Does Filing a Construction Lien Guarantee Payment?

I am often approached by contractors who wish to file a construction lien regarding either a residential or a commercial project. It is not atypical for many of these contractors to believe that filing a lien claim will guarantee the payment of the amount which is due to them. This belief is entirely incorrect, however, as filing a lien claim does not guarantee payment. Instead, all that it does is place a lien on a property, for no more than one year, during which the property cannot be sold or transferred without first addressing the lien claim. In order to receive payment for a lien claim, the lien must be foreclosed upon, which is discussed below.

Unless the property owner voluntarily pays the amount of the lien claim, the only way to receive payment once the lien is filed is to commence a lawsuit against the property owner. In that lawsuit a contractor would seek to foreclose on the lien claim in order to receive payment. During the lawsuit, the contractor would have to demonstrate that it had a contract, that it provided services, and that the owner failed to pay it for the materials and services it provided. In response, the owner could claim that the contractor breached the contract or assert other defenses. Once the lawsuit is finalized, whether by settlement or a trial, the contractor would then be entitled to enforce the lien claim to receive payment.

It is important to note, however, that a lien claim is only good for one year from the date it is filed. Prior to the expiration of that time, the contractor must file suit. Otherwise, the lien claim is no longer valid and must be discharged. If the owner demands, however, the contractor can be forced to file suit within 30 days. As such, a contractor must be aware of this possibility.

If you are a contractor that is considering filing a lien claim it is suggested that you consult with an attorney, as the process for filing a lien claim is technical, and thereafter, filing a lawsuit to perfect the lien claim is likewise technical. You should also be aware, however, that even if you do not file a lien claim that you may pursue an action against the owner to recover the fair value of the materials and services that you provided pursuant to your contract. Nonetheless, it is always suggested that you consult with competent counsel as to the best course of action in pursuing payment from a delinquent owner who has failed to pay for your services.

New Jersey Appellate Court Rejects Bid Protest: Archeologist Not Required to Be Registered under Public Works Contractor Registration Act

We recently blogged about New Jersey’s bid protest requirements for procurements solicited under the New Jersey Division of Purchase and Property (DPP) here. As we noted, public procurements by local governmental authorities fall outside the jurisdiction of the DPP. A recent intermediate appellate court opinion from January 10, 2025, Anselmi & Decicco, Inc. v. J. Fletcher Creamer & Son, Inc., provides some additional guidance on how local bid protests are administered and reviewed.

In Anselmi, the Passaic Valley Water Commission issued a solicitation for bids on a project to construct prestressed concrete tanks at the Levine Reservoir in Paterson, New Jersey. The solicitation included a requirement that all bidders and their subcontractors be registered in accordance with the requirements of the Public Works Contractor Registration Act (PWCR Act). The solicitation also included a requirement that an archaeologist be listed to monitor all construction activities on the site, a registered historic place.

An unsuccessful bidder on the project challenged the award to J. Fletcher Creamer alleging that the archeologist included in Creamer’s bid was not properly registered under the PWCR Act. The commission heard and rejected the protest finding that no archeologist or archeology practice is required to register under the PWCR Act.

The commission’s decision was then challenged in New Jersey Superior Court. The Superior Court upheld the commission’s decision finding that:

Creamer, as the lowest responsive bidder, was correctly awarded the Project. Further, the bid specifications, as well as state law, do not require that Creamer’s archaeologist be registered under the [PWCR Act] for this Project. Further, even if state law did require it, this defect would not be fatal and therefore would not automatically disqualify Creamer’s bid. Because Creamer’s bid is not disqualified, the [Commission] correctly awarded the Project to Creamer as the lowest responsive bidder.

Undeterred, the unsuccessful bidder then appealed the trial court’s decision to the Appellate Division of the New Jersey Superior Court.

On appeal, the unsuccessful bidder argued, in part, that the trial court erred in concluding that Creamer’s failure to identify an archaeologist registered under the PWCR Act was not a statutory, material defect. The appellate court described its standard of review regarding disputes on publicly bid contracts as follows:

When reviewing disputes concerning publicly-bid contracts, ‘the function of [the trial c]ourt is to preserve the integrity of the competitive bidding process and to prevent the misapplication of public funds. We use a deferential standard of review for governmental decisions in bidding cases. The standard of review on the matter of whether a bid on a local public contract conforms to specifications…is whether the decision was arbitrary, unreasonable[,] or capricious. If a public entity’s decision is grounded rationally in the record and does not violate the applicable law, it should be upheld.’

In contrast, we review issues of statutory interpretation de novo. Accordingly, when reviewing a local entity’s or trial court’s interpretation of a statute, we exercise plenary review. (internal citations omitted)

The appellate court affirmed the trial court’s and commission’s decisions rejecting the bid protest.

The appellate court found that the archaeologist on the project was not required to be registered under the PWCR Act because it was not being hired to perform “public work” as defined in New Jersey law:

Read in full context, the language of both the PWCR Act and the PW [Public Works] Act requires subcontractors to be registered when those subcontractors will be performing public work as defined by the PW Act and they are required to pay ‘prevailing wage[s]’ to their workers under State law. The archeologist on the Project will not be performing public work as defined by the PW Act. The [contract] makes clear that the archeologist will not be engaging in or performing any construction, reconstruction, demolition, alteration, custom fabrication, duct cleaning, repair work, or maintenance work. N.J.S.A. 34:11-56.26(5). Instead, the archeologist will be monitoring ‘all excavation activities’ and preparing ‘monitoring report[s].’

… In short, if the subcontractor is not performing public work as defined in the PW Act, the subcontractor does not have to be registered under the PWCR Act.

The Anselmi case illustrates how state-level bid protests outside of the jurisdiction of the DPP may be handled. Contractors working on state or local projects in New Jersey can expect some variation depending on the local authority issuing the procurement. As indicated in Anselmi, New Jersey courts are likely to be deferential to the governmental decision on the initial protest, so unsuccessful bidders may want to keep that in mind when evaluating whether to appeal a protest denial to a trial court or beyond.

Listen to this post

Property Tax Relief for Southern California Property Owners Affected by the Recent Palisades, Eaton, and Other Fires and Windstorm Conditions

Recent fires in Southern California, including the Palisades, Eaton, and Sunset fires, have collectively burned tens of thousands of acres and devastated communities across the Greater Los Angeles area. More than 12,000 structures have been destroyed or damaged, including homes and businesses, and initial estimates have placed this emergency among the most destructive in California history. On Jan. 7, 2025, Governor Newsom proclaimed a state of emergency in Los Angeles and Ventura Counties due to the Palisades Fire and windstorm conditions.

Below we highlight property tax relief measures that may be available to property owners whose properties have been damaged or destroyed by these recent events. As discussed further below, for most affected property owners, property tax relief options include a temporary reduction in the damaged or destroyed property’s assessed value, deferral of property taxes, and/or one or more options to transfer the damaged or destroyed property’s base year value to replacement property. A recently issued executive order also provides for a limited suspension on the imposition of penalties, costs, or interest for the failure to pay property taxes or file a personal property tax statement. Each of these relief measures, and the related eligibility and filing requirements, are discussed in more detail below. Additionally, in certain situations, additional relief options may be available, depending on the specific facts in each case. Property owners should seek the advice of their professional advisors to understand how the options may apply to their particular circumstances.

Samuel Weinstein Astorga also contributed to this alert

Continue reading the full GT Alert.

Flying Taxis Brisbane 2032—Olympic Dream or Reality?

Over the next eight years as elite athletes train with their eyes on winning gold at the 2032 Olympic and Paralympic Games in Brisbane, there is another Olympic dream that edges closer to reality—that of flying taxis transporting competitors and spectators around South East Queensland to Olympic venues.

It was hoped that a small fleet of flying taxis would make their Olympic debut at the 2024 Paris Olympics. Unfortunately, flying taxis ‘missed the flight’ in Paris as there were delays in obtaining the requisite air safety certifications from the European Union Aviation Safety Agency (EASA) in time for the Games. Nevertheless, a test flight was carried out on the last day of the 2024 Olympics over Versailles palace, carrying luggage but no people.1

Now air taxi manufacturers have turned their hopes towards the Los Angeles Games in 2028.2 In a positive step forward, in October 2024, the US Federal Aviation Administration (FAA) issued a final rule for operating air taxis and how pilots will be trained to fly them.3 If flying taxis are successfully integrated into the airways for the Los Angeles Games, then in a further four years’ time, they could play an important role at the Brisbane Games.

Flying taxis could assist in managing congestion, with the RACQ Red Spot Congestion Survey 2023 raising concerns about how Queensland roads would cope in 2032.4 Flying taxis could also support Queensland’s tourism industry to allow fast access to regions from Brisbane. The recent Brisbane Olympic and Paralympic Games Arrangements and Other Legislation Amendment Act 2024 inserted a new requirement on the Games Independent Infrastructure and Coordination Authority that the Games deliver legacy benefits for all of Queensland, including regional areas.5

The last few months of 2024 have seen flying taxis progress further towards becoming a reality at the Brisbane Olympics:

In November 2024, it was announced that Archerfield Airport Corporation (AAC) and Wisk Aero had signed a Strategic Alliance Agreement to support electric vertical take-off and landing aircraft (eVTOL) air taxis at Archerfield Airport, Queensland. AAC Executive General Manager Rod Parry said at the time that the airport was uniquely well-placed to service the emerging advanced air mobility (AAM) sector given “Archerfield’s central location only 11 kilometres from Brisbane’s CBD and between three 2032 Olympic and Paralympic zones.” He further noted that “By the time of Brisbane’s Olympic Games, eVTOLs will likely be providing essential emissions-free transport services from vertiports around the region, keeping traffic off our busy roads and ensuring the efficient transfer of personnel to key sites throughout South East Queensland.”6

November 2024 also saw AMSL Aero announce that it had completed the first free flight of Vertiia, its passenger-capable, emission-free, long range eVTOL aircraft. The flight was heralded a landmark as it was the first made by an Australian-designed and built eVTOL.7

In December 2024, it was reported that three Civil Aviation Safety Authority (CASA) senior certification engineers had travelled to Santa Cruz, California, to look at how the FAA and Joby Aviation (Joby) are working together to certify the company’s eVTOL Advanced Air Mobility aircraft, the JAS4-1. Joby has applied for the aircraft to be certified by CASA for use in Australia. CASA is collaborating with other aviation authorities on standardising type certification of AAM aircraft.8

Also in December 2024, CASA issued its updated ‘RPAS and AAM Strategic Regulatory Roadmap’ which charts a path for safely integrating remotely piloted aircraft systems and advanced air mobility into Australian airspace and the future regulatory program.9

Over the last three years since it was announced that Brisbane would host the 2032 Games, a lot of conjecture has focused on the location of the stadium. Whichever venue is ultimately selected, to deliver an Olympic legacy that will be fit for purpose for years to come, the stadium and indeed any new infrastructure built for the Games like new hotels and transport hubs, will need to incorporate vertiports and other facilities to cater for flying taxis as they become a way of life in the future.

There is a complex web of Australian laws that govern the innovative technologies of AAM, including flying taxis. AAM operations fall within the domain of regulation by CASA to ensure aviation safety under the Civil Aviation Safety Act 1988 (Cth) and the Civil Aviation Safety Regulations 1988 (Cth).

Beyond CASA requirements, AAM operations and their vertiports are also governed by a broad but fragmented system of different pieces of legislation ranging from town planning to environmental, privacy, safety, property damage, personal injury and radio-communications.

We have extensive experience in assisting clients comply with CASA requirements and advising on the rapidly evolving legal framework that governs AAM operations.

Footnotes

1 Caroline Petrow-Cohen, ‘Aviation startup seeks to bring air taxis to Los Angeles in time for Olympics’, Los Angeles Times (online, 26 September 2024) https://www.latimes.com/business/story/2024-09-26/startup-seeks-to-bring-air-taxis-to-los-angeles

2 Jack Daleo, ‘Air Taxis Missed Paris Olympics Goal – Could They Soar in LA?’, Flying (12 August 2024) https://www.flyingmag.com/modern/air-taxis-missed-paris-olympics-goal-could-they-soar-in-la/

3 The Associated Press, ‘Flying air taxis move closer to US takeofff with issuing of FAA rule’, AP (online, 23 October 2024) https://apnews.com/article/faa-air-taxis-regulation-electric-aviation-85fd3c8b905a003eff64590afb5da339

4 Rebecca Borg, ‘Making things difficult: New survey finds QLD roads aren’t match fit for 2032 Olympics’, News.com.au (2 July 2023) https://www.news.com.au/national/queensland/news/making-things-difficult-new-survey-finds-qld-roads-arent-match-fit-for-2032-olympics/news-story/d2c63c828589679cb3772156dcb637be

5 S.53AE(b) Brisbane Olympics and Paralympics Games Arrangements Act 2021 (Qld)

6 ‘Archerfield Airport and Wisk Aero Sign Strategic Agreement’, Archerfield Airport News (21 November 2024) https://archerfieldairport.com.au/wp-content/uploads/2024/11/Archerfield-Airport-and-Wisk-Aero-Sign-Strategic-Agreement-1.pdf

7 ‘AMSL Aero Makes Aviation History by Completing Landmark Free Flight of Zero-Emissions Aircraft “Vertiia”, AMSL Aero (18 November 2024) https://www.amslaero.com/news/landmark-free-flight

8 Civil Aviation Safety Authority, ‘Collaboration on advanced air mobility’ (3 December 2024) https://www.linkedin.com/pulse/collaboration-advanced-air-mobility-umytc/?trackingId=WNO26%2BqGI0SQocvEDS44RA%3D%3D

9 Civil Aviation Safety Authority, ‘Our updated RPAS and AMM Strategic Regulatory Roadmap is now available’ (11 December 2024) https://www.linkedin.com/company/civil-aviation-safety-authority-casa-/posts/?feedView=all

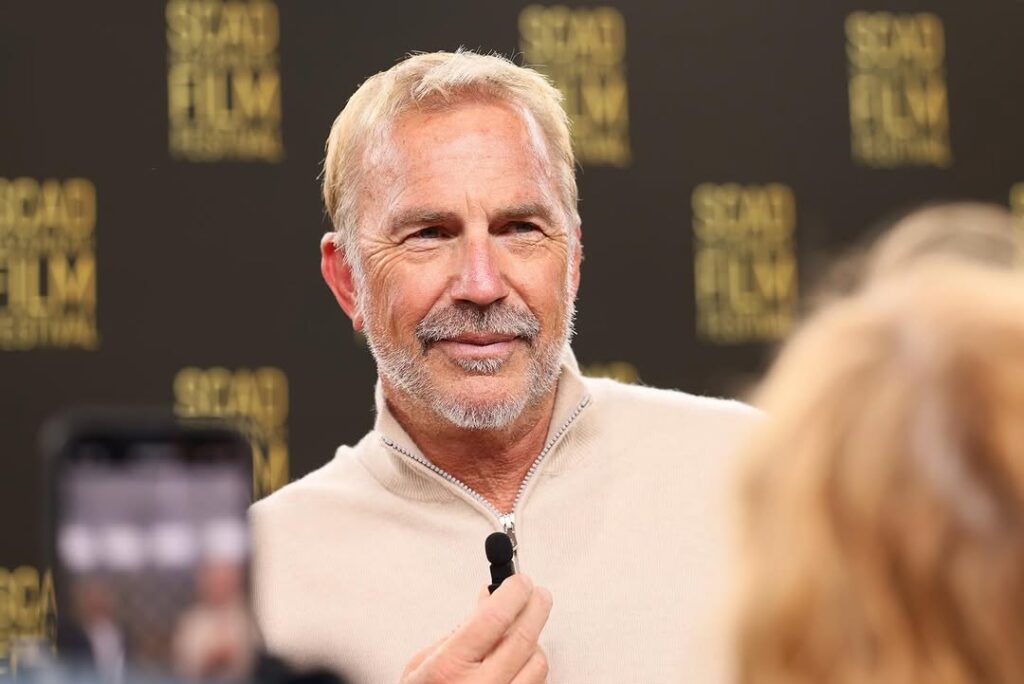

Kevin Costner Net Worth

Kevin Costner Net Worth: $250 million Kevin Costner, 70, an American actor, producer, director, and musician, has built an impressive career in Hollywood, with a net worth of approximately $250 million as of 2025. Known for his versatile talent, Costner has gained recognition for his work in both the film and television industries, creating a […]

Secured Lenders: Keeping Your Receiver in the Driver’s Seat During Bankruptcy

You put in the work to get a receiver appointed. Do not let a bankruptcy filing get in the way of your efforts. A receivership is a remedy used by secured lenders primarily to preserve their collateral when a borrower fails to pay its debt and the property may be at risk of losing value. The receivership is often used during a judicial proceeding to foreclose a lender’s mortgage on real estate. In a court-authorized receivership, an independent party will be appointed as receiver and will exercise control over the mortgagor’s property to preserve and manage the property. That sometimes involves managing business operations, collecting rents or even preparing the property for a sale.

It is not uncommon that on the eve of a foreclosure sale, as a defense, a mortgagor will file a voluntary petition for bankruptcy to stop the sale of the property. The Bankruptcy Code not only stops the sale by virtue of the automatic stay, but it also imposes obligations on the receiver to turn over property to the debtor-in-possession and provide an accounting in the bankruptcy case pursuant to Section 543(b) of the Bankruptcy Code.

Section 543(b) states that a custodian shall:

(1) deliver to the trustee any property of the debtor held by or transferred to such custodian, or proceeds, product, offspring, rents or profits of such property, which is in such custodian’s possession, custody or control on the date that such custodian acquires knowledge of the commencement of the case; and

(2) file an accounting of any property of the debtor, or proceeds, product, offspring, rents or profits of such property, that, at any time, came into the possession, custody or control of such custodian.

Section 543(a) generally bars a receiver from taking further action to administer property of the estate, or in other words, to perform the duties and obligations the receiver is required and authorized to carry out in the non-bankruptcy proceeding.

What secured lenders should know is that the court-appointed receiver’s turnover requirements may be excused pursuant to Section 543(d). Under Section 543(d), the bankruptcy court may excuse the receiver’s compliance with Sections 543(a) and (b) if the interest of creditors would be better served by permitting the receiver to continue in possession, custody or control of the property.

Factors that bankruptcy courts have often looked at to determine whether compliance should be excused are:

(1) The likelihood of reorganization and whether funds held by the receiver are required for reorganization;

(2) Whether there were instances of mismanagement by the debtor;

(3) Whether turnover would be injurious to creditors; and

(4) Whether the debtor will actually use the property for benefit of its creditors.

In re Franklin, 476 B.R. 545, 551 (Bankr. N.D. Ill. 2012) (citing In re Falconridge, LLC, No. 07-BK-19200, 2007 WL 3332769, at *7 (Bankr. N.D. Ill. Nov. 8, 2007)). Generally, when the majority of a debtor’s debt is owed to a secured lender, the secured lender’s interest is given great weight. See In re Foundry of Barrington Partnership, 129 B.R. 550, 558 (Bankr. N.D. Ill. 1991).

These factors are not exhaustive and the bankruptcy court’s inquiry will be fact specific.

Online judicial sales – Illinois Mortgage Foreclosure Law Enters the Digital Age

Purchasers of distressed real estate in mortgage foreclosure proceedings can now work remotely, too. Governor JB Pritzker signed into law Public Act 103-930 S.B. 2919, which became effective January 1, 2025, and allows the “sheriff or other person” to conduct a judicial sale “in person, online or both.” 735 ILCS 5/15-1507(b)(2). From the birth of the Illinois Mortgage Foreclosure Law (IMFL) in 1987 through 2024, foreclosure auctions could only be conducted in person.

The primary purpose of this amendment to the IMFL is to maximize the value of real estate sold at auction by expanding the reach to bidders unbound by geography. So, rather than needing to appear in person in the lobby of a sheriff’s office or in a room of a court-approved selling officer, bidders can now log in to an online platform like Ten-X through their computer or mobile device, perhaps in their sweats, and bid up the price of the collateral being sold. The higher the sale price, the better the chance the first mortgage holder gets paid in full, a junior lien holder makes a recovery and the mortgagor collects a surplus.

The rules applicable to online judicial sales are set forth in section 15-1507.2 of the IMFL. The highlights are as follows: the sheriff or other person may may conduct an online sale or engage a third-party online sale provider and charge an additional fee for associated costs to be paid by the seller; must demonstrate to the court’s satisfaction the processes and procedures for conducting online auctions and adequate record-keeping; shall require bidders to complete a registration process that includes providing information relevant to identify the buyer, contact the buyer and complete the sale of the property; and shall verify the identity of the bidder through an independent verification process. Importantly, the person conducting the online sale and the third-party online sale provider may “promote and market the sale to encourage and facilitate bidding.”

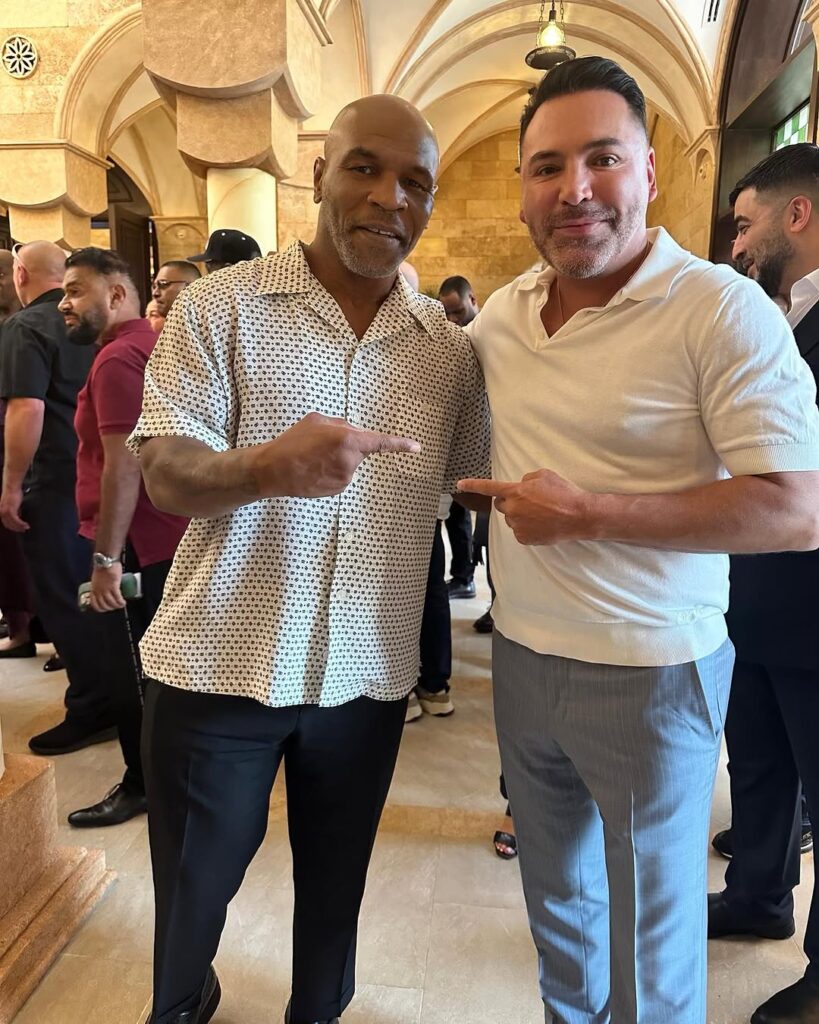

Oscar De La Hoya Net Worth

Oscar De La Hoya Net Worth: $200 Million What Is Oscar De La Hoya’s Net Worth? Oscar De La Hoya, a retired American professional boxer of Mexican heritage, boasts a net worth of $200 million. Known as “The Golden Boy,” he has made a significant impact on the boxing world with his outstanding career. De […]

Text Form Now Sufficient for Long-Term Commercial Leases in Germany

Fourth Bureaucracy Reduction Act (BEG IV) entered into force Jan. 1, 2025

The Fourth Bureaucracy Reduction Act (BEG IV) took effect Jan. 1, 2025, introducing a major change for commercial leases. Compliance with the statutory written form pursuant to section 126 BGB of the German Civil Code (BGB) will no longer be required to meet the form requirement for long-term commercial lease agreements stipulated at section 550 BGB. Instead, compliance with the statutory text form pursuant to section 126b BGB will be sufficient. As a result, commercial leases with a fixed term of longer than one year will now only have to comply with the text form requirement.

As was previously the case, lease agreements concluded without complying with this form requirement will not be invalid. Rather, they will be deemed to have been concluded for an indefinite period and may be terminated after one year, complying with the statutory notice period for ordinary termination.

The relaxation of the form requirement applies to all commercial leases entered into or amended after Jan. 1, 2025. For leases concluded before Jan. 1, 2025, the written form will continue to apply up to and including Jan. 1, 2026. Thereafter, the applicable form for existing leases will also be the statutory text form. Compliance with the Statutory Text Form

In contrast to the written form, the text form does not require a wet-ink signature or a qualified electronic signature. To comply with the statutory text form, a legible declaration must be recorded on a durable medium and names the person making the declaration. A durable medium enables the recipient to store or save the declaration in such a way that it remains accessible to them for a reasonable period and can be reproduced unchanged. Examples of such mediums include e-mail, messenger services, SMS, social media messaging services, as well as PDF files or data files that have been signed using a simple electronic signature (e.g. via DocuSign).

Open Questions

Previous case law has developed several requirements for complying with the statutory written form, particularly regarding wet-ink signatures. The signature serves as a concluding function, and courts required maintaining “documentary connection” (Urkundszusammenhang), meaning all components of a lease agreement (the individual pages, annexes, and amendments), must be recognizable as belonging to the same contract. While current case law no longer requires the physical binding of all documents, a connection between the main contract, amendments and annexes must remain clearly recognizable through corresponding references. It remains uncertain whether the courts will impose the same requirements for lease agreements executed in text form. However, given that the form requirement’s purpose remains unchanged – allowing property purchasers who enters into lease agreements by operation of law the opportunity to comprehensively review the contract – suggests this may be the case.

Despite the BEG IV’s relaxation of the required form, careful consideration remains essential. Companies should review and potentially adapt existing conclusion and signing processes, depending on the preferred method of signing. Additionally, companies may wish to exercise caution during digital contract correspondence, as it could bring about unintended contract changes or risk required form breaches by failing to preserve the required documentary connection. Additionally, the content of digital correspondence is often unclear, incomplete, or contradictory. This not only makes it more difficult for the contracting parties and potential purchasers to clearly determine the contract content, which may lead to disputes and give rise to a breach of form due to unclear provisions.

Considerations

In light of the new relaxation of the form requirements, companies and practitioners should consider the following points:

Form of signature

As future long-term commercial lease agreements now only need to comply with the statutory text form, neither wet-ink signatures nor qualified electronic signatures are required. As such, lease agreements can be concluded electronically, without printing out the contract and its annexes. For evidentiary and storage purposes, however, consider using tools to sign the contract digitally. Wet-ink or qualified electronic signatures also remain permissible, as they meet the text form requirements. Parties may also agree to subsequently use the stricter written form. Landlords should determine whether and how they wish to sign their contracts in future and adapt their contract conclusion, signing and storage processes, if necessary. Purely digital contracts may quickly gain acceptance, particularly in the case of major landlords or international contracting parties, due to the simplified processes for preparing contracts and obtaining signatures.

Careful contract drafting

Material contractual terms should still be recorded clearly and without contradiction, regardless of form. Companies should consider creating a single (even if only digital) document including all annexes. Caution should be exercised when concluding or amending contracts by means of purely digital correspondence, e.g. by way of email, as this entails risks with regard to form and interpretation.

Disclaimers in offers and correspondence

To avoid unwanted contracts being concluded by email or other digital media, companies should use clear communication guidelines and appropriate disclaimers.

Complete contract document exchange

When concluding a contract digitally, parties should exchange the entire contract, rather than only exchanging signature pages. If annexes need to be sent separately, they should clearly relate to the main body of the contract, and the other party should expressly confirm their content.

Secure digital document storage

Digitally concluded contracts must be permanently saved. Since some tools delete contracts after a certain period of time, separate storage is required. Depending on the circumstances, associated email correspondence may also need to be archived.

Amendment of previous written form clauses

Depending on the preferred conclusion procedure, previously standard written form clauses should be amended in new and existing lease agreements, and any voluntary (text) form criteria for concluding future contracts defined, e.g., it can be agreed, for evidentiary and storage purposes, that contract conclusion requires at least the exchange of parts signed using a simple electronic signature.

In summary, while the relaxation of the form requirement under section 550 BGB the BEG IV introduced will simplify the conclusion of long-term commercial leases in the future, it does give rise to potential pitfalls. Parties should continue to carefully observe form requirements and adjust existing contract conclusion, signing, and filing processes if required.

Vikki Ziegler Net Worth

Vikki Ziegler Net Worth: $3 million Early Life and Education Vikki Ziegler was born in New Jersey, USA, where she spent her formative years. Her journey into law and media was shaped early on by her deep curiosity and a strong work ethic. She pursued higher education at Rutgers University, where she earned […]

CFPB Issues Warning on Risks of Home Equity Contracts, Takes Legal Action to Ensure Compliance with TILA

Today, the Consumer Financial Protection Bureau (CFPB) issued a report, consumer advisory, and filed an amicus brief addressing the risks associated with home equity contracts (HECs)—financial products often marketed as home equity “investments.” The Bureau highlighted the high costs, complexity, and risks these products pose to homeowners, including the potential for financial distress and forced home sales if repayment obligations become unmanageable. The Bureau’s amicus brief, filed in a lawsuit currently ongoing in the United States District Court for the District of New Jersey, is discussed in detail below.

CFPB Amicus Brief

In its amicus brief the Bureau argued that HECs are traditional mortgage loans subject to the Truth in Lending Act (“TILA”). Under TILA, a “residential mortgage loan” is “any consumer credit transaction that is secured by a mortgage, deed of trust, or other equivalent consensual security interest on a dwelling or on a residential property that includes a dwelling.” 15 U.S.C. § 1602(dd)(5). The Bureau disagreed with the defendant home equity loan provider’s argument that its product is an investment contract, not a credit product (and thus not subject to TILA), on the grounds that:

Defendant’s HEC Satisfies the Statutory Definition of Credit. Under the HEC, the plaintiff has an obligation to pay defendant either 70% of the value of the home, or the initial payment she received, plus 18% interest. Accordingly, the plaintiff incurred a debt and payment of the debt is deferred, making the product credit.

Defendant’s Product Is Not “Credit” Under Reg Z. Reg Z states that “credit” does not include “[i]nvestment plans in which the party extending capital to the consumer risks the loss of the capital advanced.” 12 C.F.R. Pt. 1026, Supp. I, cmt. 2(a)(14)-1.viii. The Bureau contended that this exception does not cover defendant’s product because it does not meaningfully risk the loss of its capital due to its structure. Plaintiff was paid a lumpsum equivalent to only 44% of the value of their home but was required to repay 70% of their home’s value; unless the home value depreciates by more than 39%, the company will profit.

Issue Spotlight: Home Equity Contracts

The Bureau’s Issue Spotlight was an overview of the home equity contract market. The Bureau found that the industry is small but has expanded in recent years, driven in part by an emerging secondary market for securitizations. In the first 10 months of 2024, the four largest HECs companies securitized approximately $1.1 billion backed by about 11,000 HECs.

Consumers primarily used HECs for debt consolidation and home improvements, though some consumers have reported that they use the funds for real estate investing or savings for or during retirement.

The Bureau found that HECs are often marketed as an alternative to a cash-out refinance, home equity line of credit (HELOC), or traditional reverse mortgage loans but in their view are more expensive than those offerings. Moreover, they noted that advertisements for home equity contracts tout large upfront payments, with “no monthly payments,” and “no interest,” and also claim that HECs are not debt, a contention they disagree with.

Finally, according to the Bureau, HECs are complex financial contracts that can be difficult to understand or compare to other options, and companies currently provide non-standardized disclosures. The Bureau pointed to consumer complaints that highlighted how difficult they were to understand.

Consumer Advisory

Many of these criticisms were later highlighted on the Bureau’s consumer advisory. The Bureau noted that HECs companies may not give standard loan disclosures, conduct ability to re-pay underwriting, may contain arbitration clauses, and may be more expensive than traditional loan products.

Putting It Into Practice: Assuming the Bureau’s provision prevails in the litigation prevails, this will have a dramatic impact on the small but growing HEC market. HECs will need to be restructured to comply with TILAs requirements, including having standard disclosures, and no arbitration provisions which are currently in many agreements. In addition, HEC providers will need to conduct ability-to-repay underwriting, and provide loss mitigation options for consumers. Finally, assuming the Bureau reverses its position in a new administration, litigants will likely not be deterred. Advocacy groups such as the National Consumer Law Center, and state regulators such as the Washington Department of Financial Institutions have been active in this space. See DFI Issues Report on Home Equity Sharing Agreement Inquiry

Listen to this post

New Statute Affects Small Business Leases in California

Go-To Guide:

California Senate Bill 1103 (SB 1103) introduces changes to commercial leases, offering enhanced protections for small business tenants.

Tenants that meet the “5/10/20 rule” and provide written notice of their qualified status can seek the benefits of these new protections.

Landlords must translate leases into the tenant’s primary language for qualified commercial tenants.

Leases with qualified commercial tenants automatically renew unless landlords provide timely nonrenewal notices, aligning commercial tenancy practices more closely with residential standards.

Rent increases for short-term leases require advance notice, and any fees for building operating costs must be proportionate and documented.

Effective Jan. 1, 2025, SB 1103 makes four principal changes to commercial tenancy law:

1.

increased notice periods for rental increases on short term tenancies (month-to-month or shorter);

2.

a new requirement for translating the lease into other languages;

3.

automatic renewal of the tenancy unless the landlord objects in a timely manner; and

4.

limitations on rental increases based on building operating costs. The law provides additional leasing protections to small business commercial tenants who meet the definition of “qualified commercial tenants.”

Commercial landlords should be aware of all the related changes and should build these new requirements into their form leases, tenant notices, and operating procedures. More generally, landlords should be aware that like the protections for small commercial tenants enacted during COVID-19, these new leasing regulations indicate a legislative policy towards treating small businesses more like residential tenancies, as opposed to traditional commercial leases with larger commercial tenants.

Definition of ‘Qualified Commercial Tenant’

Businesses must meet two elements of the qualified commercial tenant definition to qualify for these new protections.

First, a business must be a “microenterprise,” a restaurant with fewer than 10 employees, or a nonprofit with fewer than 20 employees. A microenterprise is defined in Business & Professions Code section 18000 as a sole proprietorship, partnership, LLC, or corporation with five or fewer employees (including the owner), who may be full or part-time, and which generally lacks sufficient access to loans, equity, or other financial capital. A convenient way to remember this definition is the “5/10/20 rule,” based on the number of employees.

Second, the tenant must have provided to the landlord, within the previous 12 months, written notice that the tenant is a qualified commercial tenant and a self-attestation regarding the number of employees the tenant employs before or upon the lease’s execution and annually thereafter. In other words, the law’s provisions are not self-executing – the tenant must give notice first. The rental rates, the premises’ square footage, and the tenant’s income or wealth are not considered when determining qualified status.

With these definitions in mind, here are the four principal changes SB 1103 makes to commercial tenancy law.

The Four New Tenant Protections

1.

Notice of Rent Increase for Short Term Rentals

Existing Civil Code Section 827 provides that for short term residential leases, namely month-to-month or a shorter period, the landlord must give prior notice of a rent increase. The amount of notice required depends on how much the rent will increase.

SB-1103 extends this notice requirement to qualified commercial tenant leases. If the increase is 10% or less of the prior year’s rent, the notice mut be given at least 30 days before the increase date, and if it is greater than 10%, then the notice must be given at least 90 days prior. The notice itself must advise the qualified commercial tenant of the requirements of this amended statute.

It is unclear how relevant this provision would be to most small businesses. Unlike short term residential tenancies such as residence hotels, a commercial business is not likely to be a month-to-month tenancy unless it is a holdover from a longer fixed lease. Due to an apparently unresolved inconsistency in the Senate and Assembly versions of this section, however, its protections may extend beyond month-to-month leases. Landlords may assume this provision applies to rental increases for all commercial real property leases by a qualified commercial tenant.

Violation of this provision does not entitle the qualified commercial tenant to civil penalties, but qualified commercial tenants may be eligible for restitution of overpaid rent or an injunction to prevent further violations.

2.

Translation of Lease

Existing law in Civil Code Section 1632 requires a business to deliver a translation of a contract from English to the primary language in which the agreement was negotiated, specifically in Spanish, Chinese, Tagalog, Vietnamese, or Korean (translation requirement) but provides an exception if the other party uses their own interpreter (interpreter exception).

SB 1103 expands this requirement to a landlord leasing to a qualified commercial tenant for leases negotiated on or after Jan. 1, 2025. It requires the landlord to comply with the translation requirement but does not grant the landlord the interpreter exception. In other words, the landlord must always comply with the translation requirement.

If the landlord fails to comply with this requirement, the qualified commercial tenant (but not the landlord) is entitled to rescind the lease.

3.

Automatic Renewal

Existing Civil Code Section 1946.1 provides that a residential lease is deemed renewed unless the landlord gives 30 to 60 days’ notice of nonrenewal prior to termination, depending on whether the lease was for less than one year.

SB 1103 expands this protection to qualified commercial tenant leases and requires the landlord to give notice of the provisions of this section in the notice to a qualified commercial tenant. Qualified commercial tenants who believe their landlord has violated this section’s notice requirement can file a complaint with local housing authorities or pursue legal action.

4.

Limitation On Building Cost Charges

Existing Civil Code Section 1950.8 prohibits a landlord from demanding an extra fee to continue or renew a lease unless the amount is stated in the lease, but this requirement does not apply if the increase is for building operating costs incurred on behalf of the tenant and the basis for calculation is established in the lease.

SB 1103 adds a new law, Civil Code Section 1950.9, that applies to leases executed or renewed on or after Jan. 1, 2025. The section prohibits a landlord from charging a qualified commercial tenant a fee to recover building operating costs unless the costs are allocated proportionately, the costs were incurred in the prior 18 months or are reasonably expected to be incurred in the next 12 months, and the landlord provides a prospective tenant notice that the tenant may inspect the cost documentation.

There are some substantial enforcement teeth in this particular provision, including actual damages, attorneys’ fees and costs, and in the case of willful, oppressive, fraudulent, or malicious violations, treble damages, and punitive damages. The tenant can also raise this section as a defense to eviction.

Application

SB 113 applies to all commercial tenancies in California where the tenant is a qualified commercial tenant. Obvious applications are shopping malls, strip malls, and other buildings where a variety of small business are collected. Some commercial landlords, for example the owner of a large commercial office building leased to large businesses, might think the statute is not relevant to them, but smaller tenants such as a café or gift shop in the lobby may be covered.

Unanswered Questions

Unanswered questions remain, such as the case of subleases, where the tenant might not be a qualified commercial tenant, but the subtenant might qualify under SB 1103. Similarly, it remains to be seen how and when a landlord could challenge the tenant’s self-attestation of qualified status, particularly if that status changes during the tenancy.