Beltway Buzz, June 6, 2025

The Beltway Buzz™ is a weekly update summarizing labor and employment news from inside the Beltway and clarifying how what’s happening in Washington, D.C., could impact your business.

Senate Republicans Want Legislative Priorities Passed in June. All eyes are on the U.S. Congress this week as Republicans in the U.S. Senate roll up their sleeves and get down to working on their version of the One Big Beautiful Bill Act. President Donald Trump has stated that he wants to sign the bill by July 4, which gives Senate Republicans roughly four weeks to pass the bill—an ambitious timetable. As a reminder, because Republicans are using the reconciliation legislative process, they can pass this bill on their own in the Senate, without the need to convince Democrats to vote in favor of the bill.

Buzz readers know that we are watching closely the status of the “no tax on tips and overtime” provisions in the House-passed reconciliation bill, particularly since the Senate passed the No Tax on Tips Act (S.129). Already at least one Republican senator has expressed concern over the U.S. House of Representatives version’s language on tips, because it would benefit certain workers over others, even when they earn the same amount of money. The Buzz is also watching to see if the Regulations from the Executive in Need of Scrutiny (REINS) Act, which was included in the House bill, will survive the reconciliation process in the Senate. The REINS Act is, in a way, the opposite of the Congressional Review Act (CRA), which we’ve often examined: while the CRA allows Congress to disapprove regulations after they’ve been finalized, the REINS Act would require Congress to affirmatively approve of regulations before they can be finalized.

SCOTUS Rejects Heightened Evidentiary Standard for Majority Group Plaintiffs. In a unanimous decision this week, the Supreme Court of the United States ruled that a plaintiff from a majority group does not have to demonstrate additional “‘background circumstances” at the initial phase of his or her case. Aaron Warshaw has the details, including how the decision may play out amidst the administration’s current scrutiny of diversity, equity, and inclusion programs.

President Trump Issues Travel Ban. On June 4, 2025, President Trump issued a proclamation entitled, “Restricting The Entry of Foreign Nationals to Protect the United States from Foreign Terrorists and Other National Security and Public Safety Threats.” Effective June 9, 2025, the proclamation “fully restrict[s] and limit[s] the entry of nationals” from the following twelve countries:

Afghanistan,

Burma,

Chad,

Republic of the Congo,

Equatorial Guinea,

Eritrea,

Haiti,

Iran,

Libya,

Somalia,

Sudan, and

Yemen.

The proclamation further institutes partial limitations and restrictions on the entry of nationals from the following seven countries:

Burundi,

Cuba,

Laos,

Sierra Leone,

Togo,

Turkmenistan, and

Venezuela.

These restrictions apply to both immigrant and nonimmigrant visas and “only to foreign nationals of the designated countries who:

are outside the United States on the applicable effective date of this proclamation; and

do not have a valid visa on the applicable effective date of this proclamation.”

A variety of exceptions are provided, including for lawful permanent residents of the United States, international athletes, immediate family immigrant visas, adoptions, and others. Whitney Brownlow and Ashley Urquijo have the details.

SCOTUS Allows CHNV Rescission to Proceed. On May 30, 2025, the Supreme Court of the United States stayed a ruling by the U.S. District Court for the District of Massachusetts to block the Trump administration’s rescission of the Cuba, Haiti, Nicaragua, and Venezuela (CHNV) humanitarian parole program. The ruling removes parole protections and work authorization for approximately 532,000 individuals while the legal challenge to the administration’s termination decision continues to work its way through the courts. In dissent, Justice Ketanji Brown Jackson (who was joined by Justice Sonia Sotomayor) wrote that the Court’s ruling “undervalues the devastating consequences of allowing the Government to precipitously upend the lives and livelihoods of nearly half a million noncitizens while their legal claims are pending.” Whitney Brownlow and Derek J. Maka have the details. Evan B. Gordon and Daniel J. Ruemenapp wrote previously about what the removal of work authorization for covered individuals means for employers.

DOL Launches New Opinion Letter Landing Page. This week the U.S. Department of Labor (DOL) announced the launch of its opinion letter program. The program will provide compliance assistance to stakeholders with questions regarding federal laws overseen by the Wage and Hour Division, the Occupational Safety and Health Administration, the Employee Benefits Security Administration, the Veterans’ Employment and Training Service, and the Mine Safety and Health Administration (which will also “provide compliance assistance resources through its new MSHA Information Hub, a centralized platform offering guidance, regulatory updates, training materials and technical support”). According to the announcement,

Opinion letters provide official written interpretations from the department’s enforcement agencies, explaining how laws apply to specific factual circumstances presented by individuals or organizations. By addressing real-world questions, they promote clarity, consistency, and transparency in the application of federal labor standards.

The DOL’s new opinion letter landing page is here. Opinion letters were a longstanding practice of the agency until the Obama administration, which replaced them with “Administrator’s Interpretations.” The program was resuscitated during President Trump’s first administration but used sparingly during the Biden administration. John D. Surma has the details on Deputy Secretary of Labor Keith Sonderling’s announcement of the program.

Budget Time! It is the time of year when the administration offers its budget to Congress in anticipation of the 2026 fiscal year (FY), which commences on October 1, 2026. Agency budget justifications are aspirational in nature, but can help guide Congress towards some final numbers, particularly in the current political climate, where Republicans control Congress and the White House.

Department of Labor. The DOL is requesting a FY 2026 budget of $8.6 billion, about $5 billion less than enacted in the current fiscal year. The budget proposes to completely shut down the remaining functions of the Office of Federal Contract Compliance Programs, transferring enforcement of the Vietnam Era Veterans’ Readjustment Assistance Act to Veterans’ Employment and Training Service, and enforcement of Section 503 of the Rehabilitation Act of 1973 to the U.S. Equal Employment Opportunity Commission (EEOC). T. Scott Kelly, Christopher J. Near, and Zachary V. Zagger have the details on the Trump administration’s proposal to eliminate OFCCP.

EEOC. The Commission is requesting $435 million in FY 2026, about $20 million less than enacted in the current fiscal year. As part of the “Chair’s Message” section of the budget submission, Acting Chair Andrea Lucas makes the EEOC’s FY 2026 priorities clear:

the agency substantively will focus on relentlessly attacking all forms of race discrimination, including rooting out unlawful race discrimination arising from DEI programs, policies, and practices; protecting American workers from unlawful national origin discrimination involving preferences for foreign workers; defending women’s sex-based rights at work; and supporting religious liberty by protecting workers from religious bias and harassment and protecting their rights to religious accommodations at work.

National Labor Relations Board. The Board is requesting $285.2 million in FY 2026, about $14 million below the FY 2025 enacted budget of $299.2 million. The anticipated savings largely come from “staff attrition” of ninety-nine employees, which would bring the NLRB staff to 1,152.

Remember that this is all just the administration’s ask. Ultimately, Congress retains the power of the purse and will set agency spending levels (and would have to authorize the transfer of Section 503 responsibility to the EEOC).

“Our Next Item Up for Bid … IRS Commissioner.” The Senate Committee on Finance has advanced the nomination of Billy Long to be Internal Revenue Service (IRS) commissioner. Long, a Republican, represented Missouri’s 7th congressional district from 2011 to 2023. Prior to his career in politics, Long was an auctioneer and owned his own auction company. He was no slouch, either. Long was named “Best Auctioneer in the Ozarks” for seven years in a row and is a member of the National Auctioneers Association Hall of Fame. During a congressional hearing in 2018, Long famously employed a mock auction chant to drown out a protestor until she was escorted out. Assuming he gets confirmed by the Senate, maybe Long can use his fast-talking skills to speed up those IRS audits.

SCOTUS Declines to Decide Fate of Classes with Uninjured Members: 8-1 Decision in LabCorp Leaves Unresolved Whether Rule 23 Allows Certification for a Class Containing Members Who Lack Standing

The United States Supreme Court, in an 8-1 decision on June 5, 2025, dismissed the highly anticipated case of Laboratory Corporation of America Holdings v. Davis as “improvidently granted.” Laboratory Corporation of America Holdings, dba Labcorp, v. Luke Davis, et al., No. 22-55873. The decision, or lack thereof, sidesteps a critical question for class action litigation: whether a damages class can be certified under Federal Rule of Civil Procedure 23 when it includes individuals who have not suffered any actual injury.

LabCorp was challenging a Ninth Circuit decision that allowed the certification of a massive class of visually impaired individuals under California’s Unruh Civil Rights Act. Cal. Civ. Code. § 51. The suit alleged LabCorp’s check-in kiosks were inaccessible, triggering statutory damages of $4,000 per violation. With a class size potentially in the hundreds of thousands, the exposure was astronomical—a classic case of “bet the company” litigation.

Background of the Case

LabCorp is a clinical diagnostic laboratory that tests samples collected from patients at its patient service centers. In a suit filed before the U.S. District Court for the Central District of California, a group of legally blind and visually impaired individuals sued LabCorp under the Americans with Disabilities Act (ADA) and the Unruh Civil Rights Act, alleging that the company’s self-service check-in kiosks were inaccessible. The District Court certified a damages class consisted of “[a]ll legally blind individuals in California who visited a LabCorp patient service center in California during the applicable limitations period and were denied full and equal enjoyment of the goods, services, facilities, privileges, advantages, or accommodations due to LabCorp’s failure to make its e-check-in kiosks accessible to legally blind individuals.”

LabCorp filed a petition under Rule 23(f)’s interlocutory appellate procedure, contending that the class encompassed uninjured individuals.

While LabCorp’s petition was pending, the District Court clarified the class definition, explaining that the class included “[a]ll legally blind individuals who . . . , due to their disability, were unable to use” LabCorp kiosks.

Subsequently, the Ninth Circuit granted LabCorp’s Rule 23(f) petition. LabCorp’s key argument was that the class was fatally overly broad and swept in countless individuals who may have never intended to use a kiosk in the first place, and thus suffered no actual injury. The Ninth Circuit relying on its opinion in Olean Wholesale Grocery Coop., Inc. v. Bumble Bee Foods LLC, 31 F.4th 651, 665 (9th Cir. 2022), held that a class can be certified even if it includes “more than a de minimis number of uninjured class members.”

Supreme Court Proceedings

The Supreme Court initially granted certiorari to address the question of “[w]hether a federal court may certify a class action pursuant to Federal Rule of Civil Procedure 23(b)(3) when some members of the proposed class lack any Article III injury.” However, after oral arguments, the Court dismissed the case in a one-line order, without ruling on the merits, stating that the writ of certiorari was “improvidently granted.”

Justice Kavanaugh’s Dissent

Justice Kavanaugh dissented from the dismissal, expressing that the Court should have addressed the merits. He argued (correctly) that certifying a damages class containing uninjured members is inconsistent with Rule 23, which requires that common questions of law or fact predominate in class actions. Notably, Kavanaugh also emphasized the risk from “[c]lasses that are overinflated with uninjured members rais[ing] the stakes for businesses that are the targets of class actions.” He went on to underscore that certifying such classes “can coerce businesses into costly settlements that they sometimes must reluctantly swallow rather than betting the company on the uncertainties of trial.”

“Classes that are overinflated with uninjured members raise the stakes for businesses that are the targets of class actions.”

The Circuit Split

This decision effectively leaves undisturbed the split in authorities that has existed since the Supreme Court’s decision in TransUnion LLC v. Ramirez, 594 U.S. 413, 431 (2021). In TransUnion, while the Supreme Court held that “[e]very class member must have Article III standing in order to recover individual damages,” it did not decide when a class member’s standing must be established and whether a class can be certified if it contains uninjured class members. Subsequently, while some courts have denied class certification if there are uninjured class members, other courts have found it appropriate to address a class member’s standing after certification.

LabCorp, in its petition for certiorari, addressed the “three camps” of opinions:

Circuits holds that a class may not be certified where it includes members who have suffered no Article III injury (the Second Circuit, Eighth Circuit, and some courts in the Fifth and Sixth Circuits);

Circuits that have strictly applied Rule 23(b)(3)’s predominance requirement to reject classes that contain more than a de minimis number of uninjured members (the D.C. Circuit and the First Circuit); and

Circuits that have held that the presence of uninjured class members should not ordinarily prevent certification (the Ninth Circuit, Seventh Circuit, and Eleventh Circuit).

In light of the majority opinion, this question remains unresolved.

Supreme Court Eases Burden Of Proof In “Reverse Discrimination” Claims (US)

On June 5, 2025, the United States Supreme Court issued its opinion in Ames v. Ohio Department of Youth Services, No. 23-1039, reviving a lawsuit brought by a heterosexual female employee who alleged she was discriminated against by her employer in favor of less qualified gay candidates. The decision conclusively establishes that the evidentiary burden in so-called “reverse discrimination” cases is identical as in cases brought by members of minority race, gender, and sexual orientation groups.

Marlean Ames worked for the Ohio Department of Youth Services for 15 years, rising from executive secretary to Program Administrator. In 2019, Ms. Ames applied and interviewed for a newly created management position in the agency’s Office of Quality and Improvement, but the Department hired a lesbian instead. A few days later, Ms. Ames received word that, not only was she not getting the promotion she hoped for, but she was also being demoted to her original secretarial position and stripped of the pay raise that had accompanied her promotion. The agency then filled Ms. Ames vacant former role with a newly hired candidate, a gay man.

Ms. Ames sued the agency under Title VII, alleging she was denied the promotion and demoted because of her sexual orientation—heterosexual—but she lost at the trial court and again at the Sixth Circuit Court of Appeals. The federal appellate court concluded that Ms. Ames failed to meet her prima facie burden of proving discrimination because she had not pointed to “background circumstances to support the suspicion that the defendant is that unusual employer who discriminates against the majority.” The Sixth Circuit reasoned that, as a straight woman, Ms. Ames was required to prove additional facts to establish reverse discriminatory bias “in addition to the usual ones for establishing a prima facie case.” Like the Sixth Circuit, the Seventh, Eighth, Tenth, and D.C. Circuits also imposed a heightened evidentiary burden on majority-group plaintiffs as compared to minority-group plaintiffs at the prima facie stage; other Circuits did not. The Supreme Court granted review to resolve the Circuit split.

Writing for a unanimous court, Justice Ketanji Brown Jackson opined that the Sixth Circuit’s “additional ‘background circumstances’ requirement is not consistent with Title VII’s text or our case law construing the statute.” Noting that Title VII makes it unlawful “to fail or refuse to hire or to discharge any individual, or otherwise to discriminate against any individual … because of such individual’s race, color, religion, sex, or national origin,” the Court concluded that Title VII’s protections apply to every individual without regard to that individual’s membership in a minority or majority group. In other words, “Congress left no room for courts to impose special requirements on majority-group plaintiffs alone.”

The Court reminds employers and courts alike that a plaintiff’s burden at the prima facie stage is neither “rigid, mechanized, or ritualistic.” Having adduced sufficient evidence that she was qualified for the positions she held and sought and that she was treated less favorably than others not sharing her sexual orientation, Ms. Ames satisfied her modest prima facie burden. At that stage, the trial court should have considered whether her employer could credibly rebut her allegations of discrimination with evidence of a legitimate, non-prextual, non-discriminatory reason for its employment decisions. As the lower courts never moved past the prima facie analysis and applied the wrong evidentiary burden even at that early stage, the Court remanded the case for further consideration.

The takeaway for employers is that Ames levels the playing field for majority-group and minority-group Title VII litigants. Employers should not dismiss out of hand claims by male employees alleging more favorable treatment of women or of white employees alleging more favorable treatment of people of color, nor should courts seek that “something more” that would prove the employer to be an outlier that discriminates against the majority. The Supreme Court has spoken unanimously: all claims of discrimination are subject to the same evidentiary burden, regardless of the plaintiff-employee’s majority-group status.

A Final Rule Bites the Dust, Part II: FDA Gives up on Regulating LDTs as Medical Devices

As the song goes, the Food and Drug Administration’s (“FDA’s”) 2024 Final Rule regulating laboratory-developed tests (“LDTs”) as medical devices (“Final Rule”), is not merely dead—it’s really most sincerely dead.

Perhaps not for good, but for the foreseeable future, at least.

The FDA has let the clock run out on the 60-day time period to appeal the March 31, 2025, decision by the U.S. District Court for the Eastern District of Texas concluding that: 1) the FDA overstepped its authority, and 2) the LDT Final Rule of May 6, 2024, was unlawful. As we explained at that time, the Final Rule would have required virtually all clinical laboratories offering their own LDTs to comply with FDA expectations for medical device manufacturers in phases over a four-year period—with the first compliance deadlines set for May 2025.

The March 2025 opinion by Judge Sean D. Jordan vacated the controversial Final Rule a little more than a month before the first implementation deadlines were to take effect, and remanded the issue back to the FDA.

Now, absent an appeal, it is not likely that the last remaining option to salvage the Final Rule—i.e., congressional action—will happen in the current political climate.

As we explained at the time of its release, the 2024 Final Rule followed more than a decade of uncertainty as to the course of action the agency would take with respect to LDTs. When it came, the Final Rule escaped potential rollback by a future presidential administration as a “midnight rule” under the Congressional Review Act—yet threw clinical labs into nearly a year o

As we anticipated, the Supreme Court’s June 28, 2024, decision in Loper Bright Enterprises v. Raimondo—ending Chevron deference to agencies when interpreting ambiguous statutes—made it easier for entities to challenge both FDA authority and the validity of the agency’s Final Rule. The American Clinical Laboratory Association and the Association for Molecular Pathology filed suit in federal district court in Texas on May 29, 2024, and August 19, 2024, respectively.

But perhaps no one could have anticipated the extent to which the FDA itself has changed in the lifespan of the LDT Final Rule—with unprecedented staff cutbacks, changing policies and priorities, and a continued emphasis on deregulation at the federal level that is not likely to change until a future presidential administration rolls in. States, meanwhile, continue to regulate LDTs to some extent, and the FDA continues to have authority to regulate certain components of LDTs (such as reagents and collection devices), as well as in vitro diagnostics. While this particular chapter on LDTs has drawn to a close, we aren’t going anywhere—and we will continue to advise our lab clients on state as well as remaining federal compliance considerations.

Attorney Ann W. Parks contributed to this article

Title VII Lawsuit in Utah Federal District Court Challenges Employee’s Firing After Making Online Posts

An in-house attorney recently sued his former employer in a Utah federal district court for discrimination and retaliation under Title VII of the Civil Rights Act of 1964, alleging he was unlawfully fired after posting social media remarks criticizing gender-affirming care for transgender people and opposing a Utah nonprofit organization that advocates for LGBTQ+ rights.

Quick Hits

A former employee in Utah recently brought a federal lawsuit, claiming he was fired for criticizing on social media a LGBTQ+ rights nonprofit that partnered with his employer.

The gay Christian employee is alleging sex, sexual orientation, and religious discrimination in violation of Title VII of the Civil Rights Act of 1964.

The case is in the U.S. District Court for the District of Utah.

On May 22, 2025, a former employee for a Utah-based software company sued the company for discrimination and retaliation after he was fired a few months after he posted comments on social media criticizing gender-affirming care for transgender people and critical of Equality Utah’s policy positions. Equality Utah is a local nonprofit that supports LGBTQ+ rights.

The plaintiff, a gay Christian man, worked as in-house counsel. He alleged the software company discriminated against him based on his religion, sex, and sexual orientation, and retaliated against him for invoking nondiscrimination protections.

In February 2023, the plaintiff posted remarks on his social media account opposing Equality Utah’s positions regarding gender-affirming care for transgender children. The software company had earned a business equality leader certification from Equality Utah and partnered with the organization for trainings on diversity, equity, and inclusion (DEI). A leader at Equality Utah complained several times to the plaintiff’s employer about his social media comments on the plaintiff’s personal social media account and his account as president of the Utah Log Cabin Republicans.

In October 2023, the company fired the plaintiff, citing poor performance.

The plaintiff’s federal complaint alleges sex discrimination and religious discrimination under Title VII of the Civil Rights Act of 1964, but did not assert a claim under Utah’s Antidiscrimination Act.

Utah’s Antidiscrimination Act prohibits Utah employers from taking adverse employment action against employees for “lawful expression or expressive activity outside of the workplace regarding the [employee’s] religious, political, or personal convictions, including convictions about marriage, family, or sexuality, unless the expression or expressive activity is in direct conflict with the essential business-related interests of the employer.” The state law permits workers to express “religious or moral beliefs and commitments in the workplace in a reasonable, non-disruptive, and non-harassing way.”

The case raises questions about what employers can include in their social media policies and how such policies may be enforced. While the free speech rights in the U.S. Constitution do not give private employees free rein to say whatever they want on their personal social media accounts, other laws such as Title VII and their state law equivalents may provide protection. In some circumstances, employers may lawfully discipline or fire employees for disparaging the employer or using offensive language on social media, particularly if the post includes references to the company name or logo.

But at the same time, under the National Labor Relations Act (NLRA), private employees have the right to discuss wages and the terms and conditions of employment, which may include religious discrimination or sex discrimination in the workplace. This case is also a good reminder that even within a protected category, there may be conflict in viewpoints, and employers may want to be prepared to respond to such disagreements.

Next Steps

Employers may want to develop and distribute to employees a well-crafted social media policy that respects employees’ legal rights, including protections under state and federal law, and that also maintains workplace standards and protects business interests.

Employers that are developing or updating their social media policies may want to consider the following key principles and tips:

Including in the written policy specific examples of acceptable and unacceptable commentary and conduct.

Making it clear that employees must not use the company’s name, branding, or position themselves as speaking on behalf of the company without authorization.

Applying and enforcing the social media policy consistently with all employees in order to prevent claims of discrimination or retaliation.

Periodically reminding employees and managers about the social media policy.

Training supervisors and managers about what constitutes protected activity under the NLRA.

In Utah, taking care not to take adverse action against employees for lawful expression outside the workplace involving religious, political, or personal convictions, including matters such as marriage, family, or sexuality, unless the expression directly conflicts with the employer’s essential, business-related interests.

Judge Rules Thousands of Venezuelan TPS Beneficiaries Remain Work Authorized; Group Focuses on DHS Venezuela, Haiti TPS Decision

On June 2, 2025, U.S. District Court Judge Edward Chen ruled that the Department of Homeland Security (DHS) cannot invalidate Venezuela Temporary Protected Status (TPS) documents, including work authorization documents, issued pursuant to the Biden Administration’s Jan. 17, 2025, 18-month extension of Venezuela TPS. This ruling applies to documents received by beneficiaries on or before Feb. 5, 2025, the date of the Federal Register Notice announcing DHS’s decision to terminate the Venezuela TPS program.

Judge Chen pointed to Section 1254a(d)(3) of the Immigration and Nationality Act, which says TPS-related documents can be invalidated only after a termination notice is published.

Judge Chen’s order impacts approximately 5,000 Venezuela TPS beneficiaries.

DHS has not yet responded to Judge Chen’s June 2 ruling in light of the U.S. Supreme Court’s May 19 ruling granting a Justice Department request to lift Judge Chen’s March 31 order halting DHS’s termination of Venezuela TPS.

On June 3, the National TPS Alliance and several Venezuelans asked Judge Chen to set aside DHS’s decision to vacate the Venezuela and Haiti TPS programs, calling the rationale for the terminations “preordained and contrived.” The Alliance contends that DHS Secretary Kristi Noem lacked the authority to terminate the Venezuela and Haiti TPS programs on the basis of a defective registration process and the national interest.

In a court filing, the Alliance said, “Nothing in the record suggests the secretary had any interest in registration issues at all.” Instead, the Alliance maintains, the record indicates that DHS officials “rushed” to draft vacatur and termination notices prior to Secretary Noem’s confirmation.

A panel of the U.S. Court of Appeals for the Ninth Circuit will hear oral arguments in July on the merits of Judge Chen’s decision to enjoin termination of the Venezuela TPS program pending the outcome of litigation.

Supreme Court Rejects Heightened Evidentiary Requirement for Majority Groups in Title VII Cases

What You Need to Know:

Equal Protection Under Title VII: On June 5, 2025, the U.S. Supreme Court unanimously ruled that Title VII’s protections apply equally to all individuals, regardless of whether they are in a majority or minority group, reinforcing a plain-language interpretation of the statute.

DEI Implications and Legal Scrutiny: The decision comes amid increasing scrutiny of employer DEI initiatives, highlighting the need for programs to comply with Title VII’s equal treatment requirements for all protected groups.

More Changes on the Way? A concurring opinion questions whether the longstanding McDonnell Douglas standard should govern at summary judgment in Title VII cases, possibly foreshadowing more changes to come.

In Ames v. Ohio Department of Youth Services, the U.S. Supreme Court unanimously rejected a rule requiring that Title VII discrimination claims brought by “majority-group” plaintiffs meet a heightened evidentiary standard to establish a prima facie case of discrimination. In doing so, the Court held that Title VII applies equally to all groups within its protected classes based on the plain language of the statute that does not differentiate amongst groups. This decision is significant in light of the shifts in the Equal Employment Opportunity Commission’s position on employer diversity, equity, and inclusion (DEI) initiatives.

In Ames, a heterosexual woman plaintiff alleged that she was denied a promotion and subsequently demoted due to her sexual orientation. The district court granted summary judgment to the employer on the grounds that the plaintiff failed to meet the Sixth Circuit’s “background circumstances” rule. Plaintiffs who are members of a majority group are required to establish “background circumstances to support the suspicion that the defendant is that unusual employer who discriminates against the majority.” Multiple other Circuits similarly imposed heightened evidentiary burdens on majority group plaintiffs.

The Supreme Court unanimously rejected the background circumstances rule, holding that Title VII’s text does not support imposing a heightened standard on majority-group plaintiffs. Justice Ketanji Brown Jackson, delivering the unanimous opinion for the Court, stated that Title VII’s protections apply equally to all individuals; they do “not vary based on whether or not the plaintiff is a member of a majority group.”

While the decision is not necessarily unexpected, the impact of the Ames decision could be heightened given the recent focus on employer DEI initiatives. In recent guidance finding that employer DEI programs that provide benefits to employees based on race or other protected group status may be unlawful, EEOC has similarly expressed that Title VII’s protections and requirements are equally applicable to all protected groups.

Also notable is a concurring opinion issued by Justices Clarence Thomas and Neil Gorsuch. In addition to noting their agreement with the majority, Justices Thomas and Gorsuch questioned the lower court’s use of the McDonnell Douglas burden-shifting standard in awarding summary judgment to the employer. The concurring opinion expressed that requiring employees to meet the McDonnell Douglas standard at the summary judgment stage was an excessive burden, and invited future challenges to the standard’s application.

The Ames decision underscores the importance of treating all employees fairly under Title VII. Further, the decision emphasizes the need to assess workplace programs for vulnerabilities in light of the EEOC’s DEI focus.

Supreme Court Settles Circuit Split on Standard of Proof for “Reverse Discrimination” Lawsuits

On June 5, the US Supreme Court issued a unanimous opinion settling a split among the federal appellate courts about the burdens of proof in lawsuits alleging “reverse discrimination,” in which a member of a majority group sues for employment discrimination. The Court held that claims brought by members of a majority class are held to a standard identical to that of claims brought by members of a minority class. See Ames v. Ohio Dept. of Youth Services.

The plaintiff in the case, Marlean Ames, is a heterosexual woman who alleged that her employer failed to promote her and ultimately demoted her because of her sexual orientation. She alleged that the roles were filled by a lesbian woman and a gay man. The lower courts dismissed Ames’s lawsuit, holding that she did not provide any evidence of “background circumstances” that would support the “unusual” conclusion that her employer discriminates against the majority.

Under Title VII, to prove an employment discrimination claim, an employee must make a prima facie case, which involves identifying others outside the employee’s protected class (race, gender, sexual orientation, religion, etc.) who were treated more favorably than the employee making the claim. One way to make this showing is to point to evidence that the employee was replaced by someone outside their protected class. While Ames made this showing, the lower courts, following precedent in their circuit, held that this was not sufficient to proceed with her claim, as “reverse discrimination” lawsuits require additional facts.

The Supreme Court’s decision resolved an inconsistency among the lower federal courts. Courts in the Sixth, Seventh, Eighth, Tenth, and DC Circuits had held that there was a higher burden for members of a majority class to prevail on an employment discrimination claim. Focusing on the text of Title VII, the Supreme Court unanimously rejected this approach, agreeing with the remaining federal circuits that members of majority and minority classes should be held to the same legal standard.

This decision could have far-reaching implications for employers throughout the country, particularly as businesses grapple with shifting federal regulations and guidance around diversity, equity, and inclusion in hiring practices. In addition to heightened federal scrutiny of such initiatives, individual employees who are members of a majority class now have a clearer legal pathway to relief if they feel they have experienced workplace discrimination. Employers should ensure that they have policies in place to prevent harassment, discrimination, and retaliation in the workplace and avenues for employees to report those concerns.

Does a Bank Need to Produce Social Security Records in Response to a N.Y. Information Subpoena?

As a general rule, a bank or other financial institution is not required to produce full Social Security numbers in response to a N.Y. Information Subpoena. A bank/ financial institution should not do so unless directed by Court Order. Rather, when responding to an N.Y. Information subpoena, a subpoenaed financial institution should only provide the last four digits of a customer’s Social Security number (absent a Court Order specifically requiring the production of a customer’s complete Social Security number). We counsel our financial institution clients to follow this practice.

As a general rule, the dissemination of Social Security numbers is regulated and restricted. See, for example , New York Labor Law§ 203-d, which provides that social security numbers constitute “personal identifying information,” which should not be publicly displayed, printed on identification badges or cards, or communicated “to the general public.”

In Meyerson v. Prime Realty Servs., LLC, 7 Misc. 3d 911, 917, 796 N.Y.S.2d 848, 854 (Sup. Ct. 2005), the Court conducted a “broad review of the treatment of social security numbers” and determined that “it is clear that the weight of authority favors treating a social security number as private and confidential information. In casting for a proper legal characterization, the law appears to support a conclusion that a social security number is protected by something akin to a privilege against disclosure.” Accordingly, with respect to subpoenas, Courts will typically direct that social security numbers be redacted. See, for instance, Beaudette v. Infantino, 73 Misc. 3d 864, 873, 157 N.Y.S.3d 243, 251 (N.Y. Sup. Ct. 2021), where the Court held as follows:

the court directs the redaction of any personal identifying information of any natural person that appears within any record to be disclosed, including but not limited to such person’s name, address, telephone number, date of birth, social security number, and any information that would reveal such person’s medical or mental health condition.

(emphasis added).

For your information, it has long been our practice of redacting all but the last four digits of Social Security numbers. Specifically, New York’s electronic filing rules deem Social Security numbers to be “Confidential Personal Information” or “CPI” which should only be filed with the Court in redacted format:

“Here is the list of the CPI to redact and how to redact it:

Taxpayer ID numbers, social security numbers, and employer ID numbers are redacted by leaving out everything but the last four numbers. For example: xxx-xx-1234.”

https://www.nycourts.gov/Courthelp/goingtocourt/redaction.shtml

Accordingly, a customer’s full Social Security number should not be produced in response to a New York Information Subpoena. We would strongly suggest that when responding to a New York Information Subpoena, a bank or financial institution should provide only the last four digits of a customer’s Social Security number, unless a court Order is received requiring the production of the complete Social Security number.

TURNING UP THE HEAT: Summer Vibe Faces Putative Class Action Lawsuit Based on Alleged Violations of the Quiet Hours Provisions

Hi TCPAWorld! The Baroness here and a new TCPA lawsuit was just filed. Just in time for Summer!

Yes, another TCPA lawsuit has just hit the docket, and once again, it’s centered around the increasingly active quiet hours provision. No surprise, this one comes from Jibrael Hindi’s office, which has filed hundreds of these quiet hours cases in recent months.

For those keeping track, the “quiet hours” provision under the TCPA prohibits initiating telephone solicitations before 8:00 a.m. or after 9:00 p.m. local time of the called party. 47 C.F.R. § 64.1200(c)(1). This provision is rapidly becoming a favorite for the plaintiffs’ bar.

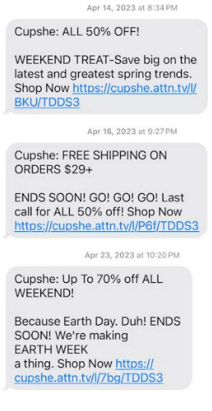

In this latest suit, Olivia Lee Pesce, alleges that between April 14, 2023 and November 17, 2023, she received 8 text messages from Summer Vibe Inc. d/b/a Cupshe (yes, the swimwear brand) before the hour of 8 a.m. or after 9 p.m. local time in her location. A screenshot of the text messages are as follows:

As you folks know, the TCPA carries statutory violations of $500 per text and up to $1,500 if they were knowing and willful violations. So at best, Olivia could recover $12,000 ($1,500 x 8 messages) for the texts she received.

But the real exposure lies in the putative class. Olivia isn’t just seeking damages for herself—she’s attempting to certify a nationwide class of individuals who also received marketing texts from Summer Vibe during the quiet hours:

All persons in the United States who from four years prior to the filing of this action through the date of class certification (1) Defendant, or anyone on Defendant’s behalf, (2) placed more than one marketing text message within any 12-month period; (3) where such marketing text messages were initiated before the hour of 8 a.m. or after 9 p.m. (local time at the called party’s location).

So now everyone Summer Vibe texted outside the quiet hours are potentially in the class. Let’s do the math. If just 100 people received similar texts, even at the base statutory amount, the potential liability is already at $50,000—and that number only goes up if willfulness is proven or more class members are found.

While these cases are multiplying, it’s important to remember quiet hours litigation is still a new and evolving area of law. It remains to be seen how far these cases will go.

Companies should keep a close eye on this trend. Hindi is clearly on the prowl.

As this case was just filed, not much has happened yet, but we will definitely keep a close eye on this one to see how it plays out. Pesce v. Summer Vibe Inc., Case No.: 2:25-cv-05042

Washington Strips Employers of Workers’ Compensation Immunity for Asbestos Claims

On May 29, 2025, the Washington Supreme Court overturned its own precedent, stripping an employer of Workers’ Compensation Immunity for asbestos claims by expanding the Deliberate Injury exception. The court held that mere “virtual certainty” that an injury could result, as opposed to the statutorily required “deliberate intention … to produce injury,” was sufficient to strip immunity in asbestos-related cancer cases. This ruling will likely result in a dramatic increase in liability for employers in Washington State whose employees may have been exposed to asbestos. The opinion also leaves open the potential for expanded liability for other, non-asbestos-related, long latency claims.

BackgroundIn Cockrum v. C.H. Murphy/Clark-Ullman, Inc., the plaintiff worked at the Alcoa Wenatchee Works aluminum smelter in Wenatchee, Washington, from 1967 to 1997. The facility is known to have contained both chrysotile and amphibole asbestos. Alcoa instituted a medical monitoring program in 1953 to screen their employees for asbestos-related disease, including screening for “pleural plaques … and early mesothelioma.” An internal 1982 memorandum states that “for a number of years, Alcoa has recognized the very serious potential health hazard represented by the various forms of asbestos use in our plant. Exposure to asbestos fibers can lead to asbestosis and various forms of cancer.”

Conversely, the plaintiff’s expert testified that “asbestos-related disease is never certain to result from asbestos exposure” and that this expert was “not aware of any carcinogen for which exposure at a particular dose is medically certain to cause cancer.” Despite this expert testimony, the Washington Supreme Court concluded that, based on these facts, “Alcoa ultimately knew of the harm of asbestos in its facilities prior to and contemporaneous with Cockrum’s exposures,” and that, therefore, the plaintiff had met the knowledge prong of the Deliberate Injury exception to Workers’ Compensation Immunity by way of a newly created multifactor test.

New Non-Exclusive Multifactor TestThe court articulated a new non-exclusive multifactor test for whether the knowledge component of the Deliberate Injury exception can be met: • The employer’s knowledge of ongoing, repeated development of symptoms known to be associated with the development of latent disease over time• The employer’s knowledge of symptoms developing in employees similarly situated to the plaintiff-employee• The timing of such symptoms developing prior to or contemporaneous with the plaintiff-employee’s exposure(s)• Whether the exposure arises from a common major cause within the employer’s control.

After the court considers these non-exclusive factors to establish knowledge, the court must still then perform the second part of the statutory test, determining if the employer disregarded this knowledge to cause an intentional injury to the plaintiff.

The Washington Supreme Court synthesized their new multifactor test down, concluding that “a plaintiff can satisfy the Deliberate Injury exception … if they demonstrate the employer had actual knowledge that latent diseases are virtually certain to occur and willfully disregard such knowledge.” Based on this, the Washington Supreme Court overturned the grant of summary judgment in favor of the employer and remanded the case back to the Superior Court to consider the second prong of the test, whether the employer disregarded their own knowledge by failing to take “known remedial measures within its control.”

TakeawayThis opinion represents a sea change in the potential for Washington employers, long sheltered by immunity, to face significant liability for asbestos disease in their own workforce. We can expect an increase in new filings against previously immune employer defendants, which should have an outsized impact on premises defendants and manufacturers with facilities within Washington State.

Alice Patent Eligibility Analysis Divergence before USPTO and District Court: Federal Circuit Clarifies Limits on Relying on USPTO Findings in § 101 Eligibility Disputes

In our prior article, we discussed instances in which the U.S. Patent and Trademark Office (USPTO) and the district courts made different findings with regard to patent eligibility under 35 U.S.C. § 101. A recent nonprecedential Federal Circuit decision, Aviation Capital Partners, LLC v. SH Advisors, LLC, No. 24-1099 (Fed. Cir. May 6, 2025), highlights a critical procedural point: District courts are not required to accept findings made by the USPTO as true at the pleading stage — unless those findings are specifically alleged in the complaint.

This issue came to the forefront on appeal after the Delaware District Court dismissed Aviation Capital’s patent infringement complaint under Rule 12(b)(6), finding the asserted patent claims ineligible under § 101. The plaintiff-appellant, Aviation Capital Partners (doing business as Specialized Tax Recovery (“STR”)), argued on appeal that the district court erred by failing to accept the USPTO’s prior eligibility analysis, which favored patent eligibility, as a factual finding at the motion to dismiss stage.

Specifically, STR contended that the USPTO’s conclusion — made during prosecution — that the claims were “integrated into a practical application” and “contained significantly more than an abstract idea” should have been accepted as a true factual finding by the District Court as part of deciding the motion to dismiss. But the Federal Circuit rejected that argument outright, stating:

STR additionally argues that, in deciding the motion to dismiss, the district court was required to assume as true the Patent Office’s “factual finding that the claims were integrated into a practical application and contained significantly more than an abstract idea.” Appellant’s Br. 23–25. We disagree. “[F]or the purposes of a motion to dismiss we must take all of the factual allegations in the complaint as true . . . .” Ashcroft v. Iqbal, 556 U.S. 662, 678 (2009) (emphasis added). Here, the complaint included no factual findings made by the Patent Office. J.A. 16–32; Oral Arg. at 4:38–5:45 (complaint alleged the Patent Office made two legal determinations but alleged no factual findings). Accordingly, the district court did not err by declining to accept as true any unalleged factual findings that the Patent Office may have made in its § 101 eligibility analysis.[

This passage underscores the procedural rigor applied to motions to dismiss: The court is bound only to the facts actually pled in the complaint. While STR tried to import the examiner’s analysis into the record, the Federal Circuit made clear that any “factual findings” by the USPTO must be explicitly alleged for a district court to credit them at the motion to dismiss stage.

Implications for Litigants and Drafting Complaints Where Examiner Made Comments Regarding § 101 Eligibility

This ruling serves as a practical guidepost for practitioners navigating § 101 disputes post-Alice. Litigants cannot assume that favorable examiner conclusions — such as an “integration into a practical application” — will be treated as facts unless those determinations are squarely and specifically alleged in the complaint.

The USPTO’s current guidance instructs examiners to evaluate whether a claim is “integrated into a practical application” and whether it includes “significantly more” than an abstract idea — criteria that may allow applications to clear the § 101 hurdle during prosecution. Yet, as Aviation Capital confirms, the deference afforded to such examiner determinations may vary, and on a Rule 12(b)(6) motion, only factual allegations specifically made in the complaint must be taken as true. This begs the question — if a patent owner explicitly alleges factual findings made by an examiner during prosecution regarding § 101, is that sufficient to defeat a motion to dismiss? Though nonprecedential, Aviation Capital suggests as much.

Takeaway

The Aviation Capital decision is a sharp reminder that litigators must be deliberate in pleading factual support for eligibility. To preserve arguments based on examiner findings, those examiner findings must be more than background — they must be alleged facts in the complaint, not just cited conclusions.

Otherwise, courts remain free to assess eligibility from a clean slate. And as this decision reaffirms, that assessment may diverge from what the USPTO previously concluded.

[1] Aviation Capital Partners, LLC v. SH Advisors, LLC, No. 24-1099 at 7 (Fed. Cir. May 6, 2025).