Federal Circuit Limits Use of Applicant Admitted Prior Art in Inter Partes Reviews

As provided by statute at 35 U.S.C. § 311(b), a petitioner in an inter partes review (IPR) may challenge the claims of a patent “only on the basis of prior art consisting of patents or printed publications.” Does this provision permit IPR challenges based on Applicant Admitted Prior Art (AAPA) ― art identified in the patent as previously known ― in combination with a patent or printed publication? The Federal Circuit recently announced its decision in Qualcomm Inc. v. Apple Inc., clarifying that AAPA is not a “patent[] or printed publication[]” under the statute, and that combining AAPA with a patent or printed publication does not shield the use of AAPA from violating 35 U.S.C. § 311(b) in a petition for IPR.

Background

History of Appeals

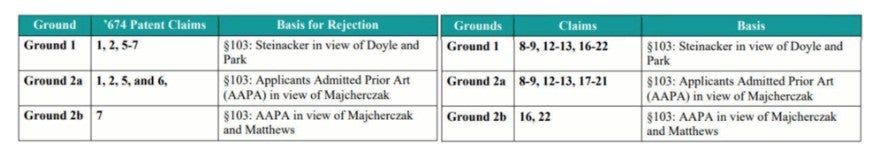

In January 2020, the Patent Trial and Appeal Board determined in a final written decision that the ’674 Patent claims were unpatentable under Ground 2. The Board rejected the arguments of the patent owner (Qualcomm) that Ground 2 was “not permitted.” The Board held that “AAPA is admitted to be prior art and is found in the ’674 patent” and was thus “prior art consisting of patents or printed publications,” and therefore qualified as prior art under § 311(b).

The patent owner appealed, arguing that AAPA could not be used as a “basis” for an IPR challenge, and that § 311(b) is limited to “prior art consisting of patents or printed publications.” While the appeal was pending, former USPTO Director Iancu published guidance in August 2020 noting that AAPA is not “prior art consisting of patents or printed publications” under § 311(b), but that AAPA, “if used in conjunction with” other patent documents “forming ‘the basis’” of an IPR proceeding under § 311, could support a finding of obviousness. Nonetheless, in February 2022, the Federal Circuit vacated the Board’s ruling against the patent owner, finding that AAPA does not qualify as prior art under § 311(b) and may not form the basis of an IPR proceeding, but could be used in an IPR “under particular circumstances,” and remanding back to the Board to consider whether the AAPA formed “the basis” of Ground 2.

In response, former USPTO Director Vidal issued superseding guidance in June 2022 that established an “in combination” rule: “Board panels should determine whether the petition relies on admissions in the specification in combination with reliance on at least one prior art patent or printed publication” and, if so, “those admissions do not form ‘the basis’ of the ground and must be considered by the Board in its patentability analysis.” Applying this superseding guidance, the Board again found in a second final written decision on remand that the challenged claims of the ’674 patent were unpatentable under Ground 2 because petitioner did not use AAPA to form the “basis” of Ground 2.

The patent owner once again appealed to the Federal Circuit. In its recent decision of April 23, 2025, the Federal Circuit found that the plain meaning of § 311(b) limits the basis of an IPR proceeding to only prior art patents or printed publications, and that AAPA cannot be used, alone or in combination with prior art patents or printed publications, as the basis for instituting an IPR. The Federal Circuit acknowledged that AAPA may be used to provide general background knowledge without violating § 311(b) and may be relied upon in combination with prior art patents or printed publications—just not as the basis.

Since the Board had already rejected petitioner’s Ground 1 argument for invalidity of the ’674 patent claims, and no other grounds remained, the Federal Circuit reversed, noting that the Board should have instead found that the challenged claims are not unpatentable.

Key Takeaways

While AAPA may be relied on in an IPR, it is critical for litigants to ensure that AAPA is not used to form the basis of the IPR. This clarification of § 311(b) by the Federal Circuit will ultimately require a higher threshold for challenging patents in IPRs. In order to avoid early dismissals, IPR petitions should be clear in how AAPA is being used, including identifying only printed patents and publications as the grounds for petitions.

USPTO Launches Task Force to Combat Patent Fraud and Protect the Patent System

The U.S. Patent and Trademark Office (USPTO) recently announced the creation of the Patent Fraud Detection and Mitigation Working Group. The working group is designed to identify and address threats to the patent system as well as to weed out improper activity in patent applications and reexamination proceedings. USPTO officials believe that these efforts will reduce pendency time for patent applications and preserve USPTO resources.

In particular, the working group is tasked with:

Addressing mistakes in fee certifications and assertions. To date, the USPTO has mailed more than 2,200 fee deficiency notices in patent applications in response to false micro entity certifications as well as 68 notices responding to false small entity certifications. Patent Applicants and practitioners are reminded that only entities that meet certain requirements can claim fee discounts as a small entity or micro entity, and an incorrect claim of small entity status or micro entity status can jeopardize the validity of a patent. Details regarding the requirements for establishing small entity status and micro entity status can be found here.

Identifying and reviewing potential misrepresentations to the USPTO, including for false signatures, and using the administrative sanctions process to address misrepresentations where appropriate. Since June 2023, the USPTO has terminated more than 3,300 applications due to false signatures. Patent Applicants and practitioners are reminded that, pursuant to 37 CFR 1.4, a signer’s signature on any paper submitted to the USPTO must be personally made or inserted by the signer and cannot be made by another at the signer’s direction. This applies to both handwritten signatures and S-signatures.

Preventing non-practitioners from engaging in the unauthorized practice of law. Except for pro se representation, a patent Applicant can only be represented in a patent matter before the USPTO by individuals specifically authorized to do so. 37 CFR 11.10(a). With some exceptions, this generally requires a registered patent practitioner who has, among other things, passed the patent registration examination. 37 CFR 11.7. Representing another before the USPTO regarding a patent matter is not limited to signing and filing papers in a patent application, but can also include drafting the patent application, drafting amendments and replies to communications from the USPTO, and giving advice to a client in contemplation of filing a patent application or an amendment or reply in a patent application. 37 CFR 11.5(b)(1). Patent Applicants are encouraged to obtain representation regarding patent matters only from authorized patent practitioners.

Monitoring and investigating otherwise suspicious filings.

Serving as the main point of contact within the USPTO for reporting potential threats to the patent system.

The USPTO has introduced a new webpage serving as a centralized hub to keep the public informed about emerging threats in patent applications and reexamination proceedings. Additionally, the USPTO will share data outlining its mitigation efforts.

Click here to visit the new USPTO Patent Fraud Detection and Mitigation website.

China’s Supreme People’s Court and Supreme People’s Procuratorate Issue Interpretation on Several Issues Concerning the Application of Law in Handling Criminal Cases of Intellectual Property Infringement

On April 24, 2025, China’s Supreme People’s Court (SPC) and Supreme People’s Procuratorate (SPP) jointly issued the Interpretation on Several Issues Concerning the Application of Law in Handling Criminal Cases of Intellectual Property Infringement (关于办理侵犯知识产权刑事案件适用法律若干问题的解释). The Interpretation clarifies trademark crimes, patent counterfeiting, copyright crimes, trade secret misappropriation, and common issues arising in IP crimes (e.g., heavier or reduced sentences). The Interpretation is effective as of April 26, 2025.

A translation follows. The original text is available here (Chinese only).

In order to punish crimes of infringement of intellectual property rights in accordance with the law and maintain the socialist market economic order, in accordance with the relevant provisions of the Criminal Law of the People’s Republic of China, the Criminal Procedure Law of the People’s Republic of China and other laws, and in combination with judicial practice, we hereby explain several issues concerning the application of law in handling criminal cases of infringement of intellectual property rights as follows:

Article 1: Where a person uses a trademark identical to a registered trademark on the same kind of goods or services without the permission of the registered trademark owner, any of the following circumstances shall be deemed to be “the same kind of goods or services” as provided for in Article 213 of the Criminal Law:

(1) The names of the goods actually produced and sold, or the names of the services actually provided by the actor are the same as the names of the goods or services approved for use by the right holder’s registered trademark;

(2) The commodity names are different, but the functions, uses, main raw materials, consumers, sales channels, etc. are the same or substantially the same, and the relevant public generally believes that they are the same kind of commodities;

(3) The service names are different, but the purpose, content, method, object, location, etc. of the services are the same or substantially the same, and the relevant public generally believes that they are the same type of services.

To determine “the same kind of goods or services”, a comparison should be made between the goods or services approved for use by the right holder’s registered trademark and the goods or services actually produced and sold, or the services actually provided, by the actor.

Article 2 A trademark that is identical to a counterfeited registered trademark, or that is substantially indistinguishable from a counterfeited registered trademark and sufficient to mislead the relevant public, shall be deemed a “trademark that is identical to its registered trademark” as provided for in Article 213 of the Criminal Law. A trademark that is substantially indistinguishable from a counterfeited registered trademark and sufficient to mislead the relevant public shall be deemed to be a trademark that is substantially indistinguishable from a counterfeited registered trademark and sufficient to mislead the relevant public if any of the following circumstances exists:

(1) Changing the font, uppercase and lowercase letters, or the horizontal and vertical arrangement of the characters of a registered trademark, which is basically indistinguishable from the registered trademark;

(2) Changing the spacing between words, letters, numbers, etc. of a registered trademark, which is basically indistinguishable from the registered trademark;

(3) Changing the color of a registered trademark does not affect the distinctive features of the registered trademark;

(4) merely adding to a registered trademark elements that lack distinctive features, such as the common name of the goods or model number, which do not affect the distinctive features of the registered trademark;

(5) There is basically no difference between the three-dimensional signs and the two-dimensional elements of the three-dimensional registered trademark;

(6) Other marks that are basically indistinguishable from the registered trademark and are sufficient to mislead the relevant public.

Article 3: Where a person uses a trademark identical to a registered trademark on the same kind of goods without the permission of the registered trademark owner, any of the following circumstances shall be deemed to be a “serious circumstance” as provided for in Article 213 of the Criminal Law:

(1) The amount of illegal income is RMB 30,000 or more, or the amount of illegal business is RMB 50,000 or more;

(2) counterfeiting two or more registered trademarks, with illegal gains exceeding RMB 20,000 or illegal business volume exceeding RMB 30,000;

(3) Having been subject to criminal or administrative punishment for committing an act specified in Articles 213 to 215 of the Criminal Law within two years, he commits the act again, and the amount of illegal gains is more than RMB 20,000 or the amount of illegal business is more than RMB 30,000;

(4) Other circumstances of a serious nature.

If a person uses a trademark identical to a registered trademark on the same kind of service without the permission of the registered trademark owner, any of the following circumstances shall be deemed to be a “serious circumstance” as provided for in Article 213 of the Criminal Law:

(1) The amount of illegal gains is RMB 50,000 or more;

(2) counterfeiting two or more registered trademarks, with the amount of illegal gains exceeding RMB 30,000;

(3) Having been subject to criminal or administrative punishment for committing an act specified in Articles 213 to 215 of the Criminal Law within two years, he commits the act again, and the amount of illegal gains is RMB 30,000 or more;

(4) Other circumstances of a serious nature.

Where a person counterfeits both a registered trademark for goods and a registered trademark for services, and the amount of illegal gains from the counterfeit registered trademark for goods is less than the standard prescribed in the first paragraph of this Article, but the total amount of illegal gains from the counterfeit registered trademark for services reaches the standard prescribed in the second paragraph of this Article, it shall be deemed as “serious circumstances” as prescribed in Article 213 of the Criminal Law.

If the amount of illegal gains or illegal business operations reaches ten times or more the standards specified in the first three paragraphs of this article, it shall be deemed as “particularly serious circumstances” as stipulated in Article 213 of the Criminal Law.

Article 4 Anyone who sells goods bearing counterfeit registered trademarks shall be deemed to have “knowingly” done so as provided for in Article 214 of the Criminal Law if any of the following circumstances exists, unless there is evidence proving that the person was truly unaware:

(1) Knowing that the registered trademark on the goods he sells has been altered, replaced or covered;

(2) Forging or altering a trademark registrant’s authorization document or knowing that the document has been forged or altered;

(3) A person who has been subject to criminal or administrative penalties for selling goods bearing counterfeit registered trademarks and then sells the same goods bearing counterfeit registered trademarks;

(4) purchasing or selling goods at prices significantly lower than the market price without justifiable reasons;

(5) after being discovered by administrative law enforcement agencies or judicial agencies to be selling goods bearing counterfeit registered trademarks, transferring or destroying infringing goods, accounting documents and other evidence, or providing false certification;

(6) Other circumstances that may be regarded as knowing that the goods are counterfeit registered trademarks.

Article 5 Where a person knowingly sells goods that are counterfeit registered trademarks and the amount of illegal proceeds is more than RMB 30,000, it shall be deemed as “a relatively large amount of illegal proceeds” as provided for in Article 214 of the Criminal Law. If any of the following circumstances exists, it shall be deemed as “other serious circumstances” as provided for in Article 214 of the Criminal Law:

(1) The sales amount is RMB 50,000 or more;

(2) Having been subject to criminal or administrative punishment for committing an act specified in Articles 213 to 215 of the Criminal Law within two years, he commits the act again, and the amount of illegal gains is more than RMB 20,000 or the amount of sales is more than RMB 30,000;

(3) The value of the goods bearing counterfeit registered trademarks that have not yet been sold reaches three times or more the sales amount standards prescribed in the first two paragraphs of this paragraph, or the sales amount of the goods that have been sold is less than the sales amount standards in the first two paragraphs of this paragraph, but the total value of the goods and the sales amount of the goods that have not yet been sold reaches three times or more the sales amount standards prescribed in the first two paragraphs of this paragraph.

If the amount of illegal proceeds, sales amount, value of goods, or the total of sales amount and value of goods reaches ten times or more of the standard specified in the preceding paragraph of this Article, it shall be deemed as “the amount of illegal proceeds is huge or there are other particularly serious circumstances” as stipulated in Article 214 of the Criminal Law.

Article 6 Forging or unauthorized manufacturing of another person’s registered trademark or selling forged or unauthorized registered trademark shall be deemed to be a “serious circumstance” as provided for in Article 215 of the Criminal Law if any of the following circumstances exists:

(1) The number of labels is more than 10,000, or the amount of illegal income is more than 20,000 yuan, or the amount of illegal business is more than 30,000 yuan;

(2) Forging, manufacturing without authorization, or selling forged or unauthorized manufacturing of two or more registered trademarks, the number of which is more than 5,000, or the amount of illegal gains is more than RMB 10,000, or the amount of illegal business is more than RMB 20,000;

(3) Having been subject to criminal or administrative punishment for committing an act specified in Articles 213 to 215 of the Criminal Law within two years, and committing the act again, the number of labels is more than 5,000, or the amount of illegal income is more than RMB 10,000, or the amount of illegal business is more than RMB 20,000;

(4) selling registered trademark signs illegally manufactured by others, where the number of signs that have not yet been sold reaches three times or more the standards specified in the first three items of this paragraph, or the number of signs that have been sold is less than the standards specified in the first three items of this paragraph, but the total number of signs that have not yet been sold reaches three times or more the standards specified in the first three items of this paragraph;

(5) Other serious circumstances.

If the number of labels, the amount of illegal income, and the amount of illegal business reach more than five times the standards specified in the preceding paragraph of this article, it shall be deemed as “particularly serious circumstances” as stipulated in Article 215 of the Criminal Law.

Article 7 The term “two or more registered trademarks” as used in this interpretation refers to two or more registered trademarks that identify different sources of goods or services. Although the registered trademarks are different, if they are used on the same goods or services and point to the same source of goods or services, they should not be considered as “two or more registered trademarks”.

The term “piece” of a registered trademark logo as used in this interpretation generally refers to a logo with a complete trademark image. If several logo images are printed on a tangible carrier and the logo image cannot be used independently without the tangible carrier, it shall be deemed as one logo.

Article 8 Whoever commits the crime of counterfeiting registered trademarks as provided for in Article 213 of the Criminal Law and also sells goods bearing the counterfeit registered trademarks, and where such a crime is constituted, he shall be convicted and punished for the crime of counterfeiting registered trademarks in accordance with the provisions of Article 213 of the Criminal Law.

If a person commits the crime of counterfeiting registered trademarks as stipulated in Article 213 of the Criminal Law and sells goods that he knows are counterfeit registered trademarks of others, and the crime is constituted, he shall be punished for multiple crimes.

Article 9 Any of the following circumstances shall be deemed as “counterfeiting another’s patent” as provided for in Article 216 of the Criminal Law:

(1) Forging or altering another person’s patent certificate, patent document or patent application document;

(2) Marking the patent number of another person on the products or product packaging manufactured or sold without permission;

(3) Using another’s patent number in a contract, product manual, advertisement or other promotional materials without permission, causing others to mistakenly believe that the invention, utility model or design is that of another.

Article 10 Anyone who counterfeits another person’s patent shall be deemed to be a “serious circumstance” as provided for in Article 216 of the Criminal Law if any of the following circumstances exists:

(1) The amount of illegal income is more than RMB 100,000 or the amount of illegal business operations is more than RMB 200,000;

(2) causing direct economic losses of more than RMB 300,000 to the patentee;

(3) counterfeiting two or more patents of others, with illegal gains exceeding RMB 50,000 or illegal business volume exceeding RMB 100,000;

(4) Having been subject to criminal or administrative penalties for counterfeiting another person’s patent within two years, he again commits the act, and the amount of illegal gains is more than RMB 50,000 or the amount of illegal business is more than RMB 100,000;

(5) Other serious circumstances.

Article 11: Any act of infringing upon copyright or rights related to copyright without obtaining authorization from the copyright owner, producer of audio or video recordings, or performer, or forging or altering authorization documents, or exceeding the scope of the authorization, shall be deemed as “without the permission of the copyright owner”, “without the permission of the producer of audio or video recordings”, or “without the permission of the performer” as stipulated in Article 217 of the Criminal Law.

A natural person, legal person or unincorporated organization that signs a work or audio or video product in a usual manner as provided for in Article 217 of the Criminal Law shall be presumed to be the copyright owner or audio or video producer, and shall have corresponding rights in the work or audio or video product, unless there is evidence to the contrary.

In cases where there are many types of works, audio and video products involved and the rights holders are scattered, if there is evidence that the works, audio and video products involved were illegally published, copied and distributed, or disseminated to the public through information networks, and the publishers, copy distributors, and information network disseminators cannot provide relevant evidence materials for obtaining permission from the copyright owner, audio and video producer, or performer, it can be determined as “without the permission of the copyright owner”, “without the permission of the audio and video producer”, or “without the permission of the performer” as stipulated in Article 217 of the Criminal Law. However, this does not apply if there is evidence that the rights holder has waived his rights, the copyright of the works involved or the relevant rights of the audio and video products and performers are not protected by China’s Copyright Law, or the protection period of the rights has expired.

Article 12 The act of reproducing and distributing, or reproducing for the purpose of distributing, a work or audio or video recording without the permission of the copyright owner or the owner of rights related to the copyright shall be deemed as “reproduction and distribution” as stipulated in Article 217 of the Criminal Law.

Without the permission of the copyright owner or the owner of rights related to the copyright, providing works, audio and video products, or performances to the public by wired or wireless means so that the public can obtain them at a time and place of their choice shall be deemed as “dissemination to the public through an information network” as stipulated in Article 217 of the Criminal Law.

Article 13 Where an act of infringing upon copyright or copyright-related rights as provided for in Article 217 of the Criminal Law is carried out, and the amount of illegal proceeds is RMB 30,000 or more, it shall be deemed as “a relatively large amount of illegal proceeds” as provided for in Article 217 of the Criminal Law; where any of the following circumstances exists, it shall be deemed as “other serious circumstances” as provided for in Article 217 of the Criminal Law:

(1) The amount of illegal business operations is more than RMB 50,000;

(2) Having been subject to criminal or administrative punishment for committing an act specified in Articles 217 and 218 of the Criminal Law within two years, he commits the act again, and the amount of illegal gains is more than RMB 20,000 or the amount of illegal business is more than RMB 30,000;

(3) copying and distributing another person’s work or audio or video recording, where the total number of copies is 500 or more;

(4) disseminating to the public through information networks other people’s works, audio and video recordings or performances, the total number of which is 500 or more, or the number of which is downloaded more than 10,000 times, or the number of which is clicked more than 100,000 times, or disseminating through a membership system with more than 1,000 registered members;

(5) The amount or quantity does not reach the standards specified in Items 1 to 4 of this paragraph, but reaches more than half of two or more of the standards.

If a person knowingly provides others with devices or components mainly used to circumvent or destroy technical measures, or provides technical services for others to circumvent or destroy technical measures, and the amount of illegal gains or illegal business reaches the standards prescribed in the preceding paragraph, he shall be held criminally liable for the crime of copyright infringement.

If the amount or quantity reaches more than ten times the corresponding standards stipulated in the first two paragraphs of this article, it shall be deemed as “the illegal proceeds are huge or there are other particularly serious circumstances” as stipulated in Article 217 of the Criminal Law.

Article 14: If a person knowingly sells infringing copies as provided for in Article 217 of the Criminal Law, and the amount of illegal proceeds is RMB 50,000 or more, he shall be deemed to have committed the “huge amount of illegal proceeds” as provided for in Article 218 of the Criminal Law. If any of the following circumstances exists, he shall be deemed to have committed the “other serious circumstances” as provided for in Article 218 of the Criminal Law:

(1) The sales amount is more than RMB 100,000;

(2) Having been subject to criminal or administrative punishment for committing an act specified in Article 217 or Article 218 of the Criminal Law within two years, he commits the act again, and the amount of illegal gains is more than RMB 30,000 or the amount of sales is more than RMB 50,000;

(3) selling another person’s work or audio or video recording, where the total number of copies is more than one thousand;

(4) The value of the infringing copies that have not yet been sold or the number of infringing copies that have not yet been sold is more than three times the standards set forth in the first three items of this paragraph; or the value or number of infringing copies that have been sold is less than the standards set forth in the first three items of this paragraph, but the total value or number of infringing copies that have not yet been sold is more than three times the standards set forth in the first three items of this paragraph.

Article 15 Whoever commits the crime of copyright infringement as provided for in Article 217 of the Criminal Law and also sells the infringing copies, and this constitutes a crime, shall be convicted and punished for the crime of copyright infringement in accordance with the provisions of Article 217 of the Criminal Law.

If a person commits the crime of copyright infringement as provided for in Article 217 of the Criminal Law and knowingly sells the infringing copies of others’ works, and this constitutes a crime, he shall be punished for multiple crimes.

Article 16: Obtaining commercial secrets by means of illegal copying or other means shall be deemed as “theft” as provided for in Article 219, paragraph 1, item 1 of the Criminal Law; obtaining commercial secrets by means of unauthorized or unauthorized use of computer information systems or other means shall be deemed as “electronic intrusion” as provided for in Article 219, paragraph 1, item 1 of the Criminal Law.

Article 17: Infringement of trade secrets under any of the following circumstances shall be deemed to be a “serious circumstance” as provided for in Article 219 of the Criminal Law:

(1) causing losses of more than RMB 300,000 to the owner of the rights of the trade secrets;

(2) The amount of illegal gains from infringement of trade secrets is more than RMB 300,000;

(3) Having been subject to criminal or administrative punishment for committing an act specified in Article 219 or Article 219-1 of the Criminal Law within two years, he commits the act again, causing losses or illegal gains of more than RMB 100,000;

(4) Other circumstances of a serious nature.

If the infringement of trade secrets directly leads to the bankruptcy or closure of the rights holder of the trade secrets due to major operational difficulties, or the amount is more than ten times the standard specified in the preceding paragraph of this article, it shall be deemed as “particularly serious circumstances” as stipulated in Article 219 of the Criminal Law.

Article 18 The “amount of loss” for infringement of trade secrets as provided for in this Interpretation shall be determined in the following manner:

(1) Where the business secrets of the right holder are obtained by improper means and have not yet been disclosed, used or allowed to be used by others, the amount of loss may be determined based on the reasonable licensing fee for the business secrets;

(2) If a person obtains the right holder’s trade secrets by unfair means and then discloses, uses or allows others to use the trade secrets, the amount of loss may be determined based on the loss of profits caused by the right holder’s infringement. However, if the amount of loss is lower than the reasonable license fee for the trade secrets, it shall be determined based on the reasonable license fee;

(3) If a person violates the obligation to keep confidentiality or the right holder’s request to keep business secrets confidential and discloses, uses or allows others to use the business secrets in his possession, the amount of loss may be determined based on the loss of profits caused by the right holder due to the infringement;

(4) Where a person knowingly obtains, discloses, uses or allows others to use a trade secret by improper means or in violation of the obligation to keep the trade secret or the right holder’s requirement to keep the trade secret, but still obtains, discloses, uses or allows others to use the trade secret, the amount of loss may be determined based on the loss of profits caused by the right holder due to the infringement;

(5) If a trade secret has become known to the public or has been lost due to an act of infringing a trade secret, the amount of loss may be determined based on the commercial value of the trade secret. The commercial value of a trade secret may be determined based on a combination of factors such as the research and development costs of the trade secret and the benefits of implementing the trade secret.

The loss of profits caused by infringement of the rights holder specified in the second to fourth items of the preceding paragraph can be determined by multiplying the total number of product sales reductions caused by the infringement by the reasonable profit of each product of the rights holder; if the total number of product sales reductions cannot be determined, it can be determined by multiplying the sales volume of the infringing products by the reasonable profit of each product of the rights holder. If the trade secret is used for other business activities such as services, the amount of loss can be determined based on the reasonable profit reduced by the rights holder due to infringement.

The remedial expenses incurred by the right holder of the trade secret to mitigate the losses to business operations or business plans or to restore the security of computer information systems or other systems should be included in the losses caused to the right holder of the trade secret.

Article 19 The “amount of illegal gains” from infringement of trade secrets as provided for in this Interpretation refers to the value of property or other property benefits obtained by disclosing or allowing others to use trade secrets, or the profits obtained by using trade secrets. Such profits can be determined by multiplying the sales volume of the infringing products by the reasonable profit of each infringing product.

Article 20: If a foreign institution, organization or individual steals, spies on, buys or illegally provides commercial secrets and the circumstances specified in Article 17 of this Interpretation exist, it shall be deemed as “serious circumstances” as specified in Article 219 of the Criminal Law.

Article 21 In criminal proceedings, if a party, defender, litigation agent or non-party applies in writing for confidentiality measures to be taken with respect to evidence or materials concerning commercial secrets or other commercial information that needs to be kept confidential, necessary confidentiality measures shall be taken, such as organizing the litigation participants to sign a confidentiality commitment letter, based on the circumstances of the case.

Anyone who violates the requirements of the confidentiality measures in the preceding paragraph or the confidentiality obligations stipulated by laws and regulations shall bear corresponding responsibilities in accordance with the law. Anyone who discloses, uses or allows others to use commercial secrets accessed or obtained in criminal proceedings without authorization shall be held criminally liable in accordance with the law if a crime is constituted.

Article 22 Anyone who knowingly commits a crime of intellectual property infringement by another person and commits any of the following acts shall be treated as a co-offender, except where otherwise provided by law or judicial interpretation:

(1) Providing assistance in producing or manufacturing the main raw materials, auxiliary materials, semi-finished products, packaging materials, machinery and equipment, labels and logos, production technology, formulas, etc. for the production or manufacture of infringing products;

(2) Providing loans, funds, accounts, licenses, payment settlement and other services;

(3) Providing production or business premises or transportation, warehousing, storage, express delivery, mailing and other services;

(4) Providing technical support such as Internet access, server hosting, network storage, and communication transmission;

(5) Other circumstances of assisting crimes of infringement of intellectual property rights.

Article 23: Where any of the following circumstances exist in the commission of a crime of infringement of intellectual property rights, a heavier punishment shall generally be imposed as appropriate:

(1) Mainly engaged in infringement of intellectual property rights;

(2) counterfeiting registered trademarks of goods or services such as emergency and disaster relief supplies or epidemic prevention materials during major natural disasters, accidents, disasters, or public health incidents;

(3) Refusing to hand over illegal gains.

Article 24: Where a crime of infringement of intellectual property rights exists and any of the following circumstances exists, a lighter punishment may be given in accordance with law:

(1) Those who plead guilty and accept punishment;

(2) the right holder has obtained forgiveness;

(3) Obtaining the right holder’s business secrets by improper means but not disclosing, using or allowing others to use them.

If the circumstances of the crime are minor, prosecution may be waived or criminal punishment may be exempted in accordance with the law. If the circumstances are significantly minor and the harm is not serious, they shall not be treated as crimes.

Article 25: Those who commit crimes of infringement of intellectual property rights shall be sentenced to a fine in accordance with the law by taking into account the amount of illegal gains from the crime, the amount of illegal business, the amount of losses caused to the right holder, the number of infringing and counterfeit goods and the social harm, etc.

The amount of the fine is generally determined to be between one and ten times the amount of the illegal income. If the amount of the illegal income cannot be ascertained, the amount of the fine is generally determined to be between 50% and one time the amount of the illegal business. If both the amount of the illegal income and the amount of the illegal business cannot be ascertained, if a sentence of less than three years of fixed-term imprisonment, criminal detention or a fine is imposed, the amount of the fine is generally determined to be between RMB 30,000 and RMB 1 million; if a sentence of more than three years of fixed-term imprisonment is imposed, the amount of the fine is generally determined to be between RMB 150,000 and RMB 5 million.

Article 26 If an organization commits any of the acts specified in Articles 213 to 219 of the Criminal Law, the organization shall be sentenced to a fine, and the directly responsible supervisors and other directly responsible persons shall be punished in accordance with the conviction and sentencing standards prescribed in these Interpretations.

Article 27 Except in special circumstances, goods with counterfeit registered trademarks, illegally manufactured registered trademark signs, infringing copies, and materials and tools mainly used to manufacture goods with counterfeit registered trademarks, registered trademark signs or infringing copies shall be confiscated and destroyed in accordance with the law.

If the above-mentioned items need to be used as evidence in civil or administrative cases, they may be destroyed upon application by the right holder after the civil or administrative case is concluded or after the evidence is fixed by means of sampling, photographing, etc.

Article 28 The “amount of illegal business” referred to in this interpretation refers to the value of the infringing products manufactured, stored, transported, and sold by the perpetrator in the process of committing an act of infringement of intellectual property rights. The value of the infringing products that have been sold shall be calculated according to the actual sales price. The value of the infringing products that have not yet been sold shall be calculated according to the actual sales average price of the infringing products that have been ascertained. If the actual average sales price cannot be ascertained, it shall be calculated according to the marked price of the infringing products. If the actual sales price cannot be ascertained or the infringing products have no marked price, it shall be calculated according to the market median price of the infringed products.

The “value of goods” referred to in this interpretation shall be determined in accordance with the value of the unsold infringing intellectual property rights products stipulated in the preceding paragraph.

The “sales amount” referred to in this interpretation refers to all illegal income obtained by and owed to the person from the sale of infringing products during the process of committing acts of infringement of intellectual property rights.

The “amount of illegal income” referred to in this interpretation refers to the total illegal income obtained by and owed to the perpetrator after selling products that infringe intellectual property rights, minus the purchase price of raw materials and products sold; if services are provided, minus the purchase price of products used in the service. If a person makes a profit by charging service fees, membership fees or advertising fees, the fees collected shall be deemed as “illegal income”.

Article 29: Where intellectual property rights infringement is committed multiple times and has not been dealt with but should be prosecuted according to law, the amounts and quantities involved in conviction and sentencing shall be calculated cumulatively.

For products that have been completed but have not yet been affixed with counterfeit registered trademark logos or have not yet been fully affixed with counterfeit registered trademark logos, if there is evidence that the product will counterfeit another person’s registered trademark, its value will be included in the amount of illegal business operations.

Article 30 Where a people’s court accepts a criminal private prosecution case involving infringement of intellectual property rights in accordance with law, and where a party is unable to obtain evidence due to objective reasons but is able to provide relevant clues when filing a private prosecution and applies to the people’s court for the evidence, the people’s court shall obtain the evidence in accordance with law.

Article 31 This interpretation shall come into force on April 26, 2025.

USPTO Reshapes Discretionary Denials for Post-Grant Proceedings

The US Patent and Trademark Office (USPTO) recently issued two memoranda reshaping the Patent Trial and Appeal Board’s (PTAB) approach to discretionary denials for parallel proceedings.

First Memo: Guidance on USPTO’s Recission of Fintiv Memo

The first memo, issued on March 24 by PTAB Chief Administrative Patent Judge Scott Boalick, clarifies how discretionary denials should be handled following the USPTO’s recission of the Fintiv Memo. Going forward, the Board will once again apply the Fintiv factors to determine whether it should exercise its discretion to deny institution for any post-grant proceeding challenging a patent that has been asserted in a parallel proceeding, including in the US International Trade Commission (ITC). Those six factors include:

Whether the court granted a stay or evidence exists that one may be granted if a proceeding is instituted.

Proximity of the court’s trial date to the Board’s projected statutory deadline for a final written decision.

Investment in the parallel proceeding by the court and parties.

Overlap between issues raised in the petition and parallel proceeding.

Whether the petitioner and the defendant in the parallel proceeding are the same party.

Other circumstances that impact the Board’s exercise of discretion, including the merits.

The memo makes clear that no single Fintiv factor is dispositive; the Board must reach a decision by conducting a holistic Fintiv analysis that weighs all the relevant factors. That said, Sotera stipulations will remain highly relevant. The Board may also consider any record evidence concerning the proximity of the Board’s final written decision to the district court’s trial date or the ITC’s final determination target date.

Second Memo: Interim Process for PTAB Institution Decisions

The second memo, issued on March 26, put forward interim procedure for institution decisions will be bifurcated into (1) discretionary considerations and (2) non-discretionary considerations and merits. Under the new procedure, the USPTO director will now consult at least three PTAB judges to determine whether a discretionary denial of institution is appropriate. If denial is appropriate, the director will simply issue a decision stating such. If denial of institution is not appropriate, the proceeding will continue under a new three-member panel, according to the normal procedure.

The interim procedure puts forward a new briefing schedule as a matter of right in addition to the normal, existing briefing schedule. The brief seeking discretionary denial of institution from the patent owner must be filed within two months of the Notice of Filing of any post-grant petition and is limited to 14,000 words. The opposition brief must be a month later and is also limited to 14,000 words. If good cause is shown, a reply brief of 5,600 words can be filed.

The briefs can address all the relevant factors under PTAB precedent, including the above described Fintiv factors. The memo enumerates specific factors, including (1) whether the PTAB or another forum has already adjudicated the validity or patentability of the challenged patent claims, (2) whether there have been changes in the law or new judicial precedent issued since issuance of the claims that may affect patentability, (3) the strength of the unpatentability challenge, (4) the extent of the petition’s reliance on expert testimony, (5) settled expectations of the parties, such as the length of time the claims have been in force, (6) compelling economic, public health, or national security interests, and (7) any other considerations bearing on the director’s discretion. One other consideration will likely be the ability of the PTAB to meet its “workload needs.”

While the memoranda do not explicitly predict the results of the new interim procedure, a rise in discretionary denials can be expected. The combination of the bifurcation of discretionary denials and the consistency in which the ITC sets target dates ahead of the PTAB estimated final written decision increases the probability of denials. Additionally, because the briefing schedule does not replace the normal briefing schedule, there should be no expected increased efficiency for patent owners from the new bifurcation procedure. Factoring in the tight three-month briefing window, any petition for post-grant review would need to be filed within one to two months of any ITC proceeding to have a chance of avoiding discretionary denial of institution.

Listen to this article

Delete All IP Law? Really?

By now, everyone should know about the X post heard around the intellectual property world. On April 11, Jack Dorsey, co-founder of Twitter and Block, posted these four words : “delete all IP law.” A few hours later, Elon Musk chimed in with “I agree.” Over the next few days, the media was full of reactions from tech and legal luminaries. Some tech celebrities agreed. “Jack has a point,” posted Chris Messina, ironically on X rival Bluesky. Members of the IP legal community who were quoted in the media objected strongly, as one might expect.

When I asked several members of the IP legal community if they wanted to comment, the response I got from some was cool.

“These offhand tweets have received far more media attention than they deserve,” said Prof. Edward Lee of Santa Clara University School of Law, adding, “Let’s talk when Block and Tesla allow competitors to freely use their trademarks and trade secrets.”

The professor has a point. Perhaps X posts, shot from the hip, aren’t worth the paper they aren’t written on. But, as documented recently in the Washington Post, “[s]ome X posts appear to have influenced the White House.”. Tech Crunch’s Anthony Ha observed, “the line between a random conversation on Twitter/X and actual government policy is thinner than it used to be.”. And there is strong pressure from Silicon Valley to weaken copyright protection to allow unfettered training of the large language models that are the backbone of Artificial Intelligence (AI). As glib as Dorsey and Musk’s X posts might be, they need to be addressed seriously.

To begin with, my colleague Jim Ko explains in his article, “Delete All IP Law”? Why the Tech Titans Want to Pull Up the Ladder Behind Them,” that intellectual property rights were considered so important to the development of America that they were enshrined in the Constitution by the Founding Fathers. Article I, Section 8, Clause 8 gives Congress the power “[t]o promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries.”

Building on that, Robert Sterne of Washington, D.C.’s Sterne, Kessler, Goldstein & Fox, PLLC, states, “having represented literally hundreds of startups, emerging companies, and universities – the lifeblood of the USA innovation ecosystem – I can say with absolute certainty that a strong, robust, and predictable intellectual property regime is essential for their commercial success. Any weakening of the USA IP system would disadvantage the future of the nation as China and the European Union continue to evolve and strengthen their IP systems to generate jobs, wealth, and security.”

Scott Kelly, a partner at Banner Witcoff in Washington, zeroes in on patent law, which he says “isn’t perfect, but it solves a critical problem. Scientific progress does not benefit from innovators keeping their inventions secret when it is trivial to copy someone else’s ingenuity. Patents incentivize a proactive approach to problem solving, and disclosure of those solutions, rather than a world where the best strategy is to let others make the investment and figure it out for you.”

The economic consequences of deleting all IP law would be severe. Russell Beck of Beck Reed Riden, LLP, of Boston notes that “IP makes up 90% of the value of S&P 500 companies”, citing Ocean Tomo’s Intangible Asset Market Value Study. He says that “eliminating IP rights would erase that value, stifle innovation, strip the US of its global competitiveness, and cripple the US economy. ‘Deleting’ IP doesn’t level the playing field for AI – it removes the field entirely. It replaces commercial ethics and rights with corporate espionage and IP theft.”

Having recently returned from The Sedona Conference’s Global IP Litigation Conference in The Hague, I am particularly sensitive to the international ramifications of ill-considered attacks on intellectual property. We are already making it difficult for foreign students, artists, and researchers to work in the United States through visa restrictions and academic funding cuts. We would exacerbate the problem if inventors and creators – and the capital backing them – decided that to protect their rights, they need to relocate to a jurisdiction with stronger patent, copyright, and trade secret laws. Many commentators have noted that a weakening of trademark protections would cause a flood of knockoff products into the domestic market, eroding consumer confidence.

Observers are correct to note that intellectual property law isn’t perfect, but we can’t afford to throw it all out. There are tensions in patent law between high tech, pharma, and manufacturing sectors. Trade secrets are becoming more important to startups, but restrict labor mobility. As a retired librarian, I find modern digital copyright restrictions difficult to square with traditional concepts of access to knowledge, but I am also anxious about the future for the musicians and videographers in my family.

At The Sedona Conference, we stand both for the “rule of law” and strive to move the law forward “in a reasoned and just way” through dialogue and consensus. It’s not easy, and it requires a lot of listening to understand different viewpoints and find common ground. It requires more than a four-word post with potentially dire consequences.

Maximizing Recovery in Trade Secret Cases: A Guide to Damages and Remedies

The landscape of trade secret damages has evolved dramatically in recent years, with courts awarding unprecedented sums in cases of proven misappropriation.

Recent verdicts, including the $604.9 million award in Propel Fuels v. Phillips 66 (over confidential data, proprietary strategies, and business intelligence regarding low carbon fuels) and the $452 million verdict in Insulet Corp v. EOFlow (involving tubeless insulin pump technology), demonstrate the potential for substantial recovery. However, securing such awards requires a sophisticated understanding of available remedies and a carefully planned approach to proving damages.

Understanding Available Damages Under the DTSA

The federal Defend Trade Secrets Act (DTSA) provides several distinct paths to monetary recovery, each serving different purposes and requiring different types of proof.

At the foundation are actual damages, which compensate for direct losses caused by misappropriation. These often begin with lost profits from sales diverted to competitor,s but can encompass much more. Companies frequently incur substantial costs developing their trade secrets, implementing remedial measures after theft, investigating the scope of misappropriation, and rebuilding damaged customer relationships.

All of these expenses may be recoverable as actual damages when properly documented and linked to the defendant’s misconduct.

The challenge in proving actual damages lies in establishing causation. Courts require evidence that specific losses resulted from the misappropriation rather than from other market factors or business conditions. This often necessitates careful analysis of historical performance data, market conditions, and customer behavior patterns to isolate the impact of the misappropriation.

Unjust enrichment provides an additional (or alternative) path to recovery by focusing on the defendant’s gains rather than the plaintiff’s losses. A plaintiff may recover damages for any unjust enrichment caused by the misappropriation of the trade secret that is not addressed in computing damages for their actual loss.

This approach can be particularly valuable when the defendant’s use of the trade secret generated profits beyond what the plaintiff lost. For instance, a defendant might have reached new markets or customers that the plaintiff wouldn’t have served, making unjust enrichment damages potentially larger than lost profits alone.

The scope of unjust enrichment can be quite broad. Beyond direct profits from sales, courts recognize that defendants may benefit from reduced development costs, accelerated time to market, improved manufacturing efficiency, and enhanced customer relationships. These benefits can be quantified and recovered even when they haven’t yet translated into direct profits.

As an alternative to actual damages and unjust enrichment, courts may award a reasonable royalty. This approach attempts to determine what a willing licensee would have paid a willing licensor for the right to use the trade secret.

Courts examining a reasonable royalty award of damages typically consider numerous factors, including:

Comparable licensing arrangements in the industry;

The competitive relationship between the parties;

The value of the secret to both parties;

Development costs saved by the defendant;

The portion of profit attributable to the trade secret and

Expert analysis of market conditions and value.

Enhanced Recovery Options

Beyond compensatory damages, trade secret law provides for potential recovery of enhanced damages and attorney’s fees in cases of particularly egregious conduct. When misappropriation is willful and malicious, courts can award exemplary damages up to twice the amount of compensatory damages.

Evidence of deliberate theft, attempts to cover up misappropriation, violation of court orders, or continued use after receiving notice can support such awards.

Attorneys’ fees represent another important component of potential recovery.

These become available in cases involving willful and malicious misappropriation or bad faith litigation conduct. The availability of attorneys’ fee awards can significantly impact litigation strategy and settlement dynamics, particularly in cases where proving damages may be challenging but liability (misconduct) is clear.

Permanent Injunctive Relief and Alternative Remedies

While monetary damages often take center stage, injunctive relief remains a crucial remedy in trade secret cases.

Parties typically begin a trade secret case by seeking a temporary restraining order and then a preliminary injunction. These orders prohibit a defendant from using a trade secret while litigation is pending up through trial.

However, at the conclusion of a case, parties can also seek an injunction that will prohibit the disclosure of the trade secret permanently and/or the use of the trade secret. Courts typically will permanently enjoin a defendant from sharing a trade secret, but an injunction on use of the trade secret is normally less permanent. Courts structure “permanent” injunctions regarding the use of a trade secret around the concept of a “head start” period – the time it would have taken the defendant to independently develop the trade secret. This approach aims to eliminate any unfair advantage gained through misappropriation, while recognizing that trade secrets don’t confer perpetual monopolies.

In some situations, courts may order ongoing royalty payments instead of a permanent injunction. This usually occurs when completely barring use of the trade secret would be inequitable or against the public interest. For instance, if the defendant has incorporated the trade secret into products serving essential public needs, a court might prefer a royalty solution over an injunction.

Building a Strong Damages Case

Successfully proving damages requires careful preparation from the earliest stages of the case. Early case assessment should examine potential damages theories and identify necessary evidence before critical information is lost. This initial analysis helps guide discovery requests, identify necessary experts, and make strategic decisions about settlement parameters.

Selection of expert witnesses proves crucial in most trade secret cases. Beyond technical expertise, damages experts need strong communication skills and the ability to present complex financial analyses in understandable terms.

Damages experts should be involved early enough to help shape discovery and document preservation efforts.

Documentation becomes particularly important in trade secret cases because of the need to establish both the secret’s value and the impact of its misappropriation.

Companies should maintain detailed records of development costs, efforts, and associated expenses to maintain secrecy, value derived from the secret, affected customer relationships, market impact, and remedial measures taken. This documentation helps demonstrate both the existence of damage and its quantum.

Strategic Considerations for Maximum Recovery

Several strategic considerations can significantly impact ultimate recovery in trade secret cases.

First, maintaining multiple theories of recovery throughout trial provides maximum flexibility. Courts typically allow plaintiffs to elect their preferred theory of recovery (actual damages vs. unjust enrichment vs. reasonable royalty) after all evidence is presented, so preserving all viable theories until that point maximizes potential recovery.

The international reach of trade secret claims presents another strategic consideration. The DTSA can reach conduct outside the United States when any act in furtherance of misappropriation occurs domestically. This allows recovery of damages from foreign sales or use when there’s a U.S. nexus, potentially expanding the scope of recovery significantly.

Timing considerations permeate trade secret damages analysis. Key questions include when misappropriation began, when it should have been discovered, the appropriate “head start” period, and the commercial life of the secret. These temporal factors can significantly impact the calculation of both damages and the scope of injunctive relief.

Looking Forward

The complexity of trade secret damages demands careful attention from the outset of any potential case. Success requires understanding available theories of recovery, maintaining necessary documentation, and building strong expert support.

While recent high-value verdicts demonstrate the potential for substantial recovery, achieving such results requires methodical preparation and strategic presentation of damages evidence.

Our final article will explore preventive measures and best practices for protecting trade secrets before misappropriation occurs, completing our comprehensive examination of trade secret protection and enforcement.

Trade Secret Law Evolution Podcast, Episode 76: Two Circuit Cases on Trade Secret Identification, Proof of Misappropriation and Contractual Damages Waivers [Podcast]

In this episode, Jordan Grotzinger discusses a recent Fifth Circuit case that addressed trade secret identification and proof of misappropriation at trial, and an Eleventh Circuit case addressing whether and how trade secret misappropriation damages can be limited by contract.

Toward Digital-Ready Design Protection: The New EU Design Act

The European Union has undertaken a comprehensive modernization and harmonization of its design protection framework. The reform, commonly referred to as the “Design Act,” comprises two legislative measures: the Design Regulation (Regulation (EU) 2024/2822, which amends Regulation (EC) No 6/2002 and repeals Regulation (EC) No 2246/2002) and the Design Directive (Directive 2024/2823, which replaces Directive 98/71/EC).

The EU aims to align design protection with technological advancements, particularly in the realm of digital and animated designs. At the same time, the system is being simplified to better serve businesses and designers while strengthening enforcement mechanisms and promoting harmonization.

The Design Regulation deals with the EU Design (which is the new name for the former Community Design) and its registration, protection and enforcement, while the Design Directive sets mandatory requirements for the national designs that each Member State will need to implement into national legislation.

Key Changes at a Glance

The Design Act seeks to align EU design protection with the demands of the digital age while enhancing its accessibility and user-friendliness:

Digital and animated designs are explicitly protected in order to ensure comprehensive protection in the digital and virtual space.

For both the register for EU Designs and national Designs, protection of registered designs has been increased. A design that is registered in the EU register or a national register is deemed to be valid and is deemed to be owned by the registered owner.

Application procedures are streamlined within the EU.

Enforcement rights are strengthened.

Design owners gain new tools for legal certainty.

Specific market needs — such as component part availability— are addressed through the introduction of a repair clause, exempting repair parts from protection.

Replacement of the term “Community design” with “EU design.”

A circled D symbol (Ⓓ) can be used to indicate design protection on products.

Implementation Phases

The reforms the Design Act introduces will be implemented progressively across three phases.

Phase 1 (from May 1, 2025): Initial Practical Changes

Simplified and Unified Registration Process

The requirement for “unity of class” in multiple design applications is abolished, allowing multiple designs from different Locarno classes to be combined into a single application (capped at 50 designs per application), reducing administrative effort and costs.

(Art. 35 ff. Design Regulation/ Art. 27 Design Directive)

Updated Fee Structure

A single, unified application fee simplifies the cost structure. Renewal fees are increased but better reflect the commercial value of extended design protection. While the registration itself will not become more expensive, the renewal fees after the fifth year will increase. However, because the “unity of class” requirement is abolished, multiple applications will be more cost-efficient than before.

(Design Regulation, Annex I)

Amended Renewal Process

Registered designs must be renewed within the six-month period before expiration – this includes both the request and the fee payment.

(Art. 50d Design Regulation/ Article 32 Design Directive)

Enhanced Enforcement Powers

New rights may enable design owners to act against unauthorized 3D printing of their designs and counterfeit goods passing through the EU (transit goods), closing enforcement gaps and enhancing the overall enforcement framework.

(Art. 19 Design Regulation/ Art. 16 Design Directive)

Design Symbol Introduction

Design owners may now use the “Ⓓ” symbol to indicate protected designs, similar to trademarks (®) or copyrights (©) to deter potential infringers in the field of design law. Additional identifiers, such as registration numbers or links to the EU design register, may also be used.

(Art. 26a Design Regulation/ Art. 24 Design Directive)

Phase 2 (from July 1, 2026): Expanding the Scope of Protection

Expanded Definition of Designs

The definition of protectable designs now explicitly encompasses dynamic features such as motion, transitions, and animation – addressing the growing prominence of digital design.

(Art. 3 (1) Design Regulation; Art. 2 (3) Design Directive)

New Representation Requirements

The European Union Intellectual Property Office executive director will determine formats, numbering, and technical specifications for both static and animated design representations, ensuring clarity and consistency in registration.

(Art. 36 Design Regulation/ Art. 26 Design Directive)

Phase 3 (by Dec. 9, 2027): Market-Specific Adjustments

Introducing a Repair Clause

Component parts of complex products – where design is dictated by the appearance of the whole product and the component part used solely to restore that appearance (e.g., automotive body parts) – are excluded from design protection. However, an eight-year transitional period, ending on Dec. 9, 2032, preserves the existing protection for such parts during that time.

(Art. 20a Design Regulation/ Art. 19 Design Directive)

Conclusion

The EU’s Design Reform introduces a modernized legal framework that seeks to meet the evolving challenges of digitalization, enhance legal certainty, simplify administrative processes, and strengthen enforcement capabilities.

While EU trademark law has long been aligned across member states, design law had previously lagged behind in terms of consistency and uniformity. With the Design Act package, the EU is now taking further steps toward achieving a more coherent and fully harmonized design protection system.

Businesses and designers are encouraged to begin preparing for the phased changes now to enhance compliance and to leverage the new legal opportunities.

China’s State Administration for Market Regulation Releases RFC for Regulations on the Protection of Trade Secrets

On April 25, 2025, China’s State Administration for Market Regulation (SAMR) released the draft Regulations on the Protection of Trade Secrets for comment (商业秘密保护规定(征求意见稿)). Comments are due May 25, 2025. This draft updates the 1998 version with necessary revisions due to the march of technology. As explained by SAMR:

The revision and promulgation of the “Regulations on the Protection of Trade Secrets” is an urgent need to adapt to the new situation and new challenges of trade secret protection. With the development and changes of the domestic and international economic situation, the “Several Provisions on Prohibition of Infringement of Trade Secrets” revised in 1998 has lagged behind the needs of practice and needs to be revised and improved in line with the times. On the one hand, with the rapid development of the digital economy, digital information has become an important carrier of corporate trade secrets. The huge changes in trade secrets in the digital age have put forward higher technical requirements for corporate self-protection and administrative law enforcement, and there is an urgent need for detailed and clear rules and guidance. On the other hand, in recent years, the world’s major developed economies have issued some new institutional regulations on trade secret protection, and major multilateral economic and trade agreements have also put forward clear requirements for trade secret protection. Improving the system of trade secret protection is an inevitable requirement to connect with international high-standard economic and trade rules and better respond to the new trend of global market competition.

A translation follows. The original text and drafting notes are available here (Chinese only).

Chapter I General Provisions

Article 1 These Regulations are formulated in accordance with the Anti-Unfair Competition Law of the People’s Republic of China (hereinafter referred to as the “Anti-Unfair Competition Law”) and other relevant laws, administrative regulations, and relevant documents of the Party Central Committee and the State Council in order to strengthen the protection of trade secrets, stop acts of infringement of trade secrets, protect the legitimate rights and interests of trade secret rights holders and related entities, encourage research and development and innovation, maintain a fair and competitive market order, and serve the high-quality development of the economy and society.

Article 2 The acquisition, disclosure and use of trade secrets shall follow the principles of voluntariness, equality, fairness and good faith, and comply with laws, regulations and business ethics.

Article 3 The market supervision and management department is responsible for the organization, coordination, and guidance of the protection of trade secrets and the administrative law enforcement of trade secret infringements.

Chapter II Definition of Trade Secrets

Article 4 The term “trade secrets” as used in these Regulations refers to commercial information such as technical information, business information, etc. that is not known to the public, has commercial value, and for which the right holder has taken corresponding confidentiality measures.

Information related to technology, such as structures, raw materials, components, formulas, materials, samples, styles, designs, new plant variety propagation materials, processes, methods or their steps, algorithms, data, computer programs and related documents, may be deemed to constitute the technical information referred to in the first paragraph of this Article.

Creativity, management, sales, finance, plans, samples, bidding materials, customer information, data and other information related to business activities may be deemed to constitute the business information referred to in the first paragraph of this Article.

Article 5 The customer information referred to in these regulations includes the customer’s name, address, contact information, and transaction habits, intentions, content and other information.

If an operator claims that specific customer information is a trade secret simply because it maintains a long-term and stable trading relationship with the specific customer, such claim will not be recognized.

If a customer conducts market transactions with an employee’s company based on trust in the employee personally, and after the employee leaves the company, it can be proved that the customer voluntarily chose to trade with the employee or his new company, it should be deemed that the employee did not use improper means to obtain the customer information of the original company.

Article 6 The term “not known to the public” as used in these Regulations means that the information was not generally known or easily accessible to relevant personnel in the field to which it belongs when the suspected infringement occurred.

Under any of the following circumstances, the relevant information may be deemed to be known to the public:

(1) The information is common knowledge or industry practice in the relevant field;

(ii) The information only involves the product’s dimensions, structure, materials, simple combination of components, etc., which can be directly obtained by relevant personnel in the field by observing the marketed products;

(3) The information has been publicly disclosed in public publications or other media;

(4) The information has been made public through public reports, exhibitions, etc.;

(5) Relevant personnel in the relevant field can obtain the information from other public channels.

If new information is formed by organizing, improving and processing information known to the public and meets the provisions of the first paragraph of this Article, it shall be deemed that the new information is not known to the public.

Article 7 The term “commercial value” as used in these Regulations means that the information has actual or potential commercial value because it is not known to the public and can bring commercial benefits or competitive advantages to the right holder.

If any of the following circumstances is met, the information can be deemed to bring commercial benefits or competitive advantages to the right holder, unless there is contrary evidence to prove that the information has no commercial value:

(1) The information brings economic benefits to the right holder;

(2) The information has a significant impact on the production and operation of the right holder;

(3) The right holder has paid a corresponding price, research and development costs or operating costs or other material inputs to obtain the information, which has brought the right holder a competitive advantage;

(iv) Other circumstances that can prove that the information can bring commercial benefits or competitive advantages to the right holder.

If the interim results formed in production and operation activities meet the requirements of the first paragraph of this Article, such results may be deemed to have commercial value.

Article 8 The “appropriate confidentiality measures taken by the right holder” as used in these Regulations refers to reasonable confidentiality measures taken by the right holder before an infringement occurs to prevent information leakage that are commensurate with factors such as the commercial value of the trade secret and the difficulty of independent acquisition.

If any of the following circumstances exists and the leakage of confidential information can be prevented under normal circumstances, it can be deemed that the right holder has taken “corresponding confidentiality measures”:

(1) Signing a confidentiality agreement or stipulating confidentiality obligations in a contract;

(2) Imposing confidentiality requirements on employees, former employees, suppliers, customers, visitors, etc. who have access to or obtain trade secrets through charters, training, rules and regulations, written notifications, etc.;

(3) Restricting visitors to factories, workshops and other production and operation sites involving confidential information or implementing differentiated management;

(4) distinguishing and managing trade secrets and their carriers by marking, classifying, isolating, encrypting, sealing, limiting the scope of persons who can access or obtain them, etc.;

(5) Taking measures such as prohibiting or restricting the use, access, storage, or copying of computer equipment, electronic equipment, network equipment, storage equipment, software, etc. that can access or obtain trade secrets;

(6) requiring a resigned employee to register, return, remove or destroy the trade secrets and their carriers that he or she has accessed or obtained, and to continue to bear the obligation of confidentiality;

(7) Other reasonable confidentiality measures are taken.

Chapter III Construction of Trade Secret Protection System

Article 9 Operators shall implement the principal responsibility for protecting trade secrets, strengthen self-protection awareness and capacity building, and actively take effective measures to strengthen internal control and compliance management of trade secrets protection such as confidential information, confidential areas, confidential personnel, and confidential carriers based on their own industry characteristics, technical requirements, and competitive advantages, and consciously resist infringements.

Article 10 Market supervision and administration departments are responsible for the organization, coordination, supervision, administration and service guidance of trade secrets protection. Through publicity and training, building service sites, improving law enforcement capabilities, and cultivating third-party service agencies, they help operators establish and improve trade secrets protection systems and promote the overall improvement of trade secrets protection levels.

Article 11 The market supervision and management department shall, together with relevant departments, provide legal consultation, policy guidance, risk warning, rights protection support and other services to operators, strengthen foreign-related rights protection guidance and assistance, guide operators to carry out trade secret protection work, and safeguard their own legitimate rights and interests.

The market supervision and management departments will work with the judicial departments to establish a rapid and coordinated protection mechanism for commercial secrets that involves information exchange, resource sharing, case consultation, and law enforcement coordination, and strengthen the effective connection between administrative protection and judicial protection.