FedEx Defeats Government’s Loper Bright Gambit

On February 13, 2025, a Tennessee federal district court handed FedEx Corporation its second win in a refund action involving the application of foreign tax credits to what are known as “offset earnings.”[1] Offset earnings are earnings from a taxpayer’s profitable related foreign corporations that are offset by losses from other related foreign corporations. FedEx previously prevailed on the question of whether it was entitled to foreign tax credits related to such earnings.[2] In this most recent ruling, the court rejected the Government’s reliance on a certain regulatory provision called the “Regulatory Haircut Rule”[3] to argue that the amount of FedEx’s claimed refund should be reduced. The case now appears to be set for appeal.

Revisiting the analysis in its first ruling, the court explained the error of the Government’s reliance upon the Regulatory Haircut Rule. In short, the court said that the rule’s application conflicted with the best construction of the governing statutes, primarily Internal Revenue Code (IRC) Sections 960, 965(b)(4), and 965(g). The Government defended its reliance by appealing to Loper Bright’s instruction that courts must respect legitimate delegations of authority to an agency.[4] Citing IRC Section 965(o), which authorized the Secretary of the Treasury to prescribe regulations “as may be necessary or appropriate to carry out the provisions of” Section 965 and to “prevent the avoidance of the purposes” of this section, the Government argued that the Regulatory Haircut Rule furthered the IRC’s broader goal of preventing tax avoidance and that Loper Bright required the court to respect the Secretary’s exercise of his delegated authority.

While acknowledging that legitimate delegations of authority to agencies remain permissible after Loper Bright, the court reminded the Government that an agency does not have the power to regulate in a manner that is inconsistent with the statute, even when a delegation provision grants the agency broad discretionary authority:

Assuming that Congress delegated authority . . . to promulgate regulations implementing section 965 . . . that authority cannot, under Loper Bright, encompass the discretion to promulgate regulations that contravene the “single, best meaning” of section 965, as determined by the courts.[5]

In other words, a statute’s delegation provision should not be interpreted to allow Treasury to eliminate rules that Congress established in other parts of the IRC.

Practice Point: Referencing Loper Bright’s acknowledgment that Congress may “confer discretionary authority on agencies,”[6] the Government has defended (and likely will continue to defend) its regulations on the theory that its exercises of such authority should be respected. But as Loper Bright reminds us, courts have an independent duty to decide the meaning of statutory delegations. Thus, taxpayers should closely examine whether regulations purportedly derived from a statute’s delegation provision comport with the rest of the statute. Those that do not should be challenged.

______________________________________________________________________________

[1] FedEx Corp. & Subs. v. United States, No. 2:20-cv-02794 (W.D. Tenn., Feb. 13, 2025)(electronically available here).

[2] FedEx Corp. & Subs v. United States, No. 2:20-cv-02794 (W.D. Tenn., Mar. 31, 2023)(electronically available here).

[3] See Treas. Reg. § 1.965-5(c)(1)(i) (limiting foreign tax credits by the amount of withholding taxes paid to a foreign jurisdiction). The court also rejected the Government’s reliance upon what it called the “Statutory Haircut Rule” based on IRC section 965(g)(1). This discussion focuses on the regulatory counterpart.

[4] See Loper Bright Enters. v. Raimondo, 144 S.Ct. 2244, 2268 (2024).

[5] FedEx, No. 2:20-cv-02794 (W.D. Tenn., Feb. 13, 2025).

[6] Loper Bright, 144 S.Ct. at 2268.

This Week in 340B: March 4 – 10, 2025

Find this week’s updates on 340B litigation to help you stay in the know on how 340B cases are developing across the country. Each week we comb through the dockets of more than 50 340B cases to provide you with a quick summary of relevant updates from the prior week in this industry-shaping body of litigation.

Issues at Stake: Contract Pharmacy; HRSA Audit Process; Medicare Payment; Rebate Model

In a case appealing a decision on a state contract pharmacy law, two amicus briefs were filed in support of the defendant-appellant state.

In one Health Resources and Services Administration (HRSA) audit process case, the court granted motion to withdraw the plaintiff’s motion for preliminary injunction.

In a case challenging a Medicare Advantage plan’s response to 340B payment cuts, defendants’ motion to compel the production of a damages spreadsheet was granted in part and denied in part.

In six cases against HRSA alleging that HRSA unlawfully refused to approve drug manufacturers’ proposed rebate models:

In five such cases, the court granted intervenor’s motion to intervene and a group of amici filed an amicus brief in support of the defendant.

In one such case, intervenors filed a notice of supplemental authority to which the plaintiff filed a response and a group of amici filed an amicus brief in support of the defendant.

Nadine Tejadilla also contributed to this article.

Compounded GLP-1 Drugs: Texas Judge Denies PI Motion and Request for Stay of FDA’s Declaration that Tirzepatide Shortage is Resolved; Plaintiff OFA Appeals

On March 5, 2025, one U.S. District Court ruled unequivocally in FDA’s favor in the case, Outsourcing Facilities Ass’n, et. al. v. U.S. Food and Drug Admin., et. al., 4:24-cv-0953-P, slip op., 2025 WL 746028, at *15 (N.D. Tex. Mar. 5 2025), denying plaintiffs’ motion for (1) a preliminary injunction (PI) prohibiting the Food & Drug Administration (FDA) from taking action against Outsourcing Facilities Association (OFA) members and FarmaKeio based on their compounding of the drug ingredient tirzepatide pending final judgment in the case and (2) a stay pending conclusion of the review proceedings in response to FDA’s declaration that the shortage of the diabetes and weight-loss tirzepatide products has been resolved.

Background

Based on unprecedented demand and Eli Lilly’s inability to meet this demand, the tirzepatide products at issue, Mounjaro® and Zepbound®, whose marketing applications were approved in 2022 and 2023 respectively, were placed on the drug shortage list in December 2022.

The Food Drug, and Cosmetic Act (FDCA) defines “shortage” as “a period of time when the demand or projected demand for the drug within the United States exceeds the supply of the drug.” 21 U.S.C.§ 356c. When a drug is placed on the FDA’s shortage list, Congress permits 503A compounders, those operating under state board of pharmacy oversight and issuing patient specific prescriptions, to compound copies of the drug and 503B outsourcing facilities which are those compounders who are registered and regulated by FDA and who manufacture large batches of sterile compounded medications for health care entities, to compound from that drug’s active ingredient—which is otherwise prohibited—including by compounding drugs that are “essentially a copy” of an approved drug. See 21 U.S.C.§§ 353b(a)(2)(A)(ii), (a)(5), (d)(2)(A). Thus, compounding copies of a drug is only permitted while a shortage exists.

Current Status for Compounders

Consistent with FDA’s February 11, 2025 update, which remains in effect given the Court’s denial of the PI and stay, FDA’s approach to compounders is as follows:

For a state-licensed pharmacy or physician compounding under section 503A of the FDCA, the period of enforcement discretion described below has ended.

For outsourcing facilities under section 503B, FDA does not intend to take action against compounders for violations of the FDCA arising from conditions that depend on tirzepatide injection products’ inclusion on FDA’s drug shortage list until March 19, 2025.

Future State

On March 10, 2025, OFA filed a notice of interlocutory appeal signaling their intention to appeal the March 5, 2025 decision in FDA’s favor to the United States Court of Appeals for the Fifth Circuit. The appeal notwithstanding, we will watch for developments on certain GLP-1 products that continue to be compounded by 503A pharmacies under the rationale that certain compounded products are required to meet the individual needs of patients. There are a number of different strengths, different dosage forms, and combination of ingredients being compounded or contemplated. While FDA has not yet taken a position with respect to these types of modified compounded products, it will be interesting to see whether FDA agrees that such modifications are determined to be needed to meet the individual needs of patients and are clinically relevant or whether such products are considered to be essentially a copy of a commercially available product. If so and barring judicial intervention, 503A pharmacies must stop compounding tirzepatide, and 503B pharmacies may only continue compounding tirzepatide until March 19, 2025.

Want To Learn More? See our prior blogs.

FDA Targets GLP-1 Providers with Warning Letters

GLP-1 Drugs: FDA Removes Lilly’s Zepbound® and Mounjaro® (semaglutide injection) from its Drug Shortage List

GLP-1 Drugs: Brand Companies Push FDA to Limit Compounding

Federal Circuit Affirms ImmunoGen Patent Obviousness

In a precedential opinion issued on March 6, the Federal Circuit affirmed the US District Court for the Eastern District of Virginia that the claims in ImmunoGen’s US patent application 14/509,809 (“the ’809 application,” published on May 14, 2015, as US 2015/0132323) were obvious.

ImmunoGen, Inc. v COKE MORGAN STEWART, ACTING UNDER SECRETARY OF COMMERCE FOR INTELLECTUAL PROPERTY AND ACTING DIRECTOR OF THE UNITED STATES PATENT AND TRADEMARK OFFICE, (2023-1762, Decided: March 6, 2025).

This case highlights the distinctions between the US law where the obviousness inquiry is generally agnostic to the particular motivation of the inventor, versus that in Europe and many other countries that evaluate inventive step/inventiveness based on a “problem–solution” approach not required in the US. The case also serves as a reminder of the risks attendant with the use of so-called boilerplate language, particularly when used in the context of ascribing a level of skill in the art regarding optimization of parameters. And it further underscores the challenges faced by patent applicants, particularly in the pharmaceutical and life sciences sectors, in balancing the scope of its own seminal patents covering new chemical entities, per se, against a reasonable foreseeability of filing of later, second-, and later-generation patent applications on various improvements, such as treatment regimens, dosage formulations, etc. This challenge has been exacerbated by a growing hostility towards building “patent thickets” around new drugs, based on the notion that they are responsible for high drug prices. This decision further adds to the growing arsenal of jurisprudence on which generic drug companies may rely on attacking later-generation Orange Book-listed patents covering drug compositions and uses thereof.

The claims at issue are directed to a dosing regimen for administering IMGN853 (mirvetuximab soravtansine), which is ImmunoGen’s patented and US Food and Drug Administration- (FDA) approved antibody drug conjugate (ADC) used for treating certain ovarian and peritoneal cancers. IMGN853 is a conjugate of an antibody known as “huMov19” linked via a charged sulfopSPDB linker to a toxic maytansinoid payload known as “DM4.” The key limitation in the claims was the recitation that immunoconjugate is administered at a dose of 6 milligrams (mg) per kilogram (kg) of adjusted ideal body weight (AIBW) of the patient.” The Patent Trial and Appeal Board (PTAB) affirmed the Examiner’s obviousness rejection, which was based primarily on ImmunoGen’s own prior patent publication [2012/0282282] directed to IMGN853, per se. Immunogen filed a civil action under 35 U.S.C. § 145. The Eastern District Court of the Eastern District of Virginia affirmed PTAB’s decision.

On appeal, ImmunoGen stressed that at the time the invention was made, the art did not appreciate that IMGN853 caused ocular toxicity in humans. Thus, in its view, the solution to an unknown problem could not have been obvious — such as found in some prior Federal Circuit and the US Court of Customs and Patent Appeals (CCPA) cases. See, e.g., In re Sponnoble, 405 F.2d 578, 585 (C.C.P.A. 1969) (“a patentable invention may lie in the discovery of the source of a problem even though the remedy may be obvious once the source of the problem is identified.”); In re Omeprazole Patent Litigation, 536 F.3d 1361, 1380-81 (Fed. Cir. 2008) (upholding patent where coatings for omeprazole were discovered by the inventors to negatively interact with each other, and solution of providing a barrier therebetween was non-obvious even if providing a barrier would have been obvious if the interaction problem were known); Leo Pharmaceutical Products v. Rea, 726 F.3d 1346, 1353-54 (Fed. Cir. 2013) (“The inventors of the ‘013 patent recognized and solved a problem with the storage stability of certain formulations—a problem that the prior art did not recognize and a problem that was not solved for over a decade.”)

This position is also consistent with jurisdictions, such as Europe, that apply a “problem-solution” approach to the determination of inventive step. Indeed, the European Patent Office granted to ImmunoGen at least one patent with claims similar to those at issue in the United States.

However, the District Court determined that because ocular toxicity was “a well-known adverse event in the administration of immunoconjugates that contain DM4,” and because IMGN853 includes a DM4 payload, a person of ordinary skill in the art would have been motivated to monitor for those side effects when administering the drug to humans, despite not knowing of IMGN853’s ocular toxicity.

The Federal Circuit agreed. It pointed to its prior decisions in reasoning that “[a]s an initial matter, although ImmunoGen is correct that “[w]here a problem was not known in the art, the solution to that problem may not be obvious,” Forest Lab’ys, LLC v. Sigmapharm Lab’ys, LLC, 918 F.3d 928, 935 (Fed. Cir. 2019), it does not follow that a claimed solution to an unknown problem is necessarily non-obvious.” (Emphasis in original). Relying on KSR for the proposition that “[i]n determining whether the subject matter of a patent claim [was] obvious, neither the particular motivation nor the avowed purpose of the patentee controls,” the Federal Circuit found no clear error in the District Court’s reasoning.

ImmunoGen also argued that the district court clearly erred in finding that a person of ordinary skill in the art would have been motivated to try AIBW dosing as a dosing methodology for IMGN853 to eliminate ocular toxicity or arrive at a dose of 6 mg/kg AIBW with a reasonable expectation of success. Regarding the former, AIBW was a known technique but had never been used as a methodology for an ADC. So, in ImmunoGen’s view, the district court “simply plucked AIBW dosing out of [a] multitude of possibilities.” In finding no clear error in the District Court’s reasoning, the Federal Circuit relied on ImmunoGen’s ‘282 publication and, in particular, for its teaching that “[t]he dosing regimen and dosages [of the disclosed ADCs] will depend on the particular cancer being treated, the extent of the disease and other factors familiar to the physician of skill in the art and can be determined by the physician.” (Emphasis in original). This reference to the level of skill in the art, especially at the time of drafting, most certainly came back to haunt ImmunoGen.

Regarding the latter, ImmunoGen was again thwarted by its own prior publication. Indeed, in view of its findings that Immunogen’s ’282 publication discloses dosing IMGN853 at around 6 mg/kg of TBW (total body weight) of the patient, an abstract from the American Society of Clinical Oncology disclosing that IMGN853 had been tested on humans at a dose of 5 mg/kg TBW, AIBW dosing was well known, and that “for patients who weigh exactly their ideal body weight, a dose of 6 mg/kg AIBW is identical to a dose of 6 mg/kg TBW,” the district court viewed ImmunoGen’s ‘809 application as an attempt “to cover a dose that was already disclosed in the prior art.” The Federal Circuit agreed, concluding: “[a] doctor dosing a patient at his or her IBW with IMGN853 at a dose of 6 mg/kg TBW would necessarily be dosing that patient at 6 mg/kg AIBW, as claimed. This would be true regardless of whether a doctor knew of AIBW dosing.” (Emphasis in original).

In sum, this case shows that, even if a problem was unknown at the time an invention was made, it may still be obvious. Moreover, this case demonstrates the difficulties of obtaining a patent to a specific method of treatment and dosage formulations in view of one’s own prior art.

DOJ Moves to Challenge Illinois Nonprofit Board Disclosure Law

The U.S. Department of Justice (DOJ) has been granted judicial leave to intervene in the American Alliance for Equal Rights’ (AAER) suit against the State of Illinois challenging the state’s diversity, equity, and inclusion (DEI) law requiring nonprofit organizations to make certain demographic data public on their websites. The intervention comes as President Donald Trump’s anti-DEI agenda takes shape.

Quick Hits

An activist group has asked a federal district court to strike down an Illinois law requiring the disclosure of nonprofit organizations’ board demographics.

The DOJ has intervened in the case, claiming that the law violates the Fourteenth Amendment.

The intervention is part of the DOJ’s effort to eliminate DEI practices nationwide.

On March 11, 2025, the U.S. District for the Northern District of Illinois granted the DOJ’s motion to intervene in American Alliance for Equal Rights v. Bennett. The plaintiff, American Alliance for Equal Rights (AAER), is a nonprofit group that has opposed a number of diversity programs nationwide.

Here, the AAER is challenging an Illinois law that requires qualifying nonprofits to disclose the demographic makeup of their directors and officers on their websites. The demographic categories include race, ethnicity, gender, disability status, veteran status, sexual orientation, and gender identity. AAER alleges that the statute violates the Fourteenth Amendment of the U.S. Constitution by encouraging organizations to discriminate based on race and the First Amendment of the U.S. Constitution by compelling organizations to speak about demographic issues that they otherwise would not discuss.

On March 4, 2025, the DOJ moved to intervene in the case. The government cited Students for Fair Admissions, Inc. v. Harvard College (SFFA), arguing that the Illinois law violates the Equal Protection clause on account of race. SFFA is the 2023 Supreme Court of the United States decision eliminating affirmative action in higher education. In a press release, the DOJ called the intervention “an early step toward eradicating illegal race and sex preferences across the government.” U.S. Attorney General Pamela Bondi emphasized the department’s intention to intervene in cases where a state “encourages DEI instead of merit.” Although certain portions of President Trump’s anti-DEI executive orders have been preliminarily enjoined, the move shows the DOJ continues to execute the administration’s policy goals in other ways.

Next Steps

Although the case is narrow in scope, the outcome may shed light on the Trump administration’s views on the legality of demographic reporting in other contexts and how the SFFA decision may be applied outside of higher education.

Federal Circuit Refuses to Extend IPR Estoppel to Unadjudicated Patent Claims

In Kroy IP Holdings, LLC v. Groupon, Inc., 127 F.4th 1376 (Fed. Cir. 2025), the Federal Circuit held that patentees in district court are not collaterally estopped from asserting claims that were not immaterially different from other claims of the same patent that the US Patent Trial and Appeal Board (PTAB) already held to be unpatentable.

The Federal Circuit’s ruling significantly impacts practitioners involved on both sides of parallel patent litigation, offering patentees a strategic advantage in district courts while requiring petitioners to reevaluate their approach to challenging claims at the PTAB.

Background

Kroy IP Holdings, LLC filed suit against Groupon, Inc., alleging infringement of 13 exemplary claims of US Patent No. 6,061,660. Groupon timely filed two inter partes reviews (IPRs), successfully invalidating 21 claims of the ’660 Patent. After Groupon’s deadline to file additional IPRs had passed, Kroy amended its complaint to allege infringement of newly asserted claims of the ’660 Patent that were not at issue in the prior IPR proceedings. Groupon moved to dismiss this complaint on grounds that Kroy was collaterally estopped from asserting these newly asserted claims based on the PTAB’s unpatentability rulings. The district court granted Groupon’s motion, dismissing Kroy’s case with prejudice after determining that the new claims were “immaterially different” from the invalidated claims. Kroy appealed.

The issue before the Federal Circuit was whether a prior decision by the PTAB declaring certain claims unpatentable can prevent a patentee from asserting other immaterially different claims from the same patent in district court.

As recently as September 2024, the Federal Circuit revisited the doctrine of collateral estoppel and considered the effect that prior final written decisions at the PTAB may have on subsequent district court litigation. The court concluded that a finding of unpatentability of apparatus claims in an IPR does not bar a patentee from contesting the validity of separate but related method claims of the same patent in district court. The Federal Circuit reasoned that collateral estoppel does not apply when different legal standards, such as burdens of proof, are involved across the two actions. Indeed, a petitioner in an IPR proceeding need only prove invalidity under the preponderance of the evidence standard, whereas in district courts, a defendant must meet the higher and more exacting clear and convincing evidence standard. Otherwise, the application of collateral estoppel in separate actions involving differing burdens of proof “would deprive patent owners of their property right.” Kroy IP Holdings, LLC, 127 F.4th at 1380-81.

Relying on this rationale, the Federal Circuit in Kroy IP Holdings, LLC v. Groupon, Inc. found that the patent owner was not barred from asserting previously unadjudicated claims that were immaterially different from claims that the PTAB had declared were unpatentable. Indeed, the PTAB’s unpatentable rulings under the preponderance of the evidence standard cannot estop a patentee from asserting other new but immaterially different claims in district court, which require the higher clear and convincing evidence standard. In holding that collateral estoppel did not apply, the Federal Circuit reversed the district court’s dismissal.

Practical Considerations

The Federal Circuit’s ruling in Kroy has significant implications for practitioners involved in parallel patent litigation at the PTAB and district courts.

For patent owners, the Federal Circuit’s ruling offers a strategic advantage by limiting the scope of collateral estoppel to only those claims that were actually challenged and adjudicated in IPR proceedings. Further, this allows patentees to pursue claims in district court that were not at issue in the IPRs, even if they are similar to the already invalidated claims. Patentees should consider strategically selecting which claims to include or exclude in enforcement actions based on the strength of their validity arguments and the likelihood of success at both the PTAB and in district courts.

For petitioners, the Kroy ruling necessitates a reevaluation of challenging claims at the PTAB, as reliance on successful IPR outcomes may not be sufficient to invalidate patent claims in district court. Petitioners should be prepared to meet the higher burden of proof required in district courts and plan for the possibility of patentees asserting unadjudicated claims in later-amended complaints or in future infringement actions.

Listen to this article

Federal District Court Reverses Firing of NLRB Member Wilcox – NLRB Returns to Statutory Quorum

On March 6, 2025, U.S. District Court Judge Beryl Howell held that Gwynne Wilcox, a former member of the National Labor Relations Board (“NLRB” or the “Board”) was “illegally” fired from her job.[1] The court ordered the Board’s current chair to restore her access to the Board and let her serve out the remainder of her five-year term. The Trump administration promptly appealed the decision and is seeking an immediate stay from a federal appeals court.[2] However, in the meantime, Wilcox’s return will give the Board three active members. Thus, for now, it appears that the Board again has a statutory quorum under the National Labor Relations Act (“NLRA” or the “Act”) and can resume operating as normal.

What Is in Dispute?

Under the NLRA, members of the Board serve fixed five-year terms after being duly nominated and Senate approved. Under the NLRA, they can be removed before their term’s end only for “malfeasance” or “neglect of duty.” They also must be given “notice and a hearing.” None of those terms are defined in the NLRA. However, they have generally been understood to require a president to show “cause” before firing a member. “For cause” protection has become increasingly controversial and some scholars have argued that removal protections interfere with the president’s ability to manage the executive branch and that the president should be able to fire officers at will.

On January 28, 2025, President Trump sent an email to Member Wilcox, who began her term in September 2023, stating that he had lost confidence in Wilcox’s ability to lead the Board and that there were no valid constitutional limits on the President’s ability to remove a Board member with or without cause.[3] After Ms. Wilcox was fired, only two active members remained on the Board. Because the Board lacked the three-member quorum, it was effectively frozen and not operating during Ms. Wilcox’s absence.[4]

Days after her firing, Ms. Wilcox filed her federal lawsuit against President Trump and Marvin Kaplan, in his capacity as the recently appointed Chairman of the Board, a position previously held by Ms. Wilcox since December 2024.[5] Ms. Wilcox’s complaint sought a ruling that her termination was unlawful and void, and injunctive relief against the Board Chairman, Mr. Kaplan, so that she may resume her role as a Board member.

The Court rendered a prompt decision because there were no disputed facts and only a pure legal question that needed to be answered.[6] The facts all parties agreed were true were that after taking office, President Trump designated Mr. Kaplan as Chairman of the Board, replacing Ms. Wilcox. Shortly thereafter, the Deputy Director of the White House Presidential Personnel Office sent Ms. Wilcox an email at 11:00 p.m. terminating her from her Board position, without “notice and hearing” and without citation to any statutory basis for removal (e.g., “neglect of duty” or “malfeasance”).[7] The email also stated the statutory limitations on removal power were “unconstitutional” because they are “inconsistent with the vesting of the executive Power in the President. The current Board Chair, Mr. Kaplan, instructed his direct report to begin Ms. Wilcox’s termination, cut-off her access to her accounts, and told her to clean out her office. The President’s decision to terminate Ms. Wilcox means the Board is unable to function because only 2 members remain and 3 members are required to form a quorum and exercise the Board’s powers.

The Constitution comes into play because President Trump conceded that the email termination violated the statutory requirements for removing a Board Member and instead contends that the President’s “removal power is fundamentally ‘unrestricted.’”[8] The Constitution enunciates both the structure and vested powers for each branch of government: Article I vests all legislative powers in Congress (the Senate and House of Representative); Article II vests the executive power in the President; and Article III vests the judicial power in one Supreme Court and other inferior Courts established by Congress. President Trump’s refusal to obey a congressional statute pits the executive branch (Article II) against the legislative branch (Article I). The role of the courts (Article III) is to interpret the Constitution, past practice, and judicial precedent to resolve the conflict. The President’s role, as wielder of the executive power, is “to be a conscientious custodian of the law, albeit an energetic one, to take care of effectuating his enumerated duties, including the laws enacted by the Congress and as interpreted by the Judiciary.”[9]

What Did the District Court Hold?

Because the Constitution does not contain any removal provisions for multi-member boards or commissions, the District Court’s analysis was distilled down to one 1935 U.S. Supreme Court case, Humphrey’s Executor v. U.S., 295 U.S. 602. Humphrey’s Executor addressed removal of commissioners of the Federal Trade Commission (the “FTC”) and in doing so discussed and upheld past practice since 1887 that Congress could establish independent, multimember commissions whose members are appointed by the President but can be removed only for cause.[10] Two months after the Humphrey’s Executor decision, Congress enacted the National Labor Relations Act and created a two part leadership structure for the agency similar to the FTC: a five member Board was designed to adjudicate cases impartially by staggering the members’ five-year terms and a General Counsel who determines which cases to prosecute, provides guidance on legal interpretation, and has a four-year term.[11]

To avoid the application of Humphrey’s Executor as binding precedent, President Trump contends: the FTC in 1935 did not exercise “executive power” and asserts that the Board does; the NLRB removal grounds are stricter because unlike the FTC they include efficiency; and Humphrey’s Executor was wrongly decided or repudiated (relying on preceding cases and interpretation of later opinions in different removal contexts).[12]

However, the district court agreed with Board Member Wilcox. The district court held that Humphrey’s Executor is still good law and applies to the NLRB. It still allows Congress to insulate the heads of multi-member expert agencies. The district court applied that description to the Board and held that, like the FTC in Humphrey’s Executor, the Board performs quasi-legislative and quasi-judicial functions. It investigates unfair labor practices and adjudicates them through an administrative process. That process ends with a decision by a three-member panel, which acts like a quasi-court. This structure, the court reasoned, was indistinguishable from the FTC’s structure. Thus, the district court concluded, Humphrey’s Executor still controlled, and Ms. Wilcox had been validly insulated from removal, meaning her termination was “illegal.”

On the other hand, the district court did not order the President to “reinstate” her. Instead, the court ordered the Board’s current chair, Kaplan, not to prevent her from doing her job – i.e., Kaplan cannot deny her access to the building, block her from accessing the Board’s systems, or otherwise interfere with her ability to serve as a Board member. Sidestepping a debate around whether any court has authority over presidential appointments, the court did not order Ms. Wilcox’s appointment to the Board; the district court’s order merely ensures that Board Member Wilcox serve out her original term.

In response to the district court’s order, on March 6, 2025, President Trump immediately filed a notice of appeal and sought to stay the district court’s order until the appeal is resolved. The district court rejected the stay request.

President Trump’s stay request is now in the hands of the U.S. Court of Appeals for the District of Columbia. A motions panel of this same court recently granted the government’s stay request, to prevent terminated Special Counsel Hampton Dellinger from resuming his role in the Office of Special Counsel (an independent agency under the Whistleblower Protection Act) while the appeal proceeds. After the stay request was granted, Mr. Dellinger dropped his appeal.

What Is Next?

For now, the Board appears to have a quorum since Ms. Wilcox has resumed her Board duties, and the Board has begun to issue decisions again.

However, that situation may not last. The appeal and the request for a stay will go to a federal appeals court in Washington and then likely to the U.S. Supreme Court. Either of those courts could reverse the district court’s decision and drop the Board back to two members.

We will continue to monitor future developments, and cover noteworthy updates on our blog. Employers with questions about how the decision affects them should consult experienced labor counsel.

FOOTNOTES

[1] Wilcox v. Trump, Case 1:25-cv-00334-BAH (Mar. 6, 2025) (dkt #34).

[2] See Emergency Motion for Stay Pending Appeal, Wilcox v. Trump, No. 25-5057 (D.C. Cir. filed Mar. 10, 2025).

[3] Opinion, p. 8.

[4] See New Process Steel, L.P. v. NLRB, 560 U.S. 674 (2010).

[5] Opinion, pp. 8-9.

[6] Opinion, p. 9.

[7] Opinion, p. 8.

[8] Opinion, pp. 5, 8, 15; 29 U.S.C. § 153(a).

[9] Opinion, p. 4 (“U.S. Const. art. II, § 3 (“[H]e shall take Care that the Laws be faithfully executed . . . .”)).

[10] Opinion, pp. 10-12.

[11] Opinion, pp. 7-8, 13-14; see also 29 U.S.C. §§ 151-169.

[12] Opinion, pp. 15-28.

Listen to this post

Thinking of Selling Your Med Spa? Here Are Six Things to Do to Prepare

Numerous legal, regulatory and operational issues will arise when selling a med spa. Proper preparation by ensuring the business is regulatory compliant, assembling the right group of professionals and documents will save time and costs and ensure that the transaction is as smooth as possible.

Ensure your business is properly organized and licensed

You should ensure that the business complies with applicable law from a structural and regulatory standpoint. Illinois follows the legal doctrine known as the “corporate practice of medicine,” which requires that a facility that provides medical services be owned solely by a physician or a physician-owned entity. It is important to analyze the scope of services being provided by your med spa to determine if you are compliant with Illinois law.

If a med spa is not organized in a compliant manner, it could cause issues for the med spa from a legal and regulatory standpoint and raise flags for the purchaser. In such a case, it would be prudent to restructure the entity to comply with applicable law. Such restructuring may include creating a management service organization (MSO) structure, in which a new non-medical MSO is created to perform all non-clinical services with respect to the med spa entity. These non-clinical services may include human resource matters, marketing, payroll, billing, accounting, real estate issues, etc. It is important that any MSO arrangements, including compensation structures, be carefully structured to comply with applicable law. The MSO structure is critical for any med spa with a non-physician owner that intends to render services that may constitute the practice of medicine.

Review the business’s governing documents

It is crucial that the med spa’s governing documents are complete and accurate. A sophisticated purchaser will review the business’s articles of organization or incorporation, operating agreement or bylaws and timely filed annual reports. A purchaser will raise issues and have concerns if a med spa cannot provide complete and accurate corporate records.

The owner of a med spa with multiple shareholders or members selling the business via an asset sale should review the bylaws or operating agreement to confirm the percentage of owners that must agree to the sale in order for it to occur. The sale of all or almost all of the business assets is a standard situation that requires majority consent.

A business owner intending to sell via a stock or membership interest sale should review all governing documents to confirm whether there are drag-along or tag-along rights. A drag-along right allows the majority shareholder of a business to force the remaining minority shareholders to accept an offer from a third party to purchase the entire business. There have been situations where a minority shareholder objects to the sale and prevents it altogether. A tag-along right is also known as “co-sale rights.” When a majority shareholder sells their shares, a tag-along right will allow the minority shareholder to participate in the sale at the same time for the same price for the shares. The minority shareholder then “tags along” with the majority shareholder’s sale. Any drag-along or tag-along rights provided in the business’s governing documents should be addressed as soon as possible to ensure such rights are provided and to deal with any disputes.

Retain an attorney at the onset of the transaction

After a med spa is offered for sale, a purchaser may prepare and submit a letter of intent (LOI) for the med spa’s review and approval. A LOI is a legal document that sets forth the form of the transaction (whether it’s an asset or stock sale), purchase price, manner of payment, deposit terms, transaction conditions, due diligence terms and timeline, choice of law and other relevant terms of the sale. Business owners often make the mistake of not engaging an attorney until after the LOI has been signed. By failing to retain an attorney to negotiate the LOI, a business owner may be stuck with unfavorable terms or may have missed the opportunity to ask for something valuable at the onset, including taking into account tax implications of the proposed deal structure.

Engaging an attorney can save significant costs and time because imperative business issues can be discussed and agreed upon in the early stages and if the parties cannot come to an agreement, they can go their separate ways as opposed to wasting time, costs and the efforts involved with both negotiating a purchase agreement (PA) and conducting due diligence. Using an attorney will also ensure that the LOI contains a timeline or expiration so that if the sale is not completed by a certain time, the med spa can move onto another interested party without issue. The LOI will continue to be a material part of the entire transaction even as the PA is negotiated. If something is agreed upon in the LOI and one party tries to differ from the LOI terms during the PA negotiation, the other party will point to the LOI for support — often successfully.

Gather information on financials and assets

One of the most important and lengthy parts of any business sale is due diligence. Due diligence is the process in which the purchaser requests to review various documents, data and other information in order to familiarize itself with the business’s operations, background and to identify potential liabilities or issues related to the business or transaction’s closing. The results of the due diligence process can cause the purchaser to react in a variety of ways, from requesting more documents, a reduction of the purchase price or terminating the transaction altogether. Some of the critical documents a purchaser will request access to include the med spa’s tax returns, income statements, balance statements, a list of accounts receivable, accounts payable, a list of inventory and a list of personal property and equipment. A med spa owner can do itself a huge favor by gathering such documents and saving them electronically in an organized fashion. This way they can be easily sent to the purchaser or uploaded to a data site. The med spa and/or med spa owners will also have to make representations and warranties based upon the accuracy and completeness of such documents so it is in the med spa’s best interest to have organized and complete files.

Gather existing contracts

Another standard due diligence request from a purchaser is to review all of the med spa’s existing contracts, purchase orders, vendor and supplier agreements. The purchaser will want to determine, among other things, what work is ongoing and what liabilities and expenses it can expect. A med spa owner considering a sale should gather and save all of such agreements electronically and in an organized manner so they can be easily uploaded for the purchaser’s review.

Consider third party consents

The business’s existing agreements will need to be reviewed to see if they are assignable or able to be terminated as the purchaser will likely want to assume some and terminate others. Therefore, it is imperative that a med spa identify and understand the assignment, change of control and termination provisions of all existing contracts so that they can plan ahead and be prepared to take action at the appropriate time. A med spa owner should review existing agreements, including leases for such provisions, to identify whether an agreement can be assigned or terminated and, if so, what is required for each assignment or termination.

Typically, an agreement requires a certain number of days’ notice to the third party or the third party’s written consent to assign the contract from the med spa to the purchaser. For stock sales, the med spa should identify whether the existing agreements have change of control provisions. If consent of the third party is required then it may be prudent for the med spa to contact the third party as soon as possible to determine whether the other party is willing to consent, subject to coordination with the purchaser and appropriate confidentiality protections. For contracts that a purchaser may not want to assume, a med spa should review the termination provisions and identify if there are any fees or penalties for termination. Closings can be delayed over a med spa’s failure to receive an important third party consent. This issue arises often with landlords that do not wish to consent to the assignment of the lease from the med spa to the purchaser.

It’s a Wrap—The Latest from the Ninth Circuit on “Sign-In Wrap” Agreements

On February 27, 2025, in Chabolla v. ClassPass Inc., the U.S. Court of Appeals for the Ninth Circuit, in a split 2-1 decision, held that website users were not bound by the terms of a “sign-in wrap” agreement.

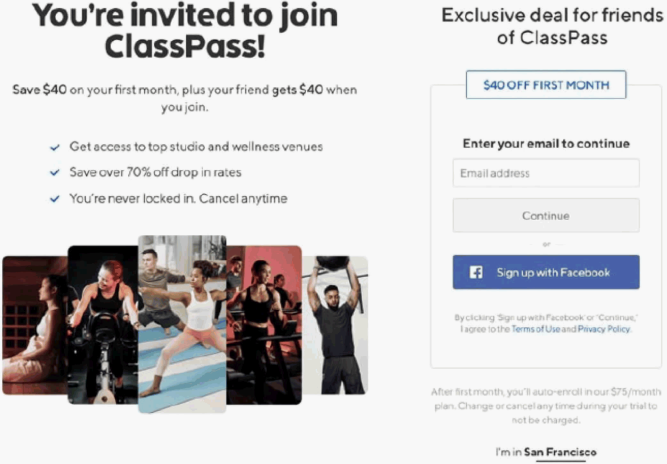

ClassPass sells subscription packages that grant subscribers access to an assortment of gyms, studios and fitness and wellness classes. The website requires visitors to navigate through several webpages to complete the purchase of a subscription. After the landing page, the first screen (“Screen 1”) states: “By clicking ‘Sign up with Facebook’ or ‘Continue,’ I agree to the Terms of Use and Privacy Policy.” The next screen (“Screen 2”) states: “By signing up you agree to our Terms of Use and Privacy Policy.” The final checkout page (“Screen 3”) states: “I agree to the Terms of Use and Privacy Policy.” On each screen, the words “Terms of Use” and “Privacy Policy” appeared as blue hyperlinks that took the user to those documents.

The court described four types of Internet contracts based on distinct “assent” mechanisms:

Browsewrap – users accept a website’s terms merely by browsing the site, although those terms are not always immediately apparent on the screen (courts consistently decline to enforce).

Clickwrap – the website presents its terms in a “pop-up screen” and users accept them by clicking or checking a box expressly affirming the same (courts routinely enforce).

Scrollwrap – users must scroll through the terms before the website allows them to click manifesting acceptance (courts usually enforce).

Sign-in wrap – the website provides a link to the terms and states that some action will bind users but does not require users to actually review those terms (courts often enforce depending on certain factors).

The court analyzed ClassPass’ consent mechanism as a sign-in wrap because its website provided a link to the company’s online terms but did not require users to read them before purchasing a subscription. Accordingly, the court held that user assent required a showing that: (1) the website provides reasonably conspicuous notice of the terms to which users will be bound; and (2) users take some action, such as clicking a button or checking a box, that unambiguously manifests their assent to those terms.

The majority found Screen 1 was not reasonably conspicuous because of the notice’s “distance from relevant action items” and its “placement outside of the user’s natural flow,” and because the font is “timid in both size and color,” “deemphasized by the overall design of the webpage,” and not “prominently displayed.”

The majority did not reach a firm conclusion on whether the notice on Screen 2 and Screen 3 is reasonably conspicuous. On one hand, Screen 2 and Screen 3 placed the notice more centrally, the notice interrupted the natural flow of the action items on Screen 2 (i.e., it was not buried on the bottom of the webpage or placed outside the action box but rather was located directly on top of or below each action button), and users had to move past the notice to continue on Screen 3. On the other hand, the notice appeared as the smallest and grayest text on the screens and the transition between screens was somewhat muddled by language regarding gift cards, which may not be relevant to a user’s transaction; thus, a reasonable user could assume the notice pertained to gift cards and hastily skim past it.

Even if the notice on Screen 2 and Screen 3 was reasonably conspicuous, the majority deemed the notice language on both screens ambiguous. Screen 2 explained that “[b]y signing up you agree to our Terms of Use and Privacy Policy,” but there was no “sign up” button—rather, the only button on Screen 2 read “Continue.” Screen 3 read, “I agree to the Terms of Use and Privacy Policy,” and the action button that follows is labeled “Redeem now”; it does not specify the user action that would constitute assent to the terms. In other words, the notice needs to clearly articulate an action by the user that will bind the user to the terms, and there should be no ambiguity that the user has taken such action. For example, clicking a “Place Order” button unambiguously manifests assent if the user is notified that “by making a purchase, you confirm that you agree to our Terms of Use.”

Accordingly, the court held that Screen 1 did not provide reasonably conspicuous notice and, even if Screen 2 and Screen 3 did, progress through those screens did not give rise to an unambiguous manifestation of assent.

The dissent noted that the majority opinion “sows great uncertainty” in the area of internet contracts because “minor differences between websites will yield opposite results.” Similarly, the dissent argued that the majority opinion will “destabilize law and business” because companies cannot predict how courts are going to react from one case to another. Likewise, the dissent expressed concern that the majority opinion will drive websites to the only safe harbors available to them—clickwrap or scrollwrap agreements.

While ClassPass involved user assent to an arbitration provision in the company’s online terms, the issue of user assent runs far deeper, extending to issues like consent to privacy and cookie policies—a formidable defense to claims involving alleged tracking technologies and wiretapping theories. Notwithstanding the majority’s opinion, many businesses’ sign-in wrap agreements will differ from the one at issue in the lawsuit and align more closely with the types of online agreements that courts have enforced. Nonetheless, as the dissent noted, use of a sign-in wrap agreement carries some degree of uncertainty. Scrollwrap and clickwrap agreements continue to afford businesses the most certainty.

Nationwide Injunction Shuts Down Enforcement of Trump’s DEI Executive Orders

On February 21, 2025, a federal district court judge issued a nationwide preliminary injunction that blocks enforcement of three major provisions of President Trump’s Executive Orders related to Diversity, Equity and Inclusion (DEI) programs:

Executive Order 14151, “Ending Radical and Wasteful Government DEI Programs and Preferencing.”

Executive Order 14173, “Ending Illegal Discrimination and Restoring Merit-Based Opportunity.”

(Each an EO and collectively referred to as the EOs.)

The National Association of Diversity Officers in Higher Education filed a lawsuit in the U.S. District of Maryland (Maryland District Court) challenging the constitutionality of these EOs, arguing they are vague under the Fifth Amendment and violate the First Amendment’s Free Speech Clause.

Below is a summary of the enjoined provisions.

Termination Provision: Requires Executive agencies to terminate “equity-related grants or contracts.”

Certification Provision: Requires federal contractors and grantees to certify they will not operate programs promoting DEI that violate Federal anti-discrimination laws.

Enforcement Provision: Directs The U.S. Attorney General to investigate and take actions (e.g., civil compliance investigations) against private sector entities continuing DEI practices.

While the injunction prevents the executive branch from enforcing these EOs, U.S. District Court Judge Adam Abelson allowed the U.S. Attorney General to continue its investigation for a report on ending illegal discrimination and preferences pursuant to EO 14173.

The Trump administration filed a motion with the Fourth Circuit Court to appeal the nationwide injunction. Depending on whether the Fourth Circuit upholds or reverses the injunction, the case may go to trial to determine if the Trump administration’s actions to ban DEI policies and practices are constitutional. Pending the appeal, the Trump administration requested a stay of the preliminary injunction which was denied by Judge Abelson. The Maryland District Court stressed the Trump administration was unable to demonstrate a strong likelihood of success on the merits. Additionally, the Court emphasized, “the chilling of the exercise of fundamental First Amendment rights weighs strongly in favor of the preliminary injunction and against a stay pending appeal.”1

On March 10, 2025, Judge Abelson issued further clarification regarding the scope of the preliminary injunction, stating that it applies to all federal agencies, departments and commissions, not just the named defendants. He explained that limiting the injunction to only the named parties would create an unfair situation where the termination status of a federal grant or the certification requirements for federal contractors would depend on which specific federal agency the grantee or contractor works with for current or future funding. This would result in inequitable treatment in an area that requires uniformity. Consequently, considering President Trump’s directives for all federal agencies, departments and commissions to adhere to the Termination and Certifications Provisions, the preliminary injunction will now encompass all federal agencies to prevent any inconsistent application.

Since the Maryland lawsuit, additional complaints against the anti-DEI EOs have been filed in Illinois, California and Washington D.C., with similar legal arguments to the Maryland case. We will continue to monitor these lawsuits as they progress through the court system.

You can read more about the Maryland lawsuit and the implications of these EOs in our previous alert linked here.

[1] Nat’l Ass’n of Diversity Officers in Higher Educ. v. Trump, Memorandum Opinion and Order Denying Motion to Stay Injunction Pending Appeal, Case No. 25-cv-00333-ABA (Mar. 3, 2025), 6.

New Jersey and New York Lawmakers Propose New Limits on Restrictive Covenants

For years, New York and New Jersey legislators have proposed various measures that would prohibit or restrict employers from using non-compete agreements that may restrict employees’ future employment opportunities. This GT Alert discusses two bills, New York Senate Bill S4641 and New Jersey Senate Bill S1688, which propose changes to the landscape of restrictive covenants in these states.

New York Senate Bill S4641

On Feb. 10, 2025, the New York Senate introduced S4641 in response to Gov. Hochul’s veto of a prior non-compete bill (S3100A) in December 2023. Bill S4641 would add Section 191-d to the New York Labor Law, prohibiting employers from requiring any “covered individual” to enter into a non-compete agreement. The bill defines a “covered individual” as any person other than a “highly compensated individual” who, with or without an employment agreement, performs work or services for another person, “in a position of economic dependence on, and under an obligation to perform duties for, that other person.” “Highly compensated individuals” are those who are paid an average of at least $500,000 per year.

The bill would also prohibit use of post-employment non-compete agreements with regard to “health care professionals, regardless of the individual’s compensation level. Most health care providers who are licensed under New York law may fall under S4641’s definition of “health related professionals.” The law would permit employers to enter into agreements, even with covered individuals or a health care professional, which (1) establish a fixed term of service and/or exclusivity during employment; (2) prohibit disclosure of trade secrets; (3) prohibit disclosure of confidential and proprietary client information; or (4) prohibit solicitation of the employer’s clients.

The bill would also permit non-compete provisions as part of agreements to sell the goodwill of a business or to dispose of a majority ownership interest in a business, by a partner of a partnership, member of a limited liability company, or an individual or entity owning 15% or more interest in the business. Such non-compete agreements would still need to meet the common law test as to reasonableness in time and geographic scope, a necessity for protection of legitimate business interests, and lack of harm to the public.

S4641 would create a private right of action, allowing covered individuals who are subject to a prohibited non-compete agreement to file claims in court. If the employer is found to have violated the new Section 191-d, a court may void the non-compete agreement, prohibit the employer from similar conduct going forward, and order payment of liquidated damages, lost compensation, compensatory damages and/or reasonable attorneys’ fees and costs to the employee. The bill caps liquidated damages at $10,000 per impacted individual but permits a court to award liquidated damages to every claimant.

New Jersey Senate Bill S1688

In New Jersey, the Senate Labor Committee is considering S1688, which was initially introduced in January 2024. This bill, if passed, would amend the New Jersey Law Against Discrimination (NJLAD), N.J.S.A. 10:5-12:7, and 10:5-12:8 to clarify that the prohibition of certain waivers in employment agreements includes non-disclosure and non-disparagement provisions that would limit an employee’s right to raise claims of discrimination, retaliation, or harassment. The bill would also amend N.J.S.A. 10:5-12:7(c) to remove the original carve out for collective bargaining agreements, meaning the prohibition of waivers relating to discrimination, retaliation, or harassment claims would apply in the collective bargaining context as well as individual employment agreements.

Conclusion

These proposed bills demonstrate states’ continued efforts to limit employers’ use of restrictive covenants. Prior efforts to formalize such restrictions have been mostly unsuccessful, but the New Jersey and New York legislatures still seek to narrow the scope of the restrictions.

KEEPING UP: Kardashian Brand Sued in TCPA Call Timing Class Action

When Kim Kardashian said, “Get up and work”, the TCPA plaintiff’s bar took that seriously. And another Kardashian sibling may be facing the consequences.

We at TCPAWorld were the first to report on the growing trend of lawsuits filed under the TCPA’s Call Timing provisions, which prohibit the initiation of telephone solicitations to residential telephone subscribers before 8 am and after 9 pm in the subscriber’s time zone. Call it a self-fulfilling prophecy or just intuition honed by decades of combined experience, but these lawsuits show no signs of slowing down.

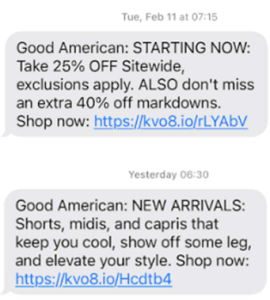

In Melissa Gillum v. Good American, LLC. (Mar. 11, 2025, C.D. Ca), Plaintiff alleges that Khloe Kardashian’s clothing brand Good American sent the following text messages to her residential telephone number at 07:15 AM and 06:30 AM military time:

Of course, Plaintiff alleges she never authorized Good American to send her telephone solicitations before 8 am or after 9 pm.

Plaintiff also seeks to represent the following class:

All persons in the United States who from four years prior to the filing of this action through the date of class certification (1) Defendant, or anyone on Defendant’s behalf, (2) placed more than one marketing text message within any 12-month period; (3) where such marketing text messages were initiated before the hour of 8 a.m. or after 9 p.m. (local time at the called party’s location).

The consensus here on TCPAWorld is that calls or text messages made with prior express consent are not “telephone solicitations” and likely not subject to Call Time restrictions. We’ll have to see how these play out but stay tuned for the latest updates!