Triggers and Risks

Having granted a Writ of Certiorari to review the decision of the United States Circuit Court of Appeals for the Ninth Circuit (the “Ninth Circuit”) in Amalgamated Bank et al v. Facebook, Inc. et al (In re Facebook, Inc. Securities Litigation), 87 F.4th 934 (9th Cir. 2023) (“Facebook”)[i], and having heard oral argument by the parties and amici curiae, on November 22, 2024 the United States Supreme Court issued an unusual decision — surprising to some but perhaps not to others. The Court dismissed the case, stating only that the Writ of Certiorari had been “improvidently granted”. (604 U.S. 4 (2024)

Facebook involved, among other things, the question of whether the discussion of a risk can be misleading if it does not disclose previous occurrences of that risk or of events that increase the probability of that risk. Facebook did not make such disclosure, and the Ninth Circuit held that the plaintiffs had adequately pleaded a cause of action under Section 10(b) of the Securities Exchange Act of 1934 (the “1934 Act”) and Rule 10b-5(b) thereunder on the grounds that the omission of such information rendered its risk discussion misleading. Facebook asked the Supreme Court to review the judgment of the Ninth Circuit on the following somewhat oddly posed question:

Are risk disclosures false or misleading when they do not disclose that a risk has materialized in the past, even if that past event presents no known risk of ongoing or future business harm?

A similar, although not identical, question was involved in the Ninth Circuit’s previous decision in Rhode Island v. Alphabet, Inc. (In re Alphabet, Inc. Securities Litigation), 1 F.4th 687 (9th Cir. 2021) (“Alphabet”). Interestingly, following the decision of the Ninth Circuit, the Supreme Court denied Alphabet’s Petition for a Writ of Certiorari.

The clear-cut answer to the question raised in both Alphabet and Facebook seems to be that, sometimes, depending on the circumstances and the language of the risk factor, some historical information may be necessary to qualify the discussion of a risk, at least somewhere in the disclosure document. Analysis of both Alphabet and Facebook is necessary to attempt an understanding of this issue under the law of the Ninth Circuit and, indeed, after the non-decision of the Supreme Court in Facebook, presumably the law of the land. While these cases raised a multitude of collateral issues, especially in the lower courts, this note will focus on the specific question directed to the Supreme Court.

Click here to view the full article.

[i] In October 2021, Facebook, Inc., the parent company of Facebook, changed its name to Meta Platforms, Inc. However, the defendant is referred to as “Facebook” throughout the litigation.

SEC Staff Cede Jurisdiction Over Certain Stablecoins

On 4 April 2025, the SEC’s Division of Corporation Finance (Division) issued a statement (Statement) providing that the offer and sale of certain “Covered Stablecoins” do not involve the offer and sale of securities within the meaning of federal securities laws. As such, persons involved in the process of offering, selling and redeeming Covered Stablecoins are not required to register those transactions with the SEC or rely on an exemption from registration.

The Division defines “Covered Stablecoins” as crypto assets that are designed to maintain a stable value relative to the US Dollar (USD) on a one-for-one basis, can be redeemed for USD on a one-for-one basis, and are backed by low-risk and readily liquid assets held in a reserve, with a USD value that, at a minimum, meets the redemption value of the stablecoins in circulation. Accordingly, stablecoins outside this definition – including those that are pegged to the price of digital assets or other currencies besides USD and algorithmic stablecoins – are not covered by the guidance included in the Statement.

The Division provided its analyses of Covered Stablecoins under Reves v. Ernst & Young and SEC v. W.J. Howey Co., the key cases setting forth the tests for whether an asset is a “security.” If not considered to be “securities,” Covered Stablecoins would likely be considered “commodities,” and thus subject to the enforcement jurisdiction of the CFTC. However, legislation currently pending in Congress could shift oversight of these digital assets to banking regulators.

Commissioner Caroline Crenshaw criticized the Statement as doing “a real disservice to USD-stablecoin holders,” and questioned whether any existing stablecoin falls within the scope of “Covered Stablecoin”.

Following the Division’s recent Statement on Meme Coins, the Statement appears to be another small but positive step towards regulatory clarity for the digital asset industry.

SEC Provides Stablecoin Guidance Amid Legislative Developments

On Friday, the Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued guidance clarifying when certain stablecoins may not constitute securities under the federal securities laws.[1] This development comes as Congress is actively considering legislation — notably the GENIUS Act and the STABLE Act — that would explicitly carve out payment stablecoins from securities definitions and establish a comprehensive federal regulatory framework for payment stablecoins. The timing suggests the SEC is attempting to provide interim clarity while legislative solutions remain pending.

Overview of the Division’s Guidance

The guidance provides detailed analysis of whether “Covered Stablecoins” constitute securities under the federal securities laws. The Division defined Covered Stablecoins as digital assets designed to maintain stable value relative to the US Dollar (USD) on a one-for-one basis, redeemable for USD on demand, and backed by assets held in a reserve with value meeting or exceeding the redemption value of stablecoins in circulation. These reserves must consist of low-risk, readily liquid assets to enable issuers to honor redemptions.

The Division’s analysis applied two distinct securities law tests. First, under the Reves “family resemblance” test for note-like instruments, the Division examines four factors: (1) buyer and seller motivations; (2) plan of distribution; (3) reasonable expectations of the investing public; and (4) risk-reducing features.[2] The Division concluded that Covered Stablecoins are issued and purchased for commercial rather than investment purposes, with buyers motivated by stability and utility in commercial transactions rather than profit potential. According to the Division, the price stability mechanisms of Covered Stablecoins minimize speculative trading, and marketing materials typically emphasize payment functionality rather than investment returns.

Importantly, the Division viewed adequately funded reserves as a significant risk-reducing feature under the fourth Reves factor, which examines whether there are features that reduce risk such that the application of securities laws becomes unnecessary. In the Reves decision, the Supreme Court noted that instruments that are “collateralized” may possess sufficient risk-reducing features to avoid classification as securities, and the Division draws a parallel between such traditional collateralization and stablecoin reserves.[3]

Second, the Division applied the Howey test for investment contracts, examining whether there is an investment of money in a common enterprise with reasonable expectation of profits derived from entrepreneurial efforts of others. The Division determined that buyers lack reasonable profit expectations since Covered Stablecoins are generally marketed for use in commerce rather than as investments, offering price stability instead of appreciation potential.

Commissioner Caroline Crenshaw issued a dissenting statement challenging the Division’s analysis. She emphasized that approximately 90 percent of USD stablecoins circulate through intermediaries rather than direct issuer-to-retail distribution channels, and as a result, retail holders generally have no direct redemption rights against issuers and no claims to the reserve assets.

For its part, the Commodity Futures Trading Commission (CFTC) has long maintained that stablecoins are commodities and, therefore, are subject to the CFTC’s anti-fraud and anti-manipulation enforcement jurisdiction. For example, in October 2021, the CFTC brought and settled an enforcement action with Tether Holdings Limited for making untrue or misleading statements of material fact when it claimed that the US dollar tether token (USDt) was fully backed by US dollars held in reserve.[4]

Regulatory and Market Implications

The guidance may serve as an interim regulatory clarification until comprehensive legislation passes, potentially offering some clarity for issuers of Covered Stablecoins. However, its effectiveness may be limited since proposed legislation, if adopted, would likely supersede it with explicit statutory carve-outs. Furthermore, both the GENIUS Act and STABLE Act would explicitly assign enforcement authority over payment stablecoins to federal and state banking regulators rather than the SEC, potentially creating a different regulatory framework than what might be inferred from the Division’s guidance.

[1]See Katten’s Quick Reads post on the Division’s recent similar guidance on proof-of-work mining activities and memecoins here.

[2]Reves v. Ernst & Young, 494 U.S. 56 (1990).

[3]Id. at 69.

[4]See also In the Matter of Opyn, Inc., 2023 WL 593238, at *3 (“Ether and stablecoins such as USDC are encompassed in the definition of ‘commodity’ in Section 1a(9) of the [Commodity Exchange Act], and are subject to the applicable provisions of the Act and Regulations.”).

Europe: UK’s FCA Intensifies Scrutiny on Private Markets Valuations

The UK’s Financial Conduct Authority has published the findings of its multi-firm review of valuation processes for private market assets. This review follows the highlighting of vulnerabilities in private markets stemming, in part, from opaque valuations, in both the Bank of England’s June 2024 Financial Stability Report and IOSCO’s September 2023 report on emerging risks in private finance markets.

The FCA’s review, which is directed at fund and portfolio managers and investment advisers, acknowledges areas of generally sound practice within the industry. These include investor reporting, documenting valuations, use of third-party valuation advisers and consistent application of established valuation methodologies.

However, the review also includes action items for firms (search for “Actions for firms”) and identifies the following areas of weakness:

firms need to improve their identification and documentation of potential conflicts of interest arising throughout the valuation process, for instance in relation to continuation fund transactions, NAV-financing, the use of unrealised performance in marketing for new vehicles, and redemptions and subscriptions in open-ended funds;

firms should ensure an adequate level of independence in valuation processes, for example by ensuring that the valuation committee’s voting membership is mostly made up of individuals independent of portfolio management with sufficient valuation expertise; and

firms should enhance processes for ad hoc valuations in times of market disruption, for instance by identifying the thresholds and types of events that would trigger ad hoc valuations.

The FCA expects firms to consider its findings and identify any gaps in their valuation approach taking into account their size and the materiality of identified gaps.

As private markets continue expanding with the introduction of new practices to navigate the race to liquidity, which may pose several conflicts issues, regulatory developments requiring valuation discipline and transparency represent a trend likely to persist.

Intentionally Discriminatory Public Offering Stalled At The SEC

In this February post, I pondered the question of whether an issuer could allocate shares on the basis of race, gender or ethnicity. That post was inspired by the case of Glennon v. Johnson, U.S. Dist. Ct. Case No. 1:25-cv-01057 (N.D. Ill. Jan. 6, 2025). That case involves a Fourteenth Amendment challenge to a proposed public offering by Bally’s Chicago, Inc. that would impose minority and gender based qualification requirements on investors. In February, U.S. District Court Judge Franklin U. Valderrama declined to issue a temporary restraining order, ruling that the plaintiff had shown neither a likelihood of success nor irreparable injury.

Despite winning this round in court, Bally’s still needs to have its registration statement declared effective by the Securities and Exchange Commission. That apparently has not yet occurred. On February 28, 2025, Bally’s filed a free writing prospectus with the SEC that included the following disclosure:

Bally’s Chicago, Inc. (“Bally’s Chicago”) thanks you for your interest and patience. Unfortunately, as of the time of this message, we have not yet received clearance from the U.S. Securities and Exchange Commission (“SEC”) to price and close our initial public offering. Consequently, prospective investors may seek to withdraw any amount deposited into their respective BitGo Trust accounts while we continue to work to obtain SEC clearance for our initial public offering. Bally’s Chicago intends to continue to make regular, periodic filings of its registration statement with the SEC once its annual financial statements for the fiscal year ended December 31, 2024, which are expected to become available in March. This process aims to fulfill the City of Chicago’s mandate of having 25% of Bally’s Chicago’s ownership held by individuals or entities that qualify as women or Minorities (as defined by MCC 2-92-670(n)), among other criteria, as required by the Host Community Agreement with the City of Chicago.

Apparently, Bally’s remains determined to effect a discriminatory offering. It remains to be seen whether the SEC is willing to declare effective a registration statement with respect to an unabashedly racist and sexist plan of distribution. In the meantime, Bally’s filed a Form D on March 14 disclosing that it had sold $83.15 million of an approximately $195 million offering of interests.

Kentucky Enacts New Law Establishing Legal Framework for Blockchain and Digital Assets

On March 24, Kentucky enacted House Bill 701, establishing a statutory framework to support blockchain-based activity and clarifying the treatment of digital assets under state law. The legislation defines key terms, permits the use of digital assets in commerce, and amends sections of Kentucky’s securities and financial services laws to improve regulatory clarity around crypto-based activities.

The bill authorizes a broad range of activities involving blockchain technology and digital assets, while limiting the regulatory burden on individuals and companies operating in the space. The new law makes several important clarifications regarding how blockchain and digital asset activities will be treated under Kentucky law, including:

Use of digital assets in transactions. Individuals may use digital assets to purchase goods or services without incurring additional taxes or fees solely due to the use of digital assets. However, businesses are not required to accept them.

Authorization of node and staking activities. The law permits individuals and businesses to operate blockchain nodes and provide staking services. Validators will not be liable for transactions they merely confirm.

Confirmation that staking is not a securities offering. The law makes clear that offering staking services does not constitute the offer or sale of a security.

Exemptions for self-custodied digital wallets. The bill confirms that holding digital assets in a personal wallet will not trigger money transmission licensing requirements in Kentucky.

Putting It Into Practice: Kentucky’s new law provides additional clarity for digital asset users amid recent federal efforts to ease regulatory pressure on the industry (previously discussed here and here). Kentucky adds to the list of states giving digital asset users and service providers more certainty about their regulatory obligations (previously discussed here). Market participants should watch for other states to adopt similar frameworks, signaling continued progress toward a more uniform and predictable regulatory landscape for digital assets.

Delaware Enacts Significant Changes to Delaware General Corporation Law

As discussed in Foley’s Corporate Governance Update last month, SB 21: Delaware Responds In The DExit Battle, the Delaware legislature has been moving quickly to ensure that Delaware remains the preeminent home of choice for many corporations by amending the DGCL. The comprehensive changes, known as SB 21, became law on March 25, 2025, when the Delaware House of Representatives passed the Bill, and Delaware Governor Matt Meyer signed it into law. A copy of SB 21 as finally adopted is available here.

Delaware’s legislature and Governor acted with dispatch to pass a law with a number of changes intended to reduce litigation targeting directors, officers, and controlling stockholders. Our previous update contained a detailed explanation of the Bill. Here is a summary of the most notable changes to DGCL Section 144 and DGCL Section 220:

Raising the bar for deeming a stockholder to be a “controlling stockholder”. One of the major criticisms of existing case law is the scope creep in the definition of who is a controlling stockholder. This has significant implications because having a controlling stockholder on both sides of a transaction pushes the standard of review into the enormously pro-plaintiff entire fairness standard. The new law effectively introduces a floor of one-third ownership in order to be deemed to be a controlling stockholder.

Easing the standard for shielding controlling stockholder transactions from judicial review outside the “going private” context. Recent case law required the double protections of approval by both disinterested and independent directors and a majority of minority stockholders in order to obtain the business judgment standard of review. The new law only requires one of these two protections. It also further relaxes the standard in other ways, such as by relaxing the test for directors of listed companies to be deemed disinterested, and lowering the voting standard for obtaining majority of minority stockholder approval.

Narrowing the ability to make Books-and-records demands. The scope of available books-and-records under DGCL Section 220 has been narrowed under most circumstances to exclude emails, text messages, or informal board communications, and to limit books and records to a three-year look-back. In addition, a complainant must now show a “proper purpose” for any books-and-records demand and must do so with “reasonable particularity” while showing that the requested materials are “specifically related” to that purpose. These changes give Delaware corporations more tools to fight back against nuisance requests.

SB 21 was signed into law only 36 days after it was first introduced—in large part due to the legislature’s bypassing the normal process for amending the DGCL. In the House, the Bill faced nearly two hours of debate and five failed amendments. The motive for acting quickly was clear and explicit: Governor Meyer had asked for a bill like SB 21 to be on his desk by month’s end in an effort to preserve Delaware’s status as the preeminent place to incorporate in response to a growing movement by companies to exit the State following some unfavorable decisions from the State’s judiciary over the last few years.

Notably, the amendments to Sections 144 and 220 apply retroactively unless (1) an action commenced in court concerning an act or transaction is already completed or pending or (2) a books-and-records demand was made on or before February 17, 2025, when SB 21 was first introduced in the Delaware Senate.

SB 21’s changes to the DGCL have been heralded by some in the legal community, but criticized by others as engaging in a race-to-the-bottom with Texas and Nevada that risks long-term repercussions because they push Delaware’s carefully constructed balance too much in favor of corporate controllers and insiders and away from the rights of minority stockholders. Only time will tell whether Delaware remains the domicile of choice for so many of America’s corporations, but the State’s legislative and executive branches have made quite clear that they intend to do whatever is in their power to preserve the advantages of incorporating in the State.

Another Post SB21 Proposal To Reincorporate From Delaware To Nevada

The ink has barely dried on Delaware’s hotly debated amendments to its General Corporation Law and already another company has proposed reincorporation in Nevada. In preliminary proxy materials filed yesterday with the Securities and Exchange Commission, Roblox Corporation, an NYSE listed company, gave the following reasons for the reincorporating in Nevada:

Our Board believes that there are several reasons the Nevada Reincorporation is in the best interests of the Company and its stockholders. Our Board and the NCGC [Nominating & Corporate Governance Committee] determined that to support the mission of innovation of the Company it would be advantageous for the Company to have a predictable, statute-focused legal environment. The Board and the NCGC considered Nevada’s statute-focused approach to corporate law and other merits of Nevada law and determined that Nevada’s approach to corporate law is likely to foster more predictability in governance and litigation than Delaware’s approach. Among other things, the Nevada statutes codify the fiduciary duties of directors and officers, which decreases reliance on judicial interpretation and promotes stability and certainty for corporate decision-making. The Board and the NCGC also considered the increasingly litigious environment in Delaware, which has engendered costly and less meritorious litigation and has the potential to cause unnecessary distraction to the Company’s directors and management team. The Board and the NCGC believe that a more predictable legal environment will better allow the Company to pursue its culture of innovation as it pursues its mission.

Note that the Roblox’s statement focuses on Nevada’s statutory approach as opposed to Delaware’s judge-made development of the law. In the recent debate over Delaware’s amendments to its General Corporation Law, some decried the Delaware legislature’s interference with lawmaking by the courts:

The Delaware General Corporate Law is characterized by the strength of judicial oversight, whereas the bill seemingly has as its express purpose the disempowerment of the Court of Chancery and Supreme Court—a key feature and reason why companies incorporate in Delaware. The bill would overturn decades of precedent and carve out avenues for the most conflicted transactions to proceed unchallenged.

Council of Institutional Investors Letter dated March 18, 2025 to Chair of Delaware General Assembly’s Senate Judiciary Committee. The effrontery of the General Assembly in presuming to make law! Based on recent proposals, it would seem that the Court of Chancery and Supreme Court are the reason that companies are looking for the exit.

How to Report a Crypto Ponzi Scheme and Earn an SEC Whistleblower Award

Crypto Ponzi Schemes on the Rise

The rise in popularity of cryptocurrency has created fertile ground for fraud, including Ponzi schemes. Crypto Ponzi schemes function similarly to traditional Ponzi schemes by misleading investors into believing their returns are generated from legitimate trading or business activities. In reality, the fraudulent cryptocurrency companies use new investor funds to pay earlier investors, eventually leading to collapse when recruitment slows.

The SEC remains committed to rooting out these crypto frauds. On February 21, 2025, SEC Commissioner Hester M. Peirce stated:

[T]he Commission’s efforts continue unabated to combat fraud involving securities, including crypto assets that are securities or that were offered and sold as part of an investment contract, and tokenized securities. The Commission welcomes the public’s tips about securities violations.

And, indeed, whistleblower tips are needed to combat the rising number of crypto schemes. According to the FBI’s 2023 Cryptocurrency Fraud Report, crypto frauds account for a majority of losses due to financial fraud:

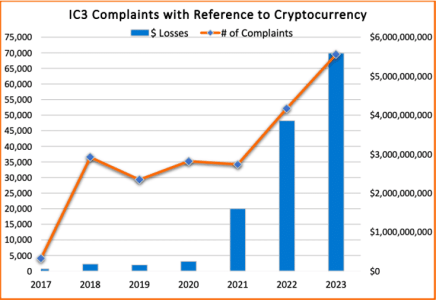

In 2023, the Federal Bureau of Investigation (FBI) Internet Crime Complaint Center (IC3) received more than 69,000 complaints from the public regarding financial fraud involving the use of cryptocurrency, such as bitcoin, ether, or tether. Estimated losses with a nexus to cryptocurrency totaled more than $5.6 billion. While the number of cryptocurrency-related complaints represents only about 10 percent of the total number of financial fraud complaints, the losses associated with these complaints account for almost 50 percent of the total losses.

The FBI’s report also highlights the significant increase in losses due to crypto frauds since 2021:

Under the SEC Whistleblower Program, whistleblowers can submit tips anonymously to the SEC through an attorney and be eligible for an award for exposing any material violation of the federal securities laws, including crypto Ponzi schemes and scams. Since 2011, whistleblower tips have enabled the SEC to bring enforcement actions resulting in more than $6 billion in monetary sanctions and the SEC has issued more than $2.2 billion in awards to whistleblowers. The largest SEC whistleblower awards to date are $279 million (May 5, 2023), $114 million (Oct. 22, 2020), and $110 million (Sept. 15, 2021).

This article discusses: 1) how to identify a crypto Ponzi scheme; 2) the SEC Whistleblower Program; 3) how to report a crypto Ponzi scheme and earn an SEC whistleblower award; and 4) examples of recent SEC enforcement actions against crypto Ponzi schemes and scams.

How to Identify a Crypto Ponzi Scheme

The SEC and FBI have warned investors about common red flags associated with Ponzi schemes, including crypto Ponzi schemes, such as:

High returns with little or no risk: Claims of consistent, substantial profits is a hallmark of Ponzi schemes. Every investment carries some degree of risk and investors should be suspicious of any “guaranteed” investment opportunity.

Complex or secretive investment strategies: Fraudsters often claim proprietary or undisclosed trading algorithms that cannot be independently verified.

Difficulty withdrawing funds: Investors may experience delays or be encouraged to “roll over” their investment for even higher returns. Additionally, some crypto frauds require investors to pay “fees” prior to withdrawing their (fake) profits.

Heavy recruitment incentives: Some schemes require investors to recruit new members to receive payouts, resembling pyramid structures.

Anonymous or unlicensed promoters: Many crypto frauds are run by unknown entities or individuals with no verifiable credentials.

Domain or website names that impersonate legitimate crypto companies and exchanges: Many crypto Ponzi schemes would be halted in their tracks if investors conducted research on their domain names, which would reveal that the websites are fake and/or were created recently to resemble a successful cryptocurrency company or exchange. Investors can use resources, such as Wayback Machine or Whois lookup, to research domains and determine, at a minimum, when a website was created.

If an investment opportunity sounds too good to be true, it likely is.

SEC Whistleblower Program

Under the SEC Whistleblower Program, the SEC will issue awards to whistleblowers who provide original information, including information about Ponzi schemes, that leads to successful enforcement actions with total monetary sanctions in excess of $1 million. A whistleblower may receive an award of between 10% and 30% of the total monetary sanctions collected. If represented by counsel, a whistleblower may submit a tip anonymously to the SEC.

In its short history, the SEC Whistleblower Program has had a tremendous impact on securities enforcement and has been replicated by other domestic and foreign regulators. Since 2011, the SEC has received an increasing number of whistleblower tips in nearly every fiscal year. In FY 2024, the SEC received approximately 24,980 whistleblower tips and awarded over $225 million to whistleblowers.

How to Report a Crypto Ponzi Scheme

To report a Ponzi scheme and qualify for an award under the SEC Whistleblower Program, the SEC requires that whistleblowers or their attorneys report the tip online through the SEC’s Tip, Complaint or Referral Portal or mail/fax a Form TCR to the SEC Office of the Whistleblower. Prior to submitting a tip, whistleblowers should consult with an experienced whistleblower attorney and review the SEC whistleblower rules to, among other things, understand eligibility rules and consider the factors that can significantly increase or decrease the size of a future whistleblower award.

SEC Targets Crypto Ponzi Schemes

The SEC has aggressively pursued crypto-related fraud, including crypto Ponzi schemes and other fraudulent investment scams. Below are some examples of recent crypto-related frauds that were halted by the SEC. Notable cases include:

In August 2024, the SEC filed a lawsuit against NovaTech and its promoters, alleging they operated a fraudulent crypto pyramid scheme that raised around $650 million from over 200,000 investors worldwide. According to the SEC’s complaint, the defendants operated NovaTech as a multi-level marketing (MLM) and crypto asset investment program from 2019 through 2023. They lured investors by claiming NovaTech would invest their funds on crypto asset and foreign exchange markets. In reality, NovaTech used the majority of investor funds to make payments to existing investors and to pay commissions to promoters, using only a fraction of investor funds for trading. The complaint further alleges that the Petions siphoned millions of dollars of investor assets for themselves.

In August 2024, the SEC obtained emergency asset freezes against brothers Jonathan and Tanner Adam for allegedly conducting a $60 million Ponzi scheme affecting more than 80 investors across the U.S. According to the SEC’s complaint, the brothers promised up to 13.5% monthly returns, claiming the funds would be used in a crypto asset trading platform. Instead, they used new investor funds to pay earlier investors and for personal expenses, including luxury items and real estate.

In November 2022, the SEC charged Douver Torres Braga, Joff Paradise, Keleionalani Akana Taylor, and Jonathan Tetreault for their roles in Trade Coin Club, a fraudulent crypto Ponzi scheme that raised more than 82,000 bitcoin, valued at $295 million at the time, from more than 100,000 investors worldwide. According to the SEC’s complaint, Braga created and controlled Trade Coin Club, a MLM program that operated from 2016 through 2018 and promised profits from the trading activities of a purported crypto asset trading bot. The SEC also alleged that Trade Coin Club operated as a Ponzi scheme and that investor withdrawals came entirely from deposits made by investors, not from any crypto asset trading activity by a bot or otherwise.

In August 2022, the SEC charged 11 individuals for their roles in creating and promoting Forsage, a fraudulent crypto pyramid and Ponzi scheme that raised more than $300 million from retail investors worldwide. According to the SEC’s complaint, Forsage allowed millions of retail investors to enter into transactions via smart contracts that operated on the Ethereum, Tron, and Binance blockchains. Forsage allegedly operated as a pyramid scheme for more than two years, in which investors earned profits by recruiting others into the scheme. Forsage also allegedly used assets from new investors to pay earlier investors in a typical Ponzi structure.

As crypto-related fraud continues to evolve, the SEC relies on whistleblowers to expose these scams and protect investors. See the SEC’s Investor Alert: Watch Out for Fraudulent Digital Asset and “Crypto” Trading Websites.

The SEC Under Paul Atkins – What to Expect for Registered and Private Offerings, Climate-Related Disclosure, Consolidated Audit Trail, Digital Assets, and Agency Re-Organization

Paul Atkins, who has been nominated by President Trump to serve as Chairperson of the Securities & Exchange Commission, last week completed a short confirmation hearing before the U.S. Senate Banking Committee. Despite its brevity, the hearing provided meaningful clues to Mr. Atkin’s plans if he is confirmed by the Senate to lead the SEC, which appears reasonably assured to occur. On April 3, 2025, the Senate Banking Committee approved his nomination with a vote of 13 to 11.

Paul Atkins previously served on the staff of SEC Chairman Richard Breeden, as an SEC Commissioner from 2002 to 2008, and as a member of the Congressional Oversight Panel for the Troubled Asset Relief Program, or TARP following the 2008 financial crisis. Most recently, he founded and ran a regulatory and compliance consulting company.

Here are a few takeaways from the hearing:

He Supports Regulation, but “Clear,” More “Tailored,” Less “Political”

Mr. Atkins can be expected to avoid regulation that he perceives as unnecessarily burdensome on business, but indicated that he would back regulation that he believes appropriately balances effectiveness and costs. Pressed on whether he intends to be “deregulatory,” he stated repeatedly that he believes in regulation that is carefully tailored to the actual problem being addressed. When pressed on the causes of the 2008 financial meltdown, noting that he served as an SEC Commissioner in the years prior, he cited “mis-regulation” following the SEC’s “focus on the wrong things” rather than the “actual problems.”

Although Mr. Atkins did not comment extensively on enforcement, the expectation is that he will move away from what some perceive as “regulation by enforcement,” which refers to enforcement cases against grey area activity, in favor of a focus on more traditional fraud actions, such as insider trading and market manipulation. This has been a particular concern of market participants in the crypto and digital assets industries. Mr. Atkins stated that he was in favor of imposing penalties on regulated entities for regulatory violations, citing the compromise reflected in the 2006 Statement of the Securities and Exchange Commission on Financial Penalties.

He Appears to View the SEC’s Climate-Related Disclosure Rules as “Political”

Mr. Atkins stated that he would “get politics out of the financial markets.” When asked about the SEC’s extensive climate change disclosure rules, he clearly backed the agency’s recent retreat from those requirements [link to The SEC Votes to “End its Defense” of Climate Change Rules | Regulatory & Compliance ], but did not comment on the subject of climate-related and other ESG disclosure in principle, and thereby left the door open for new disclosure rules that in his view would provide information material to investors.

Public Registration Is Preferable to Private Offerings, and the SEC Did Not Go Far Enough In Implementing the JOBS Act, And May Suggest Further Legislation

Mr. Atkins indicated that public registration of securities offerings is preferable to private offerings, while citing the unnecessary burdens of public registration that he believes have contributed to a decline in the number of public offerings and public companies. In particular, he cited regulatory changes in 2016 called for by the JOBS Act, which among other things eased the requirements for “emerging growth companies” in registered offerings. Mr. Atkins stated that the SEC “never fully implemented” the JOBS Act, although he also mentioned potential additional statutory relief through Securities Act amendments.

Public commenters at the time of the adoption of the JOBs Act suggested some areas of additional flexibility, which may inform Mr. Atkin’s priorities. For example, the Act raised the threshold for requiring large private companies to become publicly reporting companies from 500 record holders to 2,000 record holders or 500 non-accredited investor holders. Some commenters had suggested ways to ease issuers’ determination of the number of non-accredited investor holders, such as allowing them to rely on the initial determinations made in a private offering, or to allow 3(c)(7) funds to presume the accredited investor status of their “qualified purchasers.” Under current rules, making the determination is difficult at best. The SEC under the leadership of Acting Chairperson has taken steps designed to ease access to capital in recent months, including providing staff guidance designed to increase the use of Rule 506(c) exempt offerings (see below), and opening the confidential review process of SEC registration statements to all companies regardless of how long they have been public.

Views on Retail Participation in Private Funds

Members of the Senate Banking Committee pressed Mr. Atkins on the increasing availability of hedge fund, private equity and similar interests to retail investors. In response, he did not offer any specific SEC action that he believes warranted at this time, pointing to existing guardrails, and indicating that individual retail investors who are “accredited investors” do not require special SEC protection in making these kinds of investments.

The JOBSs Act also required the SEC to adopt Rule 506(c) permitting private placements using general solicitation, and raised the threshold for requiring large private companies to file public reports with the SEC. In expanding the JOBs Act amendments, Mr. Atkins may plan to further facilitate the use of Rule 506(c), perhaps through rule amendments and/or Commission interpretive guidance, following the very recent staff interpretive letter liberalizing the rule, which received widespread attention. [link to SEC Eases Verification Burdens in Rule 506(c) Offerings | Regulatory & Compliance ].

Members of The Committee Reflected Skepticism About Favorable Treatment Afforded to “Foreign Private Issuers”

In the course of their questioning, members of the Senate Banking Committee reflected skepticism about favorable treatment of “foreign private issuers,” such as their exemption from the short-swing profit rules applicable to domestic issuers. Mr. Atkins stated that he would review these issues.

Digital Assets Will Be “Top Priority”

It comes as no surprise that Mr. Atkins believes that crypto and other digital assets have been hindered by regulatory uncertainty, and he intends to provide a “firm regulatory foundation” for the offering and trading of digital assets through “a rational, coherent, and principled approach.” In other words, he believes that these activities should be regulated, but plans to provide clear, practical regulatory processes. The SEC recently established a Crypto Task Force, which has scheduled roundtable discussions. There has been proposed legislation on digital assets, as addressed in our prior blog Digital Assets: What to Expect from the Incoming Administration and Congress | Regulatory & Compliance , and Mr. Atkins likely will weigh with Congress on where legislation may help the SEC’s efforts.

He Will Review the Consolidated Audit Trail Requirements

Members of the Committee pressed Mr. Atkins on his support for the SEC’s controversial Consolidated Audit Trail, or CAT, requirements, and indicated that he looked forward to reviewing the system to ensure that it is accomplishing the purpose it was adopted to serve. The CAT was mandated by the SEC following the 2010 “flash crash” and provides for the collection of trade and personal identifying information on all equity and options transactions in the United States. The CAT permits the SEC to detect and respond to market inefficiencies, but it has been criticized for its cost as well as for its retention of significant volumes of personal trade and other information, and for the lack of public access when the SEC writes new rules based on its analysis of the data.

No Immediate Major Overhaul of the SEC, But the Agency Will Be Reviewed For Effectiveness and Efficiency

Given his substantial experience with the SEC, Mr. Atkins likely believes in the agency and its mission, but also has ideas for reform. As for DOGE and its efforts to substantially reduce the size of government agencies, he stated that “if there are people who can help creating efficiencies I would definitely work with them,” and he will review the Commission’s operations to ensure that the agency is working “effectively and efficiently.”

Tempus Fugit Ad Nevada

Three days after Delaware’s governor, Matt Meyer, signed into law controversial amendments to Delaware’s General Corporation Law, another publicly traded company filed preliminary proxy materials with the Securities and Exchange Commission seeking stockholder approval of a reincorporation in Nevada.

“Fugit inreparabile tempus”*

Tempus AI, Inc. describes itself as “a healthcare technology company focused on bringing artificial intelligence and machine learning to healthcare in order to improve the care of patients across multiple diseases”. Although its principal executive offices are in Chicago, Illinois, it was incorporated in Delaware. Tempus’ proxy materials emphasize Nevada’s “statute focused” approach and its board’s belief “that Nevada can offer more predictability and certainty in decision-making because of its statute-focused legal environment”. The company also faults the litigation environment in Delaware:

The Board also considered the increasingly litigious environment in Delaware, which has engendered less meritorious and costly litigation and has the potential to cause unnecessary distraction to the Company’s directors and management team and potential delay in the Company’s response to the evolving business environment. The Board believes that a more stable and predictable legal environment will better permit the Company to respond to emerging business trends and conditions as needed.

I expect that Tempus’ board was aware of the Delaware legislation, but the changes were not enough to convince it to remain in the Blue Hen state.

* Time flies irretrievably. Publius Vergilius Maro, Georgics, Liber III.

SEC Policy Shift and Recent Corp Fin Updates – Part 1

Since the beginning of the year, the US Securities and Exchange Commission’s (SEC) Division of Corporation Finance staff (Corp Fin Staff) has issued several important statements and interpretations, including a Staff Legal Bulletin on shareholder proposals and multiple new and revised Compliance and Disclosure Interpretations (C&DIs). Given the pace and importance of these recent changes, it is critical that public companies be aware of the significant policy shift at the Division of Corporation Finance and the substance of the updated statements and interpretations.

This is the first part of an ongoing series that will discuss recent guidance and announcements from the Corp Fin Staff. This alert will review the new and revised C&DIs released by the Corp Fin Staff relating to Regulation 13D-G, proxy rules, and tender offer rules.

Regulation 13D-G

On 11 February 2025, the Corp Fin Staff revised one C&DI and issued a new C&DI with respect to beneficial ownership reporting obligations. Revised Question 103.11 clarifies that determining eligibility for Schedule 13G reporting (as opposed to Schedule 13D reporting) pursuant to Exchange Act Rule 13d-1(b) or 13d-1(c) will be informed by all relevant facts and circumstances and by how “control” is defined in Exchange Act Rule 12b-2. This revised C&DI removed the examples previously given as to when filing on Schedule 13D or Schedule 13G would be appropriate.

New Question 103.12 states that a shareholder’s level of engagement with a public company could be dispositive in determining “control” and disqualifying a shareholder from filing on Schedule 13G. This new C&DI notes that when the engagement goes beyond a shareholder informing management of its views and the shareholder actually applies pressure to implement a policy change or specific measure, the engagement can be seen as “influencing” control over a company. Together, these revised and new C&DIs present a significant change in beneficial ownership considerations with respect to shareholder engagements.

Since the issuance and revision of these two C&DIs, the Corp Fin Staff has further indicated that the publishing of a voting policy or guideline alone would generally not be viewed as influencing control. However, if a shareholder discusses a voting policy or guideline when engaging with a company and the discussion goes into specifics or becomes a negotiation, it could be seen as influencing control. Additionally, the Corp Fin Staff explained that, while statements made by a shareholder during an engagement may indicate that it is not seeking to influence control, a shareholder’s actions may still be considered an attempt to do so.

For companies that actively engage with shareholders that report ownership of the company’s holdings pursuant to a Schedule 13G, the new and revised Regulation 13D-G C&DIs may have the unintended effect of causing additional time and resources to be spent engaging with a broader pool of investors if engagements with larger shareholders are canceled, postponed, or lessened in scope.

Proxy Rules and Schedules 14A/14C

Over the past several proxy seasons, there has been an increase in the number of voluntary Notice of Exempt Solicitation filings by shareholder proponents and other parties in what is often seen as an inexpensive way to express support for a shareholder proposal or to express a shareholder’s views on a particular topic. This can be seen as contrary to the intended purpose of a Notice of Exempt Solicitation filing, which was to make all shareholders aware of a solicitation by a large shareholder to a smaller number of shareholders. Many companies that had these voluntary Notice of Exempt Solicitation filings made in connection with a shareholder proposal have found them to be confusing to shareholders since there was limited information required by these filings and there was uncertainty about how to respond to materially false and misleading statements in them.

On 27 January 2025, the Corp Fin Staff revised two C&DIs and issued three new C&DIs relating to voluntary Notice of Exempt Solicitation filings. The new and revised C&DIs clarify that voluntary submissions are allowed by a soliciting person that does not beneficially own more than US$5 million of the class of subject securities, so long as the cover page to the filing clearly indicates this fact. Additionally, the notice itself cannot be used as a means of solicitation but instead should be a notification to the public that the written material has been provided to shareholders by other means. The Corp Fin Staff also confirmed that the prohibition on materially false or misleading statements contained in Exchange Act Rule 14a-9 applies to all written soliciting materials, including those filed pursuant to a Notice of Exempt Solicitation.

For companies that have had voluntary Notice of Exempt Solicitation filings made to generate publicity for a shareholder proposal or express a view on a particular topic, the new and revised Proxy Rules and Schedules 14A/14C C&DIs are intended to significantly limit the number of or stop these voluntary filings, which are simply made for publicity or to express a viewpoint.

Tender Offer Rules

On 6 March 2025, the Corp Fin Staff added five new C&DIs relating to material changes to tender offers after publication. According to Exchange Act Rule 14d-4(d), when there is a material change in the information that has been published, sent, or given to shareholders, notice of that material change must be promptly disseminated in a manner reasonably designed to inform shareholders of the change. The rule goes on to say that an offer should remain open for five days following a material change when the change deals with anything other than price or share levels.

In new C&DI Question 101.17, the Corp Fin Staff clarified that while the SEC has previously stated that an all-cash tender offer should remain open for a minimum of five business days from the date a material change is first disclosed, it understands this may not always be practicable. The Corp Fin Staff believes that a shorter time period may be acceptable if the disclosure and dissemination of the material change provides sufficient time for shareholders to consider this information and factor it into their decision regarding the shares subject to the tender offer.

New C&DIs 101.18–101.21 address material changes related to the status or source of the financing of a tender offer. In Question 101.18, the Corp Fin Staff indicated that a change in financing of a tender offer from “partially financed” or “unfinanced” to “fully financed” constitutes a material change that requires shareholder notice and time for consideration on whether a shareholder will participate. In Question 101.20, however, the Corp Fin Staff clarifies that the mere substitution of the source of financing is not material. The Corp Fin Staff did note that an offeror should consider whether it needs to amend the tender offer materials to reflect the material terms and the substitution of the funding source. While this may seem contrary to the Corp Fin Staff’s guidance in this C&DI, an immaterial change in the funding source could trigger an obligation to amend the tender offer materials to reflect other changes, such as the material terms of the new source of funding.

In Question 101.19, the Corp Fin Staff indicated that a tender offer with a binding commitment letter from a lender would constitute a fully financed offer, while a “highly confident” letter would not. The answer to Question 101.21 builds on the guidance from the previous three new C&DIs to establish that when an offeror has conditioned its purchase of the tendered securities on the receipt of actual funds from a lender, a material change occurs when the lender does not fulfill its contractual obligation and the offeror waives it without an alternative source of funding.

In light of these new C&DIs, companies planning tender offers should play close attention to the status of any necessary funding, as changes in unfunded, partially funded, or fully funded financing can trigger the need to disclose a material change to stakeholders as well as to amend the tender offer materials.

Conclusion

This publication is the first in a series that seeks to highlight these policy changes and help public companies stay up to date on the Corp Fin Staff’s guidance. Our Capital Markets practice group lawyers are happy to discuss how these policy and guidance changes can impact companies as they consider how to address the new and revised Regulation 13D-G, proxy rules, and tender offer rules C&DIs.