to Section 404 of the Clean Water Act and Section 10 of the Rivers and Harbors Act. The Order provides similar requirements for actions that may require agency consultations under the Endangered Species Act (ESA). Agencies must identify and report on planned or potential actions that may be subject to the ESA and provide a summary report of those actions. Agencies are directed to use, to the maximum extent permissible under applicable law, the ESA regulations on consultations in emergencies.

Additionally, the Secretary of the Interior, acting as Chairman of the Endangered Species Act Committee, must convene the committee not less than quarterly to review and consider applications submitted by any applicant for a permit or license who requests an exemption from the agency consultation obligations imposed by Section 7 of the ESA. To the extent practical, the Secretary of the Interior must ensure an initial determination is made on applications within 20 days of receipt and the submission must be resolved within 140 days of the initial determination.

Executive Order: Unleashing American Energy

President Trump’s declaration of an energy emergency dovetails with his Executive Order entitled Unleashing American Energy. The Order directs federal agency heads to review all existing agency actions and identify those that unduly burden domestic energy resources and, within 30 days, develop and begin implementing action plans to suspend, revise, or rescind all such actions. It calls for a particular focus on oil, natural gas, coal, hydropower, biofuels, critical mineral, and nuclear energy resources. The Order also directs agencies to notify the Attorney General of any actions taken to review or suspend, revise or rescind regulations so that (i) notice of the Order and such actions can be provided to any court with jurisdiction over pending litigation in which such actions may be relevant and (ii) a request can be made to the court stay or otherwise delay further litigation, or seek other appropriate relief consistent with the Order.

The Order also focuses on increasing permitting efficiency across agencies, in part by revoking President Carter’s 1977 Executive Order 11991 relating to protection and enhancement of environmental quality, which authorized the Council on Environmental Quality (CEQ) to issue mandatory regulations to implement the National Environmental Policy Act (NEPA). The Order requires CEQ to provide guidance on implementing NEPA and to issue a proposed rule rescinding CEQ’s current NEPA regulations. It also encourages agencies to eliminate permitting delays in their respective processes by utilizing general permits and permit by rule and authorizes the use of emergency authorities for any project an agency head has determined is essential to the nation’s economy or national security. The Director of the National Economic Council (NEC) and the Office of Legislative Affairs are also directed to jointly prepare recommendations to Congress to streamline judicial review of NEPA applications, facilitate permitting, and construct interstate energy transportation and infrastructure.

The Order requires the Environmental Protection Agency (EPA) to issue guidance to address abandoning the social cost of carbon calculations in decision making within 60 days of the Order, and within 30 days of the Order, EPA must submit recommendations on the legality and future applicability of the 2009 Endangerment Finding for greenhouse gases under the Clean Air Act.

Significantly, the Order directs all agencies to pause the disbursement of funds appropriated through the Inflation Reduction Act and the Infrastructure Investment and Jobs Act pending review, including funds for electric vehicle charging stations, and review agency processes, policies, and programs for issuing grants, loans, contracts, or any other financial disbursements of such appropriated funds.

The Order also contains provisions pertaining to liquified natural gas, which lifted a freeze on liquified natural gas exports put in place by President Biden in early 2024. The Order directs the Secretary of Energy to restart reviews of the applications for approvals of liquified natural gas export projects, and reconsider records of decision for proposed deepwater ports for the export of liquified natural gas.

Finally, the Order contains components on mineral dominance, which directs relevant agencies to identify and rescind all agency actions that unduly burden domestic mining and processing of non-fuel minerals. It also provides for geological mapping to focus on unknown mineral deposits, tapping into the potential of uranium, allocating federal funds for critical mineral projects, and requires that policy recommendations pertaining to enhancing mining competition in the United States be submitted by relevant agencies within 60 days of the Order.

Memorandum: Temporary Withdrawal of All Areas on the Outer Continental Shelf from Offshore Wind Leasing and Review of the Federal Government’s Leasing and Permitting Practices for Wind Projects

The Trump administration’s efforts to promote the production of energy from traditional energy sources stand in contrast to President Trump’s Memorandum aimed at curtailing wind energy production by withdrawing the Outer Continental Shelf (OCS) from offshore wind leasing and reviewing all leasing and permitting practices for wind energy projects. The Memorandum temporarily prevents consideration of any area in the OCS for any new or renewed wind energy leasing for the purposes of generation of electricity or any other such use derived from the use of wind. It directs the Secretary of the Interior, in consultation with the Attorney General, to conduct a comprehensive review of the ecological, economic, and environmental necessity of terminating or amending any existing wind energy leases, identify any legal bases for such removal, and submit a report with recommendations to the President. Finally, it directs that no new or renewed approvals, rights of way, permits, leases, or loans for onshore or offshore wind projects be issued pending the completion of a comprehensive assessment and review of federal wind leasing and permitting practices.

Executive Order: Unleashing Alaska’s Extraordinary Resource Potential

President Trump also issued an Executive Order entitled Unleashing Alaska’s Extraordinary Resource Potential. The Order’s more significant provisions include directing agencies to prioritize the development of Alaska’s LNG potential, including the permitting of all necessary pipeline and export infrastructure related to the Alaska LNG Project, and to issue permits, right-of-way permits, and easements necessary for the exploration, development, and production of oil and gas from leases within the Arctic National Wildlife Refuge.

Trump Administration Day One Executive Orders: A Transformation of American Energy and Environmental Policies

On January 20, 2025, the Trump administration issued a suite of Executive Orders and memoranda signaling a dramatic shift in American energy and environmental policy. Collectively these actions, among a historically large array of “Day One” orders issued by the administration, aim to stimulate domestic energy production (with a focus on oil, natural gas, coal, hydropower, biofuels, critical minerals, and nuclear energy resources), expand energy transmission infrastructure, enlarge refining capacity, and streamline environmental permitting and review requirements for energy production and infrastructure projects while canceling Biden-era domestic climate policies, disengaging from international climate agreements, and curtailing leasing and permitting for offshore and onshore wind energy projects.

In conjunction with these Executive Orders and memoranda, the Trump administration carried out a sweeping revocation of Biden-era Executive Orders, including orders relating to energy policy and environmental regulation, climate initiatives, promoting electric vehicles, environmental justice, the withdrawal of areas of the Outer Continental Shelf from oil and gas leasing, and the implementation of the Inflation Reduction Act and Infrastructure Investment and Jobs Act.

President Trump also issued a Day One memorandum implementing a regulatory freeze requiring agencies to refrain from proposing or issuing any new rule and withdraw rules that have been finalized but not yet been published in the Federal Register, until those rules are approved by the new agency head. The memorandum also directs agency heads to consider postponing for 60 days the effective date of any rules that have been published or issued but have not taken effect, for the purpose of reviewing any questions of fact, law, and policy that the rules may raise. Some Biden-era rules relating to energy and the environment appear to be subject to this freeze, however, the overall impact of the freeze appears to be limited.

More detailed reviews of these actions are available at the links below.

Energy Policy

Regulatory Freeze

Key Environmental Regulatory, Permitting, and Enforcement Implications

Additional actions by President Trump on energy and environmental issues are expected, and legal challenges are practically certain as federal agencies take concrete steps to implement these directives. We are tracking these matters closely and will issue future Alerts as significant developments arise.

Employee Benefit Strategies to Aid Workers During 2025 California Wildfires

The wildfires moving through Southern California have destroyed communities and displaced countless individuals.

While the nation’s first responders are tirelessly working to contain and neutralize the devastation, many employers are grappling with how best to provide support for their affected employees.

Disaster Assistance to Employees

Employers may consider offering the following disaster assistance directly to employees:

Qualified Disaster Relief Payments: Under Section 139 of the Internal Revenue Code of 1986, as amended (the “Code”), employers operating in states such as California, receiving FEMA assistance can make tax-free qualified disaster relief payments directly to impacted employees. The payments can be made for reasonable and necessary personal, family, or living expenses as a result of a qualified disaster. Funeral expenses as a result of a qualified disaster will also qualify under these payments. However, employers should be aware that these payments do not cover income replacement payments or expenses reimbursed through insurance of FEMA grants.

Charitable Emergency Funds: Employers may provide tax-free emergency funds to employees through related 501(c)(3) charities and foundations. The specific rules and requirements for these 501(c)(3) entities, including whether and to what extent contributions are deductible, differ depending on whether the entity is an employer-sponsored public charity, an employer-sponsored private foundation, an employer-sponsored donor advised fund, or an unrelated public charity.

Distributions from 401(k) Plans and 403(b) Plans

Depending on the terms of an employer’s plan, which may be amended subject to coordination with the plan’s recordkeeper, impacted participants may be eligible to withdraw funds from their retirement plans to assist with the wildfire-related expenses.

Hardship Distributions: Participants may be able to take in-service distributions from their 401(k) or 403(b) plan to cover certain hardships that create an immediate financial need that cannot be met from other assets reasonably available. This could include expenses and losses related to the wildfires if the participant either worked or lived in the wildfires’ designated disaster areas and repairs to the participant’s residence or the costs involved with purchasing a new residence. A hardship distribution is typically subject to income tax plus an additional 10% early withdrawal penalty if the impacted participant is under age 59 ½.

Qualified Disaster Recovery Distributions: Under the SECURE 2.0 Act, participants may take in-service Qualified Disaster Recovery Distributions from their 401(k) or 403(b) plan account in an amount up to $22,000. To qualify for this distribution, a participant’s principal residence must be in a qualified disaster area, and the participant must have sustained an economic loss due to the disaster. These distributions are not subject to the 10% early withdrawal penalty, which distinguishes them from the Hardship Distributions discussed directly above. These distributions must be requested within 180 days of the disaster’s declaration. For the Southern California wildfires, which were declared emergencies in early January, participants will have until early July to request a Qualified Disaster Recovery Distribution.

In order to offer Qualified Disaster Recovery Distributions as a distribution option from a 401(k) plan or 403(b) plan, employers must adopt provisions for their plans specifically permitting these types of distributions. However, if an employer does not do so, affected participants may still be able to take another type of distribution (e.g., a hardship distribution or other in-service distribution) and treat it as a Qualified Disaster Recovery Distribution by using Form 89150F to report the distribution. This would allow participants to avoid the 10% early withdrawal penalty for up to the $22,000 limit. Employers who are not able to adopt the Qualified Disaster Recovery Distribution option in a timely manner may wish to communicate this alternative option to employees.

Emergency Personal Expense Withdrawals: Participants may also make emergency withdrawals from their 401(k) or 403(b) plan account to cover unforeseeable or immediate financial needs required for personal or family expenses. These distributions are limited to the lesser of $1,000 or the participant’s vested balance minus $1,000 and may only be taken once per calendar year. These distributions are exempt from the 10% early withdrawal penalty, but are generally subject to income tax in the year of distribution.

Plan Loans: Participants may be able to take loans from their 401(k) or 403(b) plan. The maximum loan is the lesser of $50,000 or 50% of the participant’s vested account balance, reduced by any outstanding loans the participant may have. The SECURE 2.0 Act’s disaster relief sections provide that participants residing in a qualified disaster area may have this loan limit increased to the lesser of $100,000 or 100% of their vested balance, reduced by any outstanding loans the participants may have. Affected participants may also be granted an additional year to repay their loans. As with the Qualified Disaster Recovery Distributions, these expanded plan loan options are only permitted if the terms of the plan specifically allow for them, meaning that employers may need to adopt an amendment to offer these options.

Deadlines and Other Relief

In response to previous disasters, the Department of Labor and other federal agencies have released guidance extending certain deadlines (e.g., COBRA continuation coverage election) to aid those most severely impacted. The extensions can also apply to businesses operating in the affected areas (e.g., Form 5500 filings). On January 10, 2025, the Internal Revenue Service issued a press release, “IRS: California wildfire victims qualify for tax relief; various deadlines postponed to Oct. 15,” extending various deadlines for individuals and businesses impacted in Southern California. The press release notably extends the deadline for 2024 contributions to IRAs and health savings accounts to October 15, 2025 for eligible taxpayers. Employers should work with their counsel to monitor for similar extensions and may consider voluntarily extending deadlines (subject to insurer/stop loss carrier approval) for directly impacted employees.

Next Steps

Employers should work with counsel when offering any qualified disaster relief payments or charitable emergency funds to ensure that requirements are met for such payments to remain tax-free.

Employers should also review their current retirement plans to see what options for employee relief are available, amending plans as necessary. Employers should also coordinate with their retirement plan recordkeepers to implement any distribution options and ensure that participants are notified of the options available to them.

2025 California Wildfires: Understanding Employers’ Obligations

As the Southern California wildfires rage on with devastating consequences, employers may be grappling to formulate an appropriate response.

Employers may have specific legal obligations as well as optional ways to provide assistance to affected employees. This publication addresses applicable employment laws that implicate pay, leaves, and other aspects of employment that may be impacted by the wildfires. Employers should also review our publication on special benefits they may wish to provide.

Employer Obligations

Notice Requirement for New Hires

California law requires employers to provide non-exempt employees with a wage theft notice upon hire. Among other requirements, employers must notify employees if there is a state or federal emergency or disaster declaration applicable to the county or counties where the employee will work issued within 30 days before the employee’s first day of employment that may affect their health and safety. Accordingly, employers in Los Angeles and Ventura counties will need to notify non-exempt employees starting employment within thirty days after January 7, 2025 that the Governor issued an Emergency Proclamation related to the wildfires if the emergency may affect their health and safety during their employment.

Disaster and Evacuation Zones

Except for certain essential personnel, employees are generally protected from retaliation by employers under a new California law if they refuse to work in unsafe conditions, including refusing to work in evacuation zones. The law also prohibits employers from preventing any employee from accessing their mobile or other communication device for seeking emergency assistance, assessing the safety of the situation, or communicating with a person to confirm their safety. California employers can monitor to see whether their worksites are subject to an evacuation order or evacuation warning through resources such as the California Department of Forestry and Fire Protection (CalFire)’s Emergency Incident website.

Addressing Wildfire-Related Workplace Closures

Employers in certain industries or specific circumstances may be subject to special rules governing their payroll and benefits obligations, as detailed in this section below. If in doubt about whether any of the following special rules or exceptions apply, and for information about additional wage and hour laws, California employers should seek counsel to ensure compliance. Several points are broadly applicable to employers whose normal operations are disrupted by the ongoing disaster.

Non-Exempt (Overtime-Eligible) Employees

Under normal circumstances, California requires employers to provide reporting time pay to non-exempt employees who report to work but are sent home early by the employer. Specifically, when a non-exempt employee reports for their shift and works less than half of their scheduled shift, they must be compensated for “reporting time” at their regular rate of pay for at least half of their scheduled hours, but in no event for less than two hours nor more than four hours.

However, no reporting time pay is due:

When the employer’s operations cannot begin or continue due to threats to employees or property, or when civil authorities recommend that work not begin or continue;

When public utilities fail to supply electricity, water, or gas, or there is a failure in the public utilities, or sewer system; or

When the interruption of work is caused by conditions not within the employer’s control (for example, a wildfire).

When a business must close due to a wildfire (as a result of a threat to employees or property, a public utilities failure, or on civil authorities’ recommendation), the reporting time pay requirements do not apply. In this limited scenario, an employer that sends non-exempt employees home early must only pay for the hours the employee actually worked. However, as noted below, employees may be entitled to access paid time off, such as vacation and paid sick time under an employer’s policies and applicable law to be compensated during the time not worked.

Similarly, retail employers operating in the City of Los Angeles that are subject to the Fair Work Week Ordinance should note that store closures due to the wildfires may qualify as a “force majeure” exemption from the ordinance’s predictive scheduling requirements, as described in Regulation 5.1 of the Rules and Regulations implementing the law.

Exempt (Overtime-Ineligible) Employees

Generally, under federal and California law, when an exempt employee performs any work during a workweek, they are entitled to their full pay for the workweek. Therefore, even if an exempt employee only works one day in a workweek before a business is closed due to a wildfire, the employer must generally pay the exempt employee for the entire workweek.

However, if a business is closed for a full workweek and the exempt employee performs no work, an employer is not required to pay the employee for that workweek (though an employer may still choose to do so). Employees who are not paid for a full week for this reason may be entitled to access paid time off, such as vacation and paid sick time under an employer’s policies and applicable law.

Wildfires’ Impact on Unemployment Benefits and Filing of Payroll Taxes/Reports

Employees who lose their jobs or have their hours reduced due to the wildfires may be eligible for unemployment insurance benefits through the State of California. The Governor’s Executive Order N-2-25 related to the wildfires waives the one-week waiting period for affected workers who qualify for regular unemployment benefits. The order also allows employers to request up to a 60-day extension to file state payroll reports or deposit payroll taxes.

In addition, individuals who lost their jobs due to the severe wildfires and winds, and who do not qualify for regular unemployment benefits, may now apply for federal Disaster Unemployment Assistance (DUA). DUA benefit claims must be filed by March 10, 2025.

Leave of Absence and Time Off Considerations

Employers in impacted areas will likely see employees taking time off from work for various wildfire-related reasons. In this regard, employers should keep the following laws in mind, including some recent amendments.

California and Los Angeles City Paid Sick Time

Employees who need time off due to wildfire-related reasons may be entitled to use paid sick time under state and local law. This can be for treatment or for preventative care. Employers should remember that covered “family members” include an employee’s parent, child, spouse, registered domestic partner, grandparent, grandchild, sibling or designated person. A “designated person” is anyone designated by the employee at the time of taking leave. While employees may be limited to one designated person per year under state law, the Los Angeles City paid sick leave law also covers as family members any individual related to the employee by blood or affinity whose close association with the employee is the equivalent of a family relationship.

The number of paid sick time hours to which employees are entitled under California law increased last year to 40 hours per year. Employers should also be mindful that employees working in the City of Los Angeles may be entitled to up to 48 (not 40) hours of paid sick time per year. More time may be required under both laws if the employer uses an accrual-based policy.[1]

The California Family Rights Act (“CFRA”)

Employers should also recall that, to the extent an eligible employee needs to take time off to care for their own serious health condition or a serious health condition of a family member, the California Family Rights Act applies where an employer has at least five employees (not 50, as under the FMLA), and that under CFRA, the definition of “family member” is broader than under the FMLA. Specifically, in addition to covering an employee’s spouse, parents, and minor children, CFRA also covers an employee’s child of any age, domestic partner, parent-in-law, grandparent, grandchild, or sibling with a serious health condition. As is the case with the paid sick leave law, there is also a “designated person” provision. Under this law, a designated person can be any individual related by blood or whose association with the employee is the equivalent of a family relationship.

Employers should also remember that even in cases where the FMLA and/or CFRA does not apply, the employer may be required to allow an employee to take time off as an accommodation for a disability under the federal ADA and/or the California Fair Employment and Housing Act.

Other Potentially Applicable California Leave Laws

California employers should also be mindful of the following leave laws that could be implicated by the fires. The State’s School Activities Leave Law may provide employees with the right to take time off in connection with school closures and other childcare emergencies, and to locate and enroll a child in a new school. Further, California’s recently expanded crime and victim leave laws may require that employees be given time off to testify or attend court proceedings related to certain crimes or obtain medical treatment and psychological counseling in connection with domestic violence. Finally, under California’s bereavement leave law, employers should be aware that they must provide up to five unpaid days off in connection with the death of certain family members of their employees.

Wildfire Smoke and Workplace Safety

The California Division of Occupation Safety and Health (Cal/OSHA)’s “Protection From Wildfire Smoke” regulation addresses the hazards employees may be exposed to from small particles in wildfire smoke, known as PM2.5.

Employers must comply with the regulation where applicable unless:

The worksite is a completely enclosed building or vehicle in which air is filtered by a mechanical ventilation system and the employer ensures that windows, doors, and other openings are kept closed except when it is necessary to open doors to enter or exit.

The employee’s exposure is limited to a total of one hour or less during a shift.

The employee is a firefighter engaged in wildland firefighting.

When an employer subject to the regulation should reasonably anticipate that employees may be exposed to wildfire smoke, the employer must:

Monitor the Air Quality Index (AQI) for levels of PM2.5, which can be monitored through resources such as the U.S. Environment Protection Agency’s AirNow website.

Implement a system for communicating wildfire smoke hazards in a language and manner readily understandable by all employees.

Provide relevant training.

Control harmful exposures to employees, including but not limited to, providing NIOSH-approved respirators (such as N95s) to employees for voluntary use when AQI for PM2.5 is between 151 to 500; and for mandatory use when AQI for PM 2.5 exceeds 500.

Cal/OSHA maintains an informative “Worker Safety and Health in Wildfire Regions” webpage, including a fact sheet for employers.

Additional Ways to Assist Employees

Provide your employees with information from the State and County regarding wildfire resources and recovery.

Provide your employees with a 401(k) or other benefits plan that allows for hardship distributions for disaster-related expenses and losses, or remind them of existing distribution options.

Work with tax advisers to explore the feasibility of providing employees with non-taxable payments to assist with disaster-related expenses or establishing a charitable foundation to provide disaster relief assistance to employees.

Consider donating to or collaborating with an existing charitable relief organization to aid employees, clients, and other stakeholders in need.

Add an Employee Assistance Program (EAP) as a benefit, which includes counseling and other social services to assist employees and families in crisis. If the company already maintains an EAP, remind employees of its existence and benefits provided.

ENDNOTES

[1] Recent changes to the California paid sick time law include an expansion of the use of paid sick time for “safe time” purposes and clarification of the preventative care reasons for which agricultural employees may use paid sick time. We wrote about that here.

Mr. Robot Goes To Washington: The Shifting Federal AI Landscape Under the Second Trump Administration

President Trump’s inauguration on January 20, 2025, has already resulted in significant changes to federal artificial intelligence (AI) policy, marking a departure from the regulatory frameworks established during the Biden administration. This shift promises to reshape how businesses approach AI development, deployment, governance, and compliance in the United States.

Historical Context and Initial Actions

The first Trump administration (2017–2021) prioritized maintaining US leadership in AI through executive actions, including the 2019 Executive Order (EO) on Maintaining American Leadership in Artificial Intelligence and the establishment of the National Artificial Intelligence Initiative Office. This approach emphasized US technological preeminence, particularly in relation to global competition.

For its part, the Biden administration’s approach to AI development emphasized “responsible diffusion” — allowing AI advances and deployment while maintaining strategic control over frontier capabilities.

In a swift and significant move, President Trump revoked President Biden’s October 2023 Executive Order on Safe, Secure, and Trustworthy Artificial Intelligence on his first day in office. This action signals a clear pivot toward prioritizing innovation and private sector growth and development over regulatory oversight and AI safety (or at least a move away from government mandates and toward market-driven safety measures).

Emerging Policy Priorities

Several key priorities have emerged that will likely shape AI development under the second Trump administration:

Focus on National Security: The Trump administration EO framed AI development as a matter of national security, particularly with respect to competition with China. This is an area where the administration is likely to enjoy bipartisan support.

Energy Infrastructure: The Trump administration’s declaration of a national energy emergency on his first day in office highlights the administration’s recognition of AI’s substantial computational and energy demands. And on his second day in office, President Trump followed the declaration with the announcement of a private-sector $500 billion investment in AI infrastructure assets code-named “Project Stargate,” with the first of the project’s data centers already under construction in Texas.

Defense Integration: Increased military spending on AI capabilities and the administration’s focus on military might indicate an emphasis on accelerated development of defense-related AI applications.

Regulatory Shifts and Business Impacts

The new administration’s approach signals several potential changes to the AI regulatory landscape:

Federal Agency Realignment: Key agencies like the Federal Trade Commission may relax their focus on consumer protection to allow more free market competition and innovation.

Preemption Considerations: The administration might pursue federal legislation to create uniform standards that preempt the current patchwork of state and local AI laws and regulations.

International Engagement: Restrictions on international AI collaboration and technology sharing, particularly regarding semiconductor exports used for AI (which had already been tightened under the Biden administration), are likely to be enhanced.

Strategic Planning Considerations

The AI policy shift creates new imperatives for business leaders, including:

Multi-jurisdictional Compliance: Despite potential reduced federal oversight, businesses must maintain compliance with any applicable federal, state, and local regulations and international requirements, including the EU AI Act for those organizations doing business in EU countries.

Investment Strategy: Changes in federal policy and potential international trade restrictions could transform AI development costs, investment patterns, and technology budgets.

Risk Management: Businesses should maintain robust internal governance frameworks regardless of regulatory requirements, particularly considering the ongoing operational and reputational risks.

Looking Ahead

While specific policy developments remain in flux, the Trump administration’s emphasis on technological leadership and reduced regulatory oversight suggests a significant departure from previous approaches. The continued integration of AI into critical business functions, however, necessitates continued attention to responsible development and deployment practices, even as the regulatory landscape evolves.

Businesses should stay informed of policy developments while maintaining robust AI governance and compliance frameworks that can adapt to changing federal priorities while ensuring compliance with any applicable legal and regulatory obligations and standards.