Treasury Issues Final Guidance on Clean Hydrogen Production Tax Credit

Go-To Guide:

Treasury finalizes clean hydrogen tax credit rules, clarifying Carbon Intensity calculations.

New regulations address additionality, hourly matching, and deliverability for zero-carbon electricity.

Annual matching allowed until 2030, with hourly matching required thereafter.

Renewable Natural Gas treated similarly to electricity, with monthly matching and single-region deliverability.

Potential impacts of new administration and Congress on 45V regulations remain uncertain.

The U.S. Treasury Department has issued final regulations for clean hydrogen production tax credits, which may significantly impact the renewable energy sector. These regulations implement the Section 45V clean hydrogen tax credit. Critical to developers of hydrogen production projects, they determine the requirements to qualify for the Section 45V credit and resolve disagreements over how to calculate the Carbon Intensity (CI), or life cycle greenhouse gas emissions, for clean hydrogen production projects.

The CI is a key factor in determining whether hydrogen produced by a clean hydrogen project qualifies for a 45V credit, as well as the amount of that credit. The regulations also cover other important aspects, such as:

the petitioning process for provisional emissions rates,

rules for verifying clean hydrogen production, sale, or use,

rules for modifying or retrofitting existing qualified clean hydrogen production facilities,

rules for using electricity from certain renewable or zero-emissions sources to produce qualified clean hydrogen, and

options for treating part of a clean hydrogen production facility as energy property eligible for the Section 48 energy credit.

I.

How the Carbon Intensity that Dictates Section 45V Credit Value is Determined

Under the final regulations, the CI of hydrogen will be determined based on life cycle emissions through the point of production, known as “well-to-gate.” This determination will use the most recent Greenhouse gases, Regulated Emissions, and Energy use in Transportation (GREET) model developed by Argonne National Laboratory. The well-to-gate system boundary includes several types of emissions. It covers emissions associated with feedstock growth, gathering, extraction, processing, and delivery to a hydrogen production facility. It also includes all emissions resulting from the facility’s hydrogen production process. This encompasses the production of mixed gas or impurities, electricity used by the hydrogen production facility, and any capture and sequestration of carbon dioxide generated by the facility. Emissions from activities that occur after the facility’s hydrogen production process is complete, such as liquefaction, storage, or transport, are generally beyond the well-to-gate system boundary. However, there is an exception: emissions from certain purification activities that occur downstream of the facility’s qualified clean hydrogen production process are considered within the well-to-gate system boundary.

II.

Treasury Resolves Issues Over ‘The Three Pillars’

In the case of clean hydrogen produced from zero carbon electricity, three issues critical to measuring CI have emerged: (1) additionality – whether the electricity must be produced by newly constructed renewable generation facilities; (2) hourly matching – whether the electricity must be produced in the same hour, or under a more lenient standard, the same year in which it is consumed to produce hydrogen; and (3) deliverability – whether the electricity must be generated in the same region where the hydrogen is produced. The final rules adopt less restrictive standards than initially proposed on many of these issues.

Additionality

The final rules address additionality by finding that the newly constructed renewable generation facility’s generation must begin commercial operations within 36 months of the facility being placed into service. However, Treasury also adopted an exception to this general rule that will allow up to 200 MW of nuclear generation capacity at risk of retirement to be considered incremental. In addition, when clean power is sourced from states with stringent emissions caps, such as California and Washington, that ensure continued growth in renewable generation capacity, the electricity will be considered incremental. Finally, electricity produced by a generation facility that has added carbon capture and sequestration within 36 months will be considered incremental.

Hourly Matching

The regulations on Hourly Matching give hydrogen producers more time to adapt. They can use annual matching until 2029, with hourly matching required in 2030. This extends the transition period by two years.

After 2030, when hourly matching is mandatory, any electricity use not covered by a qualifying Energy Attribute Certificate (EAC) will be assessed based on the regional electricity grid’s default emissions intensity. The Section 45V credit amount varies based on the produced hydrogen’s CI. To qualify, hydrogen must have an annual average CI below 4 kilograms of CO2 per kilogram of hydrogen. The credit value increases as CI decreases: $0.60 for CI between 2.5 and 4.0, $0.75 for CI between 1.5 and 2.5, $1.00 for CI between 0.45 and 1.5, and $3.00 for CI below 0.45.

The final rules allow taxpayers to optimize their credit value. If the annual average CI is below 4.0 for all hydrogen produced in a calendar year, they can choose to calculate emissions from electricity use on an hourly basis to potentially increase their 45V credit.

Deliverability

The final regulations largely adopt the proposed rules for EACs and deliverability. An EAC meets the deliverability requirement if the associated electricity is generated by a facility in the same grid region as the hydrogen production facility. The National Transmission Needs Study (DOE Needs Study), which the DOE released on Oct. 30, 2023, defines these regions. Alaska and Hawaii, as well as each U.S. territory, are considered separate regions.

The final regulations amend the proposed regulations to allow an eligible EAC to meet the deliverability requirement in cross-region deliveries where the generation’s deliverability can be tracked and verified.

Hydrogen Produced from Renewable Natural Gas

The adopted regulations seek to treat methane similarly to hydrogen produced from electricity. They introduce gas EACs to track emissions from RNG used in methane production. Qualified EAC registries will manage these EACs.

The regulations also require monthly matching and treat the contiguous United States as a single region for deliverability purposes. However, the regulations do not adopt a “first productive use” requirement to address incrementality. A first productive use requirement would have required the taxpayer to establish that the biogas has not been previously used for another productive application, such as electricity generation or transportation.

III.

Potential Impacts of a New Administration and Congress

It is uncertain how the new administration and Congress may impact the 45V regulations. The incoming administration and Republican Congressional majority have expressed opposition to various grants and tax credits adopted under the Inflation Reduction Act, such as those relating to electric vehicles and offshore wind facilities. But they may also be aware of the substantial U.S. investments that have already been made, additional investments and employment that might be unleashed, and support for hydrogen some Republicans, Democrats, and fossil fuel companies have expressed. Additionally, while the final regulations could also be revised by the incoming administration, this would require a lengthy regulatory process.

Inflation Reduction Act Domestic Content Bonus Update: IRS Issues Updated Guidance with First Updated Elective Safe Harbor

On January 16, 2025, the IRS released Notice 2025-08, modifying its prior guidance issued as Notice 2023-38 and Notice 2024-41, for taxpayers seeking to qualify for the domestic content bonus tax credit amounts under the Inflation Reduction Act of 2022 (IRA). The IRA amended §§ 45 and 48 of the Internal Revenue Code and enacted §§ 45Y and 48E of the Internal Revenue Code to provide domestic content bonus tax credits for certain qualified energy facilities or projects.

Notice 2025-08 introduces the First Updated Elective Safe Harbor, providing new tables for solar photovoltaic, land-based wind, and battery energy storage system projects that modify the New Elective Safe Harbor tables provided in Notice 2024-41. Our initial post on the New Elective Safe Harbor is available here.

A summary of many of the modifications introduced by the notice is provided below:

The safe harbor table for solar PV systems has been split into two separate tables: one for ground-mount and one for rooftop. The Assigned Cost Percentages for module and inverter Manufactured Product Components (MPCs) have generally increased, but the Assigned Cost Percentages for production have generally decreased or remain unchanged. Notably, the Assigned Cost Percentage for production for a ground-mounted system with tracking decreased from 11.5 to 4.7.

Solar PV projects that install modules with domestic crystalline silicon cells and wafers (only applicable to modules) are valued higher (e.g., with an Assigned Cost Percentage of 51.6 for ground-mounted projects with tracking technology and 66.6 for ground-mounted fixed-tilt projects) than solar PV projects with only domestic cells (e.g., with an Assigned Cost Percentage of 38 for ground-mounted projects with tracking technology and 53.2 for ground-mounted fixed-tilt projects).

The First Updated Elective Safe Harbor table is significantly restructured for BESS projects, notably with a much higher Assigned Cost Percentage of 52 for cells for grid-scale projects (up from 38).

The notice adjusts various MPCs and Applicable Project Components (APCs):

“Steel or iron rebar in foundation” is modified to be “steel or iron reinforcing products in foundation.”

For PV modules, “Adhesives” have been removed as an MPC, intended to be covered by Edge Seals and Pottants.

For inverters, the former “Climate Control” is modified to be “Thermal Management System,” and “Enclosure” is modified to be “Enclosure & Skids.”

For trackers, the former “Slew Drive” is modified to be “Drive System,” and “Motor” is modified to be “Actuator.”

For wind projects, “Material” is modified to be “Preform.”

For BESS, “Battery Pack” has been narrowed to “Battery Pack/Module,” now containing only “Cells and Packaging.”

For BESS, “Inverter” is modified to be “Inverter/Converter.”

For BESS, the “Battery Container/Housing” APC remains, but is expanded to include what has been excluded from the original “Battery Pack” APC (Battery Management System and Thermal Management System for Battery Container/Housing).

The notice provides definitions for MPCs and APCs that clarify the classification of equipment and components, providing more certainty for taxpayers seeking to use the safe harbor.

The notice also expressly permits projects subject to the 80/20 Rule (allowing certain qualified facilities or energy property to be treated as originally placed in service even with some used components) to qualify for the domestic content bonus using the First Updated Elective Safe Harbor.

Taxpayers may rely on the notice for any applicable project beginning construction before the date that is 90 days after any future modification, update, or withdrawal of the notice.

Overall, the First Updated Elective Safe Harbor is likely to provide greater clarity in the interpretation of requirements necessary to obtain the domestic content bonus tax credit pursuant to the IRA.

Listen to this post

CBP’s Proposed Changes to De Minimis Shipments

This week, U.S. Customs and Border Protection (CBP) published two Notices of Proposed Rulemaking1 that could significantly impact and curtail the entry of low-value shipments not exceeding $800 (commonly known as de minimis shipments) that are eligible for duty-free and simplified entry. Companies currently relying on de minimis shipments as a strategy to reach the U.S. market, whose shipments include Chinese, steel and/or aluminum goods, may be prevented from continued use of that strategy. In addition, CBP proposes to collect new data on de minimis shipments under a new “enhanced entry process” and revisions to existing processes to better facilitate CBP’s verification of eligibility for duty- and tax-free entry of de minimis shipments.

Section 321 of the Tariff Act of 1930 allows for the informal entry of articles that have a retail value of $800 or less and are imported by one person in one day. These de minimis shipments are free of duty and taxes and are subject to expedited clearance processing.

With the rise of e-commerce, CBP is clearing historic high levels of de minimis shipments per day. That increase, coupled with the expedited clearance processing to which de minimis shipments are entitled, has prompted CBP and industry concerns about the agency’s ability to identify and prevent the shipment of illicit drugs, counterfeit or pirated goods, merchandise that poses a risk to public safety, and other contraband through de minimis shipments.

Moreover, there has been growing concern about the utilization of de minimis shipments to evade – even if legitimately – special tariffs imposed on certain imported merchandise under various trade-related statutes including Section 232 of the Trade Expansion Act of 1962 (Section 232) and Sections 201 and 301 of the Trade Act of 1974 (Sections 201 and 301). For example, tariffs are currently being imposed on steel and aluminum imports under Section 232, which authorizes the President to adjust imports — including through the use of tariffs — if excessive foreign imports are found to be a threat to U.S. national security. Certain merchandise such as solar cells and modules are subject to tariffs under Section 201, which authorizes the President to take all necessary actions including imposing tariffs if merchandise is being imported into the U.S. in such increased quantities to cause or threaten serious injury to the domestic industry producing the merchandise. Further, various goods imported from China are currently subject to duties imposed under Section 301, which authorizes the President to take retaliatory measures to address foreign governments’ unreasonable or discriminatory acts that burden U.S. commerce. Currently, de minimis shipments containing the merchandise subject to these special tariffs are nonetheless eligible to claim duty-free entry.

CBP’s dual proposed rulemakings aim to address these concerns by prohibiting shipments subject to those special tariffs from utilizing de minimis entry procedures and collecting additional data on all shipments utilizing de minimis entry procedures to verify eligibility for the program.

First, CBP proposes to make all goods subject to tariffs imposed under Sections 232, 201, and 301, whether or not the goods were granted an exclusion from such tariffs under those laws, ineligible for duty-free entry under de minimis provisions. However, CBP acknowledged a hurdle to this decision as relates to international mail shipments, noting the U.S. Postal Service (USPS) cannot collect duties directly from foreign mailers. To determine whether to exclude international mail shipments from the scope of this proposed rulemaking and handle them through a later rulemaking tailored to the international mail shipments environment, CBP is soliciting comments from the public and the USPS.

Second, CBP proposes collection of additional information on de minimis shipments under the existing basic entry process and through creation of a new enhanced entry process intended to encompass merchandise subject to partner government agency regulations and/or non-exempt from duties, taxes and fees. This new process would remove the requirement that de minimis shipments be segregated on advance manifests but require the electronic transmission of the individual bill of lading or other shipping document used to file or support entry, as well as other additional data elements, including:

Clearance tracing identification number (CTIN);

Country of shipment of the merchandise;

Seller’s and purchaser’s name and address;

Any data or documents required by other government agencies;

Advertised retail product description;

Marketplace’s name and website address (or, in the alternative, product picture, product identifier, or shipment x-ray or other security screening report number); and

10-digit Customs classification of the merchandise under the Harmonized Tariff Schedule of the United States (HTSUS).

Finally, CBP proposes to clarify the rule that when the aggregate fair retail value of shipments imported by one person on one day under the de minimis exemption exceeds $800, all such shipments imported on that day by that person become ineligible for duty- and tax-free entry under the exemption. CBP further clarifies that the “one person” eligible for the administrative exemption is “the owner or purchaser of the merchandise imported on one day.”

We expect this to be only an opening salvo in a protracted battle over the use of de minimis waged before the agency and through legislative changes over the coming year.

[1] See Entry of Low-Value Shipments, 90 Fed. Reg. 3,048 (Jan. 14, 2025), available at https://www.govinfo.gov/content/pkg/FR-2025-01-14/pdf/2025-00551.pdf; see also Trade and National Security Actions and Low-Value Shipments, 90 Fed. Reg. 6,852 (Jan. 21, 2025), available at https://www.govinfo.gov/content/pkg/FR-2025-01-21/pdf/2025-01074.pdf.

Some Unofficial Predictions for Spring 2025 Alabama Tax Legislation

Each year we are asked to predict the tax-related bills that died in the last legislative session but will likely be re-introduced in one form or another, as well as the tax issues that we expect to see addressed for the first time in the upcoming session of the Alabama Legislature. Because of the November general elections, Alabama’s 2025 Regular Session starts a bit later than normal – February 4, 2025. Here is our list as of January 21, 2025, which is a moving target. Oftentimes we will not see some of the more important tax bills filed until a week or two (or less) before the session convenes:

House Bill 36 has been prefiled to amend the Simplified Sellers Use Tax Program (SSTP) to increase the rate from the current flat 8% to a combined rate much closer to the average rate charged by retailers within most municipalities in our state, e.g., 9.3%, and to allocate the incremental revenue differently than the current population-based formula. That bill died last session, but Rep. Chris England has announced he will try again, with the backing of the state’s largest municipalities.

We expect a bill to be introduced by House Minority Leader Anthony Daniels and others to repeal the June 30, 2025, sunset date for the popular “overtime exemption,” and make it permanent or at least extend the current sunset date. Readers may recall that the fiscal impact of this exemption far exceeded initial estimates, which has decreased Education Trust Fund (ETF) receipts.

House Bill 52 has been prefiled to extend the sunset date for the deductibility of contributions to ABLE accounts (Rep. Danny Garrett).

Senate Bill 22 has reappeared, which if enacted would, under unstated criteria and procedures, recapture or “claw-back” Jobs Act incentives if a company previously awarded these incentives or a “related company” violates federal child labor or state human trafficking laws (Sen. Merika Coleman).

House Bill 46 would amend the controversial Rural Physician Tax Credit statute to clarify the criteria, increase the amount of the credit to $10,000 annually, and allow it to be claimed for four consecutive years (rather than the current five-year period). This was called for by Chief Judge Jeff Patterson in a recent Alabama Tax Tribunal ruling that, as is often the case, denied the credit to what both parties agreed to be an otherwise deserving rural doctor (Rep. Ed Oliver).

We anticipate a bill to be introduced that would reduce the state sales tax on “food” from 3% to 2%, even though less-than-stellar ETF growth did not trigger the automatic reduction that many hoped for, and that would clarify how much municipalities may reduce their respective tax rates. Most recently, Kansas completed its multi-step repeal of its “grocery tax.” Tennessee, Mississippi and Arkansas are also considering the proposal.

We expect a bill will be introduced (again) to allow municipalities that forfeited their authority to levy taxes and fees on residents and businesses in their police jurisdictions to re-acquire that authority by filing delinquent reports with the Examiners of Public Accounts and submission of annual reports (hopefully this time with fair notice to taxpayers).

We expect a bill to be introduced (again) to increase the income tax exemption for withdrawals from IRC Section 401(k) plans and IRAs to $10,000 annually for “seniors.”

We expect that a bill will be introduced (again) to create a Small Business Health Care Insurance Premium deduction for individuals, which was backed last session by several prominent business and trade associations.

We are monitoring legislative and Alabama Department of Revenue (AL DOR) reaction to Congressional and President Trump’s efforts either to extend various provisions of the Tax Cuts and Jobs Act of 2017, that will otherwise sunset on December 31, 2025, or allow certain provisions to lapse or be amended in some way, e.g., the so-called SALT Cap and the IRC Section 163(j) interest limitation.

We should also monitor legislative and AL DOR reaction to President Trump’s tax proposals that if enacted would, for example, exempt tip income and overtime pay from income tax.

Last but certainly not least, look for legislation extending the deadline to appeal either a preliminary or final assessment from 30 days to either 60 or 90 days, as recommended by the Council On State Taxation (COST) and the AICPA.

TTB Proposes Rules on Nutrition and Allergen Labeling on Alcoholic Beverages

On January 17, 2025, the Alcohol and Tobacco Tax and Trade Bureau (TTB) proposed two rules that would require nutrition and food allergen labeling on alcoholic beverages, including wines, distilled spirits, and malt beverages. The proposed rules are in response to the Department of the Treasury’s February 2022 report on Competition in the Markets for Beer, Wine, and Spirits, which recommended TTB revive or initiate such rulemaking.

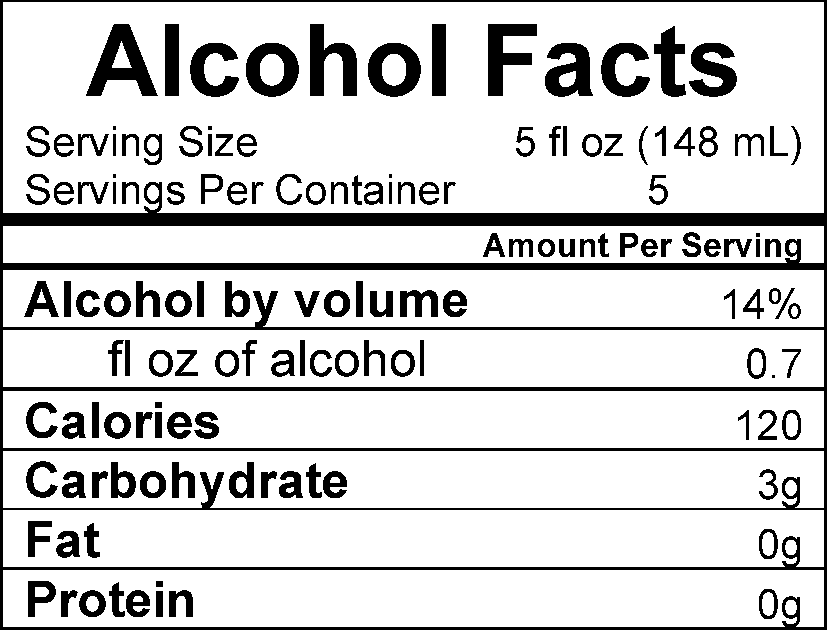

The proposed Alcohol Facts Statements in the Labeling of Wines, Distilled Spirits, and Malt Beverages would require disclosure of per-serving alcohol, calorie, and nutrient content information in an “Alcohol Facts” statement on all TTB-regulated alcoholic beverage labels. Specifically, the Alcohol Facts statement would be required to include:

The serving size of the product;

The number of servings per container;

Alcohol content as a percentage of alcohol by volume;

The mount of pure ethyl alcohol per serving in fluid ounces;

The number of calories per serving; and

The amount of carbohydrates, fat, and protein per serving.

The amount of sugars may be optionally declared in the Alcohol Facts statement. The statement must be presented in a panel or linear format. An example of each format is below:

The proposed Major Food Allergen Labeling for Wines, Distilled Spirits, and Malt Beverages would require labeling disclosures of all major food allergens used in the production of TTB-regulated alcoholic beverages. The declaration must consist of the words “Contains Major Food Allergen(s)” followed by a colon and the name of the food source from which each major food allergen is derived. Processing aids may include the parenthetical explanation “(processing aid)” following the name of the allergen. If major food allergens used in the production of distilled spirits have been completely distilled such that no protein remains, the declaration is not required.

TTB is accepting comments on both proposed rules until April 17, 2025, at regulations.gov. Comments on the nutrition labeling rule should be filed in Docket No. TTB-2025-0002, and comments on the allergen rule should be filed in Docket No. TTB-2025-0003.

DOL Releases Final Rule for Self-Correction Under the Voluntary Fiduciary Compliance Program

On January 14, 2025, the U.S. Department of Labor’s (DOL) Employee Benefits Security Administration (EBSA) released its long-awaited final rules regarding changes to the Voluntary Fiduciary Compliance Program (VFCP). The new rules, which were initially proposed in November 2022, are the first changes to the VFCP in nearly two decades.

Quick Hits

On January 14, 2025, the DOL released new rules for the Voluntary Fiduciary Compliance Program (VFCP), introducing a self-correction feature for retirement plan sponsors to address common operational failures.

The VFCP rules allow plan sponsors to self-correct late deposits of participant contributions and loan repayments without filing a formal application.

The DOL also amended Prohibited Transaction Exemption 2002-51 to extend excise tax relief to self-corrections of participants and loan repayment features.

Most significantly, the final rules create a self-correction feature for retirement plan sponsors to address delinquent transmittal of participant contributions and loan repayments, which are two of the most common retirement plan operational failures. In addition, the final rules provide that the self-correction procedures also apply to certain participant loan failures that are eligible for correction under the Internal Revenue Service’s (IRS) Employee Plans Compliance Resolution System (EPCRS). The SECURE 2.0 Act of 2022 (SECURE 2.0) greatly expanded the ability of plan sponsors to self-correct “eligible inadvertent failures,” including certain plan loan failures. SECURE 2.0 also directed the EBSA to implement new rules approving self-correction of loan failures.

The Voluntary Fiduciary Compliance Program

The VFCP permits plan fiduciaries, including plan sponsors, to correct certain fiduciary breach violations under the Employee Retirement Income Security Act (ERISA) by formally applying to EBSA for relief. The VFCP specifies nineteen enumerated categories of fiduciary violations that are eligible for correction. Plan sponsors may submit corrections to EBSA using the VFCP for approval. If the plan sponsor’s correction is approved, EBSA will issue what is referred to as a “no-action” letter to the employer. The no-action letter provides that EBSA will not take any civil enforcement action against the plan sponsor with respect to the corrected fiduciary breach, including foregoing legal action and assessment of civil monetary penalties. VFCP applicants may also obtain relief from payment of excise taxes for certain transactions.

Self-Correction of Delinquent Transmittals of Participant Contributions and Loan Repayments

Among the fiduciary breaches that are eligible for correction using the VFCP are delinquent transmittals of participant contributions and loan repayments. Late deposits of participant contributions and loan repayments are a common occurrence for plan sponsors and, according to EBSA, are the most commonly corrected failures using the VFCP. In general, an employer must transmit employee contributions (including loan repayments) to a plan as soon as they can be segregated from the employer’s general assets, but in no case later than the fifteenth business day of the month immediately following the month in which the contribution is either withheld or received by the employer. For plans with fewer than one hundred participants, a safe harbor rule provides that contributions to a plan are deemed compliant if those amounts are deposited within seven business days of withholding or receipt.

Under the new rules, plan sponsors can self-correct late deposits of participant contributions and loan repayments, regardless of the number of plan participants or the amount of plan assets, without the need to file a formal VFCP application. In order to be eligible for self-correction, the general rules for participation in the VFCP must be met, including that the plan and plan sponsor are not “under investigation” by EBSA. In addition, the self-correction rules require that:

The lost earnings associated with the principal portion of the delinquent participant or loan repayments contributions must be less than $1,000. EBSA maintained this $1,000 threshold from the proposed rule despite comments to increase the cap in order to preserve guardrails for this self-correction component.

Delinquent participant contributions or loan repayments must be remitted to the plan within 180 calendar days from the date of withholding from participants’ paychecks or receipt by the employer.

The correction amount must include both the principal amount of the delinquent contribution as well as any associated lost earnings based on the EBSA’s VFCP online calculator.

The plan sponsor must prepare and electronically file a self-correction notice, which requires that the plan sponsor provide the name and an email address for the self-corrector, the plan name, the plan sponsor’s nine-digit employer identification number and the plan’s three-digit number, the principal amount and amount of lost earnings and the date of withholding or receipt, and the number of participants affected by the correction.

The plan sponsor must complete a “Record Retention Checklist” and execute a penalty of perjury statement attesting to the facts of the self-correction.

Unlike a formal VFCP submission, plan sponsors will not receive a no-action letter. Instead, plan sponsors will receive an acknowledgment email from EBSA following submission of the self-correction notice. Notably, there is no limit as to the frequency with which a plan sponsor can make use of self-correction. However, plan sponsors are not relieved from the requirement that they report delinquent participant contributions on the plan’s annual Form 5500.

Self-Correction of Plan Loan Failures Eligible for Correction Under EPCRS

As indicated above, the new rules extend self-correction under the VFCP to certain loan failures that are eligible for self-correction under the IRS’s EPCRS. This includes failures involving the loan amount, duration, level amortization, or loans that defaulted due to a failure to withhold loan repayments from the participant’s wages. If a plan loan failure is determined to be eligible for correction under EPCRS, then the plan sponsor can use the VFCP’s self-correction procedures to correct the failure. Notably, the final rules provide that a self-corrector may be eligible to correct a loan failure even if the self-corrector is under investigation, as long as the loan failure is still eligible for self-correction under EPCRS.

Other Revisions to the VFCP

The new rules also make several other clarifying changes to the VFCP, including additional corrections for prohibited loan transactions and prohibited purchase and sale transactions involving plans and relief for prohibited sale and leaseback of real property to affiliates of a plan sponsor.

Excise Tax Relief Under Prohibited Transaction Exemption 2002-51

In addition to the final rules, EBSA has also amended Prohibited Transaction Exemption (PTE) 2002-51. PTE 2002-51 is a class exemption that provides for excise tax relief in connection with certain transactions corrected pursuant to the VFCP. Specifically, the amended PTE 2002-51 extends the general excise tax relief available under the VFCP to self-correction of failures to timely remit participant contributions or participant loan repayments to plans. In order to rely on PTE 2002-51, self-correctors must receive an acknowledgment email from EBSA following submission of the self-correction notice.

PTE 2002-51 also clarifies and expands coverage of the exemption to six of the transactions identified in the final rule as eligible for correction using the VFCP.

Lastly, EBSA has eliminated the requirement that relief under PTE 2002-51 is not available to VFCP applicants that had taken advantage of the exemption for a similar type of transaction within the previous three years.

Conclusion

The official ability to self-correct delinquent participant contribution transmittals and loan repayments is a welcome development for retirement plan sponsors. The new rules complement the recent expansion of EPCRS under SECURE 2.0 and underscore a new approach by the IRS and DOL to streamline their remedial programs, which emphasizes self-correction of plan errors.

Come Monday, Will It Be Alright? How Companies May Be Impacted by Immigration Priorities Under the New Trump Administration

With the inauguration of President-elect Trump on a cold Monday morning next week, there are several things that companies and their staff may want to keep in mind in preparing for possible Executive Orders and policy changes.

1. Continuity of Business Operations

Trump has vowed to crack down on illegal immigration on Day 1. This includes an aggressive push for mass deportations.

At first glance, companies may think this will not affect business since many companies use E-Verify and do not hire undocumented workers. If that’s the case, then the business may have less to worry about—but do not presume this is a worry-free zone. There are questions to ponder:

Does the company utilize the services of contractors? If so, how are the hiring practices of the contracting company? If that company was raided, could that upset the continuity of your business operations?

When did the company enroll in E-Verify? Employers who use E-Verify must begin using E-Verify for all new hires on the date the company signs the memorandum of understanding. If the company could have undocumented workers that were more easily hired prior to the use of E-Verify, and if those employees were picked up or deported, what would happen to the continuity of business operations?

2. Employee Travel – Tax and Monetary Implications

For companies in existence during the first Trump administration, you may remember that travel bans were quickly imposed by Executive Order. Although this point could also fall under the guide of business continuity, it created another unanticipated issue for companies related to taxation and costs.

One can expect based on what we learned during the first administration, any employee who is outside the U.S. and is not a U.S. citizen or permanent resident (green card holder) at the time any potential travel ban is enacted may not be able to return to the U.S. in short order.

If an employee is stuck outside the U.S., will they be in a jurisdiction where they have work authorization?

If yes, are they going to be outside the U.S. for so long that their working remotely from another country would create tax implications for the company?

If no, is the company going to sponsor that employee for work authorization where they are or cover the cost of the employee to setup shop where they are? Is there any risk in doing so?

If there are exceptions to a travel ban, and your company employs foreign workers, will the company financially support efforts to provide immigration advice to the workers on how to fall under an exception and how to make that argument?

3. Specialty Occupation Workers, Intracompany Transferees, and More

For companies that sponsor foreign nationals in various visa categories such as H-1B, L-1, TN, O-1 or others, the company may need to plan for additional resources to support such employees. Questions to ask may include:

Will the government take longer to make decisions on cases? If government processing times slow down, has the company sought to initiate cases or extensions early enough to ensure the employee and the business are protected? Should cases be initiated earlier?

Will employees who travel be subject to extreme vetting at consular appointments? This question goes to whether companies employ counsel or anyone who will prep employees for their visa interviews and whether additional support is needed in that regard. If someone is denied a visa, this rolls back up to the above point. Can the employee work remotely from a different country? What cost, tax, or other implications are there if they are unable to return to work as planned?

Will companies sponsor employees for green cards as soon as possible? With nervousness about travel bans, possible changes in how things are adjudicated or how quickly they are adjudicated, employees may seek to have the employer start the green card process as quickly as possible. Does the company have a green card policy regarding when they will be initiated? Should that be revised? Is the company prepared to pay the costs related to a possible increased number of green card requests?

The above are just a few of the things that companies may want to consider before Monday.

Key Considerations for the Construction Industry in 2025 Under President-Elect Trump

As President-elect Trump prepares to take office on January 20, the construction industry must anticipate shifts in trade policy, particularly concerning tariffs. These changes are expected to have significant implications for various sectors, including energy and clean technology.

The industry’s growing reliance on energy-efficient and clean technology components is driven by sustainability goals and regulatory requirements. For example, the US Department of Energy (DOE) guidelines on “Zero Emissions Building” provide a framework for sustainable practices, offering benchmarks for energy efficiency, zero on-site emissions, and clean energy use. Similarly, New York City’s Local Law 97 (LL97) sets ambitious emissions reduction targets for buildings, focusing on energy efficiency and renewable energy.

However, potential tariffs on imported clean technology materials could lead to increased costs, hindering compliance with regulations that rely on the imports of energy-efficient materials, and posing challenges to the adoption of sustainable building practices.

As these developments unfold, the construction sector must remain vigilant in monitoring policy changes that could affect the availability and cost of clean technology components in 2025.

Key Points to Watch in 2025

1. Evolving Tariff Policies:

The topic of tariffs under Trump’s second Administration has been a source of concern as President-elect Trump has already threatened to impose universal tariffs in addition to other country-specific tariffs.

At this juncture, we can anticipate an increase in tariff measures, but the specific measures are still unknown in part due to the uncertainty surrounding the rate of potential new tariffs, the countries they may affect, and the mechanisms that will be used to impose them, which will impact the timing any tariffs will take effect.

Because the Trump Administration’s trade policies have particularly focused on imports from Mexico, Canada, and China, such targets could significantly impact the import of construction materials, such as steel, aluminum, softwood lumber, concrete, glass, and binding materials.

For example, tariffs could benefit domestic manufacturers by increasing demand for locally produced materials, such as mass timber, but could create vulnerabilities for the construction sector that relies on imports raw materials used for energy efficiency and sustainable buildings that are sourced from Canada, Mexico, or China.

2. Material Cost Fluctuations:

Be prepared for possible increases in material costs due to tariff adjustments. This could lead to higher project expenses and necessitate budget recalibrations.

Contractors may face challenges in predicting material costs and securing project financing due to economic uncertainty and potential price volatility.

3. Supply Chain Adjustments:

Anticipate disruptions in supply chains as suppliers adapt to new trade regulations. This may result in delays and increased lead times for material availability.

Evaluate current supply chain dependencies and explore alternative sourcing options to mitigate risks.

How Can We Help?

As the new administration takes office, the construction industry must remain vigilant and proactive in addressing potential challenges posed by evolving tariff measures. Companies may need to adjust their project plans to account for potential cost increases and supply chain disruptions. Strategies such as seeking alternative suppliers, exploring domestic options, and reevaluating project budgets and timelines will be crucial in navigating these challenges.

Strategic planning and collaboration with trade experts and legal advisors will be crucial in navigating these changes. Here are some strategic ideas to consider:

Diversify Suppliers: Consider expanding your supplier base to reduce reliance on any single source, particularly those affected by tariffs.

Explore Alternative Materials: Investigate the use of alternative materials that may offer cost advantages or are less impacted by tariffs.

Contractual Safeguards: Review and update contracts to address “escalation,” “force majeure,” or other potential political risks, trade restrictions, and cost fluctuations.

Engage in Advocacy: Participate in industry advocacy efforts to influence policy decisions and promote favorable outcomes for the construction sector.

Monitor Trade Policy Developments: Monitor announcements from the new administration regarding free trade agreements (FTAs) and tariff adjustments that could affect material costs. These could include benefits from the United States-Mexico-Canada Agreement (USMCA) and exclusions from tariffs, such as the Section 301 tariffs on products from China.

Industry members seeking detailed analysis and guidance are encouraged to consult with trade experts and legal advisors specializing in construction and trade policy.

IRA Developments to Watch in the EV and Battery Supply Chain for 2025

The incoming Trump Administration’s approach to the Inflation Reduction Act (IRA) and tax policies is generating significant interest within the electric vehicle (EV) sector.

Generally, reports indicate that some Republican politicians, including individuals connected with the Trump Administration, intend to repeal or limit certain IRA tax incentives. US Congress could limit tax incentives by capping a tax credit, for example, or narrowing the activity or outputs eligible for a tax credit.

However, Republican states have invested substantial amounts into projects that benefit from IRA tax incentives. Accordingly, the repeal or limitation of many of the IRA tax incentives could negatively affect Republican constituents, and the Republican-controlled Congress and Trump Administration may seek to avoid such a result.

While exact policy directions are still unfolding, here are some critical areas to follow.

Key Points to Watch in 2025

1. Changes to EV Tax Credits

Reports indicate that Trump’s transition team aims to eliminate the $7,500 consumer tax credit for EV purchases, which was enacted as part of the IRA.

However, other reports suggest that Republicans might leave the IRA largely untouched because Republican states and constituencies have largely benefited from the IRA.

Modifications to the EV tax credits could make EVs more expensive for consumers, potentially slowing adoption and affecting industry growth. The outcome will depend on legislative negotiations and pressures from various constituencies.

2. FEOC Restrictions

Under the IRA, Foreign Enemy of Concern (FEOC) restrictions prevent taxpayers from claiming the $7,500 consumer tax credit if certain critical minerals contained in the EV battery of the purchased EV were extracted, processed, or recycled by an FEOC. Reports indicate that the Trump Administration may extend such FEOC restriction to other IRA tax incentives.

For example, it has been suggested that Congress impose FEOC restrictions on the IRA tax credit available to manufacturers under Section 45X (Advanced Manufacturing Production Credit).

Revisions to the FEOC restrictions under the Trump Administration might impact trade dynamics.

3. FEOC Equity Thresholds

The FEOC restriction limits eligibility for the $7,500 consumer tax credit for EV purchases if certain critical minerals contained in the battery of such EV were extracted, processed, or recycled by a foreign entity that is owned by, controlled by, or subject to the direction of another entity connected with certain foreign governments (generally, China, Russia, Iran, and North Korea). A foreign entity is owned by, controlled by, or subject to the direction of another entity if 25% or more of the entity’s board seats, voting rights, or equity interests are held by the other entity.

The Trump Administration may choose to maintain or adjust the current 25% equity threshold for FEOC entities.

If the Trump Administration opts to make the FEOC rules more stringent or tightens other investment regulations for FEOC entities, the Trump Administration may prevent such FEOC entities from benefitting from certain IRA tax incentives.

Investments by these entities in free trade agreement countries or the United States could face additional scrutiny or restrictions, although the extent of permissible equity stakes in such ventures remains uncertain and could be influenced by broader trade considerations, national security, and economic priorities. The Trump Administration’s stance on China and related economic strategies will significantly influence these policies.

4. National Security and IRA Coverage

Changes to the IRA’s coverage of components and constituents, particularly in the context of battery-related products, could be influenced by national security considerations. The Trump Administration might prioritize restrictions on Chinese-made energy storage systems (ESS) and related components due to their strategic importance in critical infrastructure and grid security.

The new Republican Congressional majority could seek amendments through tax reform aiming to address these concerns, potentially modifying or phasing out certain IRA incentives related to clean energy and battery production.

As discussed above, the Trump Administration may seek to impose FEOC restrictions on certain IRA incentives and may cite to national security concerns as a reason for imposing restrictions at certain points in the supply chain through changes to these incentives. However, specific policy directions will also depend on the Trump Administration’s assessment of risks and priorities at the time of such legislative developments.

Department of the Treasury and the Internal Revenue Service Issue Final Regulations on Section 45V Clean Hydrogen Production Tax Credit

On 3 January 2025, the Department of the Treasury (Treasury) and the Internal Revenue Service (IRS) released final regulations (Final Rules) implementing the Section 45V Clean Hydrogen Production Tax Credit (Section 45V tax credit) pursuant to the Inflation Reduction Act of 2022 (IRA). These much-anticipated Final Rules arrive over a year since the holiday-adjacent publication of the proposed regulations on 26 December 2023 (Proposed Rules). Treasury and IRS received approximately 30,000 written comments on the Proposed Rules and conducted a three-day public hearing that included testimony from over 100 participants. Adding to this long saga, the Biden Administration in its waning days has attempted to build upon the Final Rules and promote clean hydrogen production well into the future, announcing a US$1.66 billion loan guarantee by the Department of Energy (DOE) for Plug Power to produce and liquify clean hydrogen fuel. However, these actions come within days of the new Trump Administration and a Republican-controlled Congress, casting some uncertainty over the future of the Final Rules, DOE spending, and, more generally, the Section 45V tax credit.

In the Final Rules, Treasury and IRS made numerous modifications to the Proposed Rules—including notable changes to the controversial “three pillars” (incrementality, deliverability, and temporal matching) of the Energy Attribute Certificate (EAC) framework—largely in an effort to provide flexibility in response to industry concerns without sacrificing the integrity of the credit, while at the same time addressing concerns that substantial indirect emissions would not be taken into account. The Final Rules enable tax credit pathways for hydrogen produced using both electricity and certain methane sources, intending to provide investment certainty while ensuring that clean hydrogen production meets the IRA’s lifecycle emissions standards.

The Final Rules, and primary differences between the Proposed and Final Rules, are discussed below.

EAC Requirements for Electrolytic Hydrogen Production – The Three Pillars

Under both the Proposed and Final Rules, EACs are the established means for documenting and verifying the generation and purchase of electricity to account for the lifecycle greenhouse gas emissions associated with hydrogen production. Under this framework, a taxpayer must acquire and retire qualifying EACs to establish, for purposes of the Section 45V tax credit, that it acquired electricity from a specific electric generation facility (and therefore did not rely on electricity sourced via, e.g., the regional electric grid). Like in the Proposed Rules, the Final Rules require that taxpayers seeking to use EACs attribute electricity use to a specific generator that meets certain criteria for temporal matching, deliverability, and incrementality.

Incrementality

As in the Proposed Rule, the Final Rules define electric generation as “incremental” if the generator begins commercial operations within 36 months of the hydrogen facility being placed in service, or is uprated within that period. Treasury and IRS declined to extend the 36-month time frame for eligibility, but, within that 36-month time frame, Treasury and IRS provided more pathways for eligibility. The expanded pathways are as follows:

Uprates

The Final Rules modify the uprate rules to provide additional flexibility to taxpayers in determining “uprated” production capacity from generation facilities. The Final Rules provide that the term “uprate” means the increase in either an electric generating facility’s nameplate capacity (in nameplate megawatts) or its reported actual productive capacity.

Restarted Electric Generation Facilities

Under the Final Rules, EACs can meet the incrementality requirement with electricity from an electric generation facility that is decommissioned or is in decommissioning and restarts. The Final Rules clarify that these facilities can be considered to have additional capacity from a base of zero if that facility was shut down for at least one year.

Qualifying Nuclear Reactors

The Final Rules allow EACs to meet the incrementality requirement with electricity produced from a qualifying nuclear reactor up to 200 MWh per operating hour per reactor. A qualifying nuclear reactor is a “merchant nuclear reactor” or a single-unit plant that competes in a competitive market and does not receive cost recovery through rate regulation or public ownership.

Qualifying States

The Final Rules allow EACs to meet the incrementality requirement if the electricity represented by the EAC is produced by an electric generating facility physically located in a “qualifying state,” i.e., a state that has stringent clean energy standards (for now, California and Washington), and the hydrogen production facility is also located in the qualifying state.

Carbon Capture and Sequestration (CCS)

As authorized by the Final Rules, the “CCS retrofit rule” allows an EAC to meet the incrementality requirement if the electricity represented by the EAC is produced by an electric generating facility that uses CCS technology and the CCS equipment was placed in service no more than 36 months before the hydrogen production facility.

Temporal Matching

The Final Rules maintain the proposed hourly-matching requirement, which requires that the electricity represented by the EAC be generated in the same hour as the hydrogen facility’s use of electricity to produce hydrogen. The Proposed Rules required hourly matching to go into effect in 2028, but the Final Rules have delayed this requirement until 2030. Annual matching is required through 2029. The Final Rules note that this two-year postponement does not prohibit a hydrogen producer from voluntarily implementing hourly matching prior to 2030. Changes in the Final Rules also provide additional flexibility by allowing hydrogen producers to deviate from the annual aggregation of emissions to an hourly basis so long as the four kg CO2e per kg of hydrogen is met on an aggregate annual basis for the facility. This affords a hydrogen producer the ability to optimize the tax credit amount when it is unable to secure EACs during all hours of operation, without suffering severe penalties in the form of lower credit amounts across the entire year. Additionally, each electrolyzer is considered to be an individual qualified facility, which allows a producer to allocate EACs across electrolyzers and time periods to optimize tax credit values for a site.

Reliance Rule

In the Final Rules, Treasury and IRS declined to include a “reliance rule” (i.e., grandfathering) that would allow facilities that meet certain milestones (such as beginning of construction, being placed in service, or commencing commercial operations) by a certain date to continue to use annual matching instead of hourly matching.

Energy Storage

The Final Rules allow hydrogen producers and their electric suppliers to use energy storage, such as batteries, to shift the temporal profile of EACs based on the period of time in which the corresponding electricity is discharged from the storage device. The storage system must be located in the same region as both the hydrogen production facility and the facility generating the electricity to be stored. Storage systems need not themselves meet the incrementality requirement, but the EACs that represent electricity stored in such storage systems must meet the incrementality requirement based on the attributes of the generator of such electricity. EAC registries must be able to track the attributes of the electricity being stored.

Deliverability

As in the Proposed Rules, the Final Rules provide that an EAC meets the deliverability requirement if the electricity represented by the EAC is generated by a facility that is in the same region as the hydrogen production facility. Also, as in the Proposed Rules, the Final Rules establish that, for the duration of the Section 45V tax credit, “region” for purposes of deliverability will be based on the regions delineated in the DOE’s National Transmission Needs Study. Those regions are based on the balancing authority to which the electric generating source and the hydrogen facility are both electrically connected. The table published in the Final Rules is the authoritative source regarding the geographic regions used to determine satisfaction of the deliverability requirement.

Dynamic Deliverability Regions

Treasury and IRS intend to update the regions in future safe harbor administrative guidance published in the Internal Revenue Bulletin.

Interregional Connections

The Final Rules allow some flexibility on interregional delivery, acknowledging that interregional electric transfers commonly occur. Accordingly, the Final Rules allow an eligible EAC to meet the deliverability requirement in certain instances of actual cross-region delivery where the deliverability of such generation can be tracked and verified. The Final Rules provide specific rules to meet this standard.

Eligibility for Methane-Based Hydrogen Production

The Final Rules also provide pathways for receiving Section 45V tax credits for hydrogen production using biogas, renewable natural gas (RNG), and fugitive sources of methane (collectively, natural gas alternatives). Most notably, the Final Rules dispense with the “first productive use” requirement proposed in the draft regulations, which would have required that the RNG or biogas used to produce hydrogen was not previously used, likening this requirement to the incrementality requirement of the Three Pillars for electrolytic hydrogen. Instead, the Final Rules rely on “alternative fates,” which refer to the assumptions used to estimate emissions from the use or disposal of natural gas alternatives were it not for the natural gas alternative’s new use of producing hydrogen. Under the Final Rules, alternative fates are determined on a categorical basis, rather than adopting a single alternative fate for all natural gas alternatives or adopting alternative fates on an entity-by-entity basis. The alternative fate associated with natural gas alternatives feeds into the “background data” that is entered into the 45VH2-GREET Model. The 45VH2-GREET Model uses that background data to calculate the estimated lifecycle greenhouse gas emissions associated with the specific hydrogen production process.

Alternative Fates, as Applied to Sectors

For landfills, coal mine methane, and wastewater sources, flaring is considered the primary alternative fate. For animal waste, the alternative fate is based on a national average of all animal waste management practices for the sector as a whole. For fugitive methane from fossil fuel activities other than coal mining, the alternative fate is the emissions that would otherwise be generated from productive use.

Venting

The Final Rules reject venting as an alternative fate across all sources of natural gas alternatives because it does not account for the prevalence of flaring and productive use, nor does it address the risk of induced emissions due to the incentives provided by the Section 45V tax credit. In taking this position, Treasury and IRS recognize that venting will likely be increasingly prohibited at local, state, and federal levels.

It is worth noting that Treasury’s failure to issue actual draft regulations for a methane-pathway 45V tax credit could increase the likelihood of a successful legal challenge to the 45V Final Rules. It is unclear at this time whether Treasury’s solicitation of comments in response to the questions the agency posed related to RNG as a viable pathway to secure the 45V credit is sufficient to satisfy proper notice-and-comment requirements under the Administrative Procedure Act. The Biden Administration’s inclusion of Final Rules related to RNG could be part of a strategic effort aimed at minimizing attacks against the Final Rules by bringing RNG developers to the table.

Other Considerations

Determining Lifecycle Greenhouse Gas Emissions Rates

The Final Rules clarify that the annual determination of the tax credit amount is made separately for each hydrogen production process conducted at a hydrogen production facility during the taxable year. The Final Rules clarify that “process” means the operations conducted by a facility to produce hydrogen (for example, electrolysis or steam methane reforming) during a taxable year using one primary feedstock. CCS equipment that is necessary to meet the 45V emissions thresholds is considered part of the facility for purposes of the credit.

Construction Safe Harbor

The Final Rules allow taxpayers to make an irrevocable election to treat the 45VH2-GREET Model available on the date of construction commencement of the hydrogen production facility as the applicable 45VH2-GREET Model.

Third-Party Disclosure Requirement

As in the Proposed Rules, the Final Rules require that an unrelated third party certify the annual verification report submitted as part of the election to treat qualified property as energy property for purposes of the Section 45V tax credit.

Effective Date

The Final Rules become effective immediately upon their publication in the Federal Register.

Outlook

There is still a great deal of political uncertainty surrounding the Section 45V tax credit due to the incoming Trump Administration and Republican-controlled Congress, which could nullify these regulations through the Congressional Review Act or reduce or eliminate the credits by modifying or rolling back the IRA as part of the budget reconciliation process. There is additionally the potential for litigation challenges to the Final Rules under the new Loper Bright standard for judicial review of agencies’ interpretations of statute.1

Regardless, the Final Rules attempt to lay a foundation for hydrogen development for years to come. Barring political disruption, the Final Rules settle many uncertainties that may have acted as an obstacle to investment in the clean hydrogen sector and the progress of planned projects, including the DOE-funded hydrogen hubs. The Final Rules also generate new questions. As noted above, these Final Rules are effective immediately upon publication in the Federal Register. The immediate effectiveness and rollout of the Final Rules could contribute to the momentum needed to keep these rules and relevant IRA provisions in place even as administrations change. Strong industry reliance upon these rules may make it less politically palatable or practical to uproot and discard them entirely.

Footnotes

1 For more information on the U.S. Supreme Court’s decision in Loper Bright Enterprises v. Raimondo and how it impacted administrative law, see the following:

The Post-Chevron Toolkit | HUB | K&L Gates

The End of Chevron Deference: What the Supreme Court’s Ruling in Loper Bright Means for the Regulated Community | HUB | K&L Gates

Navigating Tariff Threats Under the Trump Administration, Challenges Ahead for the EV and Battery Supply Chain

As President-elect Donald Trump prepares to assume office on January 20, numerous tariff proposals have already been put forward that could significantly impact the electric vehicle (EV) and battery supply chain industry. Differentiating between the potential for immediate tariff actions and those requiring more time to implement is critical for companies that are in preparation of such actions.

In general, the imposition of new duties or tariffs typically requires congressional oversight and findings from relevant government agencies, a process that can extend over several months. This includes mechanisms such as the Section 301 tariffs on imports of China-origin products, where tariffs on EVs, battery parts, and critical minerals were recently increased, along with future increases on semiconductors, natural graphite, and permanent magnets that are scheduled for action. Expanding these existing actions would take time for the administration to implement.

However, President-elect Trump may seek to expedite tariff impositions through alternative legal avenues such as the International Emergency Economic Powers Act (IEEPA). While unprecedented, these actions would align with the upcoming administration’s proposals, including potential duty increases on imports from Mexico and Canada, where reports suggest implementation as early as the President-elect’s first day in office.

Such measures could significantly impact the EV supply chain and related industries, necessitating close monitoring of these developments during 2025.

What to Watch in 2025 and Beyond

1. Tariff Increases and Trade Policies: The Trump Administration’s trade policies are expected to focus on increasing tariffs, particularly on imports from China. The continuation or expansion of Section 301 tariffs on EVs, battery parts, and critical minerals could raise costs and disrupt supply chains. The administration may expedite tariff impositions through legal avenues like the IEEPA, potentially impacting imports from a host of US trading partners. Close monitoring of policy developments is the first step. Understanding their transactional impact can mitigate tariff exposure and corporate uncertainty.

2. Global Competitiveness and Supply Chain Dependencies: The administration’s protectionist stance may bolster domestic production but could also increase manufacturing costs and limit vehicle choices. The emphasis on “decoupling” from China suggests a continuation of aggressive tariff strategies, particularly on critical minerals essential for EV batteries. Industry stakeholders seeking to explore a diversified supply chains will need strategic advice prior to launching new production sites or supply partners.

3. USMCA: The United States-Mexico-Canada Agreement (USMCA) is scheduled for a trilateral review and renegotiation during 2026. Key provisions in the pact are particularly important for the EV supply chain into the United States. Some of President-elect Trump’s tariff proposals on Mexico and Canada could be tactics for leverage in the lead-up to these negotiations and provide opportunities for the Trump Administration to negotiate Free Trade Agreements (FTAs) with other countries, potentially affecting the EV and battery supply chain. Industry leaders should take stock of their current use of the USMCA tariff preference opportunities and what potential changes in the minutiae of trade rules could mean for both suppliers and customers. While 2026 is the year of USMCA talks, 2025 will be the year of industry consultations by Ottawa, Washington, and Mexico City.

4. FTAs and Trade Negotiations: The Trump Administration may prioritize renegotiating existing FTAs and pursuing new agreements with countries that align to the administration’s goals for domestic EV and battery production. The direction of such potential FTA developments will likely be impacted by the upcoming USMCA renegotiations. The US-Japan Trade Agreement could also serve as a framework for limited bilateral FTAs with new partners. FTA’s bring tariff preferences but they also require a sophisticated understanding of country-of-origin rules and other trade calculations that are far from intuitive. Stakeholders may wish to seek our advice on particular FTAs with key US trade partners to be best prepared to understand company-specific implications and to work with Washington during the negotiation stages.

5. Legal and Political Challenges in Trade Policy: While the president has some authority to influence trade agreements, unilateral withdrawal from FTAs could face legal and political challenges from Congress. The administration may use national security exceptions to modify duty-free provisions, but such actions would require careful justification. The potential for uncertainty and long-term risk exposure is high for companies involved in the EV manufacturing industry.

Treasury Department and IRS Release Final Regulations for Section 45V Clean Hydrogen Production Tax Credit

On January 3, 2025, the Treasury Department and the Internal Revenue Service issued final regulations under Internal Revenue Code (Code) Section 45V (the Final Regulations) with respect to credits for the production of clean hydrogen (the 45V Credit). The Final Regulations generally retain the requirements set forth in the proposed regulations under Code Section 45V (the Proposed Regulations)[1] with respect to the “three pillars” (incrementality, temporal matching and deliverability) for hydrogen produced using clean power but provide leniency with respect to each pillar. The Final Regulations also provide critical new guidance on hydrogen produced using methane reformation technologies. Taxpayers may rely on the Final Regulations as of January 10, 2025.

Background

Code Section 45V provides a tax credit for the production of clean hydrogen at a qualified clean hydrogen production facility for 10 years beginning on the date the facility is placed in service. The 45V Credit is technology agnostic in that qualification for the credit is not dependent on how the clean hydrogen is produced. The 45V Credit is generally calculated as the product of the kilograms of qualified clean hydrogen produced at a qualified clean hydrogen production facility and the applicable rate. The applicable rate is based on the lifecycle greenhouse gas (GHG) emissions rate of the hydrogen production process. Taxpayers qualify for an increased 45V Credit amount if the construction, alteration and repair of the qualified clean hydrogen production facility complies with the prevailing wage and apprenticeship requirements.

Electricity Used in Hydrogen Production

The Final Regulations generally retain the requirements of the three pillars set forth in the Proposed Regulations regarding the utilization of energy attribute certificates (EACs) to establish a GHG emissions rate. As compared to the Proposed Regulations, the Final Regulations provide leniency with respect to each pillar.

Incrementality. The incrementality requirement is met if the electricity generating facility that produced the electricity has a commercial operation date, or increase in rated nameplate capacity, no more than 36 months before the relevant hydrogen production facility was placed in service. The Final Regulations include three new sources of electricity generation that will be considered incremental regardless of whether the 36-month requirement is satisfied: (i) electricity generated at certain nuclear facilities (with a cap of 200 megawatt-hours per operating hour per reactor); (ii) electricity generated in states with GHG emissions policies meeting certain criteria (such as California and Washington); and (iii) electricity generated at a facility that added carbon capture and sequestration (CCS) equipment within 36 months prior to the date the hydrogen production facility is placed in service.

Temporal Matching. The temporal matching requirement is met if the electricity is generated (i) until 2030, in the same year as, or (ii) beginning in 2030, in the same hour as, the taxpayer’s hydrogen production facility uses electricity to produce hydrogen. The Proposed Regulations provided that hourly matching described in clause (ii) would be required beginning in 2028.

Deliverability. The deliverability requirement is met if the electricity is generated by a facility in the same region as the hydrogen production facility. The Final Regulations provide flexibility for demonstrating certain electricity transfers between regions and allow taxpayers to import clean power from other regions under certain circumstances.

Methane Used in Hydrogen Production

The Final Regulations provide rules for how taxpayers can claim the 45V Credit for hydrogen produced using methane reformation technologies, including those using CCS, renewable natural gas (RNG) and fugitive sources of methane (e.g., from wastewater, animal waste, landfill gas and coal mine operations). The Final Regulations provide rules on how to calculate lifecycle GHG emissions from these sources.

Alternative Fate Standard. The Final Regulations do not include a “first productive use” requirement contemplated by the Proposed Regulations, which would require hydrogen produced using RNG and coal mine methane systems to originate from the first productive use. Instead, the Final Regulations take into account the “alternative fate” of feedstocks.

Gas EACs. The Final Regulations introduce the “gas energy attribute certificate” (Gas EAC), which is defined as a tradeable contractual instrument, issued through a qualified Gas EAC registry or accounting system, that represents the attributes of a specific unit of RNG or coal mine methane. Hydrogen producers using RNG or coal mine methane will be able to acquire and retire Gas EACs as a mechanism for establishing such sources were used in the production of clean hydrogen.

Temporal matching and deliverability requirements similar to those described in the context of hydrogen produced using electricity apply to Gas EACs. The Final Regulations require monthly matching for a Gas EAC to satisfy the temporal matching requirement, and require geographic matching within the contiguous United States to satisfy the deliverability requirement.

Book-and-Claim. The Final Regulations endorse a book-and-claim framework for hydrogen produced using RNG or coal mine methane systems. Book-and-claim systems will enable taxpayers to claim use of RNG or coal mine methane despite the absence of a direct exclusive pipeline connection to a facility that generates RNG or from which fugitive methane is being sourced. Taxpayers will be able to begin using book-and-claim systems no earlier than in 2027, after the Secretary of Treasury determines when a system meets the requirements set forth in the Final Regulations.

GREET Model

The Final Regulations require that lifecycle GHG emissions be measured “well-to-gate” as determined under the most recent Greenhouse gases, Regulated Emissions, and Energy use in Technologies (GREET) model. Well-to-gate emissions are the aggregate lifecycle GHG emissions related to the hydrogen produced at the hydrogen production facility during the taxable year through the point of production. Well-to-gate emissions include emissions associated with feedstock growth, gathering, extraction, processing and delivery to a hydrogen production facility.

The Final Regulations allow hydrogen producers to use the version of the 45VH2-GREET model that was in effect when the hydrogen production facility began construction for the duration of the credit. This provision enhances investment certainty by ensuring that hydrogen producers are not subject to unexpected changes to the 45VH2-GREET model over the credit period.

The Final Regulations provide that upstream methane leakage rates will be based on default national values in the 45VH2-GREET model. Future releases of the 45VH2-GREET model, however, are expected to incorporate facility-specific upstream methane leakage rates based on data provided by the Environmental Protection Agency.

[1] We discussed the Proposed Regulations in a previous client alert.