Florida Positioned to Eliminate the Business Rent Tax

On Monday, June 16th, the Florida Legislature is scheduled to vote on the final budget and annual tax proposal, bringing an end to the extended 2025 Regular Session. An amendment to House Bill 7031 has been filed containing the details of the tax relief plan.

The cornerstone of this legislation is the complete elimination of the sales tax on commercial leases effective October 1, 2025. Florida is the only state in the nation levying such a tax, and the elimination of this tax at the state and local level will only increases the state’s prominence as a top low-tax state.

At times it felt as though Florida’s 2025 Regular Session would never end due to a $4.5B budget disagreement and competing tax proposals from the Governor, House, and Senate. Ultimately, the leadership of House Speaker Perez and Senate President Albritton broke the stalemate by agreeing that the elimination of the business rent tax would be the foundation of the tax plan.

This business rent tax has been levied on any lease or license to use Florida real property owned by another person since 1969. The Florida Legislature started slowly reducing this tax in 2017 by fractions of a percent. In 2021, Florida’s Wayfair legislation allowed the most significant reduction of the business rent tax yet when the rate was reduced to 2.0% effective June 1, 2024. Just a year later and the Legislature is poised to completely eliminate the tax.

The repeal of this sales tax marks the first statewide tax eliminated since the intangibles tax in 2006 under then Governor Jeb Bush.

While other states are raising taxes, Florida is eliminating them. Once the bill is approved by the Legislature on Monday, it will be sent to Governor DeSantis for consideration.

Florida’s commercial landlords and tenants should not collect the tax on and after October 1, 2025.

Healthcare Preview for the Week of: June 16, 2025

Short, Significant Senate Week

The House is out this week for the Juneteenth holiday, but the Senate will be in town through Wednesday. We expect these three days to be significant because the Senate Finance Committee has announced that it intends to release its reconciliation text today. The Finance Committee has jurisdiction over some of the most controversial provisions, including Medicaid, the Affordable Care Act (ACA), Medicare, and taxes. While we are focused on the health provisions, it is important to remember that reconciliation is mainly a tax bill, and much debate is focused on the tax provisions. Last week, the Senate Health, Education, Labor, and Pensions Committee released its text, which included one ACA provision that mirrors the House-passed language to fund cost-sharing reduction payments for Marketplace plans, with strict limitations against those funds going to plans that cover abortions. The Finance Committee text will likely include additional ACA provisions like those included in H.R. 1 as it passed the House. The committee may also make substantive changes to the House-passed Medicaid provisions.

One important caveat is that the Finance Committee language is likely to have gaps and placeholders for language that is still being developed or negotiated, and any provision is subject to change. Senate language also must comply with the Byrd rule to enable Senate passage by a simple majority, so additional modifications may be made via that process as well.

Republican leadership set July 4, 2025, as the target date to send the bill to President Trump’s desk. That leaves three weeks, one of which is supposed to be a congressional recess week, to pass the bill in the Senate and send it back to the House for its consideration. Senate Majority Leader Thune (R-SD) indicated he’d like the Senate to vote on the package the week of June 23, 2025, to meet this timeline. As the Senate modifies language to win votes from Republicans who have expressed concerns, it will have to be careful to ensure that the changes will be able to pass the House.

Given all of these complicating factors, the timeline could slip as negotiations and the Byrd rule process continue. Because Republicans aim to address the debt limit in reconciliation, the more significant deadline to sign the bill into law is by the August recess, which is when the US Department of the Treasury expects the United States to reach the debt limit.

NJ Supreme Court: Municipalities Are Not Immune from Sanctions Under Frivolous Litigation Statute

The New Jersey Supreme Court recently held that municipalities are not immune from liability under the State’s Frivolous Litigation Statute (the “Statute”), N.J.S.A. 2A:15-59.1, interpreting “party” and “person” in the Statute to encompass municipalities. The Statute was enacted to deter baseless litigation and reimburse parties forced to defend against frivolous actions. See Toll Bros., Inc. v. Twp. of W. Windsor, 190 N.J. 61, 68 (2007); DeBrando v. Summit Bancorp, 328 N.J. Super. 219, 226-27 (App. Div. 2000); and Ferolito v. Park Hill Ass’n, 408 N.J. Super. 401, 407 (2009).

Borough of Englewood Cliffs v. Trautner, ___ N.J. ___ (2025), analyzed whether the Borough of Englewood Cliffs (“Borough”) was liable for sanctions under the Statute. The trial court found that the Borough had initiated a frivolous action against defendants, one property developer, and the Borough’s former counsel who represented it in affordable housing litigation. The defendants sent the Borough frivolous litigation notices demanding the action be voluntarily dismissed. The Borough did not dismiss the complaint, and the defendants subsequently moved to dismiss the complaint, which the trial court granted. Thereafter, the defendants successfully moved for attorneys’ fees under Rule 1:4-8(b)(2) after the trial court found the sole purpose of the Borough’s litigation was to harass, delay, and cause malicious injury to the defendants.

The Appellate Division affirmed, concluding that a public entity is not immune from sanctions under the Statute. Borough of Englewood Cliffs v. Trautner, 478 N.J. Super. 426, 441 (App. Div. 2024). The Appellate Division observed that the issue of whether a State, or its agencies, or political subdivisions, are immune from sanctions under the Statute is unsettled, noting competing Chancery Division rulings. Ultimately, the Appellate Division relied on Matter of K.L.F., 275 N.J. Super. 507 (Ch. Div. 1993), which held that the language of the Statute suggested the Legislature’s clear intent that a “party” must also include a “public entity,” otherwise the effect of the Statute would be thwarted if sanctions are recoverable only from a private party.

The Supreme Court affirmed the Appellate Division’s judgment, as modified, and held that municipalities and municipal corporations are subject to sanctions under the Statute. Slip op. at 3. The Court explained that the Statute must be read as a whole, rather than focusing only on one word, i.e., “party” or “person.” Slip op. at 13. Guided by this approach, the Court determined that the sections of the Statute “refer to one another and both refer to the actor asserting the complaint, cross-claim or defense,” and therefore the text of the Statute indicates that “nonprevailing person” and “nonprevailing party” are interchangeable. Slip op. at 15. In further support of this conclusion, the Court considered the Sponsor’s Statement accompanying the bill later enacted as the Statute, which also used “nonprevailing party” interchangeably with “nonprevailing person” to describe the asserter of the frivolous claim. Slip op. at 15-16.

Moreover, the Court acknowledged that even if there was a meaningful distinction between “nonprevailing person” and “nonprevailing party,” the Borough would be classified as both a “party” and a “person” under the Statute. Slip op. at 16. The Court explained that N.J.S.A. 1:1-2 defines “person” to include “corporations” and defines “municipality” and “municipal corporation” to include “boroughs.” Slip op. at 16. Accordingly, when reading the Statute, as informed by the definitions provided in N.J.S.A. 1:1-2, the Court reasoned that the Borough, “as a plaintiff who filed frivolous pleadings,” would not only be considered “any other party,” but also a “person” under the Statute. Slip op. at 16.

Concerning the 1995 amendments to the Statute, the Court remarked that they allowed a municipality, under certain circumstances, the right to recover sanctions, not to provide immunity to municipalities engaging in frivolous litigation. Slip op. at 17-18.

Finally, the Court rejected the argument that the sovereign immunity doctrine immunizes municipalities from liability for engaging in frivolous litigation. Slip op. at 21. The Court explained that “municipal immunity is a concept distinct from sovereign immunity under state law” and that “municipalities, unlike States, do not enjoy a constitutionally protected immunity from suit” afforded by the Eleventh Amendment. Slip op. at 23, 21. The Court determined the Borough is liable for sanctions under the Statute because there is no: (1) history of immunizing a municipality from sanctions when it initiates frivolous litigation; (2) support in the text of the Statue providing statutory immunity; or (3) substantive law exempting municipalities or municipal corporations from liability under the Statute. Slip op. at 25-27. Notably, the Supreme Court declined to clarify whether the State is immune from liability under the Statute. Slip op. at 21.

In light of the Supreme Court’s decision, municipalities must be aware of their obligation to comply with the Statute when engaging in litigation and should ensure that all pleadings are asserted in good faith, or otherwise potentially subject themselves, and ultimately taxpayers, to bear the cost of attorneys’ fees.

Louisiana Legislators Approve Bill Increasing Funding for Student-Athletes at Certain Louisiana Public Universities

House Bill 639 is now awaiting the signature of Governor Jeff Landry after receiving approval from both the Louisiana House and Senate. If signed into law, the bill would raise the state tax rate on sports gambling in Louisiana from 15% to 21.5%. A quarter of the resulting revenue would be allocated to the newly established Supporting Programs, Opportunities, Resources, and Teams (SPORT) Fund, which is intended to benefit student-athletes at Louisiana public universities competing at the NCAA Division I level. However, these funds may be used only for new scholarships, insurance, medical coverage, facility enhancements, litigation settlement fees, and Alston awards.

Interestingly, the bill specifies that the SPORT Fund may not be used to displace, replace, or supplant any existing scholarships or awards, implying that universities may not use these funds to make direct name, image, and likeness (NIL) payments to student-athletes. While other states, such as Illinois, have increased the tax rate on in-state sports gambling, Louisiana appears to be the first state to dedicate a portion of the revenues to student-athletes.

This bill exemplifies a practical way for states to generate additional revenue to support college athletes while avoiding the complex and uncertain state and local tax implications associated with NIL payments to college athletes.

Louisiana legislators have approved a plan to give most college athletic programs in Louisiana nearly $2 million in state tax revenue annually.

lailluminator.com/…

Cleaning the Cupboard—Six More Decisions in One Day, and a Largely Harmonious Court – SCOTUS Today

As the end of the term seems to be rushing towards us, the U.S. Supreme Court issued six more opinions yesterday, mostly unanimous or near unanimous.

In other words, the Court is clearing the shelves of the “easy ones.” More profound disagreements are likely on the horizon, but not this time. Notably, in one case that was not unanimous, we find Justice Jackson and Justice Thomas together in a concurring opinion. While not landmarks, yesterday’s “Pick Six” are all interesting cases, several of which will affect the practices of many readers of this blog, and one of them hearkens back nostalgically to a case this writer argued and won years ago. So, let’s get going.

A.J.T. v. Oseo Area Schools, Independent School District No. 279 was a disabilities case brought under three statutes familiar to many lawyers who follow this blog. As described by Chief Justice Roberts writing for a unanimous Court (four Justices also concurring in two separate opinions), those laws afford protections for children with disabilities in public schools.

Section 504 of the Rehabilitation Act of 1973 provides that no qualified individual with a disability shall be excluded from participation in, denied the benefits of, or subjected to discrimination under any federally funded program solely by reason of her or his disability. Similarly, Title II of the Americans with Disabilities Act (ADA) prohibits qualified individuals with disabilities from being excluded from or denied the benefits of a public entity’s services, programs, or activities by reason of disability . . . [and] the Individuals with Disabilities Education Act (IDEA) offers federal funds to States in exchange for the commitment to furnish the core guarantee of a “free appropriate public education” to children in public schools with certain physical or intellectual disabilities.”

The Chief Justice goes on to observe that IDEA guarantees “the provision of an ‘individualized educational program,’ (IEP) which ‘spells out’ a plan to meet all of the educational needs of a child with a qualifying disability.”

The petitioner here, A.J.T., is a young girl with a rare form of epilepsy that limits her physical and cognitive functioning. She experiences frequent seizures that inhibit her learning abilities at the start of the day, but is alert and able to learn during the afternoon and evening. Although she was given evening instruction in a previous school district, that was denied her in her new school district, where she received only 4.25 hours of daily instruction, as opposed to the typical 6.5-hour school days afforded to non-disabled students. Faced with further cuts to A.J.T.’s school day, her parents filed an IDEA administrative complaint alleging that the school’s refusal to provide after-hours instruction denied A.J.T. a free, appropriate public education. An administrative law judge ruled in her favor, a decision that lower courts affirmed.

A.J.T.’s parents then sued under the ADA and the Rehabilitation Act, requesting a permanent injunction, reimbursement for certain costs, and compensatory damages. The U.S. District Court for the District of Minnesota granted summary judgment for the school, and the U.S. Court of Appeals for the Eighth Circuit affirmed, holding that a school district’s failure to provide a reasonable accommodation was not enough to state a prima facie case of discrimination under a precedent that requires proof of school officials’ bad faith or gross misjudgment.

As happened last week in a discrimination case in which the Court leveled the playing field for plaintiffs of majority and minority groups, all the Justices yesterday levelled another playing field, agreeing that schoolchildren bringing ADA and Rehabilitation Act claims related to their education are not required to make a heightened showing of “bad faith or gross misjudgment,” but instead are subject to the same standards that apply in other disability discrimination laws. In sum, text (or the absence of it) rules again.

Soto v. United States was also decided unanimously, with Justice Thomas writing for the Court. This is another statutory coverage case, here under the Barring Act, which establishes default settlement procedures for claims against the government and subjects most claims to a six-year limitations period. However, the Barring Act and its limitations period are displaced where “another law” confers authority to settle a claim against the government. In 2002, Congress enacted a statute providing “combat-related special compensation” (CRSC) up to the amount of retired pay that was waived under predecessor statutes.

Simon Soto is a former Marine who served from 2000 to 2006, when he was medically retired with a 100 percent disability related to post-traumatic stress disorder. In 2016, Soto applied for CRSC payments. His application was approved, but his retroactive compensation was limited to six years, citing the Barring Act. Soto then filed a class action lawsuit challenging the application of the Barring Act’s six-year limitations period on the ground that the CRSC statute constitutes “another law” that provides its own settlement mechanism.

In a Clintonian exercise of word parsing over the meaning of the term “settle,” Justice Thomas wrote that the Barring Act, though unspecific, confers authority to settle CRSC claims. “The term ‘settle’ in the Government-claims context refers to determining the validity of a claim and the amount of money a claimant is due. . . . A statute confers settlement authority so long as it vests an entity with these powers. While the most straightforward way to confer settlement authority may be to use the term ‘settle,’ Congress need not ‘use magic words.’”

I’ve been writing about textual literalism in this blog for weeks now, but this one is a clear exception. Moreover, its reasoning might apply to other claims-related statutes, so be aware.

Parrish v. United States wasn’t unanimous. This was the one where Justices Thomas and Jackson concurred, and Justice Sotomayor wrote for the Court while Justice Gorsuch dissented. This case, no doubt, will be taught early on in future civil procedure classes. As Justice Sotomayor explained, in civil litigation, filing an untimely late notice of appeal deprives a court of appeals of jurisdiction over the appeal. But dilatory litigants who miss the appeal deadline because they haven’t timely received the district court’s decision have been authorized by Congress to have the appeal period reopened. But what of a losing litigant who files a notice of appeal before a court acts? Must he or she file a second notice after reopening? Justice Sotomayor explains:

The answer is no. A notice of appeal filed after the original deadline but before reopening is late with respect to the original appeal period, but merely early with respect to the reopened one. Precedent teaches that a premature notice of appeal, if otherwise adequate, relates forward to the date of the order making the appeal possible. So a notice filed before reopening relates forward to the date reopening is granted, making a second notice unnecessary. Because the Fourth Circuit held otherwise, this Court now reverses.

We encourage compliance with deadlines around here, but with respect to the timing of notices of appeal, the Parrish case furnishes constructive guidance.

The Court was unanimous again in Martin v. United States. This is the case involving the so-called “discretionary-function exception” to the Federal Tort Claims Act (FTCA), 28 U. S. C. §2671 et seq., a feature of the law about which this writer, while in government service, was able to convince the Court should be applied very broadly. Indeed, Justice Scalia wrote that I should have sought even broader relief. Well, if he were around today, he’d likely have been most enthusiastic about the Martin case. Curtrina Martin, whose house was mistakenly raided by the FBI, would surely agree.

In October of 2017, an FBI SWAT team misread a warrant and raided the wrong house in suburban Atlanta, Georgia, causing injuries to its occupants. Instead of an expected gang hideout, the officers breached a quiet family home. Its residents sued the United States under the FTCA, seeking damages resulting from the officers’ alleged negligent and intentional actions during the raid. The government prevailed in the district court and in the Eleventh Circuit, which applied “a unique approach to FTCA claims.” While the FTCA famously waives sovereign immunity from suit as to certain torts committed by federal employees acting within the scope of their employment, that waiver is subject to two statutory exceptions. One exception is for 11 enumerated intentional torts, and the second bars claims against the government that are based on an official’s exercise of discretionary functions.

Practicing textual gymnastics, the Eleventh Circuit held that the law enforcement proviso protected petitioners’ intentional-tort claims from both the intentional-tort and discretionary-function exceptions. The court dismissed the petitioners’ negligence claims under the discretionary-function exception, reasoning that the FBI enjoyed discretion in preparing for the warrant execution. However, in vacating the judgment below, the Supreme Court held that the law enforcement proviso overrides only the intentional-tort exception, not the discretionary-function exception or other exceptions. Again, looking strictly to text, the Court reasoned that its terms and structure demonstrate that the law enforcement proviso applies only to the intentional-tort exception.

That said, the Court did not attempt to resolve remaining questions as to the circumstances under which the discretionary-function exception may ever foreclose a suit like this one. The Court held that that is a matter that requires the Eleventh Circuit to examine carefully in the first instance.

In Commissioner of Internal Revenue v. Zuch, the issue was whether the U.S. Tax Court had jurisdiction over appeals from collection due process hearings when there is no longer an ongoing levy. The dispute arose when Jennifer Zuch and her then-husband, Patrick Gennardo, filed untimely federal tax returns. Gennardo subsequently compromised outstanding tax liabilities that implicated $50,000 in estimated tax payments, which the IRS applied to Gennardo’s account. Zuch amended her tax return to report additional income, which resulted in an additional $28,000 in taxes due. But she claimed that the IRS should have credited the couple’s $50,000 payment to her account, entitling her to a $22,000 refund. Unsurprisingly, the IRS disagreed and sought to collect her unpaid taxes by placing a levy on her property, pursuant to its authority under 26 U. S. C. §6331(a).

While multi-year agency and Tax Court proceedings were ongoing, Zuch filed several annual tax returns showing overpayments. Instead of refunding them, the IRS applied them to her earlier liability until it reached zero. Thereupon, the IRS moved to dismiss the Tax Court proceeding as moot, arguing that the Tax Court lacked jurisdiction because the IRS no longer had a basis to have a levy on Zuch’s property. On appeal from the Tax Court, the Third Circuit vacated the dismissal, holding that the IRS’s abandonment of the levy did not moot the Tax Court proceedings. The Supreme Court reversed, holding that the Tax Court lacks jurisdiction to resolve disputes between a taxpayer and the IRS when the IRS is no longer pursuing a levy.

The fact that the case concerned a “levy,” not a mere suit for a refund of disputed taxes paid, was determinative. When Zuch no longer owed unpaid taxes, there was no basis for a levy and thus no relevant “determination” to review. At that point, the Tax Court lacked jurisdiction to resolve any tax liability suit independent of any ongoing collection effort. Zuch’s proper recourse for alleged tax overpayments is to sue for a refund, which she has already done.

The restriction of successive habeas corpus petitions returned to the Court in Rivers v. Guerrero, and the Justices again ruled unanimously, this time per Justice Jackson. The petitioner, Danny Rivers, had been convicted in state court of sexually abusing a child. After unsuccessfully seeking a direct appeal and habeas relief at the state level, he filed his first federal habeas petition under 28 U. S. C. §2254 in August 2017, asserting the usual claims of ineffective assistance of counsel and prosecutorial misconduct. That petition was denied in September 2018, and Rivers appealed to the Fifth Circuit, which granted a certificate of appealability on his ineffective assistance claim in July 2020.

While that appeal was pending, Rivers obtained a file containing a state investigator’s report that he believed was exculpatory. After the Fifth Circuit denied his request to supplement the record on appeal, he filed a second petition in the Northern District of Texas alleging newly discovered evidence. The district court classified this second-in-time filing as a “second or successive” habeas application under §2244(b) and transferred it to the Fifth Circuit for authorization to file. Rivers appealed the transfer order, and the Fifth Circuit affirmed, holding that the fact that Rivers’s first petition was still on appeal did not permit him to circumvent the requirements for successive petitions under §2244 as to his second filing.

Again, a “liberal” Justice outlines what many would describe as a “conservative” approach to text, as the Court unanimously held that when a district court has entered judgment with respect to a first filed habeas petition, a second-in-time filing qualifies as a prohibited “second or successive application” properly subject to the requirements of §2244(b). In doing so, the Court addressed the Antiterrorism and Effective Death Penalty Act of 1996, which contains several significant procedural barriers that strictly limit a court’s ability to hear “claim[s] presented” in any “second or successive habeas corpus application” even though it was made while the district court’s decision denying his first petition was still on appeal.

Again, the latest six opinions reflect matters that have not proved particularly controversial to the Justices. However, there are still several weeks to go before the summer break. One can safely assume that the recent clear weather might be punctuated by a few storms.

Key Provisions of the One Big Beautiful Bill (H.R.1) Related to Foreign Ownership and Foreign Supply (FEOC)

Applicable Limitations on Tax Credits under Sections 48E, 45Y, and 45X:

The below summary describes provisions in the One Big Beautiful Bill that were passed by the House and are currently under consideration in the Senate. The Senate may make changes to the legislation.

Section 48E Limitations[1] (Project Investment Tax Credits):

No credit is allowed for taxable years beginning after enactment of the bill if the taxpayer is a Specified Foreign Entity.

No credit is allowed for a facility that commences construction after December 31, 2025, that includes any Material Assistance From a Prohibited Foreign Entity.

No credit is allowed for tax years that begin after the date that is two years after the date of enactment of the bill:

For Foreign-Influenced Entities; or

if the taxpayer makes fixed, determinable, annual, or periodic (FDAP) amount payments to a Prohibited Foreign Entity that are more than five percent of total expenditures related to the credit generating activity or 15% in aggregate.

New recapture provisions would also apply to certain payments to Prohibited Foreign Entities after a project is placed in service.

Section 45Y Limitations[2] (Project Production Tax Credits):

No credit is allowed for taxable years beginning after enactment of the bill if the taxpayer is a Specified Foreign Entity.

No credit is allowed for a facility that commences construction after December 31, 2025, that includes any Material Assistance From a Prohibited Foreign Entity.

No credit is allowed for tax years that begin after the date that is two years after the date of enactment of the bill:

for Foreign-Influenced Entities; or

if the taxpayer makes fixed, determinable, annual, or periodic (FDAP) amount payments to a Prohibited Foreign Entity that are more than five percent of total expenditures related to the credit generating activity or 15% in aggregate.

Section 45X Limitations[3] (Manufacturing Production Tax Credits):

No credit is allowed for taxable years beginning after enactment of the bill if the taxpayer is a Specified Foreign Entity.

No credit is allowed for tax years that begin after the date that is two years after the date of enactment of the bill:

for Foreign-Influenced Entities;

for components that include any Material Assistance From a Prohibited Foreign Entity;

if the taxpayer makes fixed, determinable, annual, or periodic (FDAP) amount payments to a Prohibited Foreign Entity that are more than five percent of total expenditures related to the credit generating activity or 15% in aggregate; or

for components produced subject to a licensing agreement with a Prohibited Foreign Entity for which the value of such agreement is in excess of $1,000,000.

Underlying Definitions[4]:

“Prohibited Foreign Entity” means any of:

Specified Foreign Entity; or

Foreign-Influenced Entity.

“Specified Foreign Entity” means any of:

Foreign entities of concern as described in the William M. (Mac) Thornberry National Defense Authorization Act of FY 2021;

Chinese military companies operating in the U.S.;

Any entity on a list with regard to the prohibition on imported goods made through forced labor in Xinjiang;

An entity listed as ineligible for Department of Defense battery acquisition in the National Defense Authorization Act of FY 2024; or

A Foreign-Controlled Entity.

“Foreign-Controlled Entity” means any of:

The governments of the Democratic People’s Republic of North Korea; the People’s Republic of China; the Russian Federation; and the Islamic Republic of Iran (each, a “Covered Nation”);

A person who is a citizen, national or resident of a Covered Nation, provided the person is not a U.S. citizen or lawful permanent resident;

An entity or qualified business unit incorporated or organized under the laws of or having its principal place of business in a Covered Nation; or

An entity controlled by any of the above.

“Foreign-Influenced Entity” means any entity which:

During the applicable taxable year:

a Specified Foreign Entity has the direct or indirect authority to appoint a covered officer;

a single Specified Foreign Entity owns at least 10% of such entity;

one or more Specified Foreign Entities own in the aggregate at least 25% of such entity; or

at least 25% of the debt of such entity is held in the aggregate by one or more Specified Foreign Entities; or

For the previous taxable year:

the entity knowingly makes FDAP payments to a Specified Foreign Entity an amount equal to 10% of the annual gross receipts of the entity for the previous taxable year; or

makes aggregate FDAP payments to one or more Specified Foreign Entities of at least 25% of the annual FDAP payments of the entity.

“Material Assistance From a Prohibited Foreign Entity” means, for any property or facility, that:

Any component, or subcomponent, or critical mineral included in such property is extracted, processed, recycled, manufactured, or assembled by a Prohibited Foreign Entity; or

Any design of such property was based on any copyright or patent held by a Prohibited Foreign Entity or any know-how or trade secret provided by a Prohibited Foreign Entity.

Exception: Does not apply to any component, subcomponent, or critical mineral that:

Is not acquired directly from a Prohibited Foreign Entity; and

Is not uniquely designed for the use in construction of the applicable qualified facility or manufacture of the applicable eligible component; and

Is not exclusively or predominantly produced by Prohibited Foreign Entities.

Notes and Conclusion:

While all of the provisions in the bill related to energy tax credits are important, the prohibitions on tax credits provisions related to Material Assistance From a Prohibited Foreign Entity may overshadow the rest of the bill.

Given the broad definition of Prohibited Foreign Entity, any manufacturer with a Chinese parent or intermediate company is likely a Prohibited Foreign Entity. The definitions of component, subcomponent, and critical mineral are broad and vague, and may include nearly all parts and materials in a project (not just cells or modules).

The provisions related to Material Assistance From a Prohibited Foreign Entity (including the exceptions) are not entirely clear, however, and there is no available guidance for the interpretation of the exceptions. It is not unreasonable to interpret these provisions to render many projects ineligible for tax credits, although additional guidance would be necessary to determine whether that is actually the case. Further, as noted above, that at this stage the legislation has not been enacted into law, and it’s possible that it is never enacted or enacted in revised form.

Footnotes

[1] Sec. 122009

[2] Sec. 122008

[3] Sec. 122014

[4] Sec. 112008(d)

Louisiana Legislation Prohibits Class Action Lawsuits Against the La. Department of Revenue

Yesterday, the Louisiana Legislature passed House Bill 416 and sent it to Governor Landry for his executive approval. If the bill becomes law, which is likely, it will prohibit class action lawsuits:

Against the Louisiana Department of Revenue in the Louisiana Board of Tax Appeals or in any state or federal court by or on behalf of taxpayers or any other interested party arising from or related to the administration of tax laws and related matters; and

Against the Office of Debt Recovery within the Louisiana Department of Revenue in any state or federal court by or on behalf of any person arising from or related to the administration of the debt recovery functions of the Office.

The new law will apply on a prospective basis.

How President Trump’s ‘One Big Beautiful Bill’ Will Impact Businesses in Australia

Retaliatory tax provisions contained in H.R. 1, the “One Big Beautiful Bill Act” that recently passed the US House of Representatives, if enacted, would drastically impact common cross-border transactions, including US operations of foreign multi-national groups and inbound investments.

APPLICABILITY OF SECTION 899

Code Section 899 imposes retaliatory taxes on “applicable persons” resident in “discriminatory foreign countries,” which are defined as countries that impose unfair foreign taxes (UFTs). The US Treasury Department would quarterly publish a list of discriminatory foreign countries. The “applicable persons” subject to increased taxes include individuals and corporations resident in discriminatory foreign countries, as well as foreign corporations more than 50% (by vote or value) owned directly or indirectly by such applicable persons (unless such majority-owned corporations are publicly held). Subsidiaries of US-parented multinational groups would generally not be applicable persons.

Three categories of taxes are identified as “per se” UFTs: undertaxed profits rule taxes imposed pursuant to the OECD’s Pillar 2, digital service taxes, and diverted profits taxes.

Australia has adopted both the Undertaxed Profits Rule as well as the Diverted Profits Tax, and so Australia is a discriminatory foreign country and subject to the retaliatory tax provisions in section 899.

Certain categories of taxes, including value-added taxes, goods & services taxes, and sales taxes, are exempted from being classified as UFTs. Australia’s Digital Services Tax is contained in the Goods and Services Tax and so is not currently classified as having a Digital Services Tax.

When a country repeals all of its UFTs, it generally will cease to be a discriminatory foreign country, and persons associated with that country generally will cease to be applicable persons.

RETALIATORY TAX PROVISIONS

The retaliatory tax provisions in Code Section 899 mainly fall into two categories, (1) increased rates of US tax on applicable persons, and (2) a more stringent version of the base erosion and anti-abuse tax (“BEAT”) currently contained in Code Section 59A, referred to as the “Super BEAT.”

Increased Rates of US Tax on Applicable Persons

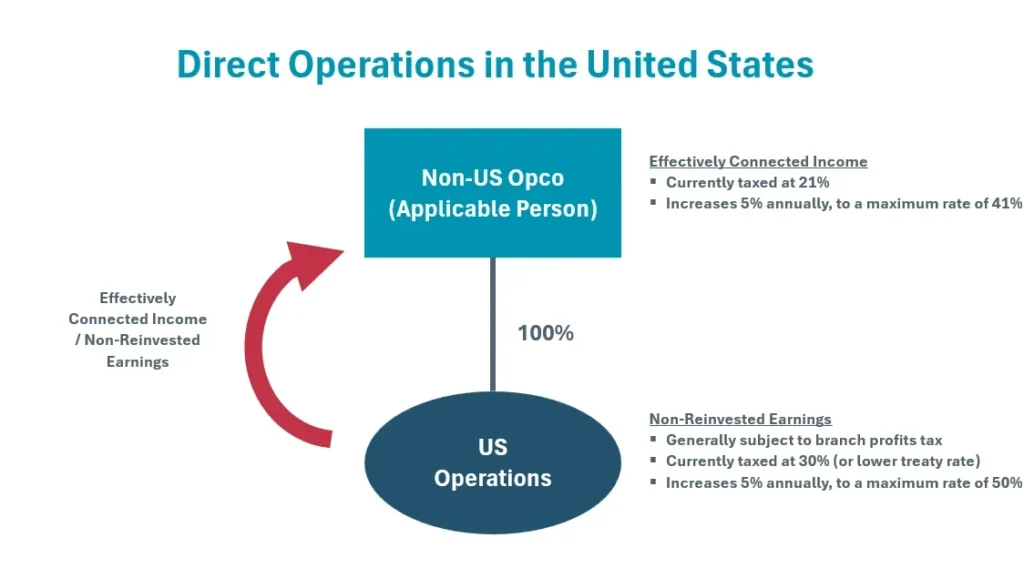

The rates of US tax to which applicable persons are subject would be increased 5 percentage points each year, possibly beginning in the current year, until the rates reach a maximum of 20 percentage points above the current statutory rates (determined without regard to any treaty). The applicable US tax rates that would be subject to increase include (1) the 30% withholding tax on passive US-source income (e.g., dividends, interest, rent, and royalties), (2) the 21% corporate income tax, and (3) the 30% branch profits tax imposed on the non-reinvested earnings of a US trade or business conducted by a foreign corporation.

Income that is currently statutorily exempt from US tax–such as US-source interest income that qualifies for the “portfolio interest” exemption–would, generally speaking, remain exempt from US tax; however, Code Section 899 expressly overrides the US tax exemption for sovereign wealth funds and other foreign governmental entities contained in Code Section 892.

In the case of appliable persons that qualify for a zero or reduced rate of tax pursuant to an income tax treaty, the increased tax rate to which the applicable person is subject would initially be 5 percentage points above the applicable treaty rate, although the rate would climb 5 percentage points each year until it reached 20 percentage points above the maximum statutory rate (determined without regard to a treaty). This may result in a 50% withholding rate on certain distributions from the United States.

The Super BEAT

In addition to the current BEAT in Code Section 59A, which was adopted as part of the 2017 Tax Cuts and Jobs Act, Code Section 899 would impose a modified “Super BEAT” on US corporations which are more than 50% owned (by vote or value, directly or indirectly) by applicable persons.

Several aspects of the Super BEAT would make it more likely for targeted companies to be liable for the BEAT. First, certain thresholds that limit the applicability of the regular BEAT would be removed. The current BEAT only applies to US subsidiaries (1) of multinational groups with gross receipts of at least $500 million, and (2) whose “base erosion” payments – i.e., deductible payments to related foreign persons–exceed 3% of total deductions (or 2% in the case of certain financial firms). These thresholds would not apply under the Super BEAT, potentially subjecting US companies to the Super BEAT despite not being part of large multi-national groups or making significant related-party payments.

The new Super BEAT would potentially both increase the tax liability of current BEAT taxpayers and subject additional US companies to the BEAT.

APPLICATION TO COMMON CROSS-BORDER TRANSACTIONS

CONCLUSION

The retaliatory tax provisions in Code Section 899, if enacted, would have a significant and potentially negative impact on a wide variety of cross-border transactions, including US operations of foreign multi-national groups. Click here for a more comprehensive alert on this issue.

Potential Refund Opportunity for Interest and Penalty Amounts Accrued During COVID-19 Federally Declared Disaster

Taxpayers who made payments to the Internal Revenue Service (IRS) that included underpayment interest and/or failure-to-file/pay penalties that accrued during all or part of the period between January 20, 2020, through July 10, 2023, should consider filing a refund claim with the IRS to potentially recover accrued interest and penalty amounts.

Internal Revenue Code (IRC) § 7508A (as in effect during the COVID-19 pandemic), legislative history, regulations, and the US Tax Court’s opinion in Abdo v. Commissioner, 168 T.C. 148 (2024), provide the basis for potential refund claims. IRC § 7508A(d) provides for a mandatory postponement period of certain tax-related obligations, including the suspension of the accrual of underpayment interest for the duration of the COVID-19 incident period plus 60 days (January 20, 2020 – July 10, 2023). IRC § 7508A also appears to have paused the increase of failure-to-file/pay penalties, which are based on the time during which the taxpayer is not in compliance.

Taxpayers considering this refund opportunity should be aware that the statute of limitations to file a refund claim expires three years from the filing deadline of the original tax return or two years from the date on which payment was made – whichever is later (unless the statute of limitations period was otherwise extended). This refund opportunity may apply to underpayment interest and/or penalties paid with respect to federal income, estate, gift, employment, or excise taxes.

La. Legislation Prohibits Class Action Lawsuits Against the La. Department of Revenue

Yesterday, the Louisiana Legislature passed House Bill 416 and sent it to Governor Landry for his executive approval. If the bill becomes law, which is likely, it will prohibit class action lawsuits:

Against the Louisiana Department of Revenue in the Louisiana Board of Tax Appeals or in any state or federal court by or on behalf of taxpayers or any other interested party arising from or related to the administration of tax laws and related matters; and

Against the Office of Debt Recovery within the Louisiana Department of Revenue in any state or federal court by or on behalf of any person arising from or related to the administration of the debt recovery functions of the Office.

The new law will apply on a prospective basis.

UK Government Carried Interest Tax Reforms Consultation Process: No New Conditions, Territorial Limits Clarified

June 2025 – The UK Government has published its response to the consultation on its proposal to change the tax treatment of carried interest, confirming the expected final shape of the new regime which will take effect from April 2026.

The reforms, first announced in October 2024, mark a significant shift in how carried interest is taxed in the UK. From April 2026, carried interest will be fully brought within the income tax regime and taxed as self-employed trading income. However, in recognition of its “unique characteristics”, as sitting somewhere between pure trading income and investment return, only 72.5% of the qualifying carried interest received will be subject to tax, giving an effective rate of 34.1% (assuming the 72.5% is applied to the current top rates of income tax of 45% and self-employed Class 4 national insurance contributions of 2%).

Background: The Current Regime and the October 2024 Announcements

Currently, carried interest which is not “income-based carried interest” is subject to tax under the capital gains tax regime but with a special rate of 32% (28% prior to April 2025), rather than the standard 24%, applying to it. Income-based carried interest is taxed as trading income in its entirety, but, due to an exclusion for carried interest holders within the employment-related securities regime, only certain carried interest holders are currently subject to the income-based carried interest rules. This exclusion for employment-related securities holders is to be removed.

,The new regime from April 2026, first announced in October 2024, would tax all carried interest as trading income but with the 72.5% multiplier applying to “qualifying carried interest”.

In the October 2024 announcements, the Government stated that income-based carried interest would not be qualifying carried interest and that the income-based carried interest rules would be extended to apply to all carried interest holders, including carried interest holders within the employment-related securities regime.

In addition, the Government considered applying two other requirements for carried interest to be treated as qualifying carried interest, being that the carried interest holder also made a minimum co-investment (the “co-investment condition”) and that the carried interest holder held their carried interest for a minimum time before the carried interest arose to them (the “minimum individual hold condition”).

In another important aspect of the October 2024 announcements, it was acknowledged that moving carried interest from the capital gains regime to the trading income regime would result in non-UK residents coming within the scope of UK tax on their carried interest to the extent that they carried out work in the UK (and subject to any relief from UK tax that might apply to them under any applicable double tax agreement (DTA)).

For further detail on the initial announcement please see our Tax Talks Blog from November 2024.

Overview of the Key June 2025 Announcements

Following significant consultation and responses from across the private fund industry, the Government confirmed on 5 June 2025 that no additional qualifying conditions will be introduced – there will be no co-investment condition or minimum individual hold condition.

The sole requirement for the carried interest to be “qualifying” and benefit from the 72.5% multiplier will be that the carried interest is not income-based carried interest. In short, income-based carried interest is carried interest from a fund with an average asset holding period of less than 36 months, with a tapering applying for average holding period of between 36 and 40 months.

In addition to this, the territorial scope of the regime will be limited through statutory limitations to reduce the impact on non-UK resident individuals who carry out some work related to their carried interest in the UK or on those who were UK tax resident at some point during the life of the fund from which the carried interest is derived.

These statutory limitations (which may be thought of as safe harbours) on the scope of UK tax on non-UK residents’ carried interest, are stated to be:

no work carried out before 30 October 2024 (the date on which the changes were first announced) will be treated as performed in the UK when working out what proportion of carried interest is taxable in the UK (related to work in the UK) and what proportion is not (related to work outside the UK);

provided that an individual is both non-UK resident for a tax year and carries out work in the UK on fewer than 60 days in the tax year then the individual will be treated as carrying on no work in the UK for that year for the purposes of this apportionment. This will allow people to carry out some work in the UK without risking UK tax on their carried interest; and

the individual will cease to be subject to UK tax on any carried interest arising in a tax year if the individual was non-UK resident and worked in the UK on fewer than 60 days for each of the prior three tax years. This will mean that UK tax ceases to apply to any carried interest arising a reasonable time after the individual ceases to have relevant links to the UK.

These statutory limitations are welcome news. However, for the purposes of both of the 60 day safe harbours, non-UK resident carried interest holders will need to keep accessible, clear and comprehensive records of time spent and work done in the UK, in case of HMRC enquiry.

In addition to these limitations, for non-UK residents who are resident in a UK DTA jurisdiction, that DTA may result in them only being subject to UK tax on carried interest that can be attributable to a permanent establishment they have in the UK (for the purpose of the DTA). However, the three new statutory limitations should mean far fewer carried interest holders having to rely on relief under a DTA in this way.

In addition, it has been confirmed that carried interest will fall within the payments on account regime that applies to trading income despite industry concerns about the unpredictability of carried interest receipts. This will add some degree of compliance complexity to tax reporting and payment for carried interest recipients, and it is expected that stakeholders will continue to press for a more appropriate outcome on this point.

These decisions reflect the Government’s stated aim to strike a balance between fair taxation of UK-based work and maintaining the UK’s competitiveness as a global asset management hub. Whether or not the new rules do strike this balance will be seen once the full details of the new rules are understood and applied, but these announcements can generally be considered as an encouraging development.

The Government has also announced that, in light of the removal of the exclusion for carried interest holders within the employment-related securities regime from the income-based carried interest rules and following technical consultation with stakeholders, it will propose changes and improvements to the income-based carried interest rules (referred to as the asset holding period or AHP condition in the response document) and how the fund’s average asset holding period is calculated in certain cases.

No Additional Conditions: A Welcome Outcome

As stated above, the Government has decided not to proceed with either of the two additional qualifying conditions it had consulted on:

a team-level co-investment requirement; or

a minimum period between award and receipt of carried interest.

This decision follows strong industry opposition. Over 60% of respondents to a member survey conducted by industry bodies said that a co-investment requirement would significantly harm their firm, and over 70% opposed a new holding period. Respondents argued that such conditions would introduce complexity, reduce competitiveness, and unfairly penalise certain fund structures.

The Government acknowledged these concerns. In particular, it agreed that the existing asset-level average holding period condition (currently within the income-based carried interest rules which will be applied to all holders of carried interest as part of the new regime), essentially requiring a 40-month average holding period to obtain preferential tax treatment, already ensures that only long-term rewards benefit from preferential treatment.

This is a welcome response by the Government and aligns with the desire that the new regime is as clear and simple to apply as possible to give industry participants certainty around the tax treatment of carried interest.

Territorial Scope: Statutory Limitations Introduced

The Government has reaffirmed that non-UK residents will be taxed on carried interest to the extent it relates to services performed in the UK. However, in response to industry feedback, it has introduced the three statutory limitations referred to above with the intention of reducing the risk of double taxation and improving the practical operation of the regime.

These three limitations are welcomed and are generally expected to materially restrict the situations when non-UK residents find themselves subject to the UK carried interest tax rules. Nevertheless, while the limitations are intended to provide clarity and proportionality, some technical complexity remains and the extent of such issues may not be fully clear until draft legislation has been published.

In addition, the Government has committed to further engagement on how these rules interact with DTAs where it is expected that there might well be difficulties in aligning the UK treatment of carried interest as attributed to a UK business (or permanent establishment) and the individual’s primary residence treating it as an investment return, and this will be an area of scrutiny as the new regime is introduced.

On a related note, for those UK residents who are also US taxpayers, the interaction of the new UK regime and the US regime might result in particular complications and their overall position will have to be considered carefully once the draft rules are published.

Technical Reforms to the Average Holding Period Condition

The Government also announced a series of technical amendments to the AHP condition to ensure that it operates appropriately across different fund strategies, particularly for private credit funds, secondaries and fund of funds, and achieves its intended goal of excluding funds that do not have a long-term investment strategy. These changes include:

removing existing restrictive rules for direct lending funds;

introducing new rules for credit funds, which are intended to apply to all types of credit funds and to deem debt investments to be made and disposed of at specific times (known as the “T1/T2” rules);

streamlining and consolidating rules for fund of funds and secondaries funds, including a new gateway which is intended to better reflect commercial reality; and

expanding exceptions for “unwanted short term investments”, including in relation to loan syndications and bundles of assets acquired by secondaries funds.

The Government has indicated that these changes are designed to avoid arbitrary or disproportionate outcomes and reflect the growing number of individuals and funds that will be subject to the revised regime from April 2026 as a result of the removal of the employment-related securities exclusion from the rules. As we noted previously in our November article, the existing rules raise some technical complexities when seeking to apply them in practice. The extent to which these proposals will resolve existing uncertainties and deficiencies in the AHP condition will not be clear until draft legislation is available, expected before the end of July.

Payments on Account: No Exemption for Carried Interest

Despite industry calls for an exemption, the Government has confirmed that carried interest will fall within the payments on account regime as a consequence of it coming into the trading income tax framework. In broad terms, this means that tax payments on account of each year’s tax will be based on the previous year’s liability, even though carried interest is often irregular and unpredictable. It should be possible, however, to reduce those payments if it is known that the relevant tax year’s income will be materially less than the previous year’s because no carried interest is expected.

While the Government has acknowledged industry concerns on this point, it argues that other forms of income are similarly unpredictable and that existing mechanisms allow taxpayers to reduce or cancel payment on account amounts to avoid overpayment.

Looking Ahead

Draft legislation is to be published for technical consultation before the parliamentary summer recess (so, expected during July), with final legislation to follow in the Finance Bill 2025–26. The Government has reiterated its commitment to ongoing engagement with stakeholders through its technical working group.

While the outcome is not perfect, and there will no doubt be some concerns left around double tax and aligning double tax relief and the application of DTAs, the Government’s response reflects a pragmatic approach that addresses many of the industry’s concerns.

The decision not to introduce new qualifying conditions and the introduction of territorial limitations are particularly welcome and signal a desire to place the tax treatment of carried interest on a stable and internationally competitive footing.

U.S. Doubles Tariffs on Steel and Aluminum

Effective June 4, 2025, the Trump Administration doubled the Section 232 tariffs on the imports of steel and aluminum from 25% to 50% from all countries, except the United Kingdom. The U.K. is exempted from the increased tariffs because of the U.S.-U.K. Economic Prosperity Deal reached on May 8, 2025. These increased tariffs apply to steel and aluminum imports, as well as the steel and aluminum content of certain derivative steel and aluminum products.

Although the announcement came via social media on May 29, the formal Proclamation was published on the White House website on the evening of June 3. The Proclamation’s implementation by Customs was further clarified by several simultaneously published messages. The Proclamation Adjusting U.S. Imports of Aluminum and Steel inverts the stacking order originally created by the April 29, 2025 Executive Order. The new Proclamation and Customs guidance clarifies that Section 232 steel and aluminum tariffs do not stack on top of the IEEPA Fentanyl tariffs as it pertains to Canada and Mexico.

The Proclamation and Customs message reminds importers that derivative articles of steel and aluminum, which are subject to Section 232 tariffs on the value of their steel and aluminum, will also be subject to reciprocal tariffs on their non-steel and aluminum value.

Interestingly, both the steel and aluminum Customs guidance messages provide an exemption or 0% tariff for steel or aluminum articles or derivative products that are (a) cast and poured (for steel) or (b) smelt and cast (for aluminum) in the United States. Mill certifications and other Country of Origin documentation will be critical for the implementation of these tariffs.

Other noteworthy tariff developments: As a development to our prior blog on the Court of International Trade’s decision finding that the President’s IEEPA tariffs are illegal. On May 29, after the U.S. filed an appeal in the Court of Appeals for the Federal Circuit and motioned for a stay of the remedy, the Federal Circuit temporarily granted the stay. A similar process will likely occur if and when the U.S. Supreme Court considers the CIT’s decision. So the IEEPA tariffs will remain in effect, likely until all appeals are exhausted.