Key Compliance Tips on How to Respond to Information Requests from OFSI

On 8 May 2025, the United Kingdom’s Office of Financial Sanctions Implementation (OFSI) of HM Treasury published a penalty notice regarding a breach of financial sanctions by a UK registered company—Svarog Shipping & Trading Company Limited (Svarog). OFSI imposed a monetary penalty of £5,000 on Svarog for failing, without reasonable excuse, to respond to a Request for Information (RFI) issued by OFSI.

Request for Information

OFSI has statutory powers to request documents and information for certain purposes, including establishing whether financial sanctions may have been breached or monitoring compliance with certain financial sanctions regulations or licences. OFSI will specify the legislative basis for the request and the time period within which the information should be provided (if no period is specified, the information must be provided within a reasonable time). Failure to comply with an RFI is a criminal offence which can lead to prosecution or a monetary penalty.

OFSI issued an RFI to Svarog on 26 January 2024 pursuant to OFSI’s statutory powers under Regulation 72 of The Russia (Sanctions) (EU Exit) Regulations 2019 (Russia Regulations). OFSI directed that a response was required by 9 February 2024. Despite OFSI sending a number of reminders, Svarog did not respond by the deadline. Svarog only responded to the RFI once OFSI contacted Svarog’s auditors. OFSI concluded that Svarog had failed to respond to OFSI’s RFI and, in the absence of a reasonable excuse, had breached Regulation 74(1)(a) of the Russia Regulations. OFSI imposed a monetary penalty of £5,000 for the breach.

Key Compliance Lessons

This case emphasises the importance of timely and accurate responses to RFIs and highlights a number of key compliance lessons, which are summarised below.

Respond Promptly to RFIs

Do not ignore the request. Failing to respond to an RFI can act as an aggravating factor in OFSI’s overall assessment of the severity of the breach.

Seek clarification if the request seems unclear or the deadline is challenging to adhere to.

If you believe you have missed a statutory deadline but you have a reasonable excuse, you should provide that excuse proactively for OFSI to consider, accompanied by a full explanation of the circumstances.

Recipients of RFIs should be aware of the importance of responding promptly, failing which can significantly impede OFSI’s ability and effectiveness to assess compliance, enforce financial sanctions and maintain compliance with the sanction’s regimes.

Understand the Legal Basis

Determine the statutory basis of OFSI’s RFI. If you are unsure, seek advice from sanctions or regulatory legal teams.

Engage Proactively and Candidly With OFSI When It Comes to RFIs

Be aware of any time limits specified in the RFI.

Provide accurate information to OFSI, ensuring it is truthful and accurate.

Engage with OFSI’s published guidance and seek professional advice on sanctions obligations if necessary.

Have Effective Communication and Monitoring Systems in Place

Keep detailed records of compliance procedures, risk assessments and responses to the RFI.

Demonstrate awareness of sanction compliance duties, including record keeping.

Appoint responsible personnel, monitoring and maintaining up-to-date contact information to ensure effective communication with OFSI RFIs.

OFSI expects firms to have effective communication and monitoring systems in place so that firms can promptly identify and respond to any RFI they might receive from OFSI.

Plan for Follow Up

Be prepared for follow-up queries or interviews. OFSI may ask for clarification, more documents or meetings after the initial response.

Consider Other Compliance and Reporting Obligations

Whilst the penalty in this case related to the failure to respond to an RFI without a reasonable excuse, other types of failures to provide information can also constitute breaches leading to penalties. For example:

Non-compliance with reporting obligations, including both failure to report and late reporting without reasonable excuse.

Incomplete or otherwise non-compliant reporting on specific and general licences, reporting requirements on licences and failures to report frozen assets.

Conclusion

You should ensure you are aware of your obligations and your requirement to comply with an RFI by OFSI.

Lost in Translation: Key Deal Points in European vs. U.S. M&A Transactions

After two decades practicing law in Silicon Valley and five formative years working on cross-border deals in Europe, I’ve come to appreciate the subtle (and not-so-subtle) differences in how merger and acquisition (M&A) transactions are structured on either side of the Atlantic. For buyers and sellers on opposite sides of the divide, these can be the difference between a smooth closing and a deal that gets lost in translation.

Below, we look at the key distinctions between U.S. M&A deal terms (sourced from SRS Acquiom) and European M&A deal terms (sourced from CMS), personal insights from the trenches, and practical takeaways for buyers and sellers trying to structure and execute cross-border transactions.

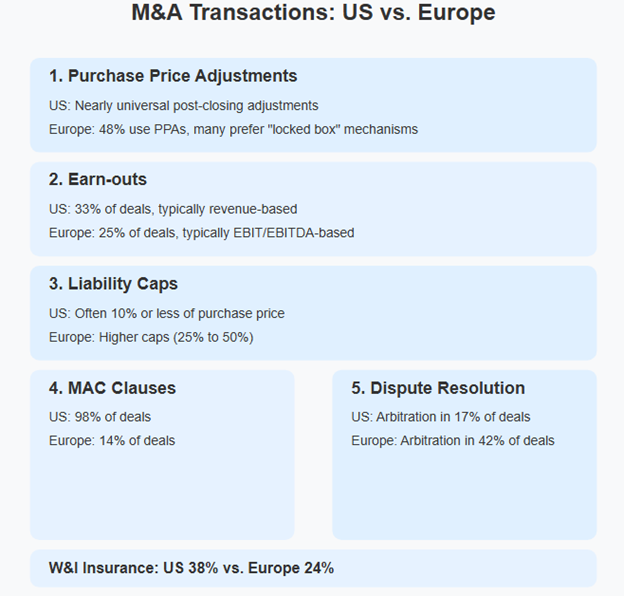

The infographic above provides a comprehensive overview of the six key differences in M&A practices between the U.S. and European markets. These points illustrate the fundamental structural variations that deal teams must navigate when working across borders.

1. Purchase Price Adjustments (PPA): Certainty vs. Flexibility

In the U.S., PPAs are nearly universal. Buyers expect to be made whole for gaps in working capital, shortfalls in cash in the bank, and any remaining debt post-closing. It’s a well-oiled machine, and most parties know the drill.

In Europe, it’s a different story. While PPAs are gaining ground (found in less than half of all M&A deals per CMS), many deals still rely on the “locked box” mechanism, where the price is fixed based on a historical balance sheet, and the seller warrants that there has been no leakage in value since the balance sheet date. This approach offers price certainty but requires trust and diligence.

U.S. clients doing deals in Europe should be open to lock box structures, especially in competitive auctions. European clients entering the U.S. should be ready for detailed post-closing adjustments and the accounting gymnastics that come with them.

2. Earn-outs: A Tale of Two Metrics

Earn-outs are common in both markets, making up 33% of U.S. deals and 25% of European ones. But the way they are structured varies widely. In the U.S., revenue-based earn-outs are more common, as opposed to Europe, where EBIT/EBITDA is king.

In tech and healthcare, where future performance is often speculative, earn-outs can bridge valuation gaps. But they are also a breeding ground for disputes.

Defining metrics clearly is table stakes, as is aligning incentives and not underestimating the emotional toll of earn-out negotiations, especially when founders are staying on board.

The chart above quantifies the prevalence of key M&A practices in both markets. Note especially the dramatic difference in MAC clause usage (98% in the U.S. versus just 14% in Europe) and the inverse relationship in arbitration preference (17% U.S. versus 42% Europe). These statistical differences highlight the importance of understanding regional norms when structuring cross-border transactions.

3. Liability Caps: How Much Skin in the Game?

In the U.S., seller liability is often capped at 10% or less of the purchase price, thanks to the widespread use of transactional, or “rep and warranties” insurance (otherwise known as “RWI”). In Europe, caps are higher, often 25% to 50%, though RWI is catching up.

European sellers are more accustomed to bearing risk, while U.S. sellers expect to shift it. This can lead to friction, so aligning expectations early is key.

United States

Europe

Liability Cap Comparison

Liability is typically capped at 10% or less of purchase price

Heavy reliance on representations & warranties insurance

Focus on limiting seller’s post-closing risk

Shorter survival periods for representations

Higher liability caps (25% to 50% of purchase price)

Growing but still lower adoption of W&I insurance

Sellers more accustomed to bearing risk

Longer warranty periods common in certain jurisdictions

Legal Framework Differences

Litigation-focused dispute resolution (83% of deals)

MAC clauses standard (98% of deals)

Common law principles

More extensive due diligence process

Arbitration more common (42% of deals)

MAC clauses rare (14% of deals)

Mix of civil and common law systems

70% of arbitration clauses apply national rules

This interactive comparison illustrates the fundamental differences in liability approaches and legal frameworks between regions. Toggle between the tabs to explore how these differences might impact deal structuring and negotiations. The higher liability caps in Europe (25-50%) versus the U.S. (typically 10% or less) reflect different risk allocation philosophies that must be reconciled in cross-border transactions.

4. MAC Clauses: Rare in Europe, Routine in the U.S.

Material Adverse Change (MAC) clauses are standard in U.S. deals and used in 98% of transactions. The idea is that between signing and closing, the business has not suffered a MAC, and if it has, the buyer does not have to close. Sometimes, it’s worded that the business hasn’t suffered a MAC since the balance sheet date. In Europe, however, they are rarefied air, appearing in only 14% of M&A deals, and often heavily qualified.

This can lead to surprises when U.S. buyers find no MAC clause in a European deal, and European sellers may balk at the broad language typical in U.S. agreements.

5. Dispute Resolution: Courts vs. Arbitration

Dispute resolution is where things really diverge. In the U.S., litigation is the default remedy, with arbitration used in only 17% of deals. In Europe, the use of arbitration is much higher (42% of deals in 2024), especially in cross-border transactions.

But there is a twist. 70% of European arbitration clauses apply national rules, not international ones. That means a “standard” arbitration clause in Germany may look very different from one in France or the UK.

U.S. clients should be prepared for arbitration in Europe and understand the local rules. European clients doing deals in the U.S. should be ready for court proceedings and the discovery process that comes with them.

6. Transactional Insurance: Growing, But Not Yet Global

RWI, or transactional insurance, is a game-changer. It smooths negotiations, caps liability, and speeds up closings. In the U.S., it’s used in 38% of deals. In Europe, it’s at 24%, but rising fast, especially in the UK and Germany.

I have seen RWI insurance unlock deals that would otherwise stall over the scope of representations and warranties, indemnity caps, or escrow mechanics. But it is not a silver bullet, so underwriting diligence still matters.

Bridging the Gaps

Cross-border M&A is never just about the numbers. It’s about culture, expectations, and communication. I have seen deals that were super smart on paper fall apart because the counterparties did not understand each other’s norms. And I have seen unlikely partnerships thrive because they took the time to bridge those gaps.

So, whether you’re a U.S. buyer eyeing a European AI startup, or a European medtech platform bolting on a U.S. target, remember that what is “market” depends on where you are. When in doubt, ask someone who’s been on both sides of the table.

CPSC Announces “Record-Breaking Week” of Enforcement Actions Against Chinese Manufacturers

On May 15, 2025, the Consumer Product Safety Commission (CPSC or Commission) announced a “record-breaking week” of enforcement actions against “foreign violators.”[1] Namely, the Commission announced 28 separate product safety recalls and warnings for products manufactured in China, including a “first-of-its-kind enforcement sweep of off-brand Chinese faucets found to leach lead and other contaminates into U.S. drinking water.”[2] Many of these actions were taken “unilaterally,” meaning the Commission issued press releases warning consumers of potentially hazardous products without final approval from the products’ manufacturer or retailer.

The CPSC’s authority to take such unilateral action originates from Section 6(b) of the Consumer Product Safety Act (CPSA). Historically, the Commission’s use of unilateral action has been minimal. Companies typically find it advantageous to cooperate with the CPSC in disclosing hazards to the public. However, this recent “record-breaking week” may signify a more aggressive approach by the CPSC, particularly when it comes to foreign manufacturers that are arguably outside the CPSC’s immediate jurisdiction.

Unilateral Press Releases under the CPSA Section 6(b)

Section 6(b) governs the CPSC’s ability to publicly disclose information about consumer products, such as identifying the manufacturer and any product-specific information.[3] Before publicly disclosing this information, the agency must notify the company and provide it with an opportunity to correct, contest, or comment on the disclosure’s content.[4] The CPSC must give the company at least fifteen days to provide comments.[5] If, however, the CPSC disagrees with the company’s comments, the CPSC may unilaterally release information to the public—without the company’s final approval—so long as it has taken “reasonable steps” to ensure the information is accurate, fair in context, and reasonably related to the agency’s mission to protect the public.[6]

Section 6(b) proponents argue these safeguards are necessary to protect against reputational damage caused by false or inaccurate disclosures. Critics maintain its rigid framework delays potentially life-saving information from prompt public disclosure, with some arguing it should not exist at all. Even so, unilateral press releases could result in litigation, especially if the content turns out to be inaccurate.[7] Thus, the CPSC may delay the issuance of a unilateral press release to independently verify the information therein—which typically requires cooperation and further disclosure from the company.

Insight from the Commission

Previous statements made by Acting Chair Peter Feldman and Commissioner Douglas Dziak provide insight into their views on unilateral activity by the CPSC. In 2023 Peter Feldman publicly touted the Commission’s Section 6(b) powers stating, “The law provides due process for a firm to seek revisions of what it believes to be erroneous information. Nevertheless, the Commission is under no obligation to make edits if it disagrees.” Further, in 2024, the CPSC refused to retract a unilateral statement by Commissioner Richard Trumka encouraging retailers to refrain from selling certain weighted infant sleep products. The manufacturer of those products complained Trumka’s statement violated Section 6(b) procedures, compelling a response from both Feldman and Dziak: “We do not take such relief lightly” and “the publication of the statements constitutes final agency action. Given the procedural deficiencies in this matter, we believe that the relief sought is best obtained through an Article III court.”[8] Now, with Acting Chair Feldman at the helm, it may not be a surprise that the CPSC is turning to this regulatory tool with more frequency, particularly in instances involving products made in foreign countries.

Implications for Domestic Stakeholders and Foreign Manufacturers

For domestic importers, distributors, and retailers of foreign products, the increased risk of unilateral press releases may present some challenges. If a foreign supply partner fails to meet U.S. safety standards and refuses to cooperate with the CPSC, the burden of compliance may fall on the U.S. entity. The CPSC may also leverage the threat of a unilateral press release naming the domestic retailer to compel cooperation, even when the foreign manufacturer may be the more appropriate focus for the violation.

Given the CPSC’s increased exercise of its unilateral authority, particularly with respect to products manufactured abroad, companies that import, distribute, or sell consumer products—especially those sourced from foreign manufacturers—should perform the appropriate vetting and due diligence, verifying product safety at the outset of the supply chain. In addition—and to the extent possible—domestic stakeholders who import from abroad should work to include provisions in supply contracts that require foreign suppliers to cooperate with CPSC inquiries and recalls.

[1] The CPSC’s official statement is available here: https://www.cpsc.gov/Newsroom/News-Releases/2025/CPSC-Sets-New-Record-for-Safety-Notices-Protecting-American-Families-and-Leveling-the-Playing-Field-for-American-Business#:~:text=WASHINGTON%2C%20D.C.%20%E2%80%93%20This%20week%2C,weekly%20high%20for%20safety%20warnings.

[2] Id.

[3] See 16 C.F.R. Part 1101.

[4] 16 C.F.R. § 1101.1(b)(1).

[5] Id.

[6] 16 C.F.R. Part 1101 Subpart D. The CPSC must first warn the company of its decision to do so and wait an additional five days before releasing the contested information to the public. 16 C.F.R. § 1101.25.

[7] See 16 C.F.R. § 1101.1(b)(3).

[8] The full statement can be found on the CPSC website: https://www.cpsc.gov/About-CPSC/Commissioner/Douglas-Dziak-Peter-A-Feldman/Statement/Statement-of-Commissioners-Peter-A-Feldman-and-Douglas-Dziak-on-the-Retraction-of-Infant-Sleep-Products-Statements.

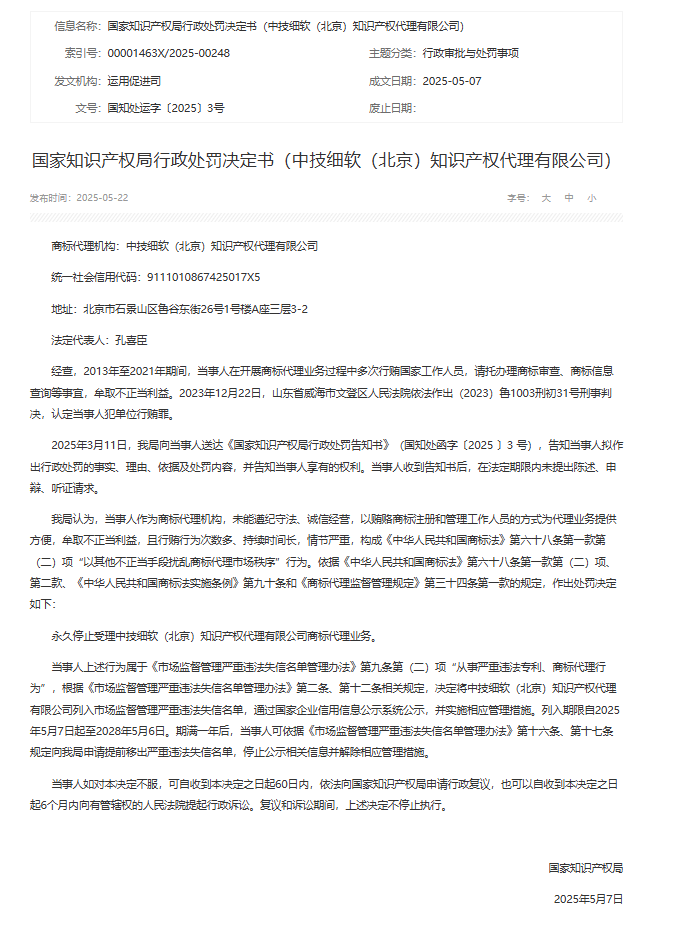

CNIPA Permanently Suspends Three Chinese Trademark Firms for Bribery

On May 22, 2025, China’s National Intellectual Property Administration (CNIPA) released three administrative penalty decisions permanently suspending three trademarks firms from accepting trademark work. Per Tianyancha (geoblocked) and a court decision, one firm in particular was found to have bribed a CNIPA trademark examiner from 2013 to 2021 totaling 1.29 million RMB. The firm was criminally convicted and fined 100,000 RMB and the illegal gains of 1,382,680 RMB were seized.

A translation of one of the Decisions follows. The original text of the Decisions can be found here, here and here. A screen shot from Tianyancha can be found here courtesy of 知识产权界.

After investigation, it was found that from 2013 to 2021, the party bribed state officials many times in the process of carrying out trademark agency business, asking them to handle trademark examination, trademark information inquiry and other matters, and seeking improper benefits. On December 22, 2023, the People’s Court of Wendeng District, Weihai City, Shandong Province, rendered a criminal judgment (2023)鲁1003刑初31号 in accordance with the law, and found that the party was guilty of corporate bribery.

On March 11, 2025, our office served the party concerned with the “Notice of Administrative Penalty by the State Intellectual Property Office” (State Intellectual Property Office Letter [2025] No. 3), informing the party concerned of the facts, reasons, basis and content of the proposed administrative penalty, and informing the party concerned of the rights they enjoy. After receiving the notice, the party concerned did not make a statement, defense or request for a hearing within the statutory period.

Our bureau believes that the party concerned, as a trademark agency, failed to abide by laws and regulations and operate in good faith, and provided convenience for agency business by bribing trademark registration and management staff, and obtained improper benefits. Moreover, the bribery was frequent, lasted for a long time, and the circumstances were serious, constituting the act of “disrupting the trademark agency market order by other improper means” as stipulated in Article 68, paragraph 1, item (2) of the Trademark Law of the People’s Republic of China. In accordance with Article 68, paragraph 1, item (2) and paragraph 2 of the Trademark Law of the People’s Republic of China, Article 90 of the Regulations for the Implementation of the Trademark Law of the People’s Republic of China, and Article 34, paragraph 1 of the Regulations on the Supervision and Administration of Trademark Agencies, the following penalty decision is made:

Permanently stop accepting trademark agency business from Beijing Zhonglian Aizhi Intellectual Property Agency Co., Ltd.

The above-mentioned behavior of the party concerned falls under the provisions of Article 9, Item (2) of the “Administrative Measures for the List of Serious Illegal Dishonesty in Market Supervision and Administration”, “engaging in serious illegal patent and trademark agency behavior”. According to the relevant provisions of Article 2 and Article 12 of the “Administrative Measures for the List of Serious Illegal Dishonesty in Market Supervision and Administration”, it is decided to include Beijing Zhonglian Aizhi Intellectual Property Agency Co., Ltd in the list of serious illegal dishonest companies in Market Supervision and Administration, publicize it through the National Enterprise Credit Information Publicity System, and implement corresponding management measures. The inclusion period is from May 7, 2025 to May 6, 2028. After one year, the party concerned may apply to our bureau for early removal from the list of serious illegal dishonest companies in accordance with Articles 16 and 17 of the “Administrative Measures for the List of Serious Illegal Dishonesty in Market Supervision and Administration”, stop publicizing relevant information and lift corresponding management measures.

If the parties are dissatisfied with this decision, they may apply for administrative reconsideration to the CNIPA within 60 days from the date of receipt of this decision, or file an administrative lawsuit with the People’s Court with jurisdiction within 6 months from the date of receipt of this decision. During the reconsideration and litigation, the above decision shall not be suspended.

Contract Adjustment In The Event Of Inflation And Crises: When The World Is Upside Down, What Are The Implications For Ongoing Agreements?

The economic environment has changed dramatically in recent years. COVID-19, the war in Ukraine, geopolitical conflicts, supply chain disruptions, skyrocketing prices for raw materials and energy, and natural disasters all highlight the fragility of international supply relationships. But what does this mean in concrete terms for companies and their contractual arrangements? What happens if a contracting party is suddenly no longer able to deliver or if the agreed prices are no longer sufficient for economic viability?

In this post, we explore the legal options available under German law to adjust contracts in response to changing circumstances.

Interference with the Basis of the Agreement: When the Foundation Shifts

Under German law, a contracting party may demand an adjustment to the agreement if the circumstances that formed the basis of the contract change significantly after its conclusion, and continued adherence to the contract would be unreasonable for that party (so-called “interference with the basis of the agreement”, according to Section 313 (1) of the BGB, the German Civil Code). If a contractual adjustment is impossible or unreasonable for one party, it may even request rescission of the agreement by withdrawal or termination, as codified in the BGB.

However, such an adjustment or rescission is generally excluded if the risk of the respective contractual interference is clearly allocated to one of the parties by law or contract. Adjustments due to supply shortages or price increases resulting from a crisis are only considered if they go beyond the scope of typical contractual risk. In other words, the interference must create a performance risk so exceptional that the parties did not assume it when entering into the agreement.

A fixed-price agreement is one example of contractual risk allocation. If the supplier’s material costs rise significantly, this typically falls within its risk sphere due to the fixed-price agreement. As a rule, the supplier cannot demand a price adjustment. For this reason, price adjustment clauses are frequently agreed upon in practice, as described in more detail below.

An example of a statutory risk allocation is the risk of use, meaning the risk of not being able to use the received goods or services as intended. This risk is typically assigned to the recipient under reciprocal contracts. For instance, if a tool manufacturer takes out a loan to invest in its production capacity in anticipation of a rise in demand, the manufacturer cannot request a contract adjustment or termination of the loan agreement if demand for its tools later collapses and the loan, therefore, becomes economically pointless. In such cases, there is generally no room for an interference-based contract adjustment.

Furthermore, an interference is excluded if the contract already contains mechanisms for adjusting performance in cases of unforeseeable events (g., force majeure, hardship, or price adjustment clauses, as explained below). In these instances, there is usually little or no scope for adjusting the contract using the legal concept of interference with the basis of the transaction.

In practice, many adjustment attempts fail because the risk that has materialized was contractually or legally allocated from the outset. Without tailored contractual clauses – such as force majeure or price adjustment provisions – a party may be denied the right to amend or terminate the contract. This underscores the importance of such clauses at the time of contract formation.

Force Majeure Clauses: Contractual Protection Against the Unforeseeable

Force majeure clauses regulate what happens if an extraordinary event makes performance impossible or unreasonable. Although not specifically defined in German law, the concept is gaining importance due to the expansion of EU legislation and the increasing international nature of commercial contracts.

Force majeure clauses are designed to shield parties from liability when events occur that are unforeseeable and beyond their control. The burden must be so high that one party cannot reasonably be expected to bear it. Whether these requirements are met in individual cases depends on the nature and content of the contract.

Because there is no statutory definition of force majeure in German law, the parties must define it themselves and set out the legal consequences. The parties usually draw up a list of events that are expressly considered to be force majeure. The clause often provides that the affected party is released from liability or that deadlines are extended. To account for cases of prolonged force majeure, it may also be advisable to include a right to terminate the contract for cause.

A valid force majeure clause generally releases the affected party from the obligation to perform or allows the performance to be postponed without triggering damages, provided the party is not at fault and the event that prevents it from fulfilling its contractual obligation is outside its control. According to the German Federal Court of Justice, force majeure is ruled out if there is even slight negligence on the part of the affected party.

The clause should also clarify under what circumstances a party may invoke force majeure. This is especially important if the event only affects a supplier further down the supply chain (e.g., a production site destroyed by an earthquake) because the parties are then generally only indirectly affected by the supplier’s failure to deliver. In such cases, the party may be expected to source alternatives, even if costly or impractical.

Typical force majeure events include natural disasters, war, pandemics, strikes, and trade restrictions. The model clause for force majeure recommended by the International Chamber of Commerce – widely used in German practice – lists such examples and defines, for example, war and hostilities, starting with extensive military mobilization, as presumed events of force majeure. If the parties have included this clause in their agreement, the occurrence of a defined event generally constitutes a case of force majeure.

Similar provisions exist under international commercial law, particularly Article 79 of the United Nations Convention on Contracts for the International Sale of Goods. This article exempts a party from liability for non-performance if it proves that the failure was due to an impediment beyond its control, which could not reasonably have been foreseen or avoided.

Service and Price Adjustment Clauses: Built-in Flexibility

Because reliance on Section 313 of the BGB or force majeure clauses can be uncertain, many businesses include performance and price adjustment clauses in their contracts from the outset. These clauses allow parties to adapt to changes in raw material prices, inflation, or other factors. However, these clauses can be problematic and must strike a balance between predictability and flexibility.

When used in general terms and conditions, these clauses must be drafted with clarity and transparency, and they must align with the interests of the parties. German courts impose strict requirements:

Performance adjustment clauses are only permitted if they are reasonable for the counterparty, taking into account both parties’ interests. There must be a valid reason, and the adjustment must preserve the balance between performance and consideration.

Price adjustment clauses aim to maintain equivalence between performance and consideration during long-term relationships. These clauses must clearly specify the reason and scope of the price change and must not retroactively increase the user’s profit margin. The counterparty must be able to assess and verify the adjustment.

According to recent case law from the Federal Court of Justice, it is easier to justify price adjustment reservations, which allow the user to modify the price “at reasonable discretion” under certain conditions. It is sufficient to name the main cost drivers as change parameters in a comprehensible manner. A full breakdown of all cost components is not required.

Conclusion: Contracts Are Not A One-way Street – But Not A Wish List Either

Contracts cannot be changed easily. German law places great value on contractual certainty. Still, global economic volatility calls for updated legal tools.

The BGB’s doctrine of interference with the basis of the transaction offers relief when unforeseeable events significantly disturb the contract’s balance. Force majeure clauses provide clarity and prevent litigation. Price adjustment clauses and comparable contractual provisions create flexibility and reduce exposure on both sides.

Best Practices

Prepare for crises before they happen. In long-term contracts, include flexible mechanisms. Seek legal advice when circumstances change. And remember: Contracts should not just secure rights; they should enable fair solutions.

Because when the world is upside down, the goal remains: Getting through hard times together.

EC Announces Low- and High-Risk Countries under the EUDR

The European Commission (EC) released on May 22, 2025, the identity of the countries that present a low or high risk of deforestation in producing seven commodities (cattle, cocoa, coffee, palm oil, rubber, soy, and wood) that are “the most relevant in terms of driving global deforestation and forest degradation” under the European Union Deforestation Regulation (EUDR). The classification takes into account other criteria as listed in Article 29(4) of Regulation (EU) 2023/1115. The Regulation is scheduled to enter into force on the third day following its publication in the Official Journal of the European Union (May 26, 2025).

High-Risk Countries

Belarus, Democratic People’s Republic of Korea, Myanmar, and the Russian Federation.

Low-Risk Countries

Afghanistan, Albania, Algeria, Andorra, Antigua and Barbuda, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belgium, Bhutan, Bosnia and Herzegovina, Brunei Darussalam, Bulgaria, Burundi, Cabo Verde, Canada, Central African Republic, Chile, China, Comoros, Congo, Costa Rica, Croatia, Cuba, Cyprus, Czechia, Denmark, Djibouti, Dominica, Dominican Republic, Egypt, Estonia, Eswatini, Fiji, Finland, France, Gabon, Georgia, Germany, Ghana, Greece, Grenada, Guyana, Hungary, Iceland, India, Iran (Islamic Republic of), Iraq, Ireland, Italy, Jamaica, Japan, Jordan, Kazakhstan, Kenya, Kiribati, Kuwait, Kyrgyzstan, Lao People’s Democratic Republic, Latvia, Lebanon, Lesotho, Libya, Liechtenstein, Lithuania, Luxembourg, Madagascar, Maldives, Mali, Malta, Marshall Islands, Mauritius, Micronesia (Federated States of), Monaco, Mongolia, Montenegro, Morocco, Nauru, Nepal, Netherlands (Kingdom of the), New Zealand, North Macedonia, Norway, Oman, Palau, Palestine, Papua New Guinea, Philippines, Poland, Portugal, Qatar, Republic of Korea, Republic of Moldova, Romania, Rwanda, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, San Marino, Sao Tome and Principe, Saudi Arabia, Serbia, Seychelles, Singapore, Slovakia, Slovenia, Solomon Island, South Africa, South Sudan, Spain, Sri Lanka, Suriname, Sweden, Switzerland, Syrian Arab Republic, Tajikistan, Thailand, Timor-Leste, Togo, Tonga, Trinidad and Tobago, Tunisia, Türkiye, Turkmenistan, Tuvalu, Ukraine, United Arab Emirates, United Kingdom of Great Britain and Northern Ireland, United States of America, Uruguay, Uzbekistan, Vanuatu, Vietnam, and Yemen.

Standard-Risk Countries

If a country is not listed in the high-risk category or the low-risk category, the EC has assigned it a standard level of risk.

The EUDR, enacted on June 29, 2023, is intended to ensure that manufacturers do not produce goods from recently deforested areas or produce their goods in ways that contribute to deforestation. The Regulation explicitly applies to the seven aforementioned commodities and, importantly, to certain byproducts that contain feedstocks from the named commodities, to be “deforestation-free” if they are made available on or exported from the European Union (EU) market.

Just because a country has been designated as “standard risk,” or even “low risk,” under the EUDR does not mean that manufacturers looking to import products into the EU are exempt from having to complete due diligence statements. Manufacturers producing products in low-risk countries have reduced obligations as set forth in the simplified due diligence requirement, and are required to collect and report information on their supply chains, but do not have to assess and address deforestation risks under Articles 10 and 11 of the Regulation. Companies manufacturing products in low-risk countries face the same data collection obligations, although they must comply with fewer compliance checks.

Companies producing goods from high-risk and standard-risk countries will need to show when and where commodities were produced and provide “verifiable” information that they were not sourced from land deforested after 2020.

Profit Sharing Payments Are Around the Corner: Key Considerations for Employers in Mexico

As of May 31, 2025, once the term for paying profit sharing (PTU) has elapsed, the Labor Ministry is expected to start labor inspections specifically to verify PTU compliance. Additionally, as of the same date, employees and former employees who had the right to receive PTU (those employees who worked during 2024) and had not received it will become entitled to claim payment and/or get the specifics on why no payment was made to them.

Quick Hits

May 30, 2025, is the last day for paying profit sharing (PTU).

As of May 31, 2025, the Labor Ministry is expected to start labor inspections to verify compliance with PTU payment requirements, and employees and former employees will become entitled to claim PTU payments and/or get the specifics on why no payment was made to them.

Key Considerations for Employers in Mexico

Although May 30, 2025, is the last day for paying PTU on time, a process must have been met before the requirements for payments take effect, as considered by the Federal Labor Law (FLL).

Every employer needs to comply, regardless of whether PTU was generated, with the whole PTU process considered in the FLL, which entails:

filing an annual tax return (no later than March 31 of every year);

sharing with the employees, no later than ten days after filing was made, the annual tax return to inform them whether PTU was generated or not;

integrating a joint commission (PTU commission) with an equal number of employer and employee representatives who will determine the liquid amount of profits for each employee;

analyzing and determining a route for those employees who worked during the applicable tax period (2024) and those whose employment was terminated before the payment date, if there is PTU to be paid; and

paying PTU, if it was generated, by May 30.

Employers that cannot prove full compliance with the process may be subject to a fine of 250 to 5,000 times the measure and update unit value (UMA $113.14 pesos) (approximately USD $1,450–USD $29,010) upon an inspection by the Labor Authority.

The statute of limitations for employees and former employees to file any claim regarding PTU is one year. The yearlong term commences on May 31 annually, the date on which the benefit is enforceable.

ECHA’s Redesigned C&L Inventory Is Available in ECHA CHEM

The European Chemicals Agency (ECHA) announced on May 20, 2025, that the redesigned Classification and Labeling (C&L) Inventory is now available in ECHA CHEM, ECHA’s public database containing information from all Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) registrations received by ECHA. According to ECHA, the C&L Inventory includes information on more than 4,400 European Union (EU)-level harmonized classifications and seven million classifications notified or included in REACH registrations. ECHA states that altogether, the C&L Inventory includes data on approximately 350,000 substances. ECHA notes that the new C&L Inventory “is designed to help users easily locate the classification with the highest agreement and to bring clarity on the source behind the classification information.” It incorporates recent regulatory developments, such as the new Classification, Labelling and Packaging (CLP) Regulation hazard classes and “is built with stability and growth in mind.” The classification information is accessible in a visual format per substance with ECHA exploring complementary approaches, such as application programming interfaces (API), in future releases.

The Trump Administration Announces Trade Agreement With China

On Thursday, 8 May, shortly after the announcement of the trade agreement with the United Kingdom and the United States, US Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent provided additional details on the trade “agreement” reached with representatives of the People’s Republic of China in Geneva. The agreement was realized in the 12 May executive order “Modifying Reciprocal Tariff Rates to Reflect Discussions with the People’s Republic of China.”

Both countries announced that they would lower the 125% tariffs that were put in place after 2 April to 10% for 90 days. China will also end its restrictions on rare earth and other exports of sensitive goods during the 90-day pause. The United States will retain its 20% tariffs related to fentanyl issues and all other tariffs and duties (including the Section 301 tariffs that have been in place since 2018 and the Section 232 tariffs on steel, aluminum, and automobiles/automobile parts, as well as antidumping/countervailing duties and normal customs duties). This temporary pause brings the minimum US tariff rate on imports from China to 30%.

President Donald Trump’s 12 May executive order also amends the duty rates for goods from China or Hong Kong that fall under the US$800 de minimis threshold that were raised in the 2 April executive order “Further Amendment to Duties Addressing the Synthetic Opioid Supply Chain in the People’s Republic of China As Applied to Low-Value Imports.” The new duty rates, effective 14 May, impose a 54% ad valorem duty rate or a flat specific duty rate of US$100 per package.

The two sides are continuing to negotiate, with the US delegation repeatedly emphasizing the “constructive” and “positive” tone in the negotiations and a “path forward” on the 20% fentanyl tariffs. Representatives from the Chinese trade delegation have also described the engagement with the United States as constructive but have not commented on the next steps in the negotiation, including a potential call between President Trump and China’s President Xi Jinping. Both countries have committed to establishing a “communication mechanism” to proceed with trade negotiations.1

The agreement, while demonstrating progress in the ongoing trade negotiations between the United States and China, is not a permanent deal and will require an extension or renegotiation before the end of the mutually agreed 90-day pause. As negotiations continue between the White House and global leaders, the trade and policy professionals at our firm remain actively involved in this area and are excited to help you navigate the fast-moving trade environment.

Footnotes

1 Anniek Bao, China calls U.S. trade talks ‘good’ but quiet on next steps, as Trump hints at Xi call, CNBC (May 16, 2025, 5:02 AM), https://www.cnbc.com/2025/05/16/china-calls-us-trade-talks-good-as-trump-hints-at-xi-call.html.

Additional Authors: Jasper G. Noble, Jeffrey Orenstein

Amendment to Mexico’s National Housing Fund Institute for Workers Law Introduces New Employer Obligations

On February 22, 2025, the amendment to Mexico’s National Housing Fund Institute for Workers Law (INFONAVIT) was published in the Official Gazette of the Federation (Diario Oficial de la Federación). Among the changes to INFONAVIT’s structure, the amendment introduces new obligations to employers related to deductions for loans granted by INFONAVIT and sanctions in case of noncompliance.

Quick Hits

The amendment to Mexico’s INFONAVIT law includes new obligations for employers related to deductions allowed under INFONAVIT per the loans granted by said authority.

Evidence of compliance with the new obligations must be presented before September 17, 2025.

New Obligations for Employers

Per the amendment, employers must adjust their systems and processes to determine, make, and enter deductions from the salaries of employees who are granted INFONAVIT loans.

Employers will be obligated to apply deductions even when employees do not receive their salary due to absenteeism or disability.

Employers are required to apply deductions even when employees are not receiving their salary for any reason other than those mentioned above (any agreed suspension of the employment relation).

Agreements to offset payments between an employee and the employee’s employer are prohibited.

Employers will be jointly liable for an employee’s loan credit, regardless of whether the employee generates salary/income (any type of compensation).

Employers must continue to pay the loan if an employee ceases to generate income.

Failure to comply with these obligations could result in audits or the determination of several tax credits for nonpayment of credits granted by INFONAVIT.

Compliance Period

The amendment to the INFONAVIT law establishes that employers must be given a reasonable period to comply with the new obligations. Therefore, on May 5, 2025, a resolution was published in the Official Gazette of the Federation granting employers with the period they will have to comply with their new obligations.

Employers must make adjustments to their systems and processes to determine, make, and enter deductions from the salaries of employees who are granted loans within the fourth bimester of 2025 (this bimester corresponds to the months of July and August). However, evidence of compliance must be presented before September 17, 2025.

UK Government’s 2025 Strategic Priorities for the CMA: Key Insights for Businesses and Investors

When the UK’s competition agency, the Competition and Markets Authority (CMA), was established in 2014 as an independent non-ministerial government department, the UK government’s “steer” was introduced as a non-binding ministerial statement of strategic priorities for the CMA. It was intended to provide a transparent statement of how the government saw the competition regime fitting within its broader economic priorities. The CMA was and is expected to have regard to the steer, but it retains full independence in how it approaches its work.

Achieving economic growth has always been central to the UK government’s mission. This was as true in 2014 as it is now. But there are some important differences between now and then. In 2014, the government’s steer saw the “central task of the CMA […] to ensure that the forces of competition are fully harnessed to support the return to strong and sustained growth.” By contrast, the government’s 2025 steer encourages the CMA “to ensure that businesses receive a ‘best in class’ experience.”

This suggests that the government wants to encourage greater investment into the UK from businesses and investors and expects the CMA to support this mission.

Recent Developments in the CMA’s Policy Framework

Over the last six months, there have been multiple new announcements and initiatives from the CMA relating to its policy framework, which occurred in parallel to the publication for consultation of the government’s draft steer in February 2025. Three announcements stood out – potentially intended to catch the eye of businesses and investors:

(i) the introduction of the “4Ps” (pace, predictability, proportionality, and process), intended to change how the CMA operates, and now regularly referred to by the CMA as a new mantra;

(ii) the introduction of the “mergers charter,” which not only incorporates the 4Ps but also introduces new KPIs for the CMA to meet in relation to its merger review function; and

(iii) the CMA’s mergers remedies review, which may lead to a greater willingness from the CMA to accept both (a) parties’ claims in relation to merger-related benefits and efficiencies; and (b) behavioural remedies to address competition concerns arising from a transaction.

Alongside these initiatives, the government has also floated further legislative reforms to revisit (a) one limb of the UK’s merger control thresholds – the potentially broad “share of supply test”; and (b) the concept of “material influence,” under which the CMA has considerable flexibility to review acquisitions of minority shareholdings even where these do not confer control on the acquirer.

Those following the CMA’s decisional practice may have seen an uptick in merger clearances and the settling of long-standing antitrust investigations [[1]. This last tranche of activity might potentially be explained away by the facts of these specific cases. However, the coincidence of all these events, taken together, may also warrant further examination.

What Businesses and Investors Should Know

Enforcement Remains a Priority

Though the CMA’s policy framework is currently in a state of flux (as described above), it remains committed to enforcing competition law. The CMA continues to take its statutory functions seriously and appears committed to delivering against its statutory duties.

Foreign Transactions May Benefit

The CMA may not intervene in international transactions with limited UK connections where it might have done so previously. Moreover, if a transaction is already under review elsewhere, the CMA may consider whether the outcome of those reviews might address concerns arising in the UK and decline additional action. Businesses operating in global markets may welcome this development, as they may see less regulatory duplication and more remedial consistency, an issue that seems to have grown in recent years.

New Ways of Working

Businesses have also been offered what some may perceive as olive branches when it comes to how the CMA works. Here are some highlights.

The steer conveys the message that CMA should be collaborative so that business experience a “predictable, proportionate and transparent regulatory environment.” In this regard, there is evidence to indicate that the CMA has been collaborative. Take for example, its work in relation to the UK’s “green agreements guidance” where the CMA led other UK regulators towards a harmonized position. But business and investors may welcome the steer’s explicit signal on this issue.

The steer also encourages the CMA to be expeditious and to abide by its statutory deadlines. While the CMA has always operated within its statutory timeframes, stakeholders have noted instances when the CMA extended its timetable. These extensions occurred for various reasons, including accommodating parties requesting additional time. The Digital Markets Competition and Consumers Act 2024 introduces new provisions that allow the CMA to impose significant fines on parties who create delays by responding late to information requests without a “reasonable excuse,” a concept now more precisely defined. By seeking to be more expeditious, the CMA may be less flexible for parties seeking more time.

The steer expects the CMA to be proactive and responsive to businesses and seek regular feedback. The government intends to amend the CMA’s framework agreement so that the CMA is required to obtain regular feedback from its stakeholders, including businesses and consumers. How this initiative plays out in practice remains to be seen. Some argue that no regulator should be isolated from those it regulates. But “regulatory capture” may be a risk, especially if the regulator relies on positive feedback from its stakeholders. To mitigate this risk, stakeholders, especially those who interact less frequently with the CMA, should be visible to the CMA so that it continues to interact with a diverse range of stakeholders and takes their views into consideration.

More substantively, the steer invites the CMA to “focus on collaborative approaches to resolving issues with interested parties” and balance the need for transparency with the market impact of public communications regarding its activity. The suggestion appears to be that the CMA should try to avoid litigation and reconsider whether it should name firms under investigation at the start of an inquiry. If this interpretation is correct, such changes may risk weakening the CMA’s hand with respect to deterrence and enforcement. By the same token, it may shelter businesses from negative publicity and the increasing risk from follow-on damages litigation. Settled investigations generally reveal less detailed evidence of an infringement than fully contested investigations, the latter being more valuable for pursuing follow-on damages litigation.

If the developments above are not enough, the steer also focuses the CMA’s future discretionary activities towards (i) the government’s eight priority sectors for growth; (ii) key public services; and (iii) supporting the government’s agenda. Taken literally, this may suggest there will be sectors of the economy less likely to be investigated than before, for example, the groceries sector. But the steer is non-binding. If, for example, the cost-of-living crisis re-emerged, it is highly unlikely the CMA would not pursue an investigation into the groceries sector if it had a reasonable suspicion of anticompetitive practices.

Takeaways

It appears both the UK government and the CMA have listened to businesses and investors. They intend the CMA to be more “user friendly” and seek to change several ways in which the CMA operates to deliver against this goal.

For businesses and investors, the government hopes that the CMA won’t be a “blocker” but an “enabler” and “best in class” at supporting the UK growth agenda.

This suggests that rather than being sidelined, the CMA may remain at the heart of ensuring that markets work well for UK businesses and UK consumers, and it has some very significant powers to help achieve this goal.

[1] See, for example: CMA clears GBT / CWT corporate travel merger – GOV.UK; UK government bonds: suspected anti-competitive arrangements – GOV.UK; Anti-competitive behaviour relating to freelance labour in the production and broadcasting of sports content – GOV.UK; Anti-competitive conduct in relation to vehicle recycling and advertising of recycling-related features – GOV.UK

Clock Ticking: DOJ’s New Data Security Rule Requires Compliance by July 8

U.S. companies are running out of time to comply with a sweeping new Department of Justice (DOJ) rule that limits sharing sensitive personal data with certain foreign countries—including China, Russia, and Iran. With a hard compliance deadline of July 8, 2025, businesses must act quickly to avoid steep civil or criminal penalties.

The rule, which is part of a broader DOJ national security initiative, took effect on April 8, 2025. However, the agency is offering a short “good faith” grace period for companies actively working to meet the new requirements. After July 8, enforcement actions can carry fines of up to $1 million and potential prison sentences of up to 20 years.

What the Rule Covers

The DOJ’s data security rule prohibits or restricts U.S. companies from sharing bulk sensitive personal datawith individuals or entities from designated “foreign adversary” nations. Affected data types include:

Human genomic and biometric data

Precise geolocation

Health information

Financial data and identifiers like account names and passwords

Logs from fitness apps or wearables

Government-related location data or data linked to U.S. government employees

What Companies Need to Do Now

To comply, businesses can take the following actions:

Audit DataIdentify whether the company stores or transmits regulated data and whether the volumes meet “bulk” thresholds defined by the rule.

Review Contracts and Data-Sharing AgreementsAmend or terminate any transactions or contracts that give covered foreign persons access to sensitive data, including data licensing, brokerage, or research partnerships.

Evaluate Foreign PartnershipsAgreements with non-adversary foreign entities must now include language stating that data will not be passed on to restricted parties.

Assess Vendor and Investment ExposureTransactions that grant foreign employees, investors, or vendors access to regulated data require strong security controls and may require renegotiation.

Build a Compliance ProgramCompanies should implement written policies, employee training, and auditing systems and report violations to the DOJ.

With less than two months remaining, companies are urged to determine the next steps for compliance, conduct a comprehensive risk assessment, and review the DOJ’s newly released compliance guide. The DOJ encourages informal inquiries before the deadline but will not review requests for advisory opinions or licenses before July 8.

Companies that handle sensitive personal data must treat the new rule as a top compliance priority or risk serious consequences for the business.