China Releases Status of Intellectual Property Protection in China Customs in 2024

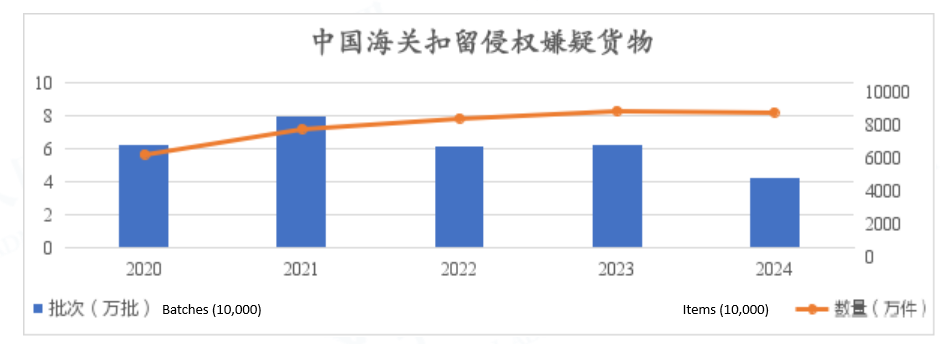

On April 23, 2025, China’s General Administration of Customs released Status of Intellectual Property Protection in China Customs in 2024 (2024年中国海关知识产权保护状况) providing statistics on the detainment of good (both import and export) for infringing intellectual property rights. A total of 53,200 intellectual property protection measures were implemented throughout 2024, and 41,600 batches and 81,605,100 items of suspected infringing goods were actually detained, representing a plateau in growth.

Suspected Infringing Goods Detained by China Customs

Other data points include:

a total of 29,541 intellectual property customs protection filing applications were accepted throughout the year, and the total number of filing applications accepted for the first time was close to 30,000. 21,614 filing applications were reviewed and approved, of which 16,034 were filed by domestic right holders, an increase of 24.19% year-on-year.

Customs detained 41,300 batches and 76,390,100 pieces of goods suspected of infringing trademark rights, accounting for 99.5% and 93.57% of the batches and quantities of suspected infringing goods, respectively.

a total of 249,000 pieces and 4,995,900 pieces of goods suspected of infringing patent rights and copyrights were detained, an increase of 71.33% and 393.61% year-on-year, respectively.

Customs detained 41,200 batches and 80,333,700 pieces of suspected infringing goods at the export stage, accounting for 99.17% and 98.41% of all detained batches and pieces respectively; 345 batches and 1,301,500 pieces of suspected infringing goods were detained at the import stage, down 34.16% and 26.52% year-on-year respectively.

clothing, shoes and hats, electronic appliances, leather goods and bags still occupy the top three batches detained, with 21,600 batches, 5,500 batches and 4,800 batches respectively. In terms of detained quantity, electronic appliances, sports equipment, tobacco products and other goods occupy the top three, with 27.9661 million pieces, 11.0748 million pieces and 4.4631 million pieces respectively.

The full text is available here (Chinese only).

Trademark Law is Now Better in The Bahamas

For most people, a mention of The Bahamas brings to mind sun, sand and tropical beverages. However, if you are an IP attorney, thoughts of sun, sand and cocktails may now be replaced by the Bahamian Intellectual Property Office’s (BIPO) recently enacted changes to their Trademark Act. BIPO’s changes to its IP laws were announced February 25, 2025, but were effective retroactively as of February 1st. The good news is that these changes bring Bahamian trademark law closer to those of international standards. The bad news is that, while applications are being accepted and accorded filing dates, it is not clear on when they will be processed or examined.

Some of the changes enacted are significant; namely, BIPO will now recognize the Nice Classification system and will accept service mark applications. Prior to February 1, 2025, trademark applications in The Bahamas were limited to goods. This made it difficult for brand owners in service industries to obtain trademark protection. The only option was to file an application for goods related to the relevant owner’s core services. Certainly, this was not an ideal workaround and left many brand owners without adequate protection. Adopting the Nice Classification system is a huge win for brand owners wishing to file service mark applications in The Bahamas, a jurisdiction highly dependent on services such as tourism and entertainment. The term for a registration will also change from 14 years to 10 years, putting The Bahamas trademark framework in line with the majority of countries worldwide.

Additionally, the new regulations will:

Recognize a claim of priority under the Paris Convention.

Expand protection to collective marks.

Allow applications for color marks, three dimensional marks, sounds, scents, textures and moving images.

Despite the modernization of The Bahamas Trademark Act, a number of questions remain. For example, it is unclear whether BIPO will permit multi-class applications. If not, brand owners will face higher filing costs. It is also unclear as to when new applications will be examined. That said, while processing of your application may be delayed, it is still worth taking advantage of the new laws and getting your applications on file as soon as possible. Lastly, fee structures and regulations surrounding the new changes have not yet been finalized. This is something brand owners will need to consider as they may not be aware of total costs until after an application is filed. For now, applications can be filed using the forms and fees of the prior Act.

Brand owners, especially those engaged in service industries, should consult with their IP counsel to determine whether they would benefit from new filings under the BIPO’s updated trademark laws.

The Serious Fraud Office’s Guidance on How to Best Avoid Prosecution

The United Kingdom’s Serious Fraud Office (SFO) recently published updated guidance on how corporates can best avoid or reduce the risk of prosecution in cases involving economic crimes such as bribery, fraud and corruption (the Guidance). The Guidance builds upon the draft guidance published for consultation last year and updates the earlier 2019 guidance by setting out the SFO’s position on self-reporting and the meaning of “genuine” co-operation by corporates in order to secure “cooperation credit.” For the first time in this updated Guidance, the SFO has set out clearer time frames in responding to a report within 48 hours and making a decision on opening an investigation within six months of the initial report.

Corporation Credit

The Guidance stipulates that corporates who self-report suspected wrongdoing and fully and “genuinely” co-operate with investigators will receive “cooperation credit” allowing them to negotiate and enter into a Deferred Prosecution Agreement (DPA) in lieu of prosecution, subject to exceptional circumstances. These exceptional circumstances include, but are not limited to, a lack of cooperation and inadequate remedial actions, repeat offending, a violation of terms of a previous DPA agreement and where the alleged criminal conduct is so serious that it would be in the public interest to prosecute.

Under the DPAs, prosecutors will agree to suspend legal proceedings in exchange for the company agreeing to conditions such as fines, compensation payments and corporate compliance programmes.

Why Self-Report?

Prior to the publishing of the Guidance, companies who self-reported to the SFO could still run the risk of a criminal conviction if the SFO decided that a DPA was not appropriate. The updated Guidance further encourages and emphasises the necessity of self-reporting as a mark of a reasonable and reflective organisation, with a legitimate expectation that, where possible, this will result in a DPA. A failure to self-report, or a failure to do so promptly within a reasonable time, could impact the SFO’s assessment of co-operation, thereby threatening the eligibility to negotiate a DPA. What amounts to a reasonable time to self-report will depend on the circumstances and is assessed on a case-by-case basis.

Co-operation

Companies that fully and “genuinely” cooperate with SFO investigations will be eligible to be invited to negotiate a DPA. Co-operation during an investigation means providing assistance to the SFO that goes above and beyond what the law requires. This is case-specific but is likely to include behaviour such as providing access to documents (digital and hard copy) likely to be relevant to the investigation, identifying potential witnesses, identifying persons involved in the alleged misconduct and early engagement with the SFO, amongst other things. A non-exhaustive list is set out in the Guidance here. Examples of cooperation include promptly reporting suspected misconduct; preservation of data; providing information to the SFO in a structured, user-friendly manner; identifying potential witnesses; identifying money flows and briefing the SFO on the background to the issue. A corporate which maintains a valid claim of legal professional privilege (LPP) will not be penalised; however, a waiver of LLP will be a significant co-operative act and would help expedite matters. This may be a significant issue where witness accounts have been taken during any internal investigation prior to the self-report.

The Guidance also sets out what the SFO views as unco-operative. This includes seeking to overload the investigation and tactically delaying it by providing an unnecessarily large amount of material or “forum shopping” by unreasonably reporting offending to another jurisdiction for strategic reasons and thereby seeking to exploit differences between international law enforcement agencies or legal systems.

Internal Investigation and Practical Guidelines on Self-Reporting

The SFO has acknowledged that the Guidance does not specify in sufficient detail what level of investigating the corporate should undertake prior to self-reporting. However, the Guidance does set out a series of core principles. The SFO expects the corporate to follow and adhere to the below self-reporting procedures and expectations as soon as the corporate learns of direct evidence indicating corporate offending:

Report directly to the Intelligence Division, which includes a legal team, headed by a senior lawyer, who will manage the initial engagement with the corporate and their legal representatives. The initial contact can be made through a secure reporting form (found here). This reporting form allows the firms or their legal representatives to discuss the reporting process with an Intelligence Division representative before making a portal submission.

The self-report should identify all relevant known facts and preserve all evidence concerning:

The suspected offences;

The individuals involved (both inside and outside the organisation);

The relevant jurisdiction;

The whereabouts of key material and any risk associated with the destruction of said material;

Any previous relevant corporate criminal conduct and how it was remediated; and

If digital material is provided, the corporate should agree with the SFO on the correct digital format for such material to be received.

It is important that corporates present a thorough analysis of any and all compliance programmes and procedures in place at the time of the offending, as well as what remedial action has been taken or planned. Information that may not be available immediately during the time of the initial self-report should be provided as soon as possible thereafter to indicate full cooperation.

Self-reporting through a suspicious activity report to the National Crime Agency or to any other agency (domestic or foreign) does not equate to self-reporting to the SFO unless done so simultaneously or after self-reporting to the SFO.

Clearer Deadlines

The Guidance also makes transparent the SFO’s responsibility when receiving a secure reporting form. In return for self-reporting, a company can expect the Intelligence Division to do the following:

Personally establish contact within 48-hours of the report or other initial contact with the Intelligence Division.

Provide regular updates to the corporate on the status.

Provide a decision as to whether to open an investigation within six months of a self-report.

Conclude the investigation within a reasonably prompt time frame. The length of the investigation will depend on the complexity and level of proactive cooperation.

Conclude DPA negotiations within six months of sending an invite.

Conclusion

This Guidance makes the SFO position clearer: The best way for corporates to avoid prosecution is through prevention, transparency, and accountability by proactively self-reporting misconduct. In return, the SFO has committed to more timely deadlines on the decision to investigate and concluding DPA negotiations, once initiated. That sharpens the timescales involved at the start and the end of the process. But what of the investigation process? The length of any SFO investigation may still take some considerable time to conclude, depending on the complexity involved.

National Computer Virus Center of China Identifies Violations of Cross-border Transfer Requirements

The National Computer Virus Emergency Response Center of China (“NCERT”) recently discovered 2 mobile apps in breach of cross-border transfer requirements in accordance with the Cybersecurity Law, the Personal Information Protection Law, the Method for Determining the Acts of Illegal, the Illegal Collection and Use of Personal Information by Apps, and other relevant laws and regulations of China.

This was the first time that NCERT announced non-compliance activities related to cross-border transfers of personal information. The non-compliance included the failure to inform relevant data subjects of the contact information of the overseas recipient, the purposes and means of processing by the overseas recipient, the types of personal information transferred to the overseas recipient, and the methods and procedures the data subjects may use to exercise their rights against the overseas recipients, and the failure to obtain separate consent.

Re-evaluation of Acesulfame K (E 950) as Food Additive

Currently, acesulfame K (E 950) is an authorized food additive in the European Union (EU) in 34 food categories with maximum permitted levels ranging from 25 to 2500 mg/kg in 31 foods categories and at quantum satis in 3 food categories of table-top sweeteners.

In its updated scientific assessment, the European Food Safety Authority (EFSA) established an acceptable daily intake (ADI) of 15 mg/kg bw per day based on a no observed adverse effect level (NOAEL) of 1500 mg/kg bw per day and applying an uncertainty factor of 100. This is an interesting outcome on the part of the Authority, as the previously established ADI was much lower (9 mg/kg bw/day, according to the scientific evaluation of the Scientific Committee on Food, EFSA’s predecessor body in the EU, in 2000), but it is unlikely that the European Commission will increase the maximum permitted levels in those 31 food categories.

Furthermore, the EFSA Panel recommends the European Commission to amend the specifications of E 950 in Commission Regulation (EU) No. 231/2012 (the Food Additive Specifications Regulation) by

Including the CAS number 55589- 62-3;

Inserting a maximum limit of 0.1 mg/kg for 5-chloro-acesulfame (unless appropriate genotoxicity data for 5-chloro-acesulfame are provided to the Authority);

Inserting a maximum limit of 1 mg/kg for acetylacetamide; and

Lowering the limit of lead and mercury.

On the other hand, no specifications for microbiological criteria are needed according to the Authority.

For more details, see EFSA Panel on Food Additives and Flavourings, 2025. Re-evaluation of acesulfame K (E 950) as food additive. EFSA Journal, 23(4), e9317. https://doi.org/10.2903/j.efsa.2025.9317

UK Cryptoassets: Draft Legislation and FCA Discussion Paper Published

On 29 April, UK Chancellor Rachel Reeves announced the publication by HM Treasury of near-final legislation to bring cryptoassets within the scope of the UK’s regulatory perimeter. Shortly after, on 2 May, the UK Financial Conduct Authority (FCA) also published a discussion paper (DP25/1) seeking views on its approach to regulating cryptoasset trading platforms, intermediaries, cryptoasset lending and borrowing, staking, decentralised finance (DeFi), and the use of credit to purchase cryptoassets.

The draft legislation, titled the Financial Services and Markets Act 2000 (Regulated Activities and Miscellaneous Provisions) (Cryptoassets) Order 2025 (the Cryptoassets Order), and DP25/1 follow, and are closely aligned with, HM Treasury’s consultation and subsequent response on the future financial services regulatory framework for cryptoassets in the UK, which were each published in 2023.

The Cryptoassets Order

The Cryptoassets Order has been published in draft form to allow stakeholders to make technical comments. HM Treasury has stated, however, that the policy behind the Cryptoassets Order is settled and will not change.

The Cryptoassets Order amends a number of pieces of existing legislation to bring certain activities relating to cryptoassets within the UK’s regulatory perimeter. More specifically, and among other things, the Cryptoassets Order:

amends the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (the RAO) to include new specified activities and specified investments relating to cryptoassets. Any person undertaking such activities in the UK will, therefore, need to be authorised by the FCA or benefit from an exemption to carry on such activities. Such specified activities include:

issuing qualifying stablecoins in the UK;

safeguarding (custody) of qualifying cryptoassets;

operating a qualifying cryptoasset trading platform;

dealing in qualifying cryptoassets as principal, which is intended to include lending and borrowing services;

dealing in qualifying cryptoassets as an agent;

arranging deals in qualifying cryptoassets, which is intended to include operating a cryptoasset lending platform; and

making arrangements for qualifying cryptoasset staking;

amends the Financial Services and Markets Act 2000 (FSMA), in particular to establish the geographic perimeter for the new regulated activities. The geographical scope of the new regulated activities can vary depending on the specific activity, but generally, firms providing any such services to UK retail customers will need to be authorised in the UK;

amends the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 to ensure alignment with the updated FSMA regulatory framework and the RAO; and

amends the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (the MLRs) to reflect the new regulatory perimeter. Notably, firms authorised by the FCA for the new cryptoasset activities will not be required to additionally register as “cryptoasset exchange providers” or “custodian wallet providers” under the MLRs, but will still be subject to the non-registration requirements thereunder.

The Cryptoassets Order also provides for a transitional period, to be determined by the FCA, during which firms can apply to the FCA for authorisation to conduct the new regulated activities (or to apply for a variation of permission, if the firm is already FCA authorised to undertake non-cryptoasset activities).

DP25/1

DP25/1 seeks views on how the FCA should regulate the following entities and activities, and sets out key policy proposals in relation to each:

Cryptoasset trading platforms. These are entities that will be authorised to operate a qualifying cryptoasset trading platform pursuant to the Cryptoassets Order;

Intermediaries. This includes entities that will be authorised to deal in qualifying cryptoassets as principal, deal in qualifying cryptoassets as agent and/or arrange deals in qualifying cryptoassets;

Cryptoasset lending and cryptoasset borrowing. This includes operating a cryptoasset lending platform, which, while not itself a specific regulated activity, will be covered by the other new regulated activities, including arranging deals in qualifying cryptoassets;

Restricting the use of credit to buy cryptoassets. The FCA is exploring whether to restrict firms from accepting credit as a means for consumers to buy cryptoassets. However, the FCA expects that qualifying stablecoins issued by an FCA-authorised stablecoin issuer will not be subject to such restrictions;

Staking. The FCA aims to address technological, customer understanding and safeguarding risks related to staking; and

DeFi. DeFi activities are not covered by the new Cryptoasset Order regime where they are truly decentralised. However, when DeFi involves the proposed regulated activities, and where there is a clear controlling person(s) carrying on an activity, then such activities will be covered. The FCA provides the example of services involving an identifiable intermediary or entity controlling business operations and product features.

Next Steps

Technical comments on the Cryptoassets Order can be submitted to HM Treasury until 23 May 2025. HM Treasury intends to legislate for the new cryptoassets regulatory regime by the end of the year, subject to Parliamentary time allowing.

Feedback on DP25/1 has been requested by 13 June 2025. If any proposals in DP25/1 are adopted as part of the FCA’s final rules, the FCA will consult on them.

The Cryptoassets Order and DP25/1 are available here and here, respectively.

More information on HM Treasury’s 2023 consultation and response is available here.

U.S. Trade Representative Releases 2025 Special 301 Report – China Failed to Implement or Only Partially Implemented IP Commitments Under the Phase One Agreement

On April 29, 2025, the United States Trade Representative (USTR) released the 2025 Special 301 Report on Intellectual Property Protection and Enforcement, of which 10 pages focus on China. The USTR stated, “serious concerns remain regarding long-standing issues like technology transfer, trade secrets, counterfeiting, online piracy, copyright law, patent and related policies, bad faith trademarks, and geographical indications. China has failed to implement or only partially implemented a number of its commitments on intellectual property under the United States-China Economic and Trade Agreement (Phase One Agreement), and the United States will continue to monitor closely China’s implementation.” Accordingly, China remains on the priority watchlist alongside Argentina, Chile, India, Indonesia, Mexico, Russia and Venezuela.

Excerpts from the Report follow. The full Report is available here (English only).

Technology Transfer

As part of the Phase One Agreement, China agreed to provide effective access to Chinese markets without requiring or pressuring U.S. persons to transfer their technology to Chinese persons. China also agreed that any transfer or licensing of technology by U.S. persons to Chinese persons must be based on market terms that are voluntary and mutually agreed, and that China would not support or direct the outbound foreign direct investment activities of its persons aimed at acquiring foreign technology with respect to sectors and industries targeted by its industrial plans that create distortion. In addition, China committed to ensuring that any enforcement of laws and regulations with respect to U.S. persons is impartial, fair, transparent, and non-discriminatory. USTR continues to work with stakeholders to evaluate whether these commitments have resulted in changes in China’s ongoing conduct at the national, provincial, and local levels.

Trade Secrets

Stakeholders report that the Chinese judicial system’s enforcement of trade secret protections continues to be weak, and implementation of the amended Criminal Law remains incomplete. In January 2023, the Supreme People’s Court (SPC) and Supreme People’s Procuratorate (SPP) issued for public comment a draft Interpretation of Several Issues Concerning the Application of Laws for Handling Criminal Cases of Infringement upon Intellectual Property Rights, which would define key terms in the amended Criminal Law. However, further changes are needed to implement a new threshold for triggering criminal investigations and prosecutions in the draft Interpretation and to update a related standard issued by the SPC and Ministry of Public Security. Although China proposed a new amendment to the Anti-Unfair Competition Law in December 2024 that would increase the minimum administrative fine for trade secret misappropriation under “serious circumstances,” such a change is no substitute for strengthening criminal enforcement of trade secrets. Moreover, stakeholders continue to identify significant enforcement challenges, including high evidentiary burdens, limited discovery, difficulties meeting stringent conditions to enforce agreements related to protection of trade secrets and confidential business information against theft, and difficulties in obtaining deterrent-level damages awards.

China needs to address concerns regarding the risk of unauthorized disclosures of trade secrets and confidential business information by government personnel and third-party experts, which continue to be a serious concern for the United States and U.S. stakeholders in industries such as software, manufacturing, and cosmetics. The draft Guiding Opinions on Strengthening the Protection of Trade Secrets and Confidential Business Information in Administrative Licensing was published for public comment in August 2020 by the Ministry of Justice but has not been finalized. U.S. stakeholders continue to express concerns about the potential for discriminatory treatment and unauthorized disclosure of their information by local authorities under the proposed expansion of administrative trade secret enforcement, for which the State Administration of Market Regulation (SAMR) issued draft rules in 2020 that have not been finalized.

Counterfeiting

China continues to be the world’s leading source of counterfeit and pirated goods. For example, a 2022 report identified China and Hong Kong as the largest exporters of counterfeit foodstuffs and cosmetics, accounting for approximately 60% of counterfeit foodstuffs customs seizures and 83% of counterfeit cosmetics customs seizures. China and Hong Kong, together, accounted for over 93% of the value measured by manufacturers’ suggested retail price of counterfeit and pirated goods seized by U.S. Customs and Border Protection in Fiscal Year 2024. Counterfeiting activities have increased as economic conditions have declined within China. The failure to curb the widespread manufacture, domestic sale, and export of counterfeit goods affects not only right holders but also the health and safety of consumers. The production, distribution, and sale of counterfeit medicines, fertilizers, and pesticides, as well as under-regulated pharmaceutical ingredients, remain widespread in China.

China’s e-commerce markets, the largest in the world, remain a source of widespread counterfeits as infringing sales have migrated from physical to online markets. Right holders also raise concerns about the proliferation of counterfeit sales facilitated by the confluence of e-commerce platforms and social media in China. This trend is now well-established as the popularity of ecommerce has led many sellers to maintain both a physical and online presence, or to shift to online platforms entirely, which offer short-form video, live stream, and e-commerce functionalities that allow sellers of counterfeit goods to evade detection. Right holders continue to report difficulties in receiving information and support from platforms in investigations to uncover the manufacturing and distribution channels of counterfeit goods and sellers, as well as onerous evidentiary requirements and excessive delays in takedowns. Counterfeiters continue to exploit the use of small parcels and minimal warehouse inventories, the separation of counterfeit labels and packaging from products prior to the final sale, and the high volume of packages shipped to the United States to escape enforcement and to minimize the deterrent effect of enforcement activities.

Widespread online piracy also remains a major concern, including in the form of “mini Video on Demand (VOD)” facilities that screen unauthorized audiovisual content, illicit streaming devices (ISDs), and unauthorized copies of or access codes to scientific journal articles and academic texts. As a leading source and exporter of systems that facilitate copyright piracy, China should take sustained action against websites and online platforms containing or facilitating access to unlicensed content, ISDs, and piracy apps that facilitate access to such websites.

There was no progress in 2024 on finalizing amendments to the E-Commerce Law, which were issued by SAMR for public comment in August 2021. The draft amendments to the E-Commerce Law include changes that would extend the deadline for right holders to respond to a counternotification of non-infringement, and impose penalties for fraudulent counter-notifications and penalties that restrict the business activities of platforms for serious circumstances of infringement. Although noting improvements under the draft amendments, right holders have raised concerns about the failure to codify the elimination of liability for erroneous notices submitted in good faith, as well as proposed changes that would allow reinstatement of listings upon posting a guarantee.

Copyright

Right holders continue to highlight the need for effective implementation and clarification of criminal liability for the manufacture, distribution, and exportation of circumvention devices, as well as new measures to address online piracy. Right holders also report continuing uncertainty about whether amendments to the Copyright Law in 2021 protect sports and other live broadcasts, and recommend clarification in the copyright regulations. While right holders welcomed some effective, but limited, enforcement actions, such as the annual Sword-Net Special Campaign that targeted online piracy of copyrighted content, they encourage China to develop these periodic campaigns into sustained, long-term enforcement measures.

Patents

Right holders raised concerns that, although the Patent Law allows the filing of supplemental data to support disclosure and patentability requirements, the rules for accepting post-filing data are opaque and patent examiners have applied an overly stringent standard to reject such data. In addition, the China National Intellectual Property Administration’s (CNIPA) administrative Patent Reexamination and Invalidation Department and Chinese courts reportedly reject supplemental data based on unduly stringent requirements for acceptance of such data, resulting in potentially improper invalidity decisions. Such decisions can also lead to automatic dismissal of parallel patent infringement proceedings in China’s courts.

Following the implementation of a mechanism for the early resolution of potential pharmaceutical patent disputes in 2021, right holders have expressed concerns about the lack of transparency in decisions issued by CNIPA, the cumbersome registration system, and the lack of any penalties for erroneous patent statements. Right holders continue to raise concerns that they had identified prior to implementation, such as regarding the scope of patents and pharmaceuticals covered by the mechanism, the lack of clarity about what could trigger a dispute under the mechanism, potential difficulties in obtaining preliminary injunctions, the length of the stay period, and the possibility of bias in favor of Chinese companies.

The issuance of anti-suit injunctions by Chinese courts in standard essential patent (SEP) disputes has not occurred in recent years, but the issue continues to raise due process and transparency concerns for right holders, including regarding how such rulings may favor domestic companies over foreign patent holders. High-level political and judicial authorities in China have called for extending the jurisdiction of China’s courts over global IP litigation and have cited the issuance of an anti-suit injunction as an example of the court “serving” the “overall work” of the Chinese Communist Party and the Chinese State. Moreover, Chinese courts appear increasingly interested in exercising jurisdiction in cases involving SEPs, raising concerns that China seeks to establish itself as the forum for SEP litigation in order to favor domestic companies.

The National People’s Congress passed amendments to the Anti-Monopoly Law (AML), which entered into effect in August 2022. Right holders have raised concerns about the implementation of the amended AML, particularly regarding the draft implementing rules that define anticompetitive behavior in the development of standards and the licensing and implementation of SEPs. Right holders stated concerns that AML enforcement can be misused for the purpose of depressing the value of foreign-owned IP in key technologies, including by finding violations of the law with respect to the licensing of patents without actual harm to competition or the competitive process.

It is critical that China’s AML enforcement be fair, transparent, and non-discriminatory; afford due process to parties; focus on whether there is harm to competition or the competitive process, consistent with the legitimate goals of competition law; and implement appropriate competition remedies to address the competitive harms. China should not use competition law to advance noncompetition goals.

Trademarks

Stakeholders welcomed the publication of draft amendments to the Trademark Law in January 2023, which contain provisions relating to bad faith trademarks. However, the draft amendments remain pending. The State Council’s 2024 Legislative Work Plan included the draft amendments to the Trademark Law, but the release date of an updated draft is still unknown. In 2023 and 2024, China sought to address some concerns regarding bad faith trademark applications, including by issuing a measure intended to provide more consistent and predictable application examination results, by providing a non-use ground for cancellation of a collective or certification mark in another measure, and by establishing goals for combating bad faith trademark registrations.

Despite these developments, bad faith trademarks remain one of the most significant challenges for U.S. brand owners in China. The United States continues to urge China to take further steps to address concerns.

In 2024, stakeholders continued to raise concerns regarding reforms that appear primarily focused on increasing the speed rather than quality of trademark examinations. While CNIPA continues to tout downward trends in the average period for obtaining a trademark from the date of application to registration (currently less than 7 months), and the average time for appeals of trademark oppositions and rejections has been cut to 11 months and 5.5 months, respectively, stakeholders continue to indicate that the quality of trademark examination is inconsistent across the board.

Developments

In 2024, the National People’s Congress (NPC) and its Standing Committee issued no new or amended legislation directly addressing IP. Despite some positive reports from right holders of courts issuing higher damage awards for IP infringement, insufficient damage awards are still a concern. China has yet to address right holder concerns with respect to preliminary injunctive relief, evidence production, evidentiary requirements, establishment of actual damages, burdensome thresholds for criminal enforcement, and lack of deterrent-level damages and penalties.

Right holders continue to raise concerns about their ability to meet consularization and notarization requirements for documents submitted to the Beijing Intellectual Property Court and in other IP related proceedings. As a positive step, the Convention of 5 October 1961 Abolishing the Requirement of Legalisation for Foreign Public Documents (Apostille Convention) entered into force with respect to China in November 2023. However, right holders continue to report inconsistent implementation, including instances where Chinese courts still required burdensome legalization procedures for certain court documents, hampering the efficacy of civil litigation to resolve IP disputes.

The decrease in transparency and the potential for political intervention with the judicial system, as well as the emphasis on administrative enforcement in China, remain as critical concerns. Adding to these concerns, in March 2025, the State Council of China issued the Provisions on the Handling of Foreign-Related Intellectual Property Disputes, a troubling new measure that seemingly legitimizes political intervention in IP disputes. This new measure authorizes Chinese government agencies to take countermeasures against and impose restrictions on foreign entities that “use intellectual property disputes as an excuse to contain and suppress China” and also to “take discriminatory restrictive measures against Chinese citizens or organizations.” The new measure further prohibits any organization or individual from implementing or assisting in implementing foreign IP enforcement actions deemed “discriminatory restrictive measures,” or else be liable for civil damages.

A long-standing concern has been that Chinese courts publish only selected decisions rather than all preliminary injunctions and final decisions. Moreover, the number of verdicts uploaded online has consistently decreased over the past few years, further hampering transparency and making it more difficult for right holders to determine how China protects and enforces foreign IP. In January 2024, the SPC admitted to the decrease in case publications and announced the launch of a National Court Judgments Database. Initial details shared in December 2023 indicated the database would not be available to the public, and the SPC has yet to clarify the extent to which case decisions will be accessible to the general public or foreign firms. Additional concerns include interventions in judicial proceedings by local government officials, party officials, and powerful local interests that undermine the authority of China’s judiciary and rule of law. In January 2024, amendments to the Civil Procedure Law entered into effect that expanded the jurisdiction of Chinese courts in cases involving foreign parties. A judiciary truly independent from the Communist Party of China is critical to promote rule of law in China and to protect and enforce IP rights. Right holders also expressed concerns about the increased emphasis on administrative enforcement, as authorities often fail to provide right holders with information regarding the process or results of enforcement actions. The transfer of administrative IP cases for criminal enforcement remains uneven, as administrative authorities may be reluctant to transfer cases where they can collect large fines and criminal enforcement authorities reportedly lack the budget for warehousing counterfeits and investigations.

China Releases Regulations on the Protection of New Plant Varieties

On May 1, 2025, China’s State Council released the Regulations on the Protection of New Plant Varieties (中华人民共和国植物新品种保护条例). Major changes in the Regulations include extending the term of variety rights for woody and vine plants from 20 years to 25 years and for other plants from 15 years to 20 years. Further, preliminary examination should be reduced from 6 months to 3 months. China has been emphasizing new plant varieties infringement this year with these Regulations, a 53 million RMB verdict in a new plant varieties infringement case, and the Supreme People’s Court release of a batch of typical cases of seed IP protection. The Regulations come into force on June 1, 2025.

The full text is available here (Chinese only). A translation follows:

Chapter I General Provisions

Article 1 These Regulations are formulated in accordance with the Seed Law of the People’s Republic of China in order to protect the rights of new plant varieties, encourage the cultivation and popularization of new plant varieties, and promote the development of agriculture, forestry and grassland.

Article 2 The new plant varieties referred to in these Regulations refer to plant varieties that have been artificially bred or improved from discovered wild plants and have novelty, specificity, consistency, stability and appropriate naming.

Article 3 The protection of new plant varieties should adhere to the leadership of the Communist Party of China, implement the party and state’s strategic deployment of intellectual property rights, promote breeding innovation, and promote high-quality development of the seed industry.

Article 4 The competent departments of agriculture and rural affairs, and forestry and grassland under the State Council shall be responsible for the protection of new plant varieties nationwide in accordance with the division of responsibilities, accept and examine applications for new plant variety rights, and grant new plant variety rights (hereinafter referred to as variety rights) to new plant varieties that comply with the provisions of these Regulations; improve the testing system for new plant varieties, improve the preservation and management of propagation materials, and strengthen publicity and training on the protection of new plant varieties and related technical research.

The agricultural, rural affairs, forestry and grassland authorities of local people’s governments at or above the county level are responsible for the protection of new plant varieties within their administrative regions in accordance with their respective duties.

Article 5 Entities and individuals who have made outstanding contributions to the breeding and promotion of new plant varieties shall be commended and rewarded in accordance with relevant national regulations.

Article 6 The production, operation and promotion of new plant varieties granted variety rights (hereinafter referred to as authorized varieties) shall comply with the provisions of relevant laws and regulations on seed management.

Chapter II Content and Ownership of Variety Rights

Article 7 The owner of a variety right (hereinafter referred to as the variety right holder) shall have exclusive rights to the authorized variety. Unless otherwise provided by law or these Regulations, no unit or individual may, without the permission of the variety right holder, conduct the following acts on the propagation materials of the authorized variety:

(1) production, propagation and processing for propagation;

(2) Promise to sell, or sell;

(3) Import and export;

(4) Storage for the purpose of carrying out the acts specified in Items 1 to 3 of this paragraph.

Where the conduct provided for in the preceding paragraph involves harvested materials obtained from the unauthorized use of propagation materials of authorized varieties, the permission of the variety right holder shall be obtained; however, this shall not apply where the variety right holder has had a reasonable opportunity to exercise his rights with respect to the propagation materials.

The acts prescribed in the first and second paragraphs for the following varieties shall be subject to the permission of the owner of the variety right of the authorized variety:

(1) a substantially derived variety of an authorized variety, but the authorized variety itself is not a substantially derived variety;

(2) a variety that, compared with the authorized variety, does not have the obvious distinction provided for in Article 16 of these Regulations;

(3) another variety produced or propagated using the authorized variety for commercial purposes.

Article 8 The State shall implement the substantially derived variety system in steps. The competent departments of agriculture and rural affairs and forestry and grassland under the State Council shall determine the specific scope of implementation in the form of a catalogue, which shall be announced and implemented after approval by the State Council.

Substantially derived varieties are mainly determined based on the results of molecular testing and phenotypic testing, and when necessary, comprehensive consideration is given to factors such as breeding methods, breeding process, and genetic relationships. The competent departments of agriculture, rural areas, forestry, and grasslands under the State Council shall formulate guidelines for the determination of substantially derived varieties, determine the scope of application, detection and testing methods, determination thresholds, technical processes, etc., and clarify the conditions that detection and testing institutions should have.

The agricultural and rural affairs and forestry and grassland authorities of the State Council have established an expert center consisting of experts in breeding, inspection, testing, management and law to provide professional support for the implementation of the substantive derived variety system.

Article 9: For work-related breeding completed in the execution of the unit’s tasks or mainly using the unit’s material and technical conditions, the right to apply for variety rights belongs to the unit; for non-work-related breeding, the right to apply for variety rights belongs to the individual who completed the breeding. For breeding completed using the unit’s material and technical conditions, if the unit and the individual who completed the breeding have a contractual agreement on the right to apply for variety rights, the agreement shall prevail.

In case of entrusted breeding or cooperative breeding, the parties may agree in the contract on the ownership of the application right for the variety right. If there is no contractual agreement, the application right for the variety right belongs to the entity or individual that is entrusted to complete or jointly completes the breeding.

Once the application is approved, the variety right belongs to the applicant.

Article 10: A new plant variety can only be granted one variety right. If two or more applicants apply for a variety right for the same new plant variety, the variety right shall be granted to the person who first applied; if they apply at the same time, the variety right shall be granted to the person who first completes the breeding of the new plant variety.

Article 11 The right to apply for a variety right and the variety right may be transferred in accordance with the law.

If a Chinese unit or individual transfers the application right or variety right of a new plant variety cultivated within the country to a foreigner, foreign enterprise or other foreign organization, it must be approved by the agricultural, rural affairs, forestry and grassland authorities of the State Council.

Where an application right or variety right is transferred, the parties shall enter into a written contract and register with the competent departments of agriculture, rural affairs, forestry and grassland under the State Council, which shall make an announcement. The transfer shall take effect from the date of registration.

If a variety right is pledged, the pledger and the pledgee shall jointly apply for pledge registration with the agricultural and rural affairs, forestry and grassland authorities of the State Council, which shall make an announcement.

Article 12 Where an authorized variety is used under the following circumstances, the permission of the variety right holder may be omitted and no royalties shall be paid to the holder, provided that other rights enjoyed by the variety right holder in accordance with these Regulations and relevant laws and administrative regulations shall not be infringed:

(1) Using the authorized varieties for breeding and other scientific research activities;

(2) Propagation materials of authorized varieties propagated by farmers for their own use.

Article 13 In the interests of the state or the public interest, the competent departments of agriculture, rural affairs, forestry and grassland of the State Council may make a decision to implement compulsory licensing of variety rights, and register and announce it.

The entity or individual that obtains the compulsory license shall pay a reasonable usage fee to the variety right holder, the amount of which shall be agreed upon by both parties; if the two parties cannot reach an agreement, the competent departments of agriculture, rural affairs, forestry and grassland of the State Council shall make a ruling.

If the variety right holder is dissatisfied with the decision on compulsory licensing, or if the variety right holder and the entity or individual that has obtained the compulsory license are dissatisfied with the ruling on the compulsory licensing fee, they may bring a lawsuit in accordance with the law.

The entity or individual that obtains a compulsory license does not enjoy exclusive implementation rights and does not have the right to allow others to implement it.

Chapter III Conditions for Granting Variety Rights

Article 14 The new plant variety for which a variety right is applied for shall belong to the genus or species of plants listed in the national plant variety protection list. The plant variety protection list shall be determined and announced by the agricultural and rural affairs, forestry and grassland authorities of the State Council.

Variety rights will not be granted to new plant varieties that violate the law and endanger the public interest or the ecological environment.

Article 15 New plant varieties granted variety rights shall be novel. Novelty means that the propagation materials and harvested materials of the new plant varieties for which variety rights are applied have not been sold or promoted before the date of application, or the propagation materials and harvested materials of the new plant varieties for which variety rights are applied have not been sold or promoted by the applicant on his own or with his consent for more than one year in China; outside China, for woody and vine varieties, it has not been more than six years, and for other plant varieties, it has not been more than four years.

For plant genus or species newly included in the list of protected plant varieties after the implementation of the Seed Law of the People’s Republic of China on January 1 , 2016 , if an application for variety rights is filed within one year from the date of publication of the list, and the propagation materials and harvested materials of the variety have not been sold or promoted in China for more than four years before the application date, they shall be novel.

In addition to the loss of novelty in sales and promotion activities, the following circumstances are deemed to have lost novelty:

(1) The variety has been confirmed by the competent departments of agriculture, rural affairs, forestry and grassland of the people’s government of the province, autonomous region or municipality directly under the central government to have actually spread based on the sowing area;

(2) The crop variety has been approved or registered for more than 2 years but no application for a new plant variety right has been made.

Article 16 A new plant variety granted a variety right shall have specificity. Specificity means that a plant variety has one or more traits that are clearly different from known varieties.

Article 17 New plant varieties granted variety rights shall be consistent. Consistency refers to the characteristics of a plant variety, which, apart from predictable natural variations, have consistent performance of related features or characteristics among individuals within a population.

Article 18 A new plant variety granted a variety right shall be stable. Stability means that the main characteristics of a plant variety remain unchanged after repeated reproduction or at the end of a specific reproduction cycle.

Article 19 A new plant variety granted a variety right shall have an appropriate name that is distinguishable from the names of known varieties of the same or similar plant genus or species. The name shall be the common name of the new plant variety after authorization. Regardless of whether the protection period of the authorized variety has expired, the authorized name shall be used for the sale and promotion of the authorized variety.

The following names shall not be used for variety naming:

(1) Expressed only in numbers;

(2) Violating social ethics;

(3) being likely to cause misunderstanding as to the characteristics, properties or identity of the breeder of a new plant variety;

(4) Infringement of the prior rights of others;

(5) Other circumstances prohibited by laws, administrative regulations or national provisions.

The same plant variety can only use the same name when applying for new variety protection and variety approval, variety registration, sales and promotion.

Chapter IV Application and Acceptance of Variety Rights

Article 20: Chinese entities or individuals applying for variety rights may submit their applications directly or through an agency to the competent departments of agriculture, rural affairs, forestry and grasslands of the State Council.

If a new plant variety for which a Chinese entity or individual applies for a variety right involves national security or major interests and needs to be kept confidential, it should be handled in accordance with relevant national regulations.

Article 21 Where foreigners, foreign enterprises or other foreign organizations apply for variety rights in China, they shall do so in accordance with the agreement signed between their country and the People’s Republic of China or the international treaty to which both countries are parties, or in accordance with these Regulations based on the principle of reciprocity.

Foreigners, foreign enterprises or other foreign organizations that do not have a permanent residence or place of business in China and who apply for variety rights to the competent departments of agriculture, rural affairs, forestry and grassland of the State Council shall entrust an agency established in China in accordance with the law to handle the application.

Article 22: Applicants for variety rights shall submit application documents that comply with the prescribed format requirements to the competent departments of agriculture, rural affairs, forestry and grasslands under the State Council.

Application documents should be written in Chinese.

Article 23 The application date is the date on which the competent departments for agriculture, rural affairs, forestry and grasslands of the State Council receive the application documents for variety rights. If the application documents are sent by mail, the application date is the date of the postmark.

Article 24 If an applicant files a variety right application in China for a new plant variety within 12 months from the date of the first filing of a variety right application in a foreign country, he or she may enjoy priority in accordance with the agreement concluded between that foreign country and the People’s Republic of China or the international treaty to which both countries are parties, or based on the principle of mutual recognition of priority.

If an applicant claims priority, he or she shall make a written statement at the time of application and, within three months, submit a copy of the first application document for variety rights submitted and confirmed by the original accepting authority; if an applicant fails to make a written statement or submit a copy of the application document in accordance with the provisions of these Regulations, it shall be deemed that no priority is claimed.

Article 25 The agricultural and rural affairs, forestry and grassland authorities of the State Council shall accept applications for variety rights that comply with the provisions of Article 22 of these Regulations, specify the application date, assign an application number, and notify the applicant to pay the application fee within one month from the date of receipt of the application.

The competent departments of agriculture, rural affairs, forestry and grassland under the State Council will not accept applications for variety rights that do not comply with, or still do not comply with, the provisions of Article 22 of these Regulations after modification, and will notify the applicant.

Article 26 An applicant may modify or withdraw the application for a variety right before the right is granted.

Article 27 Any unit or individual that applies for a variety right abroad for a new plant variety cultivated in China shall register with the competent departments of agriculture, rural affairs, forestry and grassland of the State Council; if it provides propagation materials abroad, it shall comply with the provisions of the Seed Law of the People’s Republic of China on the provision of germplasm resources abroad.

Chapter V Examination and Approval of Variety Rights

Article 28 After the applicant pays the application fee, the competent departments of agriculture and rural affairs and forestry and grassland under the State Council shall conduct a preliminary review of the following contents of the variety right application:

(1) Whether the plant belongs to the plant genus or species listed in the list of protected plant varieties;

(2) Whether it complies with the provisions of Article 21 of these Regulations ;

(3) whether the requirements on novelty are met;

(iv) Whether the naming of the new plant variety is appropriate.

Article 29 The competent departments of agriculture, rural affairs, forestry and grassland under the State Council shall complete the preliminary examination within 3 months from the date of accepting the application for variety right; if the situation is complicated, the period may be extended by 3 months. The competent departments of agriculture, rural affairs, forestry and grassland under the State Council shall announce the application for variety right that has passed the preliminary examination and notify the applicant to pay the examination fee within 3 months.

For applications for variety rights that fail to meet the preliminary review requirements, the State Council’s agricultural and rural affairs and forestry and grassland authorities shall notify the applicant to state their opinions or make corrections within three months. If no response is given within the time limit, the application for variety rights shall be deemed withdrawn; if the application is still unqualified after correction, the application shall be rejected.

Article 30 After the applicant pays the examination fee in accordance with the regulations, the competent departments of agriculture, rural affairs, forestry and grassland of the State Council shall conduct a substantive examination of the specificity, consistency and stability of the application for variety rights.

If the applicant fails to pay the examination fee as required, the variety right application will be deemed withdrawn.

Article 31 The competent departments of agriculture, rural affairs, forestry and grassland under the State Council shall conduct substantive examination mainly based on application documents and other relevant written materials. When the competent departments of agriculture, rural affairs, forestry and grassland under the State Council deem it necessary, they may entrust designated testing institutions to conduct tests or examine the results of completed planting or other experiments.

For review purposes, the applicant shall provide necessary information and breeding materials of the new plant variety in accordance with the requirements of the agricultural, rural, forestry and grassland authorities of the State Council.

Article 32 For applications for variety rights that have been substantively examined and comply with the provisions of these Regulations, the competent departments for agriculture, rural affairs, forestry and grasslands under the State Council shall make a decision to grant the variety right, issue a variety right certificate, and register and announce it. The variety right shall take effect from the date of the authorization announcement.

The competent departments of agriculture, rural affairs, forestry and grassland under the State Council shall reject any application for variety rights that does not comply with the provisions of these Regulations after substantive examination and notify the applicant.

Article 33 The competent departments of agriculture, rural affairs, forestry and grassland under the State Council shall establish a New Plant Variety Review Committee (hereinafter referred to as the Review Committee).

If the applicant is dissatisfied with the decision to reject the application for variety rights, he or she may request a review from the Review Committee within three months from the date of receipt of the notice. If the request for review complies with the regulations, the Review Committee shall make a decision within six months from the date of receipt and notify the applicant. If testing, testing and appraisal are required according to law, the time required shall not be counted within the prescribed period.

If the applicant is dissatisfied with the review decision of the Review Committee, he or she may bring a lawsuit in accordance with the law.

The specific provisions for the review shall be formulated by the competent departments of agriculture, rural affairs, forestry and grassland of the State Council.

Article 34 After a variety right is granted, if any unit or individual violates the provisions of Article 7 of these Regulations during the period from the date of the announcement of the preliminary examination result to the date of grant of the variety right , the variety right holder shall have the right to seek compensation.

Chapter VI Duration, Termination and Invalidity of Variety Rights

Article 35 The term of protection of a variety right is 25 years for woody and vine plants and 20 years for other plants, commencing from the date of announcement of the grant of the right.

Article 36 The holder of a variety right shall pay an annual fee starting from the year in which the variety right is granted, and shall provide breeding materials of the authorized variety for inspection and testing in accordance with the requirements of the agricultural and rural affairs and forestry and grassland authorities of the State Council.

Article 37 A variety right shall terminate before the expiration of its protection period in any of the following circumstances:

(1) The holder of the plant variety right renounces the plant variety right in a written statement;

(2) The holder of the variety right fails to pay the annual fee in accordance with the regulations;

(3) the holder of the variety right fails to provide the propagation materials of the authorized variety required for inspection and testing in accordance with the requirements of the competent departments for agriculture, rural affairs, forestry and grassland under the State Council;

(4) after examination and testing the authorized variety no longer conforms to the characteristics and properties for which the variety right was granted.

The termination of a variety right shall be registered and announced by the competent departments of agriculture, rural affairs, forestry and grassland of the State Council.

Article 38 From the date of announcement of the grant of variety rights, the Review Committee may, based on its authority or based on the written request of any unit or individual, declare the variety rights invalid if they do not comply with the provisions of Articles 15 to 18 of these Regulations; if they do not comply with the provisions of Article 19 of these Regulations, order them to change their names, and if they refuse to change their names, declare the variety rights invalid. The decision to declare the variety rights invalid or to change their names shall be registered and announced by the competent departments of agriculture and rural affairs, forestry and grasslands of the State Council, and the Review Committee shall notify the parties concerned.

If a party is dissatisfied with the invalidation decision of the Review Committee, he or she may bring a lawsuit in accordance with the law.

Article 39 A variety right that has been declared invalid shall be deemed to have never existed.

The decision to declare a variety right invalid shall not have retroactive effect on the judgments and mediation documents on plant variety infringements made and executed by the people’s court before the declaration, the decisions on plant variety infringements made and executed by the agricultural, rural, forestry and grassland authorities of the people’s government at or above the county level, and the variety right implementation license contracts and variety right transfer contracts that have been performed. However, if the variety right holder causes losses to others due to malicious intent, reasonable compensation shall be given.

If the compensation for infringement of new plant varieties, the fee for the use of variety rights, and the fee for the transfer of variety rights are not returned in accordance with the provisions of the preceding paragraph, which is a clear violation of the principle of fairness, they shall be returned in full or in part.

Article 40 If a party loses its rights due to force majeure due to delay in meeting the time limit prescribed in these Regulations or the time limit designated by the competent departments of agriculture, rural affairs, forestry and grassland of the State Council, it may, within 2 months from the date on which the obstacle is removed and within 2 years from the date on which the time limit expires , explain the reasons to the competent departments of agriculture, rural affairs, forestry and grassland of the State Council and request the restoration of its rights together with relevant supporting documents.

If a party loses its rights due to delay in the time limit prescribed in these Regulations or the time limit specified by the competent departments of agriculture, rural affairs, forestry and grassland of the State Council due to other legitimate reasons, it may state the reasons to the competent departments of agriculture, rural affairs, forestry and grassland of the State Council and request the restoration of its rights within 2 months from the date of receipt of the notice from the competent departments of agriculture, rural affairs, forestry and grassland of the State Council; however, if the time limit for requesting review is delayed, a party may request the competent departments of agriculture, rural affairs, forestry and grassland of the State Council to restore its rights within 2 months from the expiration of the time limit for requesting review.

If a party requests an extension of the time limit specified by the agricultural, rural affairs, forestry and grassland competent departments of the State Council, it shall explain the reasons to the agricultural, rural affairs, forestry and grassland competent departments of the State Council and complete the relevant procedures before the expiration of the time limit.

The provisions of the first and second paragraphs of this Article shall not apply to the time limits stipulated in Articles 15, 24 and 35 of these Regulations.

Chapter VII Legal Liability

Article 41 Where a violation of Article 7 of these Regulations infringes upon the variety right, the parties shall resolve the dispute through negotiation. If the parties are unwilling to negotiate or fail to reach an agreement through negotiation, the variety right holder or interested party may request the competent departments of agriculture and rural affairs, forestry and grasslands of the people’s government at or above the county level to handle the case in accordance with their respective powers, or may file a lawsuit in accordance with the law.

The competent departments of agriculture, rural affairs, forestry and grassland of the people’s government at or above the county level may mediate the compensation for damages caused by infringement of variety rights in accordance with their respective powers and on the principle of voluntary participation of the parties. If an agreement is reached through mediation, the parties shall perform it; if the parties fail to perform the agreement or the mediation fails to reach an agreement, the variety right holder or interested party may file a lawsuit in accordance with the law.

When handling cases of infringement of variety rights, the agricultural, rural, forestry and grassland authorities of the people’s governments at or above the county level shall, in order to safeguard the public interest, order the infringer to stop the infringing behavior and confiscate the illegal gains and plant variety breeding materials; if the value of the goods is less than RMB 50,000 , a fine of RMB 10,000 to RMB 250,000 shall be imposed; if the value of the goods is more than RMB 50,000 , a fine of not less than 5 times but not more than 10 times the value of the goods shall be imposed.

Article 42: If authorized varieties are counterfeited, the agricultural, rural, forestry and grassland authorities of the people’s government at or above the county level shall order the cessation of counterfeiting and confiscate the illegal gains and plant variety breeding materials; if the value of the goods is less than RMB 50,000, a fine of RMB 10,000 to RMB 250,000 shall be imposed; if the value of the goods is more than RMB 50,000 , a fine of not less than 5 times but not more than 10 times the value of the goods shall be imposed; if a crime is constituted, criminal liability shall be pursued in accordance with the law.

Article 43: When investigating and handling cases of infringement of variety rights and counterfeiting of authorized varieties, the competent departments of agriculture, rural affairs, forestry and grasslands of the people’s governments at or above the county level have the right to take the following measures in accordance with the law:

(1) Entering production and operation sites for on-site inspection;

(2) sampling, testing, experimenting or inspecting the propagation materials or harvested materials of plant varieties;

(3) Review and copy contracts, bills, account books, production and operation files and other relevant materials related to the suspected illegal acts;

(4) Seizing and detaining plant variety propagation materials that have evidence of infringing variety rights or counterfeiting authorized varieties, as well as tools, equipment and means of transportation used to infringe variety rights or counterfeit authorized varieties;

(5) Seal off the premises where activities of infringing upon variety rights or counterfeiting authorized varieties are carried out.

When the agricultural, rural, forestry and grassland competent departments of the people’s governments at or above the county level exercise the powers prescribed in the preceding paragraph in accordance with the law, the parties shall assist and cooperate and shall not refuse or obstruct.

Article 44 If the parties have a dispute over the right to apply for a variety right and the ownership of the variety right, they may bring a lawsuit in accordance with the law.

Article 45 Where a person commits the following acts with respect to propagating materials or harvested materials without knowing that such acts infringe upon the variety rights, he shall not be liable for compensation if he can prove that they have a legal source:

(1) Processing for the purpose of reproduction by others;

(2) Promising to sell or selling;

(3) Storage for the purpose of carrying out the preceding two acts.

Article 46: Any staff member of the agricultural, rural, forestry and grassland administrative departments and relevant departments of the people’s governments at or above the county level who abuses his power, neglects his duties, engages in malpractice for personal gain, or solicits or accepts bribes shall be punished according to law; if a crime is constituted, criminal liability shall be pursued according to law.

Article 47 If any dishonest behavior such as deception, concealment, forgery, etc. occurs during the application process for variety rights, the competent departments of agriculture, rural affairs, forestry and grasslands of the State Council shall record it in the credit record of the relevant subject in accordance with relevant national regulations and make it public.

Chapter VIII Supplementary Provisions

Article 48 The following terms in these Regulations have the following meanings:

(1) Propagation material refers to the whole plant or part of the plant that can be used for propagation, including seeds, fruits, roots, stems, seedlings, buds, leaves, flowers, etc.;

(2) Harvested material refers to the whole plant or part of the plant obtained after planting.

Article 49 This Regulation shall come into force on June 1 , 2025.

CPPA and UK ICO Sign Declaration of Cooperation

On April 29, 2025, the UK Information Commissioner’s Office (the “ICO”) and the California Privacy Protection Agency (the “CPPA”) signed a declaration of cooperation regarding international privacy and data protection coordination, formalizing their existing collaboration.

The statement from the CPPA sets out the key aims of the declaration, namely:

facilitating joint research and education activities related to data protection and new technologies;

comparing investigative methods, best practices and knowledge;

organizing meetings between staff members; and

developing mechanisms for collaboration.

The ICO considers the declaration to be a “commitment to work together on common issues so people’s privacy rights are respected across the UK and California.” Tom Kemp, Executive Director at the CPPA stated that through the collaboration, the CPPA “can deepen…[its] knowledge base and leverage best practices from other regulators whose citizens face many of the same privacy harms that Californians have.”

The declaration marks the latest collaboration between the CPPA and international data protection authorities. In January 2025, the CPPA entered into collaboration with the Republic of South Korea’s Personal Information Protection Commission, and in June 2024, the CPPA entered into collaboration with the French data protection authority, the Commission Nationale de l’Informatique et des Libertés.

Read the CCPA press release.

Final Opportunity to Shape SFDR’s Future in European Commission’s Call for Evidence

On 2 May 2025, the European Commission launched its ‘Call for Evidence’ on the review of the Sustainable Finance Disclosure Regulation (SFDR).

The European Commission aims to review the SFDR to simplify the framework, enhance usability, and prevent greenwashing. Stakeholders are invited to submit general feedback rather than answer specific questions, in contrast to the European Commission’s 2023 SFDR consultations. This is an important opportunity for asset managers and other stakeholders to provide their views on the future of the European Union’s sustainable finance disclosure regime. The European Commission has confirmed there will be no further public consultation following this Call for Evidence, although it may carry out targeted outreach to specific stakeholders or their representatives.

There is a general momentum in the European Union to streamline sustainability reporting, as seen under the ‘Omnibus’ initiative on corporate sustainability reporting and due diligence requirements. The Call for Evidence notes that the SFDR review will aim for greater alignment and to strengthen the coherence of SFDR with the sustainability reporting requirements for companies under the Omnibus amendments to the Corporate Sustainability Reporting Directive (CSRD). This could be particularly relevant in relation to developments on the principal adverse impact indicators (PAIs) present in both CSRD and SFDR.

The Call for Evidence states that, generally, SFDR has been effective in increasing transparency and giving investors access to detailed ESG information. Nevertheless, the European Commission notes concerns about the lack of legal clarity on key concepts, the limited relevance of certain disclosure requirements, overlaps and inconsistencies with other parts of the sustainable finance framework, and data availability concerns. As a result, there is a risk of greenwashing and an “unwarranted exclusion of some sectors because of how some rules are applied in practice,” according to the European Commission.

Of particular note for private markets clients is that the Call for Evidence suggests that an objective and policy option should be to consider different investor groups and types of financial products, as well as the international reach and exposures of investments. Feedback submitted could explore retaining the flawed but flexible Article 8, SFDR fund categorisation with the promotion of environmental and/or social characteristics or the merits of a more prescriptive new labelling regime, as envisaged by the Sustainable Finance Platform, which we reported on here.

The deadline for feedback is 30 May 2025, with the European Commission confirming that its revision of SFDR is in its work programme for Q4 2025 (coinciding with the CSRD Omnibus updates). After a lengthy wait, it seems it is now full pace ahead for a revised SFDR.

Constitutional Reform Initiative Regarding Pharmaceutical Sovereignty and Safety

On April 22, 2025, a proposal was submitted to the Deputies Chamber proposing to reform articles 4, 25 and 28 of the Mexican Constitution, regarding pharmaceutical sovereignty and security.

The proposal appoints the modification of the legal framework at the constitutional level so that the State is required to guarantee pharmaceutical sovereignty and security, which in turn is intended to allow the subsequent adaptation of secondary laws, programs and budgets with a long-term vision.

This reform mainly states the following:

The State will guarantee access to biological medicines, vaccines and medical devices by promoting the national production, storage and distribution of essential health products.

Pharmaceutical sovereignty and security will be fundamental principles to ensure the timely supply of such products, especially those of public interest and high impact on health.

The State will promote the development and strengthening of the national pharmaceutical industry, through public policies that encourage research, production and distribution of medicines recognized by law and that are strategic for the population, guaranteeing the reduction of external dependence in the acquisition of critical products for health.