Full Cost Recovery Proposed for Application Fees Under Australia’s Mandatory Merger Clearance Regime

In Brief

The Australian Treasury and the Australian Competition and Consumer Commission (ACCC) has released a consultation paper in which it proposes a full cost recovery regime for application fees under Australian’s new mandatory merger clearance regime.

The Australian Government is consulting briefly about the proposed fee structure prior to finalising its position and publishing a fees legislative instrument (which it expects to do before 30 June 2025).

The 2025/26 fees for the main substantive assessment are proposed to be as follows:

Phase 1 assessment: AU$56,800

Phase 2 assessment: AU$952,000

Additional detail about the proposed fees across all types of applications is set out below.

The Government considers that its approach “reflects the resources required by the ACCC to efficiently carry out an assessment, and will ensure businesses that propose mergers for assessment, rather than taxpayers, bear the cost they impose on the community to assess that risk”, and stated that “the fees will also ensure the ACCC is adequately resourced to undertake its expert administrative decision-making role and can efficiently administer the new system.”

The Approach Taken by the Government

The Government noted that under the present informal clearance regime, the operational cost of merger control incurred by the ACCC is funded through consolidated revenue by taxpayers generally and is not imposed on the merger parties based on cost recovery principles.

In its consideration for the 2024/25 Budget, the Government made the decision to change this approach to a full cost-recovery model. The model will impose separate fees for each type of review, in order that they are scaled to the complexity, and in all likelihood competition law risk, associated with each type of review.

The approach taken has been based on five design principles aimed at “appropriately captur[ing] the costs to deliver the ACCC’s key regulatory merger activities while ensuring the overall fees system is efficient, equitable and transparent for parties and the ACCC to navigate.” In brief, the design principles are:

To align costs with fees: the fee structure will be based on the complexity of review to ensure that it is the merger parties, not the public, that bear the cost of assessment – particularly intensive assessment;

To promote equity and competition: the fee structure will be based on complexity of review while providing for exemptions in appropriate instances (e.g. for small businesses), in order that the fees are not a barrier to merger activity;

To promote efficiency and effectiveness: the fees will be set at a level that reflects the minimum and efficient resourcing necessary for the ACCC to carry out the assessment;

To minimise regulatory and administrative burden: clarity will be provided to parties about the fee rates and reasons for them; and

To ensure transparency and accountability: the ACCC will report on the operation of the regime (including the numbers of applications, waivers, Phase 1 and 2 determinations, timeline extensions etc), and will carry out annual reviews/consultations regarding fees.

The Proposed Fee Structure

The full set of fees are set below and in the consultation paper as follows:

Type of Review

Fee in 2025‑26

Description of Activity

Notification Waiver Application

AU$8,300(50)

An application that seeks a waiver from the requirement to notify a merger to the ACCC.

Notification (Phase 1 Assessment)

AU$56,800(201)

The review of all notified mergers commences in Phase 1 and incurs a fee.

Phase 2 Assessment

AU$952,000(8.5)

An additional fee will be charged for mergers that proceed to Phase 2.

The ACCC anticipates that only a small number of mergers will proceed to a more in-depth consideration of the competition issues in a Phase 2 assessment.

Public Benefits Application

AU$401,000(1.5)

Notifying parties may also seek ACCC approval of an acquisition on public benefit grounds.

If a notifying party makes an application for a public benefits review, an additional fee will be payable, reflecting the further assessment undertaken by the ACCC to determine whether the acquisition should be approved because the likely public benefits will outweigh the likely public detriments.

Interestingly, the consultation paper also sets out the “estimated volume of applications” expected by Treasury and the ACCC in the 2025/26 year – which are the numbers we have inserted in brackets in the above table.

Time will tell how realistic these numbers will prove to be – noting that they account for the ‘voluntary’ period for making applications from 1 July 2025 and the first six months of operation of the mandatory regime.

The quite high costs associated with the Phase 2 and Public Benefit Reviews (which Treasury and the ACCC expect to be in single digits in terms of numbers of applications) reflect the likely complexity of these matters and the likely use of:

The ACCC’s compulsory document and information gathering powers under section 155 of the Competition and Consumer Act, as well as the potential use of oral examinations under this power;

The potential need to use quantitative analysis to inform the ACCC’s assessment, and the need for the ACCC to source data from multiple sources to undertake that analysis (again potentially via compulsory notices);

The likely need to use both internal and external economic (including expert economists), industry and legal advisers to inform the ACCC’s assessment of the proposed acquisition – including any remedies proposed by the merger parties; and

In the case of public benefit reviews, the likely need by the ACCC to undertake consumer, industry and economic engagement to ‘test’ the veracity of the public benefit claims – over and above the ‘pure’ competition analysis.

Exemptions, Future Changes (Indexation) and Reviews

As per the design principles, a fee exemption will be available for acquisitions made by small businesses so that fees are “not a disproportionate burden for those businesses” – small businesses having an aggregated turnover of less than AU$10 million.

Once the fees are set mid-year, they will then be indexed annually at the beginning of each financial year. The ACCC will also review its processes and costs estimate and the fees will be adjusted if required, so that that the charges reflect the cost of providing activities.

The Government finally noted that the costs associated with reviews of ACCC determinations under the mandatory merger clearance regime by the Australian Competition Tribunal will be subject to a separate Government consultation and decision.

The Government’s consultation paper can be found here.

Best Practices for Due Diligence in Government Contractor M&A Transactions

Mergers and acquisitions (M&A) involving government contractors present unique challenges and considerations that require meticulous due diligence. Unlike purely commercial deals, government contracts introduce layers of regulatory compliance, security requirements, and approval processes that can significantly affect deal structure, valuation, and risk. This blog post outlines some of the basic best practices for due diligence when acquiring or selling a business that performs U.S. government contracts.

Assess Government Contracting Status Early

Early in the due diligence process, buyers should determine whether the target is a prime contractor, subcontractor, or both, and identify all relevant contracts, subcontracts, and task orders. It is important to understand the customer base — whether it’s DoD, civilian agencies, or state/local governments — as each target presents different risks and obligations.

Review Contract Performance and Compliance History

Key questions to answer during due diligence include:

Has the contractor met performance milestones and delivery requirements?

Are there any pending or past disputes, cure notices, terminations for default, or performance issues?

Are there any audit findings or noncompliance issues reported by the Defense Contract Audit Agency (DCAA) or inspector general?

Moreover, understanding the target’s history with compliance — including adherence to the Federal Acquisition Regulation (FAR), Cost Accounting Standards (CAS), and agency supplements (like DFARS) — is essential.

Analyze Past Performance

The target company’s past performance record is a key asset in government contracting. However, an acquiring company must ensure that this past performance will be recognized in future bids. The FAR allows agencies discretion in considering the past performance of predecessor companies (FAR 15.305(a)(2)(iii)).

Evaluate Representations, Certifications, and Registrations

Ensure that all representations and certifications made in the System for Award Management (SAM) and on contract solicitations are accurate and current. Check for proper registrations, including:

SAM.gov

NAICS code alignment

Small business or socioeconomic certifications (e.g., 8(a), HUBZone, SDVOSB, WOSB, etc.)

Misrepresentations can lead to False Claims Act liability and/or suspension or debarment.

Identify Organizational Conflicts of Interest (OCI)

Conduct a thorough analysis of potential OCIs that could impair objectivity or create unfair competitive advantages post-closing. This is especially important if the buyer already holds government contracts that could overlap with the target’s portfolio.

Understand Novation Requirements

Government contracts are not automatically assignable. If the transaction constitutes a change of ownership requiring a novation agreement under FAR 42.1204, the buyer must:

Notify the relevant contracting officer(s)

Prepare a novation package, including the purchase agreement and corporate documentation

Be aware that novation approval is discretionary and can delay closing or transition

Some buyers structure transactions to avoid novation altogether, such as through equity purchases.

Review Security Clearances and Facility Requirements

If the target holds facility security clearances (FCLs) or performs classified work, due diligence must verify:

That the clearances are active and match the scope of work

Personnel clearances (PCLs) and any foreign ownership, control, or influence (FOCI) mitigation plans

Compliance with the National Industrial Security Program Operating Manual (NISPOM)

Post-closing, the Defense Counterintelligence and Security Agency (DCSA) will review the transaction to ensure continued eligibility for classified contracts.

Scrutinize Pricing and Cost Accounting Practices

For cost-reimbursable and time-and-materials contracts, buyers must understand the target’s accounting systems, indirect cost rates, and billing practices. Ensure systems are compliant with government standards and validated by relevant audits.

Additionally, evaluate potential exposure to cost disallowances, overbillings, or defective pricing under the Truthful Cost or Pricing Data statute (formerly TINA).

Analyze Paycheck Protection Program (PPP) Loans

PPP loans, forgiveness applications, and supporting documentation should also be analyzed.

Analyze Subcontracting Plans and Flowdowns

Examine the target’s subcontracting compliance, especially for large businesses with small business subcontracting plans. Confirm that required FAR clauses have been flowed down to subcontractors and that appropriate monitoring systems are in place.

Assess Export Control and ITAR Compliance

If the target deals with defense articles or technical data, review its compliance with:

International Traffic in Arms Regulations (ITAR)

Export Administration Regulations (EAR)

Export licenses and technology control plans

Violations may not only carry penalties but also restrict post-acquisition operations.

Assess False Claims Act and Compliance Risks

M&A due diligence for government contractors should include a rigorous review of compliance with the False Claims Act (FCA) (31 U.S.C. §§ 3729–3733), the Procurement Integrity Act, and other federal statutes. Undisclosed compliance violations or internal investigations can result in successor liability or post-closing enforcement actions.

Tailor the Purchase Agreement to Government Contract Risks

The purchase agreement should include:

Robust representations and warranties regarding government contracts

Indemnities for known risks (e.g., outstanding investigations, pending audits)

Covenants related to novation, change-of-control notifications, and post-closing cooperation

Conclusion

Government contractor M&A requires far more than standard commercial diligence. By proactively identifying regulatory risks, understanding contract transfer limitations, and ensuring compliance, parties can better structure the transaction, protect value, and avoid costly surprises. Buyers and sellers alike should involve counsel with deep experience in government contracts early in the process to guide these critical due diligence steps.

Listen to this post

DOJ’s Antitrust Leadership Emphasizes Procedural Fairness and Targeted Enforcement in Merger Reviews

In a recent speech, Deputy Assistant Attorney General Bill Rinner of the DOJ Antitrust Division[1] outlined the Division’s approach to merger enforcement in the Trump administration under the leadership of Assistant Attorney General Gail Slater. Rinner emphasized a balanced, law-driven, and transparent merger review process aimed at vigorously enforcing antitrust laws without deterring lawful transactions.

Below are key takeaways from the speech:

Antitrust Enforcement Grounded in Law, Not Ideology. The Division views itself as an enforcement agency, not a regulator, focused on preventing mergers that harm competition instead of blocking transactions for broader policy goals. Rinner rejected the idea of using merger review as a tool for social policy or regulatory overreach, drawing a clear boundary between antitrust enforcement and broader public interest regulation.

Procedural Fairness as a Foundation for Enforcement. Rinner emphasized predictability and fairness in merger review, warning that abuse of investigatory tools can undermine due process and public trust. Specific practices the Division will avoid include (1) so-called “Scarlet letter” warnings that implore parties to “close at their own risk;” (2) off-the-books relief or “shadow decrees” neither grounded in the Clayton Act nor transparent to the public; and (3) leveraging the merger review process to impose a “regulatory review tax” or fish for unrelated conduct violations.

Commitment to Vigorous, Case-Specific Enforcement. The Division will continue to pursue strong enforcement where evidence shows harm, but will treat each transaction on its own merits. Vigorous enforcement means using a scalpel, not a sledgehammer.

Preference for Structural Remedies. Rinner reaffirmed the DOJ’s institutional preference for structural remedies (e.g., divestitures), citing their effectiveness and clarity. However, he acknowledged that behavioral remedies may supplement structural relief in fact-specific cases. Settlements must be transparent and subject to public oversight, including under the Tunney Act.

Respect for the Adversarial Process. Rinner encouraged good-faith advocacy from merging parties and their counsel and economists, reaffirming that DOJ values substance over political affiliation or stature in the antitrust bar. He stressed that the DOJ will scrutinize underhanded efforts to conceal documents or abuse privilege claims and will pursue sanctions where necessary.

***

Rinner’s remarks signal that the DOJ Antitrust Division does not view dealmaking with inherent suspicion. When necessary, however, the agency will pursue vigorous, case-specific enforcement grounded in procedural fairness and legal principles. Merging parties should expect a transparent review process focused on competitive effects, with a strong preference for – but not absolute adherence to – structural remedies. Companies should align deal strategies accordingly and be prepared for active engagement before the Division.

[1] The Division has broad antitrust enforcement authority and commonly reviews mergers and competitive conduct in industries such as technology, healthcare (often involving health plans), financial services, and industrials.

FAR 2.0 Rollout Begins

We recently wrote about the Trump administration’s efforts to streamline the Federal Acquisition Regulation (“FAR”). The FAR contains approximately 2,000 pages of regulations that guide hundreds of billions of dollars in acquisitions each year. Some clauses in the FAR are mandated by a statute while others have been adopted over time to fix a problem, institute an Executive Order or because regulators thought it would be a best practice. As detailed in a recent blog, the administration’s current effort is aimed at confining the FAR to provisions mandated by statute “or essential to sound procurement.”

The FAR Council, in coordination with the Office of Management and Budget, is expected to release revisions of each FAR Part as proposals, but effectively require agencies to issue class deviations and adopt each section before the revisions become final. This means contractors may see dramatic change in short order. It is important to remember, however, that updated FAR sections do not immediately require compliance; that only occurs when a solicitation is issued with an updated provision or a contracting officer successfully modifies a contract to include them.

To start, the administration has released proposed revisions to FAR Parts 1 and 34.

FAR Part 1, entitled, “The Federal Acquisition System,” lays out fundamentals of the FAR and how it works. Some important changes include:

Elimination of language surrounding the purpose and goals for the FAR such as “to deliver on a timely basis the best value product or service to the customer, while maintaining the public’s trust and fulfilling public policy objectives.” FAR 1.102(a).

Deletion of nearly the entire “performance standards” clause. This includes language that “[t]he System must be responsive and adaptive to customer needs, concerns, and feedback. Implementation of acquisition policies and procedures, as well as consideration of timeliness, quality and cost throughout the process, must take into account the perspective of the user of the product or service.” FAR 1.102-2(a)(2). Also, “[w]hen selecting contractors to provide products or perform services the Government will use contractors who have a track record of successful past performance or who demonstrate a current superior ability to perform” and “[t]he Government will maximize its use of commercial products and commercial services in meeting Government requirements” and “[i]t is the policy of the System to promote competition in the acquisition process.” FAR 1.102(a).

Other deleted provisions talk to minimizing administrative costs and conducting business “with integrity, fairness, and openness.” FAR 1.102(c).

FAR applicability language deleted. Elimination of the language regarding the applicability of the FAR: “[t]he FAR applies to all acquisitions as defined in part 2 of the FAR, except where expressly excluded.” FAR 1.104.

Potential increase in agency-specific regulations. The allowances for agencies to issue their own supplemental regulations was left largely untouched, but limitations on those regulations in FAR 1.302 have been proposed for deletion. This may allow agencies more flexibility to issue supplemental regulations, potentially at the expense of regulatory consistency across agencies.

Elimination of the requirement for public comment. The provisions requiring public comment for “significant” FAR revisions has been deleted. FAR 1.501-2.

Contracts may be entered into by individuals other than contracting officers. Part of FAR, Section 1.601, is being proposed for deletion: “[c]ontracts may be entered into and signed on behalf of the Government only by contracting officers.”

The content of Determinations and Findings are no longer required to clearly and convincingly justify the specific determination made under FAR 1.704. The requirement for expiration dates was also deleted.

It is altogether possible that the deletions will be moved to guidance, but it is an open question whether that guidance will be as enforceable as a FAR provision where these requirements previously resided.

We will continue to monitor changes to the FAR and provide updates as warranted.

Competition and Consumer Law Round-Up June 2025

What’s Inside This Issue?

This edition of the K&L Gates Competition & Consumer Law Round-Up provides a summary of recent and significant updates from the Australian Competition and Consumer Commission (ACCC), as well as other noteworthy developments in the competition and consumer law space.

Key Developments in Environmental / Greenwashing Guidance and Enforcement

EnergyAustralia Settles Greenwashing Action Brought by Advocacy Group

AU$8.25 Million Penalty Ordered Against Clorox for Misleading Greenwashing Claims

Enforcement

Oil and Gas Company Qteq Found to Have Engaged in Cartel Conduct

Federal Court Orders Captain Cook Vocational College to Pay AU$30.4 Million in Penalties for Unconscionable Conduct and Misleading Representations

ACCC Commences Proceedings Against Retailer City Beach for Noncompliant Button Battery Products

Mergers and Acquisitions

ACCC Raises Concerns With Rural Merchandiser Elders’ Proposed Acquisition of Delta

Qube’s Acquisition of MIRRAT Not Opposed by ACCC

Notifications and Authorisations

ACCC Proposes to Grant Authorisation to Australian Payment Network to Facilitate Wind Down of Cheque Industry

Noteworthy Developments

Mandatory Information Standard for Toppling Furniture Brought into Effect

Click here to view the Round-Up.

M&A Disputes Set to Rise in Latin America: How Savvy Investors Are Protecting Themselves

As deal activity shows signs of rebounding in 2025, investors are bracing for an increase in M&A-related disputes globally, and Latin America is no exception. It appears to be leading the trend.

According to Berkeley Research Group’s latest M&A Disputes Outlook, more than 80% of investors and legal experts surveyed expect the volume and value of disputes in Latin America to rise this year. The reasons are hardly surprising to anyone following the news. According to Alejandro Martinolich, a BRG associate director based in Buenos Aires, persistent political and economic uncertainty in Brazil and Mexico, the region’s two largest economies, contributes to investor anxiety, making it more difficult to price and structure deals with confidence.

“With highly valuable assets and continuous political and regulatory changes, not to mention macroeconomic uncertainty, Latin America has ideal conditions for a dispute,” said Martinolich. And he’s right. The region has seen volatility in both the Mexican peso and the Brazilian real, partly due to concerns over tariff threats and unpredictable government decisions.

What’s Driving the Disputes?

According to the BRG survey, financial and operational performance issues are the most common flashpoints, followed closely by foreign exchange volatility. Deal terms such as put and call options, redemption rights, and other contract provisions aimed at managing uncertainty often become contentious when the operating environment deteriorates or projections go unmet.

Notably, it’s not the billion-dollar megadeals that are fueling this trend. It’s the smaller transactions, the ones under $50 million, that are seeing the sharpest rise in disputes, likely because these deals often lack the deep due diligence, legal firepower, and sophisticated structuring of larger transactions.

Why Investors Are Structuring Deals to Avoid Local Jurisdictions

Considering these conditions, sophisticated investors now structure their deals to avoid having disputes resolved in the operating country altogether. Instead of relying on local courts in Brazil, Mexico, or other Latin American nations where litigation is often lengthy and sometimes unpredictable and subject to local political winds, investors increasingly route dispute resolution through corporate structures based in the United States or other common law jurisdictions like the U.K. or Singapore. Why?

Speed and Predictability: Courts in common law jurisdictions are known to be quicker and more transparent than their Latin American counterparts. Common law systems, like those in the United States and the U.K., are based on judicial precedents. More importantly, common law generally provides quicker remedies to the parties in equity and law, and this can be faster than relying on codified laws.

Higher Legal Costs as a Deterrent: The expense of litigating in the United States can act as a powerful deterrent against frivolous lawsuits. Courts can impose sanctions, fines, and payment of the other party’s expenses and attorney fees on parties who file frivolous claims or engage in abusive litigation practices.

Perceived Fairness: Investors believe they’ll receive a more balanced hearing in jurisdictions where judges and arbitrators are less likely to be influenced by local politics or pressure.

A Global Trend with Local Nuances

Latin America is part of a larger global uptick in disputes, as seen in BRG’s wider survey of 200+ financial and legal professionals. Globally, several sectors including fintech, real estate, and energy are expected to see a rise in litigation, driven by shifting regulations and deal terms that no longer align with evolving realities.

In the United States, regulatory shifts such as rollbacks of Biden-era clean energy incentives by the current administration would have rippling effects leading to disputes over valuations and government support.

Bottom Line

Latin America remains a region of opportunity with compelling valuations, rising markets, and untapped assets. However, it also comes with particular dispute risks. Dealmakers operating in Latin America have to be especially diligent in crafting precise and adaptable contracts that can withstand economic shocks, currency swings, and regulatory unpredictability to reduce the likelihood of post-transaction disputes. Ultimately, for dealmakers, the solution is not to avoid the region but to structure smarter, recognizing and anticipating instability and making sure any dispute that does arise plays out on their home turf, or at least on more neutral ground.

Why Sellers Need an M&A Attorney [Video]

When selling a business, having experienced legal counsel is critical to protecting your interests, limiting liability, and maximizing the final sale value. In a recent conversation hosted by Calder Capital, Varnum partner Chris George sat down with Garrett Monroe to discuss the key legal considerations sellers should be aware of during M&A transactions.

Key topics covered in the discussion include:

Legal strategies to minimize post-closing liability;

Structuring the deal to align with your goals;

Navigating due diligence and disclosure obligations;

Common pitfalls sellers encounter—and how to avoid them; and

The importance of early legal counsel involvement in the transaction process.

Chris draws from his extensive experience representing sellers in a wide range of industries to provide practical, actionable guidance for business owners considering an exit.

GLP-1 Receptor Agonists: The Surge of M&A Activity and the Future of Metabolic Health

Over the past decade, the global pharmaceutical industry has witnessed a transformation in the treatment landscape for metabolic disorders, particularly type 2 diabetes and obesity. At the heart of this shift is the explosive rise of GLP-1 receptor agonists, once a niche therapeutic class, now a multi-billion-dollar market shaping the future of chronic disease management. With this surge in clinical and commercial success, the GLP-1 technology space has become a hotbed for mergers and acquisitions (M&A), as major pharma players race to secure their foothold in what many consider the next blockbuster category.

This post explores the strategic drivers, recent deals, and future implications of M&A activity in the GLP-1 sector, unpacking why this field has become a focal point for investment, innovation, and consolidation.

GLP-1: From Diabetes Therapy to Weight Loss Powerhouse

Originally developed to help manage blood sugar in type 2 diabetes, GLP-1 receptor agonists have evolved beyond their initial indications. These drugs mimic the glucagon-like peptide-1 hormone, which enhances insulin secretion, suppresses glucagon, and slows gastric emptying. What made them revolutionary was their ability to induce weight loss, a feature that has become a cornerstone in the battle against obesity, a condition with vast medical, social, and economic implications.

The commercial success of drugs like Novo Nordisk’s semaglutide (Ozempic®, Wegovy®) and Eli Lilly’s tirzepatide (Mounjaro®, Zepbound®) has catalyzed not just clinical excitement but also intense investor and acquirer interest. These medications have demonstrated not only weight loss upwards of 15-20% but also cardiovascular and metabolic benefits, positioning them as game-changers in preventive medicine.

Why the GLP-1 Market Is Attracting M&A Interest

Massive Market Potential: Obesity affects over 890 million adults globally[1], with related comorbidities including diabetes, cardiovascular disease, and certain cancers. Analysts estimate the GLP-1 market could reach US$139 billion annually by 2030.[2]

Pipeline and Platform Expansion: As demand surges, big pharma companies are under pressure to expand their metabolic portfolios. M&A offers a fast-track route to diversify into GLP-1 and adjacent incretin-based therapies (e.g., GIP (Gastric Inhibitory Polypeptide), dual/triple agonists).

Technology Differentiation: Although current GLP-1s are effective, there is a premium on next-generation delivery systems (oral, transdermal, long-acting injectables) and multi-modal agonists. Acquiring innovative biotech firms with proprietary delivery platforms or novel peptide structures provides a competitive edge.

Limited In-House Innovation: Not all big pharma players developed GLP-1 assets internally. As a result, acquiring external innovation, whether through platform technologies or late-stage assets, is becoming a strategic imperative.

Recent M&A Moves in the GLP-1 Landscape

The following transactions illustrate the growing M&A momentum in the GLP-1 space:

Roche’s Acquisition of Carmot Therapeutics (2023):Roche paid US$2.7 billion upfront for Carmot, a clinical-stage biotech with a promising portfolio of incretin-based therapies, including dual GLP-1/GIP agonists. This move positioned Roche to compete in the metabolic disease arena, leveraging Carmot’s small molecule platforms to diversify beyond oncology.[3]

AstraZeneca’s Acquisition of CinCor Pharma (2023):Though primarily targeting hypertension, AstraZeneca’s US$1.8 billion buyout of CinCor included a nod toward combinational potential with metabolic therapies, signaling broader interest in cardiometabolic synergies.[4]

Pfizer’s Strategic Reassessment and Potential for Acquisitions (2024, 2025):After halting internal development of its oral GLP-1 candidate due to tolerability concerns, Pfizer has publicly stated its interest in acquiring external GLP-1 assets. Although no formal deal has closed, analysts speculate an acquisition could be imminent, especially in the wake of divestitures from its COVID-era portfolio.[5], [6]

Novo Nordisk’s Expansion via Catalent Deal (2024):Novo Nordisk’s US$16.5 billion acquisition of Catalent’s fill-finish facilities demonstrates another angle of strategic M&A, ensuring capacity for GLP-1 manufacturing and reducing supply chain risks amid skyrocketing demand.[7]

Beyond Big Pharma: Biotech’s Role as Innovation Engines

Small- to mid-cap biotech firms are proving essential in advancing the next frontier of GLP-1 therapies. These companies are often rich in innovation but resource-constrained, making them prime acquisition targets for larger players. A few noteworthy examples include:

Structure Therapeutics: Developing oral GLP-1R agonists, Structure has seen rapid investor interest post-Initial Public Offering (IPO) and is considered a prime candidate for acquisition due to its differentiated delivery approach.[8]

Terns Pharmaceuticals: The company recently announced positive Phase 1 clinical results for its oral GLP-1R agonist for treating obesity, triggering acquisition rumblings.[9]

Viking Therapeutics: The company is advancing early-stage GLP-1 or dual agonists with strong preclinical profiles and have recently experienced stock price surges on clinical data, fueling acquisition speculation.[10]

Strategic Implications and Risks

Although the M&A landscape in GLP-1 technology is vibrant, it is not without challenges, such as the following:

Supply Chain Constraints: Companies acquiring GLP-1 assets must also manage complex peptide synthesis, formulation, and delivery bottlenecks. This makes CMC (chemistry, manufacturing, controls) and scale-up capabilities a due diligence priority.

Regulatory Scrutiny: With GLP-1s being prescribed off-label for cosmetic weight loss, regulators may impose tighter restrictions, impacting long-term market forecasts.

Valuation Pressure: As competition intensifies, valuations are soaring. This poses a risk of overpaying for early-stage assets with limited clinical data. Strategic buyers must carefully weigh scientific promise against commercial risk.

Patent Life and Biosimilar Threats: The first-generation GLP-1s are already facing biosimilar competition timelines. Acquirers must assess exclusivity windows and invest in lifecycle management strategies.

The Future of M&A in the GLP-1 Arena

Looking ahead, several trends are likely to shape the next wave of M&A, including the following:

Combination Therapy Focus: Expect acquisitions targeting companies developing dual/triple agonists (GLP-1/GIP/Glucagon) to address broader metabolic endpoints.

Digital and Companion Tech Integration: Companies integrating wearables or AI-driven metabolic monitoring may become attractive M&A targets for firms aiming to offer holistic obesity/diabetes management solutions.

Emerging Markets Expansion: Firms with strong distribution in Asia, Latin America, or Africa may see M&A interest as acquirers look to expand the global footprint of GLP-1 therapies.

Conclusion

The GLP-1 revolution is not only transforming the treatment of diabetes and obesity, it is also reshaping the strategic priorities of the pharmaceutical industry. With blockbuster sales, novel delivery technologies, and growing clinical applications, GLP-1s have become a magnet for M&A. For investors, innovators, and pharma executives alike, the current M&A wave in the GLP-1 sector represents both opportunity and inflection, one that will define the metabolic health market for years to come.

As GLP-1 technology continues to evolve, one thing is certain: the race to acquire the next breakthrough is only just beginning.

[1] World Health Organization, Obesity and overweight, May 7, 2025; https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight#:~:text=In%202022%2C%201%20in%208,million%20were%20living%20with%20obesity.

[2] TD Securities, GLP-1 Market: The Pipeline Expands, Mar. 10, 2025; https://www.tdsecurities.com/ca/en/glp1-market-the-pipeline-expands#:~:text=Global%20sales%20of%20GLP%2D1,from%20sales%20posted%20in%202024.

[3] “Roche to acquire Carmot Therapeutics for $2.7bn,” Pharmaceutical Technology, Dec. 3, 2023; https://www.pharmaceutical-technology.com/news/roche-to-acquire-carmot-therapeutics/.

[4] “AstraZeneca to buy US-based CinCor Pharma for $1.8bn,” Pharmaceutical Technology, Jan 10, 2023; https://www.pharmaceutical-technology.com/news/astrazeneca-buy-cincor-pharma/#:~:text=AstraZeneca%20has%20signed%20a%20definitive%20agreement%20to%20buy,CinCor%20Pharma%20for%20%2426%20per%20share%20in%20cash.

[5] A. Zank, “Pfizer CFO talks strategic growth through acquisitions,” CFO Brew, Sept. 24, 2024; https://www.cfobrew.com/stories/2024/09/24/pfizer-cfo-talks-strategic-growth-through-acquisitions.

[6] M. Lee, “Pfizer Eyes $20 Billion Revenue From Acquisitions Amid Patent Cliff Challenges,” AInvest, Jan. 14, 2025; https://www.ainvest.com/news/pfizer-eyes-20-billion-revenue-from-acquisitions-amid-patent-cliff-challenges-25011010cf8550e9ae82e13f/.

[7] “Novo completes $16.5bn takeover of Catalent,” PharmaPhorum, Dec. 2024; https://pharmaphorum.com/news/novo-completes-165bn-takeover-catalent.

[8] “Structure Therapeutics Announces First Patients Dosed in Phase 2b ACCESS Clinical Study Evaluating Oral Small Molecule GLP-1 Receptor Agonist, GSBR-1290, for Obesity,” Global Newswire, Nov. 13, 2024; https://www.globenewswire.com/news-release/2024/11/13/2980634/0/en/Structure-Therapeutics-Announces-First-Patients-Dosed-in-Phase-2b-ACCESS-Clinical-Study-Evaluating-Oral-Small-Molecule-GLP-1-Receptor-Agonist-GSBR-1290-for-Obesity.html.

[9] “Terns Pharmaceuticals Announces Positive Phase 1 Clinical Trial Results with TERN-601 Once-Daily Oral GLP-1R Agonist for the Treatment of Obesity,” Global Newswire, Sept. 9, 2024; https://www.globenewswire.com/news-release/2024/09/09/2942701/0/en/Terns-Pharmaceuticals-Announces-Positive-Phase-1-Clinical-Trial-Results-with-TERN-601-Once-Daily-Oral-GLP-1R-Agonist-for-the-Treatment-of-Obesity.html.

[10] “Viking Therapeutic’s new GLP1 impresses at ObesityWeek 2024,” GLP1.Guide, Nov. 4, 2024; https://glp1.guide/content/viking-therapeutics-new-glp1-impresses-at-obesity-week-2024/.

Supreme Court Addresses Fraudulent Concealment and Indemnification in Post-Closing Dispute

The Delaware Supreme Court provides useful clarification regarding when a fraudulent concealment claim tolls the statute of limitations for indemnification claims, in LGM Holdings, LLC v. Gideon Schurder, et al., Del. Supr., No. 314, 2024 (April 22, 2025).

Background

In this post-closing dispute involving claims of intentional breach of representations and warranties in an acquisition agreement as well as fraudulent concealment, the court considered evidence of wrongdoing the sellers found after closing and in connection with an investigation by the FDA and the United States DOJ.

The post-closing investigation was the basis for claims that triggered indemnification. After the investigation, a separate letter agreement between the parties imposed caps on indemnification–but only for certain claims related to the government investigation.

Key Legal Principles

The high court explained that when contract interpretation is at issue, the trial court may not grant a motion to dismiss when there is more than one reasonable interpretation. See Slip op. at 16, 20-21.

The Supreme Court also instructed that when additional support for a key argument made at the trial level is presented for the first time on appeal, that additional support is not waived even if not presented to the trial court. Slip op. at 20.

The court addressed when fraudulent concealment will–or will not–toll the statute of limitations. The court’s analysis should be reviewed in its entirety but a few highlights include the following:

Under the doctrine of fraudulent concealment, the statute of limitations can be disregarded, like “stopping a clock,” when a defendant has fraudulently concealed from a plaintiff facts necessary to put the plaintiff on notice of the truth.

Specifically, a plaintiff must allege “an affirmative act of actual artifice” by the defendant that either prevented the plaintiff from being aware of material facts or led the plaintiff away from the truth. Slip op. at 22.

The statute of limitations begins to run when the plaintiff is objectively aware of the facts giving rise to the wrong, i.e., on inquiry notice. Slip op. at 23.

The tolling stops on the date the plaintiff was put on inquiry notice of the claim—if the plaintiff successfully proves fraudulent concealment. Slip at 25. The trial court erred when it instead held that the plaintiff was put on inquiry notice such that the plaintiff had sufficient time to file a claim. Id.

Partial disclosure of facts in a misleading or incomplete way can rise to the level of the requisite actual artifice. Slip op. at 26.

Lost in Translation: Key Deal Points in European vs. U.S. M&A Transactions

After two decades practicing law in Silicon Valley and five formative years working on cross-border deals in Europe, I’ve come to appreciate the subtle (and not-so-subtle) differences in how merger and acquisition (M&A) transactions are structured on either side of the Atlantic. For buyers and sellers on opposite sides of the divide, these can be the difference between a smooth closing and a deal that gets lost in translation.

Below, we look at the key distinctions between U.S. M&A deal terms (sourced from SRS Acquiom) and European M&A deal terms (sourced from CMS), personal insights from the trenches, and practical takeaways for buyers and sellers trying to structure and execute cross-border transactions.

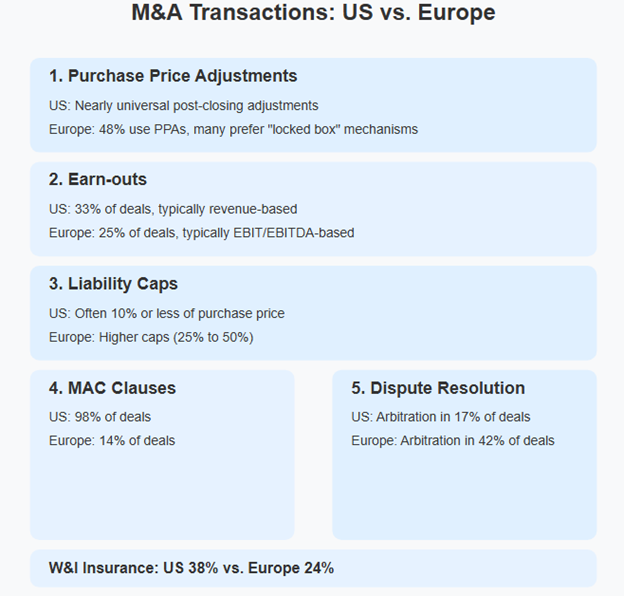

The infographic above provides a comprehensive overview of the six key differences in M&A practices between the U.S. and European markets. These points illustrate the fundamental structural variations that deal teams must navigate when working across borders.

1. Purchase Price Adjustments (PPA): Certainty vs. Flexibility

In the U.S., PPAs are nearly universal. Buyers expect to be made whole for gaps in working capital, shortfalls in cash in the bank, and any remaining debt post-closing. It’s a well-oiled machine, and most parties know the drill.

In Europe, it’s a different story. While PPAs are gaining ground (found in less than half of all M&A deals per CMS), many deals still rely on the “locked box” mechanism, where the price is fixed based on a historical balance sheet, and the seller warrants that there has been no leakage in value since the balance sheet date. This approach offers price certainty but requires trust and diligence.

U.S. clients doing deals in Europe should be open to lock box structures, especially in competitive auctions. European clients entering the U.S. should be ready for detailed post-closing adjustments and the accounting gymnastics that come with them.

2. Earn-outs: A Tale of Two Metrics

Earn-outs are common in both markets, making up 33% of U.S. deals and 25% of European ones. But the way they are structured varies widely. In the U.S., revenue-based earn-outs are more common, as opposed to Europe, where EBIT/EBITDA is king.

In tech and healthcare, where future performance is often speculative, earn-outs can bridge valuation gaps. But they are also a breeding ground for disputes.

Defining metrics clearly is table stakes, as is aligning incentives and not underestimating the emotional toll of earn-out negotiations, especially when founders are staying on board.

The chart above quantifies the prevalence of key M&A practices in both markets. Note especially the dramatic difference in MAC clause usage (98% in the U.S. versus just 14% in Europe) and the inverse relationship in arbitration preference (17% U.S. versus 42% Europe). These statistical differences highlight the importance of understanding regional norms when structuring cross-border transactions.

3. Liability Caps: How Much Skin in the Game?

In the U.S., seller liability is often capped at 10% or less of the purchase price, thanks to the widespread use of transactional, or “rep and warranties” insurance (otherwise known as “RWI”). In Europe, caps are higher, often 25% to 50%, though RWI is catching up.

European sellers are more accustomed to bearing risk, while U.S. sellers expect to shift it. This can lead to friction, so aligning expectations early is key.

United States

Europe

Liability Cap Comparison

Liability is typically capped at 10% or less of purchase price

Heavy reliance on representations & warranties insurance

Focus on limiting seller’s post-closing risk

Shorter survival periods for representations

Higher liability caps (25% to 50% of purchase price)

Growing but still lower adoption of W&I insurance

Sellers more accustomed to bearing risk

Longer warranty periods common in certain jurisdictions

Legal Framework Differences

Litigation-focused dispute resolution (83% of deals)

MAC clauses standard (98% of deals)

Common law principles

More extensive due diligence process

Arbitration more common (42% of deals)

MAC clauses rare (14% of deals)

Mix of civil and common law systems

70% of arbitration clauses apply national rules

This interactive comparison illustrates the fundamental differences in liability approaches and legal frameworks between regions. Toggle between the tabs to explore how these differences might impact deal structuring and negotiations. The higher liability caps in Europe (25-50%) versus the U.S. (typically 10% or less) reflect different risk allocation philosophies that must be reconciled in cross-border transactions.

4. MAC Clauses: Rare in Europe, Routine in the U.S.

Material Adverse Change (MAC) clauses are standard in U.S. deals and used in 98% of transactions. The idea is that between signing and closing, the business has not suffered a MAC, and if it has, the buyer does not have to close. Sometimes, it’s worded that the business hasn’t suffered a MAC since the balance sheet date. In Europe, however, they are rarefied air, appearing in only 14% of M&A deals, and often heavily qualified.

This can lead to surprises when U.S. buyers find no MAC clause in a European deal, and European sellers may balk at the broad language typical in U.S. agreements.

5. Dispute Resolution: Courts vs. Arbitration

Dispute resolution is where things really diverge. In the U.S., litigation is the default remedy, with arbitration used in only 17% of deals. In Europe, the use of arbitration is much higher (42% of deals in 2024), especially in cross-border transactions.

But there is a twist. 70% of European arbitration clauses apply national rules, not international ones. That means a “standard” arbitration clause in Germany may look very different from one in France or the UK.

U.S. clients should be prepared for arbitration in Europe and understand the local rules. European clients doing deals in the U.S. should be ready for court proceedings and the discovery process that comes with them.

6. Transactional Insurance: Growing, But Not Yet Global

RWI, or transactional insurance, is a game-changer. It smooths negotiations, caps liability, and speeds up closings. In the U.S., it’s used in 38% of deals. In Europe, it’s at 24%, but rising fast, especially in the UK and Germany.

I have seen RWI insurance unlock deals that would otherwise stall over the scope of representations and warranties, indemnity caps, or escrow mechanics. But it is not a silver bullet, so underwriting diligence still matters.

Bridging the Gaps

Cross-border M&A is never just about the numbers. It’s about culture, expectations, and communication. I have seen deals that were super smart on paper fall apart because the counterparties did not understand each other’s norms. And I have seen unlikely partnerships thrive because they took the time to bridge those gaps.

So, whether you’re a U.S. buyer eyeing a European AI startup, or a European medtech platform bolting on a U.S. target, remember that what is “market” depends on where you are. When in doubt, ask someone who’s been on both sides of the table.

Navigating Earn-Out Disputes: Key Considerations for Private Funds

Times of economic volatility often increase disparities between a seller’s valuation and the buyer’s valuation of the same company. Earn-out provisions are one tool frequently used to address such disparities. An earn-out provision requires the buyer to make one or more post-closing payments (the “earn-out consideration”) to the seller if the company being sold (the “earn-out entity”) meets certain milestones during a defined post-closing period (the “earn-out period,” which is usually between one to five years). These milestones may include EBITDA, gross revenue, net income, the expansion of the business into defined geographic or product areas, or other metrics.

Earn-out provisions can be fertile grounds for post-closing disputes between the seller and buyer. Specifically, earn-out provisions often lead to disputes as to whether the identified milestones were satisfied during the earn-out period, and if so, the amount of earn-out consideration that the buyer is obligated to pay. First, the seller and buyer approach earn-out provisions with competing incentives. The seller is motivated by the opportunity to receive further consideration for the transaction. Meanwhile, the buyer may be incentivized to argue that the identified milestones have not been met, and thus the seller is not entitled to any additional consideration. The seller may respond to such arguments by arguing that the buyer failed to make appropriate efforts to manage the earn-out entity in a manner to meet those milestones.

As earn-out provisions are often used in private equity merger and acquisition transactions involving portfolio companies, the management team is often left with the task of interpreting the earn-out provision and applying it to the performance of the portfolio company. While it is impossible to eliminate the risk of a dispute related to an earn-out provision, there are steps that can be taken to mitigate that risk, both pre- and post-closing.

One category of disputes that can result from an earn-out provision are disputes related to the milestone(s) identified in the earn-out provision. Earn-out milestones often rely upon metrics such as EBITDA, gross revenue or net income. When drafting the earn-out provision, the parties may believe that determining whether such well-recognized accounting metrics have been achieved will be straightforward. However, once control of the earn-out entity passes to the buyer, it may alter the company’s accounting practices or make other operational decisions that impact the company’s financial performance. Meanwhile, earn-out provisions often require the buyer to produce post-closing financial documents to the seller so it may analyze whether the milestones have been met. The seller’s review of those financial documents can fuel arguments that accounting practices or other vehicles have been used to prevent the milestones from being met.

The best way to mitigate this particular risk is for the parties to focus on the precise language in the earn-out provision related to the milestones. They should consider whether to include any limitations on the buyer’s power to alter accounting practices, such as the use of inter-company debt to finance the earn-out entity, and the company’s operations. The buyer and seller should consider including examples of how the milestones will be calculated and what specific documents the buyer will need to provide to the seller to review those post-closing calculations.

In two recent cases, Fortis Advisors LLC v. Johnson & Johnson (“Johnson & Johnson”) and Shareholder Representative Services LLC v. Alexion Pharmaceuticals (“Alexion”), the Delaware Court of Chancery has emphasized the use of “bespoke” earn-out provisions to mitigate this category of risk. The court noted that earn-out provisions must be tailored to the specifics of the company involved in the transaction and its products and emphasized the importance of counsel and their clients working closely together to craft language that addresses the details of how the company’s operations impact the milestones.

Another category of risk lies in the seller’s argument that the buyer purposely or negligently impacted the earn-out entity’s performance to preclude it from meeting the identified milestones and thus avoiding the payment of some or all of the earn-out consideration. Earn-out provisions frequently require the buyer to use “commercially reasonable efforts,” “good faith efforts,” “best efforts” or some similar variation in their operation of the earn-out entity. In Johnson & Johnson, the court noted that “there is no agreement in case law over whether [these phrases] create different standards” and Delaware courts have viewed some of these provisions, especially those that include the term “reasonable,” as “largely interchangeable.”

The threshold issue related to this particular risk is to identify whether the earn-out consideration is expected unless the earn-out milestones are not satisfied, or whether the earn-out consideration is required only after the milestones have been met. The difference in approach impacts which party has the burden of proof in any litigation.

In addition, the risk related to “best efforts” provisions or similar terms can be mitigated by including explicit language about what the buyer needs to due to satisfy the “best efforts” clause. Obviously, the analysis of whether certain actions satisfy a “best efforts” clause is factually dependent, and the more detail the parties can agree to include in the earn-out provision, the less risk they will have a dispute whether the buyer has satisfied such a provision. Another alternative is to avoid such terms completely and instead include language that prevents the buyer from taking actions with the intent or purpose to prevent the earn-out entity from meeting the milestones.

In sum, the use of an earn-out provision usually comes with increased risks of a post-closing dispute. The best way to mitigate that risk is to invest time in the discussions and drafting of the earn-out provision and to ensure that the provision is specifically tailored to the earn-out entity and its products.

Additional Authors: Seetha Ramachandran, Nathan Schuur, Robert Sutton, Jonathan M. Weiss, William D. Dalsen, Adam L. Deming, Adam Farbiarz and Hena M. Vora.

UK Government’s 2025 Strategic Priorities for the CMA: Key Insights for Businesses and Investors

When the UK’s competition agency, the Competition and Markets Authority (CMA), was established in 2014 as an independent non-ministerial government department, the UK government’s “steer” was introduced as a non-binding ministerial statement of strategic priorities for the CMA. It was intended to provide a transparent statement of how the government saw the competition regime fitting within its broader economic priorities. The CMA was and is expected to have regard to the steer, but it retains full independence in how it approaches its work.

Achieving economic growth has always been central to the UK government’s mission. This was as true in 2014 as it is now. But there are some important differences between now and then. In 2014, the government’s steer saw the “central task of the CMA […] to ensure that the forces of competition are fully harnessed to support the return to strong and sustained growth.” By contrast, the government’s 2025 steer encourages the CMA “to ensure that businesses receive a ‘best in class’ experience.”

This suggests that the government wants to encourage greater investment into the UK from businesses and investors and expects the CMA to support this mission.

Recent Developments in the CMA’s Policy Framework

Over the last six months, there have been multiple new announcements and initiatives from the CMA relating to its policy framework, which occurred in parallel to the publication for consultation of the government’s draft steer in February 2025. Three announcements stood out – potentially intended to catch the eye of businesses and investors:

(i) the introduction of the “4Ps” (pace, predictability, proportionality, and process), intended to change how the CMA operates, and now regularly referred to by the CMA as a new mantra;

(ii) the introduction of the “mergers charter,” which not only incorporates the 4Ps but also introduces new KPIs for the CMA to meet in relation to its merger review function; and

(iii) the CMA’s mergers remedies review, which may lead to a greater willingness from the CMA to accept both (a) parties’ claims in relation to merger-related benefits and efficiencies; and (b) behavioural remedies to address competition concerns arising from a transaction.

Alongside these initiatives, the government has also floated further legislative reforms to revisit (a) one limb of the UK’s merger control thresholds – the potentially broad “share of supply test”; and (b) the concept of “material influence,” under which the CMA has considerable flexibility to review acquisitions of minority shareholdings even where these do not confer control on the acquirer.

Those following the CMA’s decisional practice may have seen an uptick in merger clearances and the settling of long-standing antitrust investigations [[1]. This last tranche of activity might potentially be explained away by the facts of these specific cases. However, the coincidence of all these events, taken together, may also warrant further examination.

What Businesses and Investors Should Know

Enforcement Remains a Priority

Though the CMA’s policy framework is currently in a state of flux (as described above), it remains committed to enforcing competition law. The CMA continues to take its statutory functions seriously and appears committed to delivering against its statutory duties.

Foreign Transactions May Benefit

The CMA may not intervene in international transactions with limited UK connections where it might have done so previously. Moreover, if a transaction is already under review elsewhere, the CMA may consider whether the outcome of those reviews might address concerns arising in the UK and decline additional action. Businesses operating in global markets may welcome this development, as they may see less regulatory duplication and more remedial consistency, an issue that seems to have grown in recent years.

New Ways of Working

Businesses have also been offered what some may perceive as olive branches when it comes to how the CMA works. Here are some highlights.

The steer conveys the message that CMA should be collaborative so that business experience a “predictable, proportionate and transparent regulatory environment.” In this regard, there is evidence to indicate that the CMA has been collaborative. Take for example, its work in relation to the UK’s “green agreements guidance” where the CMA led other UK regulators towards a harmonized position. But business and investors may welcome the steer’s explicit signal on this issue.

The steer also encourages the CMA to be expeditious and to abide by its statutory deadlines. While the CMA has always operated within its statutory timeframes, stakeholders have noted instances when the CMA extended its timetable. These extensions occurred for various reasons, including accommodating parties requesting additional time. The Digital Markets Competition and Consumers Act 2024 introduces new provisions that allow the CMA to impose significant fines on parties who create delays by responding late to information requests without a “reasonable excuse,” a concept now more precisely defined. By seeking to be more expeditious, the CMA may be less flexible for parties seeking more time.

The steer expects the CMA to be proactive and responsive to businesses and seek regular feedback. The government intends to amend the CMA’s framework agreement so that the CMA is required to obtain regular feedback from its stakeholders, including businesses and consumers. How this initiative plays out in practice remains to be seen. Some argue that no regulator should be isolated from those it regulates. But “regulatory capture” may be a risk, especially if the regulator relies on positive feedback from its stakeholders. To mitigate this risk, stakeholders, especially those who interact less frequently with the CMA, should be visible to the CMA so that it continues to interact with a diverse range of stakeholders and takes their views into consideration.

More substantively, the steer invites the CMA to “focus on collaborative approaches to resolving issues with interested parties” and balance the need for transparency with the market impact of public communications regarding its activity. The suggestion appears to be that the CMA should try to avoid litigation and reconsider whether it should name firms under investigation at the start of an inquiry. If this interpretation is correct, such changes may risk weakening the CMA’s hand with respect to deterrence and enforcement. By the same token, it may shelter businesses from negative publicity and the increasing risk from follow-on damages litigation. Settled investigations generally reveal less detailed evidence of an infringement than fully contested investigations, the latter being more valuable for pursuing follow-on damages litigation.

If the developments above are not enough, the steer also focuses the CMA’s future discretionary activities towards (i) the government’s eight priority sectors for growth; (ii) key public services; and (iii) supporting the government’s agenda. Taken literally, this may suggest there will be sectors of the economy less likely to be investigated than before, for example, the groceries sector. But the steer is non-binding. If, for example, the cost-of-living crisis re-emerged, it is highly unlikely the CMA would not pursue an investigation into the groceries sector if it had a reasonable suspicion of anticompetitive practices.

Takeaways

It appears both the UK government and the CMA have listened to businesses and investors. They intend the CMA to be more “user friendly” and seek to change several ways in which the CMA operates to deliver against this goal.

For businesses and investors, the government hopes that the CMA won’t be a “blocker” but an “enabler” and “best in class” at supporting the UK growth agenda.

This suggests that rather than being sidelined, the CMA may remain at the heart of ensuring that markets work well for UK businesses and UK consumers, and it has some very significant powers to help achieve this goal.

[1] See, for example: CMA clears GBT / CWT corporate travel merger – GOV.UK; UK government bonds: suspected anti-competitive arrangements – GOV.UK; Anti-competitive behaviour relating to freelance labour in the production and broadcasting of sports content – GOV.UK; Anti-competitive conduct in relation to vehicle recycling and advertising of recycling-related features – GOV.UK