Disclosure in England and Wales: A Duty to Use Technology

It is not enough that we do our best; sometimes we must do what is required. This famous line attributed to Britain’s defining war time leader, Sir Winston Churchill, serves as a reminder to parties litigating through the English and Welsh courts that the use of technology is central to the discovery process – it is no longer optional.

Whether parties are operating under either of the two regimes that govern disclosure in England and Wales (Part 31 and Practice Direction (PD) 57AD of the Civil Procedure Rules (CPR)), the disclosure process is a central component that seeks to ensure transparency and fairness. However, burgeoning data volumes have increasingly necessitated the use of technology. This is why PD 57AD, which is the newer of the two regimes and in operation in the Business and Property Courts, places technology on the front line by obligating the parties’ legal representatives to use it.

The Duty

Specifically, under PD 57AD, a party’s legal representative is under a duty to promote the reliable, efficient, and cost-effective conduct of disclosure by using technology (paragraph 3.2(3) of PD 57AD). This duty persists until the conclusion of any proceedings and a failure to discharge this duty may result in sanctions from the court. Those sanctions may include adverse cost orders, or a failure may be dealt with as a contempt of court in appropriate cases.

To facilitate this duty, PD 57AD goes further to encourage and support the use of technology throughout the disclosure process. For example, when dealing with the exclusion of narrative documents (these are documents that are relevant only to the background of a dispute and are not readily disclosable) parties must consider using:

software or analytical tools, including technology-assisted review (TAR);

coding strategies, including to reduce duplication; and

prioritisation and workflows.

In addition, where the court orders Extended Disclosure, requiring parties to search for documents, the court may make specific provisions related to technology use. For example, the court might require parties to use certain software or analytical tools or provide for the use of data sampling.

Why Not?

Blindly applying technology, however, is not sufficient. In order to ensure that technology is used efficiently and effectively when Extended Disclosure is ordered, parties must provide the court and the other parties with information about the data in their control. This includes where and how the data is held and how they propose to process and search that data.

This information is set out in the Disclosure Review Document (DRD). The DRD is a comprehensive document that the parties must complete, seek to agree on, and keep updated. To do this, and despite any trench warfare that may be adopted elsewhere in the litigation, parties must cooperate and constructively engage with each other when it comes to completing the DRD and agreeing to the scope of the disclosure exercise.

Where parties consider the use of technology to facilitate collecting and reviewing any data beyond being reasonable, proportionate, and reliable, they are not obliged to justify its use. Instead, it is the opposite. If they decide not to use technology to aid either process, they should explain why such tools would not be used. The requirement to justify why technology is not being used applies especially if the number of documents that need reviewing is more than 50,000 and what is proposed is simply a manual review exercise.

PD 57AD: Ahead of the Curve

PD 57AD came into effect in October 2022, but it was drafted approximately five years prior to its implementation, meaning it came along well before the technological leap forward in terms of generative AI. However, PD 57AD was drafted to be forward-looking and flexible enough to accommodate technological advances.

Therefore, whilst generative AI is not specifically mentioned in the rules or the DRD, the references to technology throughout are purposefully non-exhaustive. Indeed, while AI is considered an umbrella term, many of the tools that are mentioned and that are already routinely used as part of the disclosure process utilise the machine learning element of AI. Tools, such as continuous active learning models that are used to assess which documents, compared to others, are more likely to be relevant to the underlying dispute, should be reviewed first.

Parties litigating before the English and Welsh courts should look to leverage new technologies, tools, and workflows as part of the disclosure process. In doing so, they are not doing their best – they are doing what is required.

News From Across the Pond: UK+ Regime Now Permanent

In 2021, shortly after Brexit became effective, the UK Intellectual Property Office (IPO) established the “UK+ regime” on the exhaustion of intellectual property (IP) rights with regard to the European Economic Area (EEA). After consultations with stakeholders, the UK IPO announced that this regime will be permanent.

IP rights are exhausted throughout the European Union when the IP owner or its licensee places goods in commerce anywhere in the EU. Post-Brexit, the United Kingdom became a third state, meaning that there was no exhaustion when goods were put on the UK market, then exported to the EEA. Similarly, there was no exhaustion when goods were put on the EU market, then exported to the UK. To address the latter issue, the UK unilaterally implemented the UK+ regime, which was initially planned as an interim solution. The UK+ regime ensured that, from a UK perspective, IP rights were still considered exhausted when goods were placed on the EU market and subsequently resold in the UK. Once a product had been legitimately sold in the EEA, the IP owner could not prevent its resale in the UK with reference to its IP rights. Thus, relevant goods could continue to be parallel traded into the UK, which ensured continued access to products for consumers, as UK businesses could continue to buy from EU suppliers and resell in the UK without needing permission from the IP owner.

Now that the UK+ regime is permanent, an exhaustion regime persists that is asymmetric. From the EU’s point of view, the UK is still a third state, so IP rights are not exhausted in the EEA when relevant goods are sold in the UK and subsequently exported to the EEA. Therefore, the IP owner can continue to prevent the product from being resold in any EEA state with reference to its IP rights and the lack of exhaustion, even if the product was originally sold in the UK by the IP owner itself or by its licensee. When goods are legitimately sold in the EEA and subsequently exported to the UK, however, exhaustion will occur.

Chemical Coalition Withdraws TSCA Section 21 Petition Seeking Revisions to TSCA 8(a)(7) PFAS Reporting Rule

As reported in our May 4, 2025, blog item, on May 2, 2025, a coalition of chemical companies petitioned the U.S. Environmental Protection Agency (EPA) for an amendment of the Toxic Substances Control Act (TSCA) Section 8(a)(7) rule requiring reporting for per- and polyfluoroalkyl substances (PFAS). The petitioners ask that EPA revise the reporting rule to exclude imported articles, research and development (R&D) materials, impurities, byproducts, non-isolated intermediates, and PFAS manufactured in quantities of less than 2,500 pounds (lb.). Petitioners also request that EPA remove the requirement to submit “‘all existing information concerning the environmental and health effects’ of the chemical substance covered by” the reporting rule and instead allow “robust summaries, similar to the approach adopted by the European Chemicals Agency” (ECHA). According to a May 22, 2025, letter from EPA, on May 16, 2025, the coalition withdrew its petition via email to EPA Administrator Lee Zeldin and “EPA now considers this petition closed.” After the coalition submitted its petition, EPA published an interim final rule to postpone the data submission period to April 13, 2026, through October 13, 2026. 90 Fed. Reg. 20236. Small manufacturers reporting exclusively as article importers would have until April 13, 2027, to report. According to the interim final rule, EPA is separately considering reopening certain aspects of the rule to public comment. Comments on the interim final rule are due June 12, 2025. More information on the interim final rule is available in our May 12, 2025, memorandum.

Supply Chain Transparency: Updates on UK and EU Provisions on Forced Labour and Modern Slavery

Forced labour and modern slavery have been the subject of renewed focus across the UK and EU in recent months. Below we touch upon key issues relating to the UK Home Office’s update to its statutory guidance on the Modern Slavery Act; the EU ban on products made with forced labour due to come into force in 2027; and the conclusion of the Italian Competition Authority’s recent investigation into fashion brands for misstatements about forced labour.

Update to the UK Home Office’s Statutory Guidance on Supply Chain Transparency

In the UK, companies are subject to the reporting obligations set out in section 54 of the Modern Slavery Act 2015 (the MSA). The largest commercial organisations (those with a turnover of £36 million or more) must produce and publish an annual modern slavery and human trafficking statement (MSS). These statements should set out the steps taken in the last financial year by an organisation to ensure that slavery and human trafficking are not taking place in its business or supply chain.

In the 10 years since the MSA received Royal Assent, the world’s concept of supply chain transparency reporting has been transformed, leading to criticism that the UK’s reporting regime had not kept pace. In particular, there had been poor monitoring and enforcement of compliance with these requirements, resulting in inconsistency in the quality and effectiveness of such statements. In response to recommendations made by the House of Lords Select Committee on Modern Slavery in October 2024, the UK government published new guidance “Transparency in supply chains: a practical guide” (Guidance) at the end of March 2025. The Guidance offers practical advice to businesses and sets higher expectations on organisations for the contents of their MSS.

The new legislation has not changed the fundamental reporting requirements under section 54 MSA. However, the October 2024 report also recommended that the UK government enact “legislation requiring companies meeting the threshold to undertake modern slavery due diligence in their supply chains and to take reasonable steps to address problems”, so more onerous requirement may be on their way. Some other jurisdictions (e.g. Australia and Canada) already have more significant compulsory reporting requirements and others, e.g. the EU through the EU Corporate Sustainability Due Diligence Directive (CSDDD), are in the process of implementing them. Complying with the expectations in the new Guidance is a good basis for existing and incoming global benchmarks.

Key Points in the New Guidance

Section four provides more detail on what should be included in an MSS under each of the six areas of disclosure recommended (but not required) under section 54 MSA: (i) organisation structure, business and supply chains; (ii) organisational policies; (iii) assessing and managing risk; (iv) due diligence; (v) training; and (vi) monitoring and evaluation.

It breaks the level of detail down into two levels. Level 1 reflects the more limited content expected from an organisation reporting for the first time. Level 2 builds upon level 1 and reflects the more detailed disclosure expected from organisations reporting on an ongoing basis.

It provides examples of how it expects the reporting information to reflect a business’s current status in terms of supply chain transparency, to acknowledge areas where development or improvement is needed, and to articulate short- or long-term plans for that development. It emphasises the importance of continuous improvement, meaning that organisations need to consider how their modern slavery statements evidence progress year on year.

It expects organisations to summarise their remediation policies and processes.

It encourages businesses to describe incidents of modern slavery identified in their supply chain and remediation taken.

The new guidance introduces the concept of modern slavery “disclosures”, a term that does not feature in the MSA. This emulates other reporting regimes, such as the EU Corporate Sustainability Reporting Directive.

Organisations are encouraged to enter their MSS in the UK’s modern slavery registry (although it is voluntary).

There are signposts to the relevant parts of internationally recognised benchmarks for supply chain due diligence, namely the Organisation for Economic Co-operation and Development Due Diligence process and the United Nations Guiding Principles on Business and Human Rights.

How Should We Respond to the New Guidance?

Organisations that produce MSSs should:

Undertake a gap analysis exercise of their current MSS against the new guidance

Consider if any other documentation (for example existing modern slavery risk assessments, supplier due diligence questionnaires and policies) should be updated to align with the spirit of the new guidance

Assemble a team of internal stakeholders to assist with the preparation of the next statement and ensure sufficient time is allocated to deliver this

Consider briefing the Board (and any director signatory) in advance of seeking their approval of the statement if it is more detailed than the previous year

Many organisations that fall outside the scope of the current section 54 MSA requirement still opt to produce an annual MSS because they recognise the importance of corporate transparency (to the public, suppliers, shareholders or others). Any organisation publishing a statement on this basis should have regard to the new guidance.

EU Ban On Products Made With Forced Labour

EU Regulation 2024/3015 (the Forced Labour Regulation or FLR) entered into force on 13 December 2024 and will apply to EU member states from 14 December 2027. It prohibits individuals and businesses from importing into, making available in or exporting from the EU any product made with forced labour. “Making available” includes distance or online selling targeted at consumers in the EU. The FLR applies not just to products themselves, but to raw material and component parts, irrespective of where they originate. It is not limited to certain sectors or industries and covers the entire lifecycle of the product, as well as every person involved in its production, distribution and sale.

While the FLR does not impose specific due diligence obligations beyond those already provided for at EU level or in individual EU member states, it will operate in conjunction with the CSDDD when it comes into force. The FLR will be enforced by local authorities – customs and other national competent authorities – whose remit will be to prevent products made with forced labour from being imported into, exported from or made available on the EU market. The FLR provides for a Union Against Network Against Forced Labour Projects to streamline regulation and ensure information sharing and consistency. By mid-June 2026, the EU Commission is required under the FLR to publish guidance on due diligence, and on best practices for mitigating forced labour and will establish a database of products, as well as regions that pose a high risk of forced labour. The database will enable the public to submit information on breaches of the FLR. Where there is a “substantiated concern” of forced labour, the EU or national competent authority can investigate.

Decisions by the competent authorities on whether a violation of FLR has occurred (i.e., a decision on whether a product made with forced labour has been placed on the market or made available in the EU or exported from the EU) should be adopted within nine months. If there has been a violation, the competent authority has various powers, including:

Prohibiting the product from being placed on the market, or made available in the EU and from being exported

Ordering the person subject to the investigation to withdraw products already placed on the market or made available, or to remove online marketing for such products

Ordering the disposal destroy the relevant product or replace relevant component parts

The FLR provides a process for reviewing decisions of competent authorities. Businesses likely to be affected by the FLR should ensure that they have effective policies and procedures to identify and address issues of forced labour in their supply chain, to remediate issues if they arise, and a comprehensive training and audit programme. We also recommend that UK businesses ensure that these are reflected in their MSS and that careful records of supply chain due diligence are maintained so that companies can respond quickly to any investigations.

Italian Competition Authority Landmark Forced Labour Case

A recent investigation by the Italian Competition Authority highlights the breadth of ways that issues relating to modern slavery can be subject to investigation and enforcement action. In July 2024, the Italian Competition Authority (the AGCM) launched an investigation into several high-end fashion companies. According to press coverage, prosecutors in Milan identified workshops with underpaid workers, some of whom were illegal immigrants, producing leather bags that were then sold to the company and others below their retail price. The investigation was conducted under the Italian Consumer Code and considered whether the company had misled consumers in its statements about its suppliers’ working conditions.

In May 2025, the AGCM announced the closure of the investigation, without finding that a violation had occurred. As part of a settlement, the company committed to amending its ethics and social responsibility statements; introducing new supply chain due diligence and monitoring procedures; additional training internally on consumer protection laws and for suppliers on forced labour law and the ethical principles set out in the company’s Supplier Code of Conduct. It also committed to paying €2 million over 5 years to fund initiatives aimed at helping victims of labour exploitation. Other brands in the leather consumer goods industry have also been implicated in enforcement action, with reports of another fashion brand being placed under judicial administration for a year after worker abuse was discovered in its supply chain.

Companies in the UK can face similar action. In March 2024, the Competition and Markets Authority (CMA) published an open letter to businesses in the fashion retail industry, highlighting the need to consider their obligations under consumer protection law. While this primarily concerned environmental claims in the sector, the publication highlights the growing regulatory scrutiny faced by this industry. The UK authorities have a wide range of powers to investigate and prosecute individuals and businesses for misrepresentations about compliance with business human rights. Businesses could also be liable for misrepresentations by their associated persons once the UK’s new failure to prevent fraud offence comes into force on 1 September 2025.

Conclusion

In light of increased focus on forced labour issues in the UK and EU, businesses should revisit and revamp their existing risk assessments, policies and procedures relating to supply chain due diligence, transparency and monitoring. Our experts advise companies on a wide range of supply chain compliance and regulatory matters across the UK, EU and globally.

US Easing of Sanctions on Syria Creates Opportunities and Risks

What Happened

On May 23, 2025, the US Department of Treasury Office of Foreign Assets Control (OFAC) issued a general license (GL 25) broadly authorizing financial transactions previously prohibited under the Syrian Sanctions Regulations (found at 31 C.F.R. part 542).

The Bottom Line

Effective immediately, GL 25 allows US persons to engage in certain transactions with the Government of Syria and certain blocked persons following almost 50 years of comprehensive economic sanctions on Syria, most of which were imposed during ex-Syrian President Bashar Assad’s rule. GL 25 represents the first step in lifting US sanctions on Syria. Companies and individuals seeking to do business with or in Syria should carefully consider the scope and limitations of GL 25. Companies should also review internal compliance policies, and sanctions compliance covenants and obligations, to take into account the shifting sanctions landscape with respect to Syria.

Full Story

US sanctions on Syria date from Syria’s 1979 invasion of Lebanon and expanded during Syria’s civil war through a range of legislative actions and executive orders. On January 6, 2025, following the end of President Bashar Assad’s rule, OFAC issued Syria General License 24, which authorized a narrow set of transactions with Syria’s transitional government and energy sector, as well as personal remittances. On May 13, 2025, President Trump announced that the United States would lift sanctions on Syria; on May 23, OFAC issued GL 25.

As described in the press release accompanying the issuance of GL 25, the license is intended to help rebuild Syria’s economy, financial sector and infrastructure; align Syria’s new government with US foreign policy interests; and bring new investment into Syria, signaling opportunity for companies interested in investing in the rebuilding of Syria.

GL 25 authorizes transactions that would otherwise be prohibited under the US economic sanctions on Syria, including new investment in Syria, the provision of financial and other services to Syria and transactions related to Syrian-origin petroleum or petroleum products. GL 25 also authorizes all transactions with the new Government of Syria, and with certain blocked persons identified in a list appended to the license (any transactions with other blocked persons not identified in the annex remain prohibited).

GL 25 represents a significant shift in the US sanctions landscape. For international financial institutions, the reach of US sanctions, especially the secondary sanctions imposed by the Caesar Act of 2019, have been a significant sanctions compliance concern. For nearly five decades, Syria has been viewed as a comprehensively sanctioned country, with the effect that financing and commercial documentation often specifically prohibits doing business in Syria.

The shifting sanctions landscape with respect to Syria introduces new compliance risks for companies seeking to do business there or otherwise take part in rebuilding opportunities. Although GL 25 represents a significant easing of sanctions—such that Syria can no longer be considered a truly “comprehensively” sanctioned country—it is important to note that issuance of the general license is merely an interim step intended to provide immediate relief. While certain sanctions can be lifted by executive order, other sanctions on Syria are imposed by statute and will require Congressional action. Syria’s re-entry into the global financial system may be complicated by this variation in different sanctions authorities as institutions begin to adjust to a post-sanctions Syria.

Financial institutions and companies should carefully review internal compliance policies to take into account the changing scope of sanctions on Syria. Companies and funds seeking to invest in Syria should also consider internal compliance policies with respect to Syria, as well as existing covenants in financing and other agreements that may restrict investment or other business dealings in Syria.

China’s Supreme People’s Court Designates Record-Setting Trade Secret Case as a Typical Case

On May 26, 2025, China’s Supreme People’s Court (SPC) released the “Typical cases on the fifth anniversary of the promulgation of the Civil Code” (民法典颁布五周年典型案例) including one intellectual property case – the record-setting 640 million RMB trade secret case of June 2024. While the decision was a hollow victory as the defendant is insolvent and has not paid any damages, designation as a typical case may encourage lower courts to award higher damages in future trade secret cases. While the parties are unnamed, the plaintiff is Geely Holding Group and the defendant is WM Motor.

As explained by the SPC:

III. “Strict protection” and “high compensation” to actively create an environment that encourages innovation – Ji XX Company et al. v. Wei XX Company et al. Case of infringement of technical secrets

1. Basic Facts of the Case

Nearly 40 senior managers and technical personnel of Ji XX Company and its affiliated companies resigned and went to work for Wei XX Company and its affiliated companies, of which 30 joined the company immediately after resigning in 2016. In 2018, Ji Co. discovered that Wei Co. and the two companies used some of the above-mentioned resigned personnel as inventors or co-inventors, and applied for 12 patents using the new energy vehicle chassis application technology and 12 sets of chassis parts drawings and technical information carried by digital models (hereinafter referred to as “the technical secrets involved in the case”) that hey learned from their prior employer. In addition, the Wei EX series electric vehicles launched by Wei Co. were suspected of infringing the technical secrets involved in the case. Ji Co. filed a lawsuit with the first instance court, requesting that Wei Co. be ordered to stop the infringement and compensate for economic losses and reasonable expenses totaling 2.1 billion RMB.

2. Judgment Result

The effective judgment held that this case was an infringement of technical secrets caused by the organized and planned use of improper means to poach technical personnel and technical resources of new energy vehicles on a large scale. Through overall analysis and comprehensive judgment, Wei Co. obtained all the technical secrets involved in the case by improper means, illegally disclosed part of the technical secrets involved in the case by applying for patents, and used all the technical secrets involved in the case. Therefore, the judgment is: unless the consent of Ji Co. is obtained, Wei Co. shall stop disclosing, using, or allowing others to use the technical secrets involved in the case in any way, and shall not implement, permit others to implement, transfer, pledge, or otherwise dispose of the 12 patents involved in the case; all drawings, digital models, and other technical materials containing the technical secrets involved in the case shall be destroyed or handed over to Ji Co.; the judgment and the requirements for stopping infringement shall be notified to Wei Co. and all its employees, affiliated companies, and relevant component suppliers by means of announcements, internal company notices, etc., and the relevant personnel and units shall be required to sign a letter of commitment to maintain secrecy and not infringe, etc.; considering that Wei Co. has obvious intention to infringe, the circumstances of infringement are serious, and the consequences of infringement are serious, double punitive damages shall be applied to Wei Co.’s infringement profits from May 2019 to the first quarter of 2022, and Wei Co. shall compensate Ji Co. for economic losses and reasonable expenses of about 640 million RMB. At the same time, it is made clear that if Wei Co. violates the obligation to stop infringement determined by the judgment, it shall pay the late performance fee on a daily basis or in one lump sum.

3. Typical significance

General Secretary Xi Jinping profoundly pointed out that protecting intellectual property rights is protecting innovation. Strengthening judicial protection of intellectual property rights is an inherent requirement and important guarantee for the development of new quality productivity. In this case, the People’s Court, in accordance with the relevant provisions of the Civil Code, based on the determination of infringement of technical secrets, while applying punitive damages in accordance with the law, also actively explored the specific way to bear civil liability for stopping infringement and the calculation standard of delayed performance of non-monetary payment obligations, which promoted the renewal of intellectual property trial concepts and innovation of judgment rules, fully demonstrated the clear attitude of strictly protecting intellectual property rights and the firm stance of punishing unfair competition, and was conducive to creating a legal business environment of honest operation, fair competition, and innovation incentives.

4. Guidance on the provisions of the Civil Code

Article 179 The main forms of civil liability include:

(1) cessation of the infringement;

(2) removal of the nuisance;

(3) elimination of the danger;

(4) restitution;

(5) restoration;

(6) repair, redoing, or replacement;

(7) continuance of performance;

(8) compensation for losses;

(9) payment of liquidated damages;

(10) elimination of adverse effects and rehabilitation of reputation; and

(11) extension of apologies.

Where punitive damages are available as provided by law, such provisions shall be followed.

The forms of civil liability provided in this Article may be applied separately or concurrently.

Article 1168: Where two or more persons jointly commit an infringement and cause damage to others, they shall bear joint and several liability.

The original text, including four other Civil Code Typical Cases, can be found here (Chinese only).

Big State, Big Scrutiny: Texas Steps into the Foreign Investment Review Arena

On March 13, the Texas House of Representatives introduced HB 5007, along with its companion bill SB 2117. The legislation—“Relating to the establishment of the Texas Committee on Foreign Investment to review certain transactions involving certain foreign entities; creating a civil penalty”—is currently under committee review. If enacted, the Lone Star State would become the first state to establish its own interagency committee to screen foreign investments, modeled in part on the federal Committee on Foreign Investment in the United States (CFIUS).

From our experience navigating CFIUS risks and filing obligations, preparing and submitting notices, negotiating Committee mitigation agreements, and authoring The CFIUS Book, 2nd Edition, we are preparing to support clients should they face a new layer of state-level scrutiny when the proposed Texas Committee on Foreign Investment (TCFI) become law.

A New Sheriff in Town: Texas Proposes Its Own CFIUS

The TCFI would be structured similarly to CFIUS. Just as the CFIUS Committee includes the heads of federal agencies, the TCFI would comprise senior officials from various Texas agencies—including the Attorney General (paralleling DOJ), the Comptroller (Treasury), and the heads of the Department of Public Safety and the Department of Information Resources (Defense analogues). In a move that reflects Texas-specific concerns, the Commissioner of Agriculture would also sit on the committee, highlighting growing attention to foreign ownership of farmland and food security.

Not Their First Rodeo: Texas Tweaks the Rules on Covered Transactions

Like CFIUS, the TCFI would apply to transactions that meet two criteria: (1) a governance threshold and (2) involvement in a sensitive sector. But Texas approaches both criteria differently:

Governance Threshold. While CFIUS uses a qualitative test (focusing on control or access rights rather than ownership percentage), HB 5007 would impose a quantitative test. A transaction would be subject to review if it exceeds a minimum dollar value or ownership percentage—thresholds to be set by the Governor.

Sensitive Sectors. The TCFI would apply to investments in “critical infrastructure” and “sensitive personal data.” These terms are borrowed from federal terminology but redefined under Texas law.

Critical infrastructure would cover a broader range than under CFIUS—extending to commercial facilities, emergency services, dams, food and agriculture, health care, and government buildings. This is significantly wider than both CFIUS definitions and Texas’s existing Lone Star Infrastructure Protection Act.

Sensitive personal data is defined not in terms of identifiability, but in terms of potential risks to public safety if accessed by a foreign entity. Though narrower in scope than CFIUS in some respects, this standard could be applied broadly in practice.

The bill would also add two new categories of covered sectors: Texas agricultural land and any “strategic industry or asset” identified by the Governor, allowing for future expansion.

Filing Deadlines and Legal Spurs: The Process and Enforcement Landscape

The process outlined in HB 5007 differs notably from the federal model. While CFIUS allows for voluntary and mandatory filings and may initiate its own reviews, HB 5007 would require mandatory pre-closing notification to the Texas Attorney General at least 90 days before closing. The Attorney General would then conduct an initial review within 30 days and, if needed, a secondary investigation within 45 days.

The TCFI would not conduct the review itself, but would receive findings and proposed mitigation terms from the Attorney General. If the committee rejects a proposed agreement, the Attorney General would be responsible for presenting a revised version. The Attorney General would also have enforcement authority—including injunctive relief and divestment—though the bill limits civil penalties to $50,000 per violation.

Foreign investors unfamiliar with Texas procedure may find the process deceptively straightforward—but, as any traveler making their way across the state knows, it pays to plan ahead, double-check the route, and occasionally pull off at the beaver for fuel, supplies, and a quick reset. The logistics of navigating parallel state and federal reviews may call for similar recalibration—especially when timelines, procedures, and enforcement mechanisms diverge.

Two-Lane Traffic: CFIUS, TCFI, and the Potential for Overlap

HB 5007 does not address how TCFI and CFIUS might coordinate when both claim jurisdiction—raising practical concerns for investors facing parallel notice and review processes. Navigating two regimes, potentially with different mitigation expectations, could introduce delays, friction, and uncertainty.

It remains to be seen whether future amendments will clarify jurisdictional boundaries, establish coordination mechanisms, or provide safe harbors. In the meantime, companies should be prepared to address both state and federal review obligations—requiring careful planning, aligned timelines, and coordinated strategy.

US Supreme Court Will Allow Trump Administration to End TPS Program for Venezuelans

On May 19, 2025, the U.S. Supreme Court lifted a district court order that had temporarily postponed the April 7 termination of the 2023 Venezuela Temporary Protected Status (TPS) designation. The ruling allows the Trump administration to end legal protection for roughly 350,000 Venezuelans now living in the United States under a program that had protected them from deportation known as TPS. The U.S. Supreme Court granted the Justice Department’s request to lift a judge’s order that had halted Homeland Security Secretary Kristi Noem’s decision to terminate TPS under the 2023 designation for Venezuela.

The termination of the 2023 designation may open the door for possible deportations soon. The decision appears to state that that the group has effectively lost their status and employment authorization. U.S. Citizenship and Immigration Services may release guidance regarding its implementation of the reinstated termination.

Venezuelans in the United States with TPS are divided into two groups: those who received TPS in 2021 when the Biden administration initially designated Venezuela for TPS, and those who received TPS when the program was extended in 2023. This Supreme Court decision does not affect the approximately 250,000 Venezuelans who were given the protection in 2021.

TPS allows people to live and work in the United States legally if their home countries are deemed unsafe, including wars, natural disasters, or other “extraordinary and temporary” conditions.

Employers should be aware that some workers may lose their work authorization and ability to remain lawfully in the United States with limited notice. Employers should review their workforce for employees relying on Venezuelan TPS. Employers can then review expiration dates and determine if impacted employees have alternative immigration options. At the same time, employers should avoid any premature terminations pending further guidance from the U.S. government. Finally, employers should have a workforce contingency plan.

Employers should refer to the TPS webpage for updates.

Tariffs & Supply Chains: An English Law Perspective on Contractual Levers You May Have (or Want)

These are challenging times for supply chains. In recent months, the US government has announced, reversed, delayed, adjusted, and enacted a series of tariffs on imports to the United States from a long list of countries; some countries have retaliated, and others are negotiating and beginning to announce trade deals. The supply chain is trying to adapt fast and frequently.

Whether tariffs are imposed for additional tax revenue, to encourage domestic production and consumption, as a geopolitical tool to favour some countries over others, a combination of these or otherwise, they are having significant impact. From increasing material and production costs, to squeezing operating margins, increasing administrative and trade compliance burdens, inflating end-product pricing, and affecting supply and demand cycles with stockpiling in advance of anticipated tariffs or import delays in case tariffs are soon to be removed or reduced.

While supply chain restructuring or diversification may be a medium or longer-term priority, its participants may wish to be agile and respond swiftly in the short-term, but where does the tariff burden lie, how flexible are the contracts, and what contractual levers might be available to mitigate the impact?

We consider below (from an English law perspective – though the comments may have general application) some contractual levers that may help navigate these challenges. One comment of universal application is that: whether any tariff announcement is sufficient to trigger a contractual lever, and the consequences which may flow from it, will be contract clause and context specific.

Where Does the Tariff Burden Lie?

Does the contract contain provisions which allocate the parties’ risks and responsibilities in the event of tariffs? If not, each party may bear the increased costs of performing their respective obligations.

Does a Tariff Trigger Automatic Consequences?

Dynamic pricing provisions may vary the price payable by reference to an underlying index, which may shift in response to a tariff, or they may build-in formulae to adjust prices by reference to an increase in the cost of supply, which could include the imposition of a tariff. These provisions may provide that price adjustments are time limited, subject to a maximum cap, or kick-in only once a cost threshold is exceeded.

What Contractual Levers Are Available?

Does the contract provide opportunities for the parties to require or request variations, to suspend performance, or even to terminate, in the event of tariffs or significant cost increases?

Surcharge

Surcharge pricing may allow a party to apply an additional fee beyond the original contract price, to cover a particular cost. End users will often be expected to pay increased prices for consumer goods affected by tariffs, and a similar principle may apply to business-to-business contracts if a clause permits a party to levy surcharges. As with dynamic pricing provisions mentioned above, these may be subject to threshold and time limits, and they may provide a unilateral right to adjust pricing, or trigger a renegotiation.

Change in Law

The contract may specify the consequences of a change in law after its execution. The clause would need to be examined to assess whether: a tariff could qualify as a change in law; it requires contractual adjustments or triggers a renegotiation; it allocates the consequent burden of additional cost of compliance; it addresses the ramifications of any delays caused, or even perhaps provides a right to terminate. Such a clause may only apply if the change in law requires that the contract be amended (for example, in order for it to remain compliant with the law that has changed), so whether a tariff could be said to require a variation or merely affect the economics of the arrangement could give rise to debate/dispute.

Force Majeure / Frustration

Is often the first thing that comes to mind when a significant event impacts a contract, but circumstances in which such a clause may be successfully utilised can be limited. There is no standalone doctrine of force majeure under English law, so step one is to see if there is such a clause. A force majeure clause is usually composed of two parts: the first lists a series of events considered to trigger the force majeure provisions, and the second determines the consequences, which may for example include a right to suspend performance temporarily and/or to give notice to terminate, if certain circumstances apply. Whether a tariff constitutes a force majeure event will depend on the clause wording.

Even if tariffs are specifically referenced, force majeure clauses can require that the triggering event make it legally or physically impossible to perform, rather than merely more expensive, and English caselaw indicates that such clauses will not generally be construed to extend to changes in economic circumstances. So, force majeure may not be an especially useful lever in respect of tariffs. That said, if the imposition of a tariff has knock-on consequences, such as a key component or ingredient becomes temporarily unavailable rendering it impossible to manufacture a product, there may be better prospects of force majeure responding to assist.

Absent a force majeure clause, parties to English law contracts sometimes consider the doctrine of frustration (discharging a contract when an unforeseen event makes the contract incapable of being performed), though the English courts have consistently held that increased costs or reduced profitability will not be sufficient to frustrate a contract – so unless the impact of a tariff is so extreme as to create impossibility, it is unlikely to assist.

MAC / Hardship

Is there a “material adverse change” (MAC) or a hardship provision? MAC clauses may allow a party (e.g. a buyer in an acquisition) to renegotiate or withdraw from a transaction if a certain event occurs which has a material negative impact. The potential applicability and effect of the clause would need careful consideration in each case. It may list specific triggering events, refer more generally to any matter which has a materially adverse effect, or incorporate carve-outs that may prevent tariffs from being considered a relevant event. What consequences are specified, and does it trigger a renegotiation or provide a right to terminate or withdraw?

Alternatively, there may be an economic hardship clause, permitting a party to trigger a renegotiation if something occurs making performance significantly more difficult / financially onerous (though not impossible). Carefully defining what constitutes “hardship” will be important, as this may be an area ripe for dispute when something drastic occurs. Hardship clauses are not especially common in English law contracts, though sometimes appear in cross-border long-term supply relationships, or where markets may be volatile.

Change Control / Variation

some longer-term or complex contracts may have a prescribed process to propose, evaluate, negotiate in good faith, and implement changes to contract economics following a change to the scope of work or a cost increase for example.

The boilerplate provisions in many contracts incorporate a variation clause expressly permitting contract amendment by agreement between the parties, and parties are generally free to agree and implement variations to their contracts in any event (subject to any express restrictions in the contract).

Their utility can be limited where they do not specify what changes should be made on the occurrence of a triggering event, constitute only an “agreement to agree”, or provide no more than an option to negotiate, though incorporating an obligation to negotiate in good faith may be more helpful than nothing at all. In certain circumstances (such as where the parties have a particularly strong desire to continue working together, or where all parties find themselves similarly impacted by an event), a mutually agreeable change control or variation clause may assist to achieve a commercial resolution. That being said, where a collaborative relationship persists despite challenging circumstances, the parties may elect to vary the underlying agreement regardless of any express variation process. It would be extremely unusual for a commercial agreement to prohibit its parties from amending the agreement in writing executed by all parties.

Termination

If nothing sufficiently reduces the damage that will be done by continuing to perform, looking at contract termination possibilities may be the only option.

Some of the provisions mentioned above may allow notice of termination to be given if certain circumstances have arisen. If not, does the contract permit termination for convenience by giving a period of notice? Where such a right exists, it may however be accompanied by exit costs and these should be balanced against the costs associated with the tariff to ascertain which route makes most economic sense. Or has the imposition of the tariff brought about a breach of the contract sufficiently serious to warrant a termination – for example, if the tariff brings about a failure to supply or a refusal to order, accept delivery or pay – whether under a provision allowing notice of termination to be given in the event of a material breach or under the common law for repudiatory breach?

Comment

Scope for complex contractual disputes abound: contrasting interpretations of contractual provisions; whether they are enforceable; whether a clause encompasses a particular event; whether that event has occurred; can US tariffs be classified as “unforeseen” events when they featured so prominently in the election campaign?; has a force majeure event occurred?; if so, has the obligation become impossible (not just expensive) to perform?; what constitutes a material adverse change or a hardship?; is a party engaging in negotiations in good faith?; has a right to terminate arisen?; whether the tariff has brought about a breach of contract; does a breach give rise to a right to terminate under the contract or English common law? And these are just a number of examples arising from the concepts considered above.

The firm’s Commercial Disputes and International Arbitration lawyers regularly assist clients seeking to rely on, or challenge an opponent’s reliance on, the types of levers discussed above, and with resolving any complex contractual disputes arising. The team works closely with our international trade team, which is advising our global clients in real-time as the trade landscape continues to shift.

We noted above that the availability and utility of these rights and levers will be contract clause and context specific, and the wording of each provision will be very important. Do your supply chain contracts include some or all of the levers you need, and will they operate as you would like?

There is a delicate balance to be struck between incorporating levers for sufficient flexibility and allowing the parties to navigate their business through unexpected and significant disruptive events (such as tariffs), whilst at the same time maintaining levels of contractual certainty that may be required to justify investment in a relationship, and so that everything is not forever up for renegotiation. Our commercial contracts and other lawyers assist clients to assess the context-specific strategic benefits of these levers, advising on the drafting, negotiation and incorporation of such provisions. Ultimately, it is about tailoring the balance between flexibility and certainty to the specific industry and business needs of our clients in order to future proof their commercial relationships.

Key Compliance Tips on How to Respond to Information Requests from OFSI

On 8 May 2025, the United Kingdom’s Office of Financial Sanctions Implementation (OFSI) of HM Treasury published a penalty notice regarding a breach of financial sanctions by a UK registered company—Svarog Shipping & Trading Company Limited (Svarog). OFSI imposed a monetary penalty of £5,000 on Svarog for failing, without reasonable excuse, to respond to a Request for Information (RFI) issued by OFSI.

Request for Information

OFSI has statutory powers to request documents and information for certain purposes, including establishing whether financial sanctions may have been breached or monitoring compliance with certain financial sanctions regulations or licences. OFSI will specify the legislative basis for the request and the time period within which the information should be provided (if no period is specified, the information must be provided within a reasonable time). Failure to comply with an RFI is a criminal offence which can lead to prosecution or a monetary penalty.

OFSI issued an RFI to Svarog on 26 January 2024 pursuant to OFSI’s statutory powers under Regulation 72 of The Russia (Sanctions) (EU Exit) Regulations 2019 (Russia Regulations). OFSI directed that a response was required by 9 February 2024. Despite OFSI sending a number of reminders, Svarog did not respond by the deadline. Svarog only responded to the RFI once OFSI contacted Svarog’s auditors. OFSI concluded that Svarog had failed to respond to OFSI’s RFI and, in the absence of a reasonable excuse, had breached Regulation 74(1)(a) of the Russia Regulations. OFSI imposed a monetary penalty of £5,000 for the breach.

Key Compliance Lessons

This case emphasises the importance of timely and accurate responses to RFIs and highlights a number of key compliance lessons, which are summarised below.

Respond Promptly to RFIs

Do not ignore the request. Failing to respond to an RFI can act as an aggravating factor in OFSI’s overall assessment of the severity of the breach.

Seek clarification if the request seems unclear or the deadline is challenging to adhere to.

If you believe you have missed a statutory deadline but you have a reasonable excuse, you should provide that excuse proactively for OFSI to consider, accompanied by a full explanation of the circumstances.

Recipients of RFIs should be aware of the importance of responding promptly, failing which can significantly impede OFSI’s ability and effectiveness to assess compliance, enforce financial sanctions and maintain compliance with the sanction’s regimes.

Understand the Legal Basis

Determine the statutory basis of OFSI’s RFI. If you are unsure, seek advice from sanctions or regulatory legal teams.

Engage Proactively and Candidly With OFSI When It Comes to RFIs

Be aware of any time limits specified in the RFI.

Provide accurate information to OFSI, ensuring it is truthful and accurate.

Engage with OFSI’s published guidance and seek professional advice on sanctions obligations if necessary.

Have Effective Communication and Monitoring Systems in Place

Keep detailed records of compliance procedures, risk assessments and responses to the RFI.

Demonstrate awareness of sanction compliance duties, including record keeping.

Appoint responsible personnel, monitoring and maintaining up-to-date contact information to ensure effective communication with OFSI RFIs.

OFSI expects firms to have effective communication and monitoring systems in place so that firms can promptly identify and respond to any RFI they might receive from OFSI.

Plan for Follow Up

Be prepared for follow-up queries or interviews. OFSI may ask for clarification, more documents or meetings after the initial response.

Consider Other Compliance and Reporting Obligations

Whilst the penalty in this case related to the failure to respond to an RFI without a reasonable excuse, other types of failures to provide information can also constitute breaches leading to penalties. For example:

Non-compliance with reporting obligations, including both failure to report and late reporting without reasonable excuse.

Incomplete or otherwise non-compliant reporting on specific and general licences, reporting requirements on licences and failures to report frozen assets.

Conclusion

You should ensure you are aware of your obligations and your requirement to comply with an RFI by OFSI.

Lost in Translation: Key Deal Points in European vs. U.S. M&A Transactions

After two decades practicing law in Silicon Valley and five formative years working on cross-border deals in Europe, I’ve come to appreciate the subtle (and not-so-subtle) differences in how merger and acquisition (M&A) transactions are structured on either side of the Atlantic. For buyers and sellers on opposite sides of the divide, these can be the difference between a smooth closing and a deal that gets lost in translation.

Below, we look at the key distinctions between U.S. M&A deal terms (sourced from SRS Acquiom) and European M&A deal terms (sourced from CMS), personal insights from the trenches, and practical takeaways for buyers and sellers trying to structure and execute cross-border transactions.

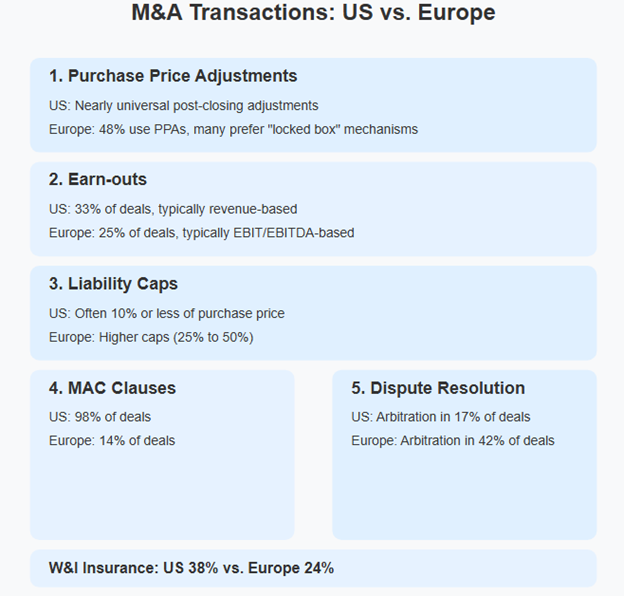

The infographic above provides a comprehensive overview of the six key differences in M&A practices between the U.S. and European markets. These points illustrate the fundamental structural variations that deal teams must navigate when working across borders.

1. Purchase Price Adjustments (PPA): Certainty vs. Flexibility

In the U.S., PPAs are nearly universal. Buyers expect to be made whole for gaps in working capital, shortfalls in cash in the bank, and any remaining debt post-closing. It’s a well-oiled machine, and most parties know the drill.

In Europe, it’s a different story. While PPAs are gaining ground (found in less than half of all M&A deals per CMS), many deals still rely on the “locked box” mechanism, where the price is fixed based on a historical balance sheet, and the seller warrants that there has been no leakage in value since the balance sheet date. This approach offers price certainty but requires trust and diligence.

U.S. clients doing deals in Europe should be open to lock box structures, especially in competitive auctions. European clients entering the U.S. should be ready for detailed post-closing adjustments and the accounting gymnastics that come with them.

2. Earn-outs: A Tale of Two Metrics

Earn-outs are common in both markets, making up 33% of U.S. deals and 25% of European ones. But the way they are structured varies widely. In the U.S., revenue-based earn-outs are more common, as opposed to Europe, where EBIT/EBITDA is king.

In tech and healthcare, where future performance is often speculative, earn-outs can bridge valuation gaps. But they are also a breeding ground for disputes.

Defining metrics clearly is table stakes, as is aligning incentives and not underestimating the emotional toll of earn-out negotiations, especially when founders are staying on board.

The chart above quantifies the prevalence of key M&A practices in both markets. Note especially the dramatic difference in MAC clause usage (98% in the U.S. versus just 14% in Europe) and the inverse relationship in arbitration preference (17% U.S. versus 42% Europe). These statistical differences highlight the importance of understanding regional norms when structuring cross-border transactions.

3. Liability Caps: How Much Skin in the Game?

In the U.S., seller liability is often capped at 10% or less of the purchase price, thanks to the widespread use of transactional, or “rep and warranties” insurance (otherwise known as “RWI”). In Europe, caps are higher, often 25% to 50%, though RWI is catching up.

European sellers are more accustomed to bearing risk, while U.S. sellers expect to shift it. This can lead to friction, so aligning expectations early is key.

United States

Europe

Liability Cap Comparison

Liability is typically capped at 10% or less of purchase price

Heavy reliance on representations & warranties insurance

Focus on limiting seller’s post-closing risk

Shorter survival periods for representations

Higher liability caps (25% to 50% of purchase price)

Growing but still lower adoption of W&I insurance

Sellers more accustomed to bearing risk

Longer warranty periods common in certain jurisdictions

Legal Framework Differences

Litigation-focused dispute resolution (83% of deals)

MAC clauses standard (98% of deals)

Common law principles

More extensive due diligence process

Arbitration more common (42% of deals)

MAC clauses rare (14% of deals)

Mix of civil and common law systems

70% of arbitration clauses apply national rules

This interactive comparison illustrates the fundamental differences in liability approaches and legal frameworks between regions. Toggle between the tabs to explore how these differences might impact deal structuring and negotiations. The higher liability caps in Europe (25-50%) versus the U.S. (typically 10% or less) reflect different risk allocation philosophies that must be reconciled in cross-border transactions.

4. MAC Clauses: Rare in Europe, Routine in the U.S.

Material Adverse Change (MAC) clauses are standard in U.S. deals and used in 98% of transactions. The idea is that between signing and closing, the business has not suffered a MAC, and if it has, the buyer does not have to close. Sometimes, it’s worded that the business hasn’t suffered a MAC since the balance sheet date. In Europe, however, they are rarefied air, appearing in only 14% of M&A deals, and often heavily qualified.

This can lead to surprises when U.S. buyers find no MAC clause in a European deal, and European sellers may balk at the broad language typical in U.S. agreements.

5. Dispute Resolution: Courts vs. Arbitration

Dispute resolution is where things really diverge. In the U.S., litigation is the default remedy, with arbitration used in only 17% of deals. In Europe, the use of arbitration is much higher (42% of deals in 2024), especially in cross-border transactions.

But there is a twist. 70% of European arbitration clauses apply national rules, not international ones. That means a “standard” arbitration clause in Germany may look very different from one in France or the UK.

U.S. clients should be prepared for arbitration in Europe and understand the local rules. European clients doing deals in the U.S. should be ready for court proceedings and the discovery process that comes with them.

6. Transactional Insurance: Growing, But Not Yet Global

RWI, or transactional insurance, is a game-changer. It smooths negotiations, caps liability, and speeds up closings. In the U.S., it’s used in 38% of deals. In Europe, it’s at 24%, but rising fast, especially in the UK and Germany.

I have seen RWI insurance unlock deals that would otherwise stall over the scope of representations and warranties, indemnity caps, or escrow mechanics. But it is not a silver bullet, so underwriting diligence still matters.

Bridging the Gaps

Cross-border M&A is never just about the numbers. It’s about culture, expectations, and communication. I have seen deals that were super smart on paper fall apart because the counterparties did not understand each other’s norms. And I have seen unlikely partnerships thrive because they took the time to bridge those gaps.

So, whether you’re a U.S. buyer eyeing a European AI startup, or a European medtech platform bolting on a U.S. target, remember that what is “market” depends on where you are. When in doubt, ask someone who’s been on both sides of the table.

CPSC Announces “Record-Breaking Week” of Enforcement Actions Against Chinese Manufacturers

On May 15, 2025, the Consumer Product Safety Commission (CPSC or Commission) announced a “record-breaking week” of enforcement actions against “foreign violators.”[1] Namely, the Commission announced 28 separate product safety recalls and warnings for products manufactured in China, including a “first-of-its-kind enforcement sweep of off-brand Chinese faucets found to leach lead and other contaminates into U.S. drinking water.”[2] Many of these actions were taken “unilaterally,” meaning the Commission issued press releases warning consumers of potentially hazardous products without final approval from the products’ manufacturer or retailer.

The CPSC’s authority to take such unilateral action originates from Section 6(b) of the Consumer Product Safety Act (CPSA). Historically, the Commission’s use of unilateral action has been minimal. Companies typically find it advantageous to cooperate with the CPSC in disclosing hazards to the public. However, this recent “record-breaking week” may signify a more aggressive approach by the CPSC, particularly when it comes to foreign manufacturers that are arguably outside the CPSC’s immediate jurisdiction.

Unilateral Press Releases under the CPSA Section 6(b)

Section 6(b) governs the CPSC’s ability to publicly disclose information about consumer products, such as identifying the manufacturer and any product-specific information.[3] Before publicly disclosing this information, the agency must notify the company and provide it with an opportunity to correct, contest, or comment on the disclosure’s content.[4] The CPSC must give the company at least fifteen days to provide comments.[5] If, however, the CPSC disagrees with the company’s comments, the CPSC may unilaterally release information to the public—without the company’s final approval—so long as it has taken “reasonable steps” to ensure the information is accurate, fair in context, and reasonably related to the agency’s mission to protect the public.[6]

Section 6(b) proponents argue these safeguards are necessary to protect against reputational damage caused by false or inaccurate disclosures. Critics maintain its rigid framework delays potentially life-saving information from prompt public disclosure, with some arguing it should not exist at all. Even so, unilateral press releases could result in litigation, especially if the content turns out to be inaccurate.[7] Thus, the CPSC may delay the issuance of a unilateral press release to independently verify the information therein—which typically requires cooperation and further disclosure from the company.

Insight from the Commission

Previous statements made by Acting Chair Peter Feldman and Commissioner Douglas Dziak provide insight into their views on unilateral activity by the CPSC. In 2023 Peter Feldman publicly touted the Commission’s Section 6(b) powers stating, “The law provides due process for a firm to seek revisions of what it believes to be erroneous information. Nevertheless, the Commission is under no obligation to make edits if it disagrees.” Further, in 2024, the CPSC refused to retract a unilateral statement by Commissioner Richard Trumka encouraging retailers to refrain from selling certain weighted infant sleep products. The manufacturer of those products complained Trumka’s statement violated Section 6(b) procedures, compelling a response from both Feldman and Dziak: “We do not take such relief lightly” and “the publication of the statements constitutes final agency action. Given the procedural deficiencies in this matter, we believe that the relief sought is best obtained through an Article III court.”[8] Now, with Acting Chair Feldman at the helm, it may not be a surprise that the CPSC is turning to this regulatory tool with more frequency, particularly in instances involving products made in foreign countries.

Implications for Domestic Stakeholders and Foreign Manufacturers

For domestic importers, distributors, and retailers of foreign products, the increased risk of unilateral press releases may present some challenges. If a foreign supply partner fails to meet U.S. safety standards and refuses to cooperate with the CPSC, the burden of compliance may fall on the U.S. entity. The CPSC may also leverage the threat of a unilateral press release naming the domestic retailer to compel cooperation, even when the foreign manufacturer may be the more appropriate focus for the violation.

Given the CPSC’s increased exercise of its unilateral authority, particularly with respect to products manufactured abroad, companies that import, distribute, or sell consumer products—especially those sourced from foreign manufacturers—should perform the appropriate vetting and due diligence, verifying product safety at the outset of the supply chain. In addition—and to the extent possible—domestic stakeholders who import from abroad should work to include provisions in supply contracts that require foreign suppliers to cooperate with CPSC inquiries and recalls.

[1] The CPSC’s official statement is available here: https://www.cpsc.gov/Newsroom/News-Releases/2025/CPSC-Sets-New-Record-for-Safety-Notices-Protecting-American-Families-and-Leveling-the-Playing-Field-for-American-Business#:~:text=WASHINGTON%2C%20D.C.%20%E2%80%93%20This%20week%2C,weekly%20high%20for%20safety%20warnings.

[2] Id.

[3] See 16 C.F.R. Part 1101.

[4] 16 C.F.R. § 1101.1(b)(1).

[5] Id.

[6] 16 C.F.R. Part 1101 Subpart D. The CPSC must first warn the company of its decision to do so and wait an additional five days before releasing the contested information to the public. 16 C.F.R. § 1101.25.

[7] See 16 C.F.R. § 1101.1(b)(3).

[8] The full statement can be found on the CPSC website: https://www.cpsc.gov/About-CPSC/Commissioner/Douglas-Dziak-Peter-A-Feldman/Statement/Statement-of-Commissioners-Peter-A-Feldman-and-Douglas-Dziak-on-the-Retraction-of-Infant-Sleep-Products-Statements.